Opinion: BTC has no “intrinsic value” but it is still the best value storage medium

With regard to bitcoin, skeptics often reject it by criticizing that they have no intrinsic value. Their arguments are usually like this: "Bitcoin cannot be used as currency because it has no intrinsic value as a commodity. To make something Things become a viable currency, which must first be accepted and used for other commodity purposes inherent in the item, and then slowly become a currency over time. For example, gold can be used to make jewelry and electronics, People naturally store it to store value."

Prior to this, Bitcoin enthusiasts have put forward several convincing arguments for rebuttal. Their reasons are: 1) intrinsic value is subjective, and 2) bitcoin is a payment method that is good for boycotting censorship. Has intrinsic value.

What I am saying here is that Bitcoin skeptics are right. Bitcoin does not have "intrinsic value" as a commodity, but it is a good thing for Bitcoin (and the rest of the world).

- Chain to 2013 – Looking back at the beginning of the blockchain business

- Opinion: Why is the cryptocurrency market about to usher in a “slow cow”?

- Behind the return of Bitcoin is human greed and fear?

Skeptics' core ideas

Intrinsic value is an old concept. Even Aristotle wrote about the importance of money. He wrote: “Currency is useful in nature and is easy to apply to life purposes. Examples are iron, silver, etc.” This concept has persisted. For thousands of years, the value of goods is indispensable to humans and very straightforward for most people.

Although this idea originated in ancient times, there is no direct connection between intrinsic value and monetary function. A good currency needs to have many attributes: it is lightweight, easy to trade, scarce, durable, storable, replaceable, and easy to segment. So why do many critics claim that money needs to have intrinsic commodity value?

There are two main reasons.

1. History left

Many skeptics condemn Bitcoin's lack of intrinsic value simply because they are used to linking value storage to goods at the same time. Simply put, they live in the past, and many people mistakenly believe that the previous definition will always be correct.

All previous forms of value have physical form, but this does not mean that new value stores must also be physical. During the rise of the Internet, there was a similar debate about physical shopping. The following is a very bad view of a contributor to Newsweek in the 1990s. He said that since we have been selling entities in the past, physical sales will not be replaced by the Internet. Bitcoin skeptics claim that money needs to be a useful physical commodity, and this view will become ridiculous in the next decade or so.

In fact, history shows that commodity value is far from money demand. Nick Szabo explains at the beginning of his classic book The Origins of Money that society used to use other "useless items" to store and deliver value. These glass beads have many strong currency attributes and are used for trade throughout Africa and parts of North America, but they are rarely used as commodities. The Yap Island stone coin is used by the Yap people as a currency. This example of no commodity use is also a similar example of value storage.

Figure 1: Glass beads previously used as currency in the Oklahoma tribe

2, obey the authority of the past

Today, many people who are concerned about the value of intrinsic goods will trace their arguments to Austrian economists such as Menger, Mises and Rothbard. These scholars strongly emphasized the importance of money and its impact on society. For them, the value of goods is inseparable from the currency, and their early views are the same. Menger's groundbreaking work on the origin of money first described the currency as "the fact that a commodity became a generally accepted medium of communication" (p. 1). Later, Mises was built on this understanding. In the book Money and Credit Theory, Mises writes: "We can refer to those currencies that are simultaneously commercial goods as commodity currencies, and those that have special legal qualifications to legal tenders." page).

Many critics who follow the footsteps of Austrian economists use these outdated frameworks to attack Bitcoin. Niels van der Liden, one of the first to publicly suspect Bitcoin (the price of Bitcoin was still at $0.77), was based on the idea that he rejected Bitcoin. He claims that bitcoin does not work, and no one can do anything with them except for transactions, so he concludes that bitcoin cannot be used as a commodity or as a currency.

For the early Austrian economists, commodities and fiat currencies were the only two possibilities, but the times have changed. In our digital age, the distinction between commodities and fiat currencies has lost value. Obviously, Bitcoin is not suitable for this dichotomy. It has no use for physical goods, and it will not disappear due to any laws and regulations. We are now able to hold and trade digital currencies completely independent of simple legal forces. In contrast, the currency attributes of Bitcoin are guaranteed by the rules and logic embedded in their encoded DNA. Through this purely digital form, Bitcoin exists as a currency that is not restricted by the physical world.

Solve the hard currency paradox

In fact, if skeptics do their homework, they will realize that Mises is actually a bitcoin enthusiast. He recognized the problems inherent in commodity currencies and believed that gold was the worst option. In his book Theory of Money and Credit, Mises laments that even a gold-based monetary system, because of fluctuations in its money supply and demand, as well as changes in production conditions and industrial demand, make The monetary system has considerable disadvantages. (p. 238).

Mises correctly pointed out that as the volatility of industrial demand drives and drives co-supply, the use of money in commodities creates price distortions. Hard currency is always associated with unique physical attributes – good for money, but also for other industries. In this regard, the versatility of gold in many different industries makes this harmful effect more apparent.

The physical world has also brought other currency restrictions. Some things found in nature cannot be distributed regularly over time. In this regard, Bitcoin's predictable, periodic emissions allow for supply calculations in the coming decades, which is impossible outside the digital world. In addition, the physical supply cannot be reviewed. At any time, it is possible that someone will discover an unknown amount of gold and completely dilute the ownership of gold, while current holders cannot know the sudden change in the supply of gold, which is similar to how European businessmen secretly exaggerate the shells. The value of the damage to the interests of African tribes. With the digital nature of Bitcoin, anyone can review the supply of the entire currency and keep track of the exact amount of money created.

With these advances, it is foolish to stick to the advice of the Austrian economists in the past. These scholars do not specify the cosmological constant. Even they themselves realize their limitations and want to get a better currency than precious metals. The new environment requires a new theoretical foundation, and Bitcoin meets such conditions.

Bitcoin as the key to unlocking gold and real estate

Today, it happens that the best value stores are those that have some utility. The key here is gold, real estate or any form of commodity currency.

When someone decides to hold gold or any other asset for currency purposes, they make a clear and conscious choice to use it for wealth storage rather than as a useful commodity. Holding a gold bar is not to use it as an electronic part or jewelry, but to use its currency's value storage function. Although this decision seems to be harmless, it can have harmful economic consequences. A large number of people store their value in a particular commodity, which often leads to extreme waste and speculative bubbles.

Real estate is an example of this influence. Today, speculators chase "real estate" to protect their wealth. Developer Michael Stern explains: “The global elite are basically looking for a safe.” Many people may decide to invest in Manhattan's properties to store their assets, and they use luxury apartments to save value. Not for life. Therefore, the reporters reported: "According to the Census Bureau, nearly one-third of the apartments in 10 months of the year are completely vacant in a vast area between Fifth Avenue and Central Park in downtown Manhattan." The trend is spreading in big cities around the world. As the Guardian reported, “the world’s super rich tend to invest in prime locations in London to protect their wealth, and their purpose is not to earn rental income. This means that Kensington and Chelsea are available. The number has increased by 22.7% over the same period and has increased by 8.5% since 2015. As the elite continues to inject wealth into these places, commodities and bubbles begin to rise to the top. A recent report by UBS showed the danger of this situation.

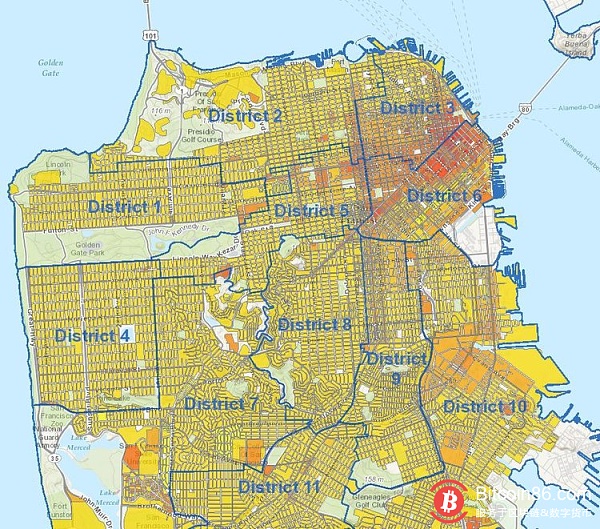

The use of housing as an important wealth reserve will not only lead to vacancy problems, but also undermine the market's health incentives for new housing development. Other real estate markets such as San Francisco and California are examples of this phenomenon. The map below illustrates the regional regulations in San Francisco. The maximum height of the building in all shaded yellow areas is limited to 40 feet.

Figure 2: San Francisco Local Zoning Map <br /> These regulations clearly hinder the construction of new affordable housing. Considering the impact on most residents and rental prices, why do they still exist? A big reason is that existing homeowners lobby to artificially limit supply to keep their wealth from shrinking as supply increases. According to a recent report from the California Office of Legislative Analysis, residents may think that new homes pose a threat to their economic health. For many homeowners, their house is their most important financial investment. As a result, existing homeowners may be inclined to limit new homes because they fear that new homes will reduce the value of the home. For most people, there are only a handful of alternative and reliable value stores, so many people think housing is the best medium to maintain personal wealth. This naturally leads to homeowners lobbying to limit housing supply so that their unstable wealth will not be diluted. In this sense, the real estate market only stores value attributes by artificially creating scarcity.

Bitcoin does not completely solve this problem, but it provides potential homebuyers with another way to securely store wealth, allowing people to reconsider their financial decisions may ease the pressure to build new homes. With the creation of new affordable housing, cities will be able to increase their density and improve the quality of life for all residents. For example, according to research modeling, if San Francisco can increase its housing density, it can greatly reduce the city's carbon footprint and improve the quality of life in the community while maintaining the sunny environment in California.

Gold is another good example. When an individual sells gold to buy bitcoin, the gold previously held for his wealth storage property can be used in electronics, medical equipment, and aerospace. It can even be eaten! Gold stored around the world can benefit society through cheaper, higher quality products, making previously impossible efforts more affordable. So, with Bitcoin, we can really afford the trip to the moon! So when you hear that gold fanatics praise the amazing social uses of gold, they are right, but they are indeed defending digital gold. Bitcoin, as a global means of value storage, unlocks the utility of storing goods, and our world has long lacked a vague currency.

Final thought

Bitcoin does not lock in useful resources to store wealth, but allows humans to store wealth without being affected by the opportunity cost inherent in storing goods. This global, permanent, and accessible wealth reserve is laying a solid foundation for future economic development around the world. As funds are transferred from other asset classes to Bitcoin, this newly discovered supply will create better opportunities for affordable housing, a more dynamic urban environment, and higher quality consumer goods. (Babbit)

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Myanmar central bank issues cryptocurrency trading warning

- How much does the encryption company have to entangle with the US SEC?

- China has begun testing its own digital currency for interbank transfers.

- Analysis of the madman market on May 20: Investment technology is the magic weapon to make money in the future

- Will the SEC's decision on the VanEck ETF cause a market crash?

- ready? Bitcoin and Ethereum are rebounding, and the callback is coming to an end.

- BM: EOS producers are not elected