The institutional change of crypto assets: ebb and flow, the new decade of the crypto world begins in 2020

Text: Looking west

Production: CoinVoice

Bill Gates once said:

- Has EOS bribery become the norm, or even a business model?

- Babbitt Exclusive | Staking + DeFi + DAO, the rough collision of complex transactions and simple governance

- Bitcoin's Secret History: How did Satoshi Nakamoto hide his identity on the Internet?

"Most people overestimate what can be done in a year, and underestimate what can be done in ten years."

Looking forward, looking forward, the annual shareholder letter of Warren Buffett, the god of stocks, was released as scheduled last weekend. Not only did the shareholders of Berkshire Hathaway pay more attention, but the entire investment community also regarded the Bible as "the Bible." Today, the crypto world has also released a major report. Financial giant JP Morgan released the 2020 blockchain research report "Blockchain, Digital Currency and Cryptocurrency: Entering the Mainstream? 》

In this 74-page report, JP Morgan pointed out that although it will take more time for blockchain technology to be adopted on a large scale by mainstream institutions, the past 2019 was a landmark year for the entire digital currency. Blockchain technology is widely used in the fields of finance and transportation. For the future of cryptocurrencies, the report mentions: "The crypto market continues to mature and the participation of institutional investors is of great significance to cryptocurrencies.

Retreat

Since the birth of Bitcoin in 2008, the high volatility of the crypto market has been driving institutional investors back. As the main regulator, the SEC's concerns about cryptocurrencies are mainly reflected in the manipulation of market risks, liquidity risks, lack of market supervision and sharing mechanisms, and opaque information.

An unregulated market is like a car with a broken brake.According to the latest analysis of CipherTrace, a blockchain data analysis company, cryptocurrency crimes have caused losses of more than $ 4.5 billion in 2019, an increase of nearly 160 from $ 1.74 billion in 2018. %. CipherTrace believes that several major scams are responsible for the substantial increase in the amount of cryptocurrency losses last year.The most notorious PlusToken scam has cost investors about $ 3 billion.

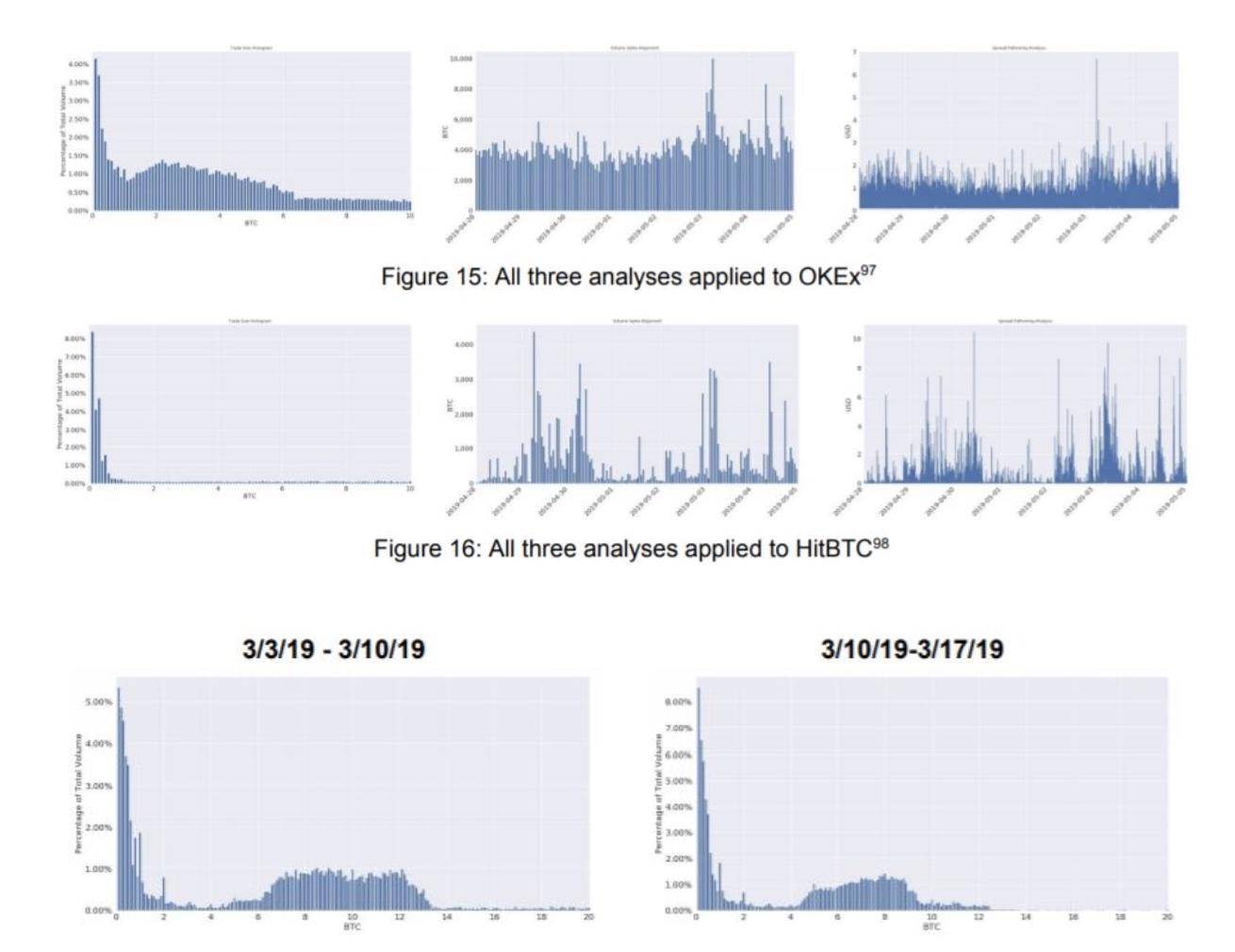

In addition, the authenticity of the crypto world is often criticized. In March 2019, Bitwise released a research report based on the analysis of 81 exchanges. According to their analysis results, Bitwise claims that the existing digital exchanges 95% of the transaction volume is the result of "fake" or fake transactions, and use this as evidence to hope that the SEC will approve the Bitcoin-led Bitcoin ETF. But the SEC took a very different view and rejected the proposed Bitwise proposal in October 2019.

For a long time, the above major obstacles have restricted the access of large institutions' funds. Many traditional investment institutions are daunting the crypto market. Compared with retail investors, institutional investors have a large trading volume. Although they are optimistic about the long-term development of the crypto world, they have not really entered the market due to fear of short-term risks. For them, more secure trading infrastructure and asset custody may be the best options for entering the crypto market.

Running into the field

At the end of 2019, Brian Armstrong, CEO of the crypto world giant Coinbase, wrote an eloquent article "2020 | What have cryptocurrencies experienced in the past 10 years?" ”, As stated in the article: Ten years ago, encryption technology was only a purely individual activity between enthusiasts and early adopters, but a clear trend emerged ten years later, and institutions began to intervene.

With the increasing trust of cryptocurrencies in the eyes of the public, institutional entities seek opportunities to bring digital assets into the traditional financial world. As the first step towards cryptocurrencies, the Chicago Board of Options Exchange (CBOE) and the Chicago Mercantile Exchange (CME) launched a cash-backed Bitcoin futures transaction in 2017, which opened a new chapter in institutional investment.

According to the latest research from Arcane Research, the daily trading volume of Bitcoin in 2020 will be close to $ 1 billion. Corresponding to daily trading volume, the Chicago Mercantile Exchange (CME) 's BTC trading volume recently exceeded $ 1 billion, a new record suggesting increased institutional demand.

As mentioned earlier, in the past few years, more than a dozen regulated and insured custodians, such as CME Group, have started to hold digital assets safely. Various trading venues with substantial liquidity have been developed. Futures and hedging capabilities are in place. Traditional financial institutions such as Fidelity and the Chicago Mercantile Exchange (CME) have gradually been able to provide the market with more secure crypto investment products.

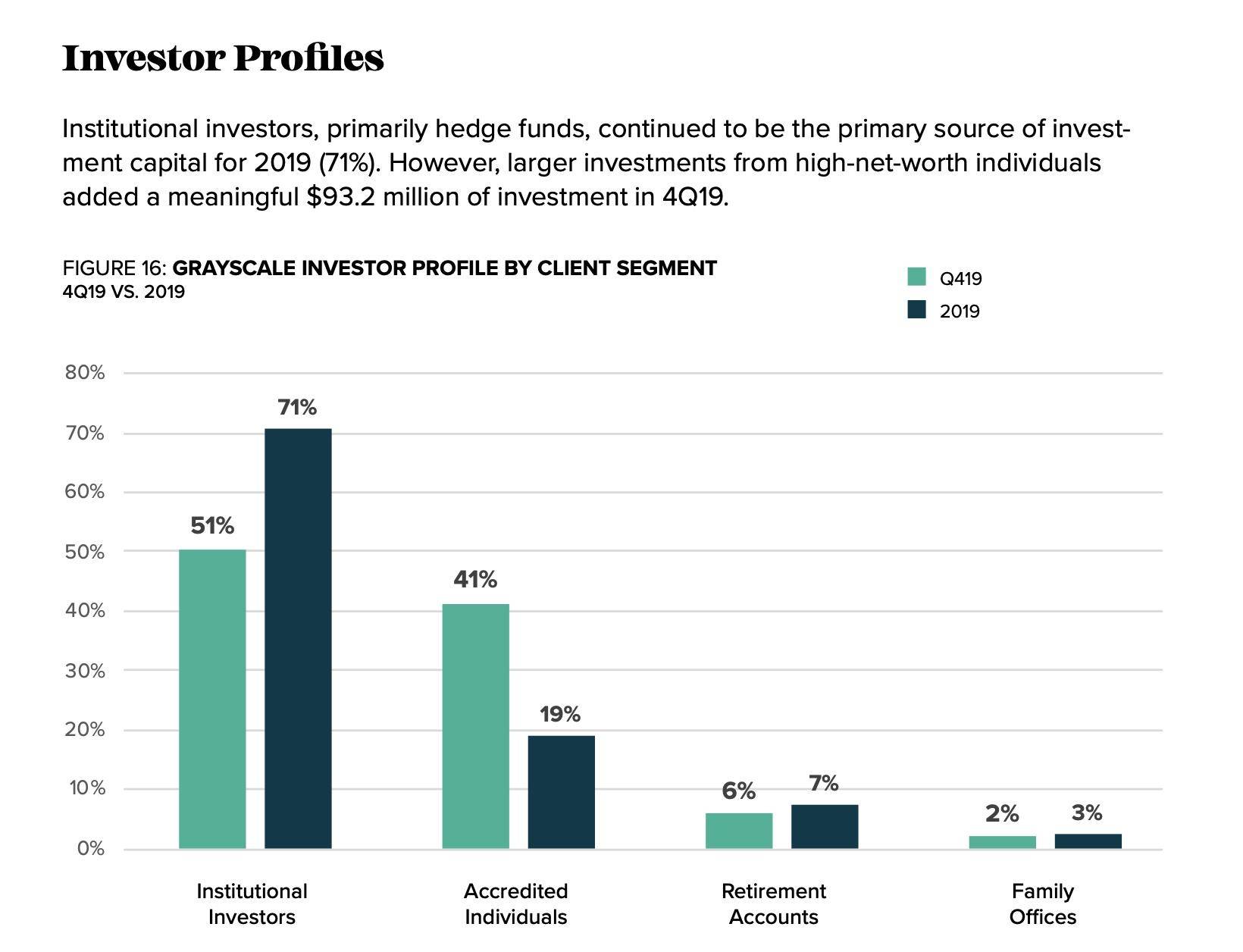

On the other hand, Grayscale, the world's largest digital asset management company in the crypto world, recently released the 2019 Digital Asset Investment Report. As stated in the report, traditional hedge funds, pension funds and endowment funds are increasing cryptocurrency holdings. In 2019, 71% of crypto investment funds of gray investment companies in 2019 came from institutional investment. Grayscale managing director Michael Sonnenshein said that institutional investors are running into the cryptocurrency market.

Ebb and flow

For a long time, "just wait for institutional investors to intervene" has been the main topic of discussion at various crypto summits.

In 2017, with the outbreak of ERC-20 tokens, institutional investors also ushered in a peak of fundraising. A total of 291 crypto funds were launched to the market. More than 290 new funds, including hedge funds and venture capital funds, were launched in 2016. More than three times the number of funds launched in the year.

In 2018, the launch speed of crypto funds remained high in 2017, with a total of 284 new crypto funds launched. In 2019, new crypto funds have experienced a cliff-like decline. As of December 2019, only 140 new crypto funds were launched globally, and the number of new funds issued was less than half of the number launched in 2018.

According to Crypto Fund Research data, more than 70 crypto funds globally have closed this year. The number of newly launched crypto funds in 2019 is less than half of last year. A total of 38 crypto funds were closed in North America this year, 23 in Europe, 14 in the Asia-Pacific region, and 3 in other regions.

Climbing on the air in 2018, crypto funds are investing in investment projects like gold everywhere. As the market turns cold, there is no investment, no funds in hand, and the tide rises and falls. The institutional investment market and players are becoming more mature.

Active head

The founder of crypto research institute Messari said in "20 Investment Experiences from Senior Experts": "Looking forward to 2020, the returns of most crypto funds are lower than expected, but I am still optimistic about crypto funds."

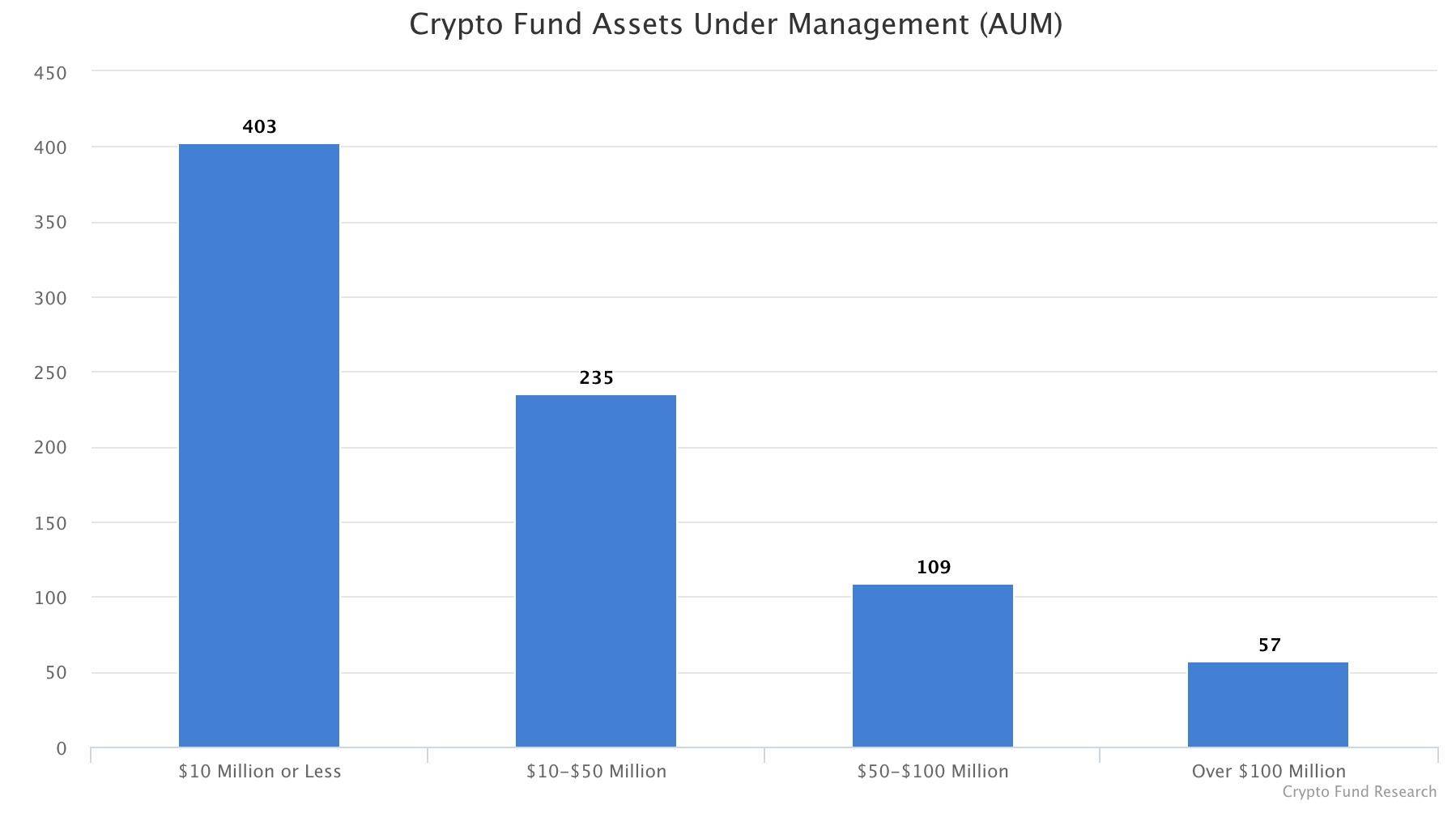

According to statistics from Crypto Fund Research, there are currently more than 800 crypto funds worldwide, most of which are venture capital funds (425), and a large number of hedge funds (355) and a small number of mixed funds, including some cryptocurrency ETFs .

Among them, the vast majority of crypto fund management assets are very small. Compared with traditional VCs, half of the funds manage assets less than 10 million US dollars. Crypto funds with assets over $ 100 million account for only 7%.

The survival of the fittest in the past few years has made the industry more mature, with tail players being washed up in the waves, while head players are still active and high-frequency shots. According to The Block statistics, the top ten most active funds in 2019 are NGC Ventures, Coinbase Ventures *, Digital Currency Group, Distributed Capital, Galaxy Digital, Polychain Capital, CMT Digital, Robot Ventures, Dragonfly Capital Partners, Pantera Capital.

With the exception of Galaxy Digital, each fund has invested in a regional exchange (mainly in South America, Europe, and the Middle East) or a trading services company, and this type of vertical has received the most investment in 2019. In addition to trading services and exchanges, the most active investment categories for 2019's most active funds are wallets, open financial platforms, and game studios using blockchain technology.

After several baptisms, the asset management scale of crypto funds has been increasing year by year, the head has been active, and the tail has been eliminated. The more obvious and more obvious the law of 28 is, the threshold of institutional investment in the crypto world is getting higher and higher.

ETF 殇

Compared to buying bitcoin directly or investing in bitcoin futures, although the bitcoin ETF can not bring higher returns to investors, it has a vanguard role in the investment of crypto market institutions.

In fact, ETF is an open-end fund that can be freely purchased, redeemed, and traded in real time. Bitcoin ETF is an investment fund that uses the BTC price as the target for tracking. It can be listed and traded freely on the exchange. .

As a product of hedging financial market investment risks, ETF provides a convenient channel for institutional investors to participate in the digital token economy. If the ETF is approved, it means that the authoritative market regulators in the United States recognize the encrypted digital currency market, the ability of the crypto world to attract funds will increase by an order of magnitude, and the number of Bitcoin investors is expected to increase several times, and may even reach thousands. Ten thousand levels make digital currency gradually become a real public investment product. As CME Director Sandra Ro said: The listing of a Bitcoin ETF signals that blockchain-based digital assets are maturing.

Since the Winklevoss brothers in 2013, the SEC has received a large number of applications for various cryptocurrency-related ETFs. At least nine different entities have submitted cryptocurrency ETF proposals to the Commission, but compliance has a long way to go, and all applications for proposals have ended in rejection, but SEC Chairman Jay Clayton still gives crypto The world retains suspense. In an interview with CNBC in September 2019, Jay Clayton bluntly stated, "We are closer to the Bitcoin ETF, and 2020 may really be the last" next year "of the Bitcoin ETF.

to sum up

As the global economy enters the 12th year of the longest expansion in history, there is no shortage of risks that need to be hedged. The outbreak of a new coronavirus pneumonia has severely damaged China ’s real economy, Brexit, German economic contraction, and continued strikes in France. Announced major sanctions against Russian oil giants. Gold broke the US $ 1600 mark for the first time in seven years, and the turbulent situation pushed the global economy to a cliff.

2020 is the beginning of a new decade in the crypto world. Although institutional investors remain cautious, no institution will ignore crypto assets and be optimistic about the future. Bill Gates once said: "Most people overestimate What can be done in one year, and what can be done in ten years is underestimated. The institutional change of crypto assets has just begun.

© This article is CoinVoice's high-quality original content. Unauthorized reproduction is prohibited. CoinVoice is a leading global blockchain media, focusing on original, deep and high-quality blockchain content, and is committed to linking blockchain innovators worldwide.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- What are the developments of Libra during the epidemic that deserve attention?

- Only 24 hours are left to register for the Wanxiang Blockchain Charity Hackathon!

- CITIC Construction Investment Securities: Bitcoin and "Blockchain + Gold" Possibility

- What if I don't want to sell coins? Finnish government forced to become hodler stumped by 1666 bitcoins

- Legal Watch | Blockchain Governance: Embracing the Chain of Law and Strictly Controlling the Risk of Coins

- It took two years! Mysterious miner rolls away 9,000 BCHs misplaced in Segregated Witness address

- Where can you spend Bitcoin in 2020?