CoinGecko: How to discover “smart money” and track them?

How can you find and monitor "smart money" using CoinGecko?Original author: CoinGecko – Joel Agbo

Original translation: BlockTurbo

Key Points

- Cryptocurrency wallet tracking involves closely monitoring a wallet’s transactions and noting significant transactions over a period of time or involving specific assets;

- Wallet tracking provides investors with asset movement information based on tracking the transactions of major holders, which can be used to speculate market trends;

- Blockchain browsers or special applications can be used to filter or track selected wallets;

- Specialized wallet trackers are designed to provide clearer information about wallet movements and notify investors.

How to Track Cryptocurrency Wallets

Tracking a cryptocurrency wallet involves three main steps: discovering the wallet, collecting deep data on wallet on-chain transactions, and translating the data obtained from the first two steps into useful information. Through these, investors can learn about the actions of “smart” investors and may use clues from significant wallets’ actions to speculate market trends.

- Bitcoin supply trend is changing, with a shift towards the East already taking shape.

- Current Status of Data Analysis in NFT Lending: Blend Takes 80% Market Share in First Month, Three Major NFT Loans Exceed Half the Total Amount

- Opportunity and risk, BRC-20 brings Bitcoin into the “smart era”

What are other traders buying, who are the buyers, and how well do they understand the market? If they seem to have a better understanding of the market, what are they investing in now, and what might they invest in next? On a larger scale, how do the behaviors of such individuals affect the market?

If you are curious about these questions and how to apply them, then read on to learn more about tracking cryptocurrency wallets!

What is Wallet Tracking?

Wallet tracking focuses on studying the wallet movements of whales or famous traders to gather data to guide potential trading decisions.

Cryptocurrency wallet trackers are designed to make it easier for individuals to track wallets of interest, such as sending alerts every time a transaction occurs. These trackers allow you to track the activity of selected wallets in real-time. Cryptocurrency wallet trackers connect to third-party APIs and access various on-chain cryptocurrency data sources for information about transactions; they then package this information and present it to users in a more useful format.

A cryptocurrency wallet tracker is designed with customizable features, such as push notifications that alert users whenever a tracked wallet executes a transaction. Based on the design, a cryptocurrency wallet tracker can display basic information about the transaction, such as the type and amount involved, as an instant alert on messaging applications such as Telegram. This enables users to react quickly without having to search for transaction details using a blockchain wallet explorer like Etherscan.

How to Find Wallets to Track

What should you be looking for before tracking a wallet? The answer largely depends on the purpose for which you’re tracking the wallet, but here are a few things investors commonly look at when tracking wallets:

Past Investments

When considering adding a smart wallet to your wallet tracker, you can check its investment record to see what assets they’ve sold in the past and how they’ve managed those assets. Look at purchase and sale times, as well as the profit or loss obtained from them. This is a good way to evaluate whether a wallet is a “smart money” wallet. If this wallet has made significant profits in most of its previous transactions, then they may be worth some attention.

Profit/Loss Ratio

When you’re looking for a smart wallet to replicate trades, it’s important to consider their profit/loss ratio, which measures the average profit gained from winning trades versus the average loss from losing trades over a period of time. Research the assets they hold and their values, track transactions related to assets in the wallet, and determine whether the wallet is profitable or not. If the wallet is profitable with the assets it manages, then you may want to track its trades.

Transaction Flow

Where are a wallet’s funds coming from and where are they going? If a wallet frequently receives deposits of varying sizes from different wallets, it may be an exchange wallet. Blockchain explorers attempt to label these transactions and wallets, but may miss some in certain cases. Vesting wallets can also be identified by the labels on their transactions. In normal circumstances, personal wallets should have fewer transaction frequencies and personal ownership of fewer wallets.

Interacting Protocol

Personal wallets usually interact with a few exchanges and other individuals. Team and project wallets are more likely to interact with more professional protocols and execute transactions such as staking, large-scale distributions, and staking reward allocations.

Find a wallet to track

Choosing a wallet to track depends on your goals and the availability of the wallet. If you just want to track the movements of top holders of smart contract projects you want to invest in or have already invested in, finding a wallet to track will be relatively easy. However, if you want to track “smart money” investors or other celebrities, the process may be slightly more complicated.

Based on the previous considerations, let’s try to find some wallets to track.

How to find top holders using a blockchain explorer

You can use a blockchain explorer for the blockchain network that the asset runs on to find the wallet of the top holder. Old blockchains such as Bitcoin and Litecoin typically have a “Rich List” feature that ranks holders in order of the assets they hold. EVM networks have similar functionality for smart contract tokens.

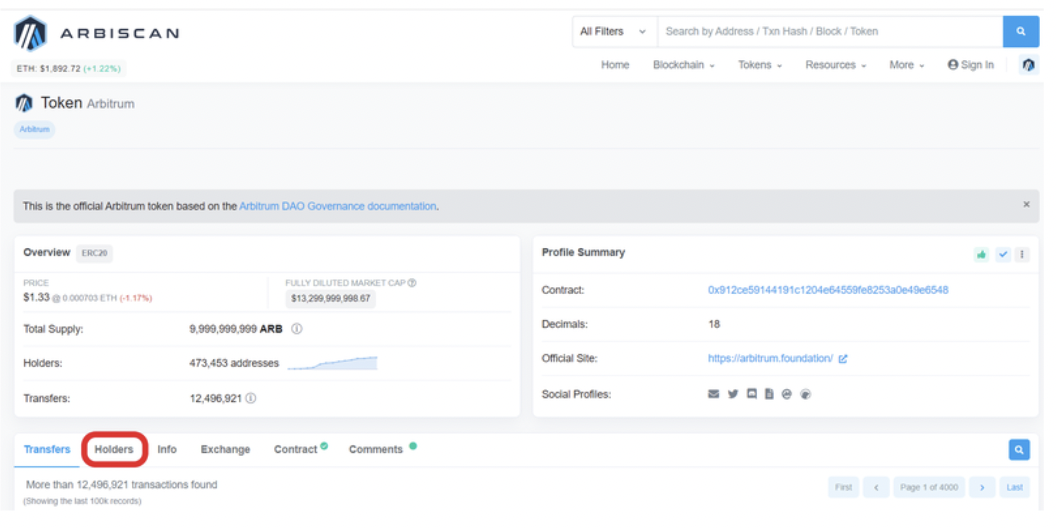

To find the top holder of a smart contract token using the explorer of the network, you first need to obtain the smart contract address of the asset and visit the explorer for more information. Here, we’ll use Arbitrum token on the Arbitrum Layer 2 network as an example.

We copied the smart contract from the CoinGecko asset page, but you can also get the smart contract address of the asset from the project’s official website and social media profiles.

Visit the Arbitrum Explorer, navigate to the Arbitrum token page, and then to the holders section, where the list of holders is sorted by the amount they hold. Note that the wallet with the highest ranking may be an official wallet or an exchange wallet.

Identifying “smart money” investors

To find “smart money” investors, more research may be needed, and additional tools may be required to simplify the process and improve its effectiveness.

Using a blockchain explorer

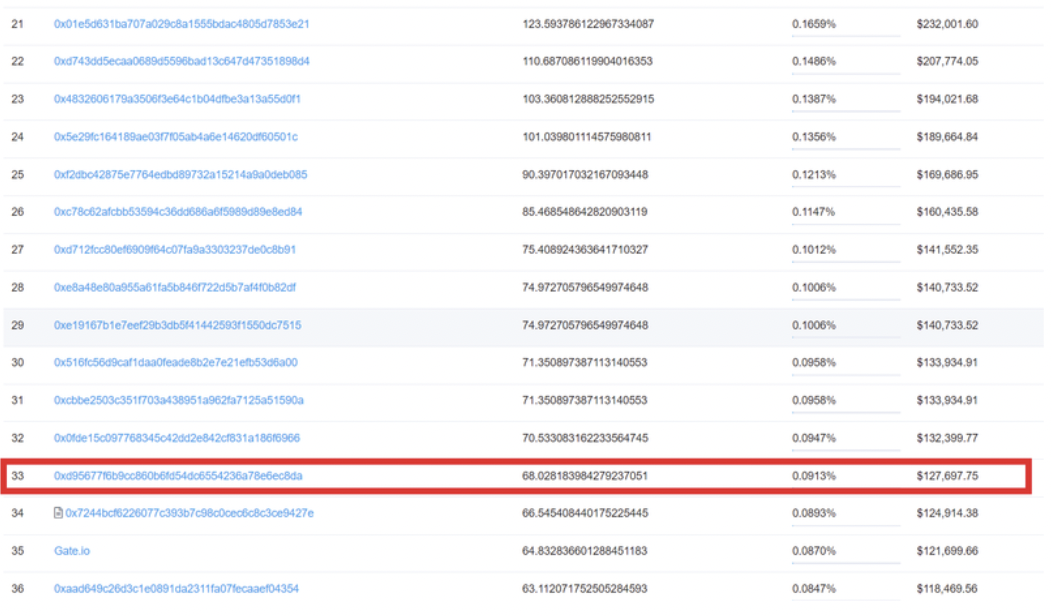

Top holders of some successful smart contract projects are a good starting point for finding “smart money” investors. To illustrate this point, let’s take a look at the Camelot token (GRAIL) on the Arbitrum network, which has been appreciating in value over time:

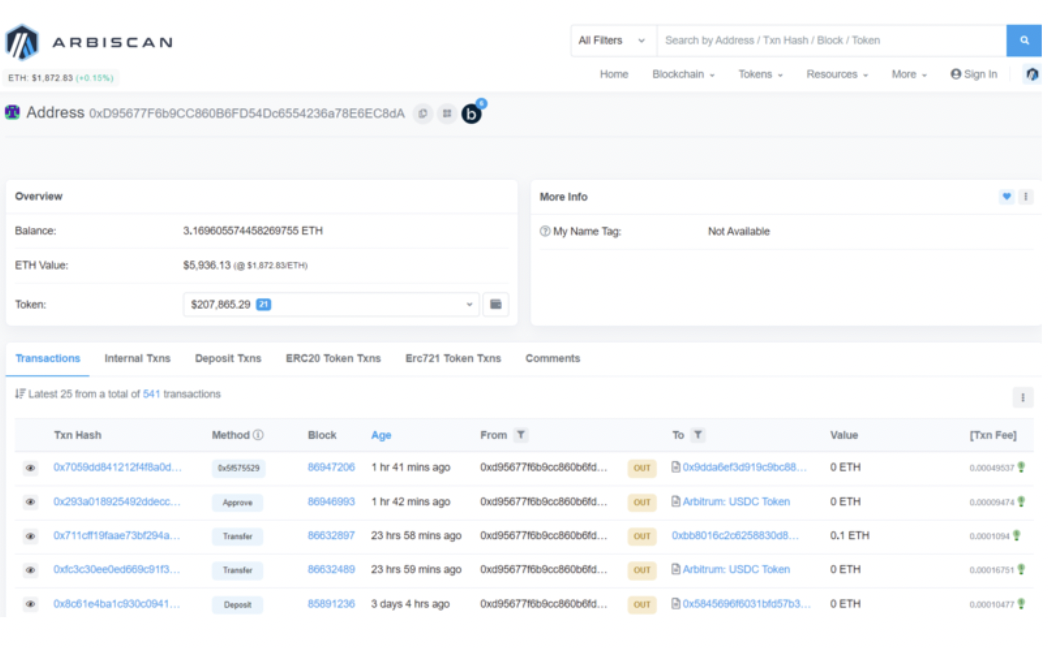

Looking at the top 50 wallets, most seem to belong to exchanges, vesting wallets, and institutions possibly related to the project. You can detect this using transaction labels and transaction frequency. Here, the wallet in the 33rd spot (at the time of writing) in the list of holders has been singled out.

Wallet 0xD956 holds approximately 68 GRAIL tokens. Of these, 22 tokens were purchased on January 17, 2023, at a price of around $241 each. At the time of writing, GRAIL was trading at $1,899 – a profit of over 780%.

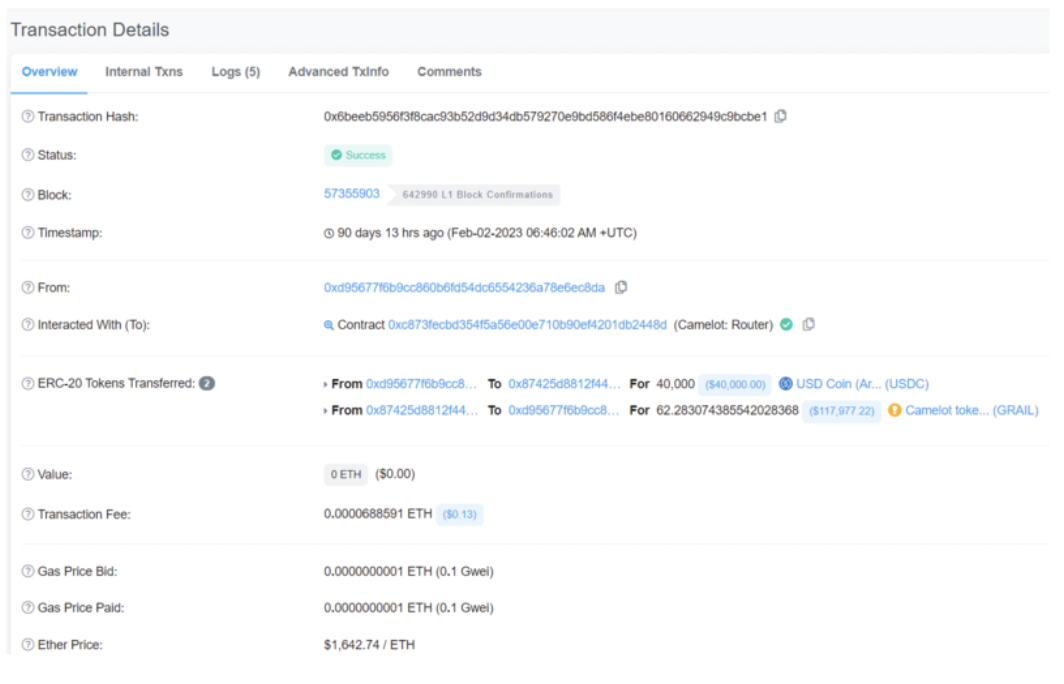

On February 2, 0xD956 also purchased 62 GRAIL tokens for around $550 each, selling 15 GRAIL for over $480 from his first purchase, realizing a profit of about 100%.

At the current value of GRAIL tokens, the February purchase represents a profit of over $70,000 at this time. This is an example of a “smart” trade, for illustration purposes only. Cryptocurrencies are volatile, and this is not financial advice.

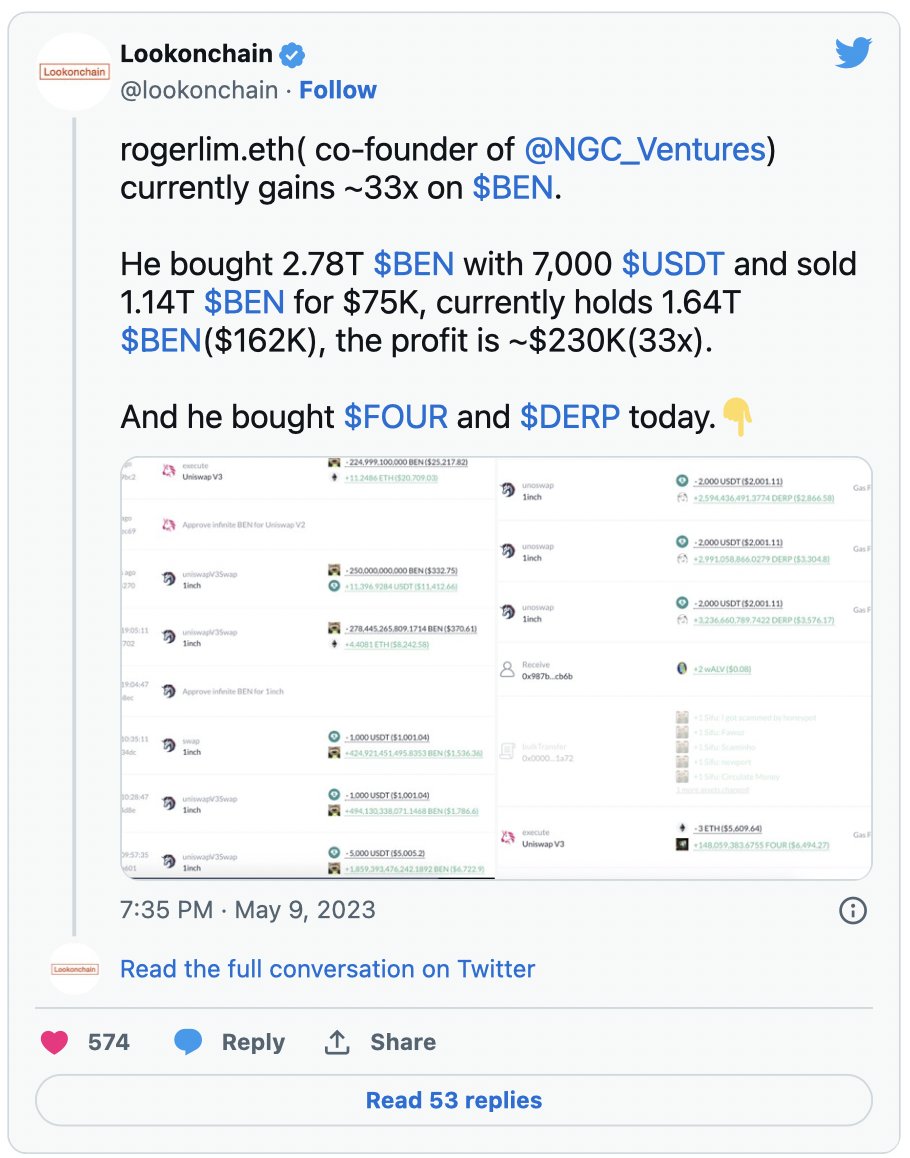

Social Media

Social media, the internet, and peer-to-peer interactions are also good ways to find wallets to track. An example of such a platform is Lookonchain. Lookonchain tracks “smart money” wallets and displays their findings on their Twitter profile. If these wallets are of interest to you, you can add them to your tracking list. Again, this is not financial advice.

Metrics to Watch When Tracking a Wallet

Now that you’ve found a smart wallet, here are a few things to keep in mind when tracking wallets.

Trading Assets

What assets are your smart investors holding, buying, or selling? Watch these to get more data on how smart money views assets. If an asset is popular among smart investors, they may believe it will appreciate in the short or long term. *Note that this is not a reliable strong data set and further research is advised on assets.

Trading Type

Observe whether your tracked wallet is purchasing, selling, claiming rewards, or receiving incentives from projects or other well-known institutions. Depending on why you are tracking wallets, this data can give you insight into financial transactions, their involvement in projects, and even more.

Trading Direction

If your wallet is sending focus assets to a centralized exchange, they may be preparing to take some profits. If you are tracking multiple “smart money” investors and their direction is consistent (especially if an asset’s price has already gone up), the most likely answer is profit taking; if the asset is not performing well, investors may be exiting the market. If the direction is opposite, “smart money” investors may be buying the asset, which may be an asset worth further research.

Trading Amount

Portfolio composition of assets in traders’ portfolios, the percentage of total supply they hold, and allocation relative to wallet size are all worth looking at to assess an investor’s belief in an asset or their impact on the overall market. A $40,000 purchase, like the one above at 0xD956, is a sign of conviction, especially for individual investors. Depending on GRAIL’s available liquidity at the time of purchase, such a trade may have a significant impact on the market.

Trading Frequency

Your smart money wallet may only be making daily trades on a decentralized exchange. This may be market manipulation or normal daily trading, but a good detection method is to look at the frequency of it repeating specific trades or trading cycles. If it repeatedly buys and sells a single asset, the trader may be attempting to profit from short-term fluctuations in the asset’s value or simply trying to influence the market.

How to Identify Scams

Scam projects attempt to steal investors’ attention by sending their tokens (unsolicited) to some well-known wallets, and inducing people to buy these project tokens or interact with their smart contracts. When tracking smart investor wallets, it is important to filter out these tokens. Blockchain browsers attempt to tag these types of tokens to protect investors. In cases where this information is not available, tracking transaction history is a good way to detect scam tokens in wallets.

Check how the smart wallet acquired this token – were they purchased, claimed, or received from peers? Claim transactions are usually marked on EVM network browsers; another way to identify claim transactions is to track transactions and verify that investors paid fees (claim fees) during the process. “Claim wallets” should also have similar transactions.

If the investor did not buy this asset on a decentralized or centralized exchange, and it is not sent by others, then it is likely to be a token that uses the wallet owner’s reputation for fraud. Track the source wallet of this transaction and observe other transactions performed by the wallet. Also, check if the smart contract page provides more information about the issuing project, and if so, verify all information related to the project.

Crypto Whale Tracker

Whales are a unique class of investors. They not only hold a significant proportion of circulating assets, but are also often seen as the most informed and important group of investors. They are considered “most important” because their activities have a huge impact on the market; they are considered “most informed” because they are believed to be closer to the project team or know more about the project than most other investors. In addition, they are also seen as the biggest believers in the project.

Therefore, investors try to track their movements and take these into account in their investment strategies. Crypto whale trackers help investors track whales.

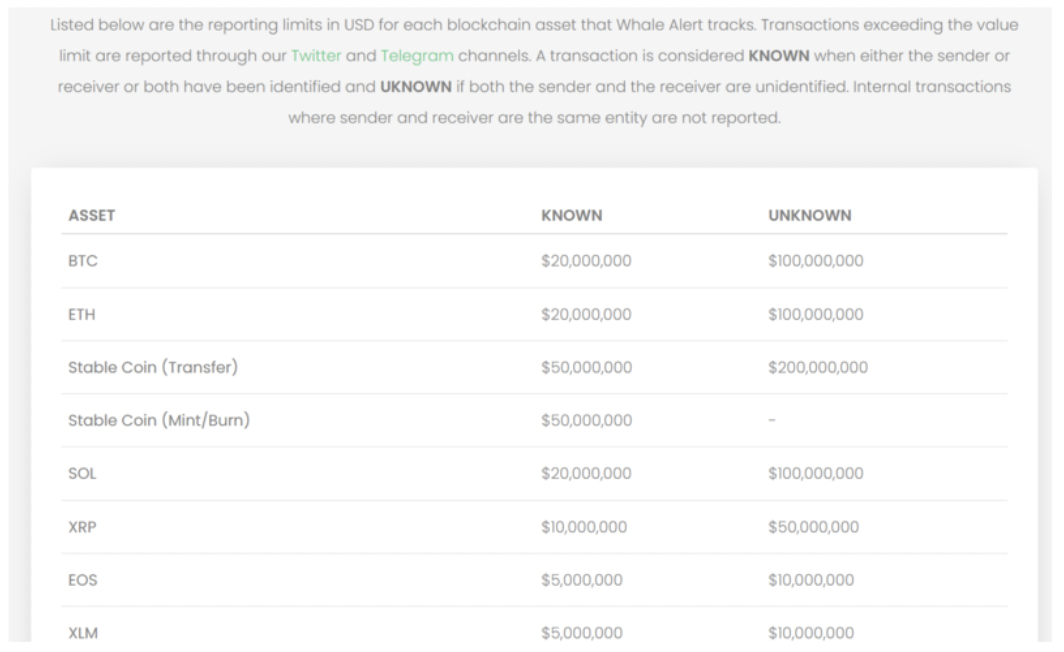

Whale trackers are similar to regular wallet trackers. They also work in a similar way. Whale trackers connect to aggregated on-chain data via API endpoints, just like wallet trackers. However, a major difference is the information they focus on.

Whale trackers only focus on significant transactions from top holders, and the information presented by whale trackers is usually high-value transactions and transactions from “wealthy” holders. On the other hand, the transactions presented by regular wallet trackers are transaction information from user-selected wallets. These transactions may be high or low value, and any wallet can be tracked regardless of its position on the holder list.

An example of a whale tracker is WhaleAlert.

Portfolio Tracker

Another related investment tool is a portfolio tracker. Portfolio trackers help investors track how the prices of their assets are developing. Some portfolio trackers will further aggregate news and additional data about the tracked assets and provide this information to investors. Cryptocurrency portfolio trackers like CoinGecko connect to data sources from cryptocurrency exchanges to obtain cryptocurrency transaction data from each exchange.

Investors can use investment portfolio tracking features on platforms like CoinGecko, Debank, and Nansen to aggregate their invested crypto assets in one place, making it easy to track these assets and related developments. Portfolio trackers can also notify investors of significant price changes through push notifications or email.

Cryptocurrency wallet trackers and portfolio trackers use similar technology, but wallet trackers focus on investors’ behavior, while portfolio trackers are more focused on asset prices.

Final Thoughts

Always do your own research when investing in cryptocurrency, and tracking wallets as part of on-chain data research can help with investment decisions. Wallet tracking may offer investors greater opportunities for profit because the goal is to follow “smart” investors with a successful track record.

Tracking a wallet can be tricky, especially when investors expect to use the data they obtain to make larger-scale decisions. This is because decisions like these require knowing not only what a wallet holds, but how long they have held these assets or plan to hold them, and why they hold these assets.

Smart investors may view certain assets as non-profit-oriented investments, and therefore do not care about making a profit. However, this means that investors tracking wallets may miss out on profit opportunities while waiting for signals from “smart” wallets. There is also the possibility of scam tokens that try to use wallet tracking to promote their tokens by sending large amounts of these tokens to well-known wallets in order to generate interest from investors who track these wallets.

When it comes to cryptocurrency investments, it is important to remember that it is a risky investment. It is always important to conduct your own research before investing in any project. Also, please note that this article is for educational purposes only and not financial advice.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Reflections on the .sats domain: Current development status and value analysis

- News Weekly | Hong Kong’s “Guideline on Virtual Asset Trading Platform Operators” will take effect on June 1, 2023.

- Glassnode Data Research: A Review of the “Crazy Week” of Bitcoin Scripting Outbreak

- Why is DigiFinex Coin considered as the “backbone” and pillar between fiat currency and virtual assets, even though it is not a stablecoin pegged to the Hong Kong dollar?

- Ark Introduction: A Layer 2 Protocol for Anonymous Bitcoin Payments Off-Chain

- BXB Capital: Made fortune from kimchi premium, once co-founded Korean market with Binance

- Multiple macroeconomic negative factors have hit the market, causing Bitcoin to drop below 26,000 US dollars in the short term.