Bitcoin has experienced a roller coaster, and it’s easier to grasp the market.

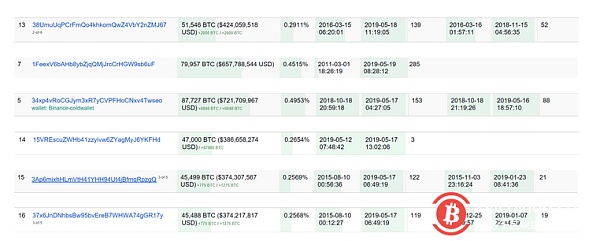

Judging from the accounts of the giant whales, in the three days from May 17th to 19th, there were a total of six addresses in the top 20 addresses, and there were some actions to increase the position. Although the amount of the increase was not large, it can be seen that Most of these users who are pursuing "Buy and Hold" are a consensus on bargain-hunting.

- The bull market has come no nonsense, but where did the big money come from?

- Why do individuals tend to get more coins than institutions?

- No one uses 100 times leverage for cryptocurrency transactions

The $8,000 is already a high-than-expected high for many BTC short-term investors, and it is certainly a wise choice to cash out now. But the market is a process of long and short games: some people look away from the market, and some people look at more positions, which has the fluctuation of prices.

From the current lyric point of view, this round of rise in Bitcoin is a process of re-recognizing the entire society. First, Bitcoin’s search volume in Google Trends hit a 14-month high. Institutional investors have always been eager to test their attitude towards BTC. According to Fidelity's survey of more than 400 US financial institutions on cryptocurrencies, about a quarter of participants have been exposed to the encryption market and entered the market in the past three years. A total of 47% of participants will consider Bitcoin as part of their portfolio. As bitcoin prices remain high, institutional investors may be more willing to recognize and enter the market.

From the 4-hour K-line, although the increase on Sunday is large, it is still a rebound after the oversold. The fall in early trading today also indicates that the selling of the $8,000 band still needs to be digested. In terms of price, the triangular area formed near the extension line of the previous high point and the rising trend line may be a region with strong pressure in the short term.

The current trend of ETH still belongs to the stronger currency of the entire cryptocurrency market. From the weekly line, the price is being suppressed by the 55-week moving average. From the recent research on the correlation between ETH and BTC, the trend of ETH is highly correlated with BTC (correlation 1.1). If BTC continues to perform in the bull market, ETH slowly digests the pressure near the 55-week moving average, and it is still up.

In the news, last weekend, on Twitter, the performance of the altcoin was investigated. As a result, ETH and XRP were favored by most investors. From the past price trend of ETH, the price elasticity of ETH has been relatively low this year. Investing in such varieties, do not rush to pursue short-term excess income, but should also look beyond the long-term, the pursuit of ETH with the increase in the entire cryptocurrency market.

Although XRP had a round of skyrocketing performance last week, the price is still in the bottom area, and there is no effective breakthrough in the strong pressure zone. In the news, although XRP is constantly cooperating with some financial institutions in payment technology, the founding team and management company that broke out last week have been suspected of shipping, and a total of 2.5 billion XRPs were thrown. Such negative news has also suppressed the positive performance of the price of XRP to a certain extent. If the price of XRP can return to the 0.3634 area, it may be more appropriate in the risk-reward ratio, but the current price is still high.

BCH hit a recent high of $450 on the 16th last week, but did not effectively break the pressure of 420 at the close. In early trading today, BCH once again hit this position, and the price is temporarily suppressed. Investors can still pay attention to the pressure position in this area. If the daily line can effectively break through, it will start to be a margin or entry point when you step back.

The price of any secondary market is cyclical. When the market is in a rising cycle, the operation should be long-term and not frequent. As John McAfee said on Weibo, "You don't need to be nervous when you fall, try to see it every few months." (CoinNess)

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Bitcoin fell 10% in an instant. Is the “bull market” a short-lived one?

- BTC price dip down! A breakthrough of $6,500 would be a good opportunity to enter?

- May 17 people madman market analysis: two features of the disk leaked the main operating heaven!

- Analyst: BTC fell sharply, price may be adjusted back to $5,200

- KPMG publishes a report listing four skills required to engage in blockchain-related occupations

- Is there still a need for banks in the blockchain world?

- EOS leader discusses node consensus issues and triggers voting rights debate