Overseas epidemic situation is still spreading. Will decentralized organizations rise?

The epidemic in 2020 killed many companies.

The tourism industry of the catering industry is seriously damaged, and it is still difficult to recover to this day.

At present, the overseas epidemic is still spreading, in line with the general trend, many companies have started to work online, and the stock price of the video conferencing company Zoom has increased by 145%.

Under the challenge of the epidemic, distributed office has become a hot topic for discussion.

- The investment trend of the currency circle in 2020: the degrading process of the public chain

- BTC fell below the $ 7,000 mark, and the rally has come to an end

- RMB overseas mobile payment growth, talk about the way DCEP solves the "double spend problem" of transactions

Some people even predict that 2020 will be the first year of distributed organizations, and sooner or later the shape of existing companies will be disintegrated.

In fact, a more distributed and autonomous form of organization has long been implemented in the blockchain . It is DAO: Distributed Autonomous Organization, short for "Decentralized Autonomous Organization".

Uncle Jian believes that through the development of blockchain, DAO is gradually rising, and it has become a trend that you cannot ignore.

American writer Ori Bluffman once used spiders and starfish to metaphorize centralized organizations and distributed organizations.

The intelligence of the spider is concentrated in the brain. If you cut off its head, the spider cannot survive. It is like a centralized organization such as the army. Without a leader, it will become a mass of sand.

The starfish is composed of a bunch of cells symmetrical to each other, and each broken tentacle can grow into a complete starfish, just like a distributed organization, with strong survivability.

Image source: Tencent

At that time, the powerful Spanish army swept across South America, and several centralized empires were easily defeated. However, during the invasion of North America, they had engaged in a tug of war for two hundred years with this tribe.

In today's blockchain world, such a starfish organization is called DAO. People write the management and operation rules of the organization on the blockchain in the form of smart contracts. Each node acts in accordance with the smart contract and is fair and open In order to achieve self-operation without centralized control and unmanned intervention.

In order to facilitate understanding, Uncle Jian gives an example in real life. Usually, in a large intelligent warehouse, thousands of robots are used to automatically plan routes, automatically receive, identify, classify, organize and extract goods.

Each robot can be compared to each running node on the blockchain, and the robot's control program is like a smart contract. The entire warehouse is like an organization that can be automated and is also a DAO .

Image source: Zhitou

The real landing of DAO benefits from the rapid development of blockchain technology.

Because blockchain integrates technologies such as distributed data storage, point-to-point transmission, consensus mechanism, encryption algorithm, etc., it has the characteristics of decentralization and non-tampering. You can create your own smart contract on a development platform like Ethereum, and then realize a decentralized organization.

On April 30, 2016, the first DAO project "The DAO" built on the Ethereum blockchain was launched. From the name, it can be seen that this project must occupy the right place and the right people.

The essence of The DAO is a financing platform, anyone can promote their projects on it, and people who hold DAO Token can vote for projects that interest them. Smart contracts stipulate that if the project is profitable, it will be rewarded.

At that time, the geek thinking of Code is law became more and more popular, and people were ambitious, hoping to use blockchain to create a truly decentralized autonomous organization.

Therefore, the birth of "The DAO" can be described as following the trend and has received great attention from the crypto community. At the end of the private placement stage, it raised up to 150 million US dollars of Ethereum ETH, which became the largest crowdfunding project in history at that time.

Although later, more than 3.6 million ETH were stolen by hackers due to The DAO code vulnerability, which in turn triggered a hard fork of ETH and once again set a community record.

But people have begun to realize the value and broad prospects of DAO.

Then a series of related projects were launched one after another, such as Polkadot (Poka), Aragon DAO, DashDAO, MakerDAO and so on.

Among them, the head project MakerDAO has developed very rapidly since it was launched on the Ethereum main network in December 2017. According to analysis, the value of its lock-up funds has exceeded US $ 760 million, and it continues to grow.

Image source: DeFi Pulse

▌1. Contract security risk

Uncle Jian believes that DAO ’s vision is indeed very strong, but no smart contract is perfectly designed, otherwise The DAO will not be caught.

So what is going on with this loophole?

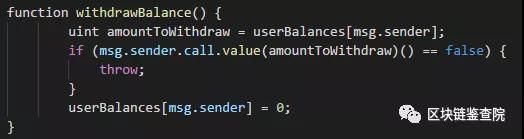

As a senior code farmer, Jian Shu will delve into the analysis and interpretation of smart contract codes. For ease of description, I simplified the real code and filtered out only the core part of the vulnerability:

Image source: Blockchain Inspection Institute

This code is actually a simple withdrawal logic. The purpose is to allow members of The DAO to get back the funds they have invested in the contract account. After the funds are withdrawn, the user's withdrawal amount is set to 0.

msg.sender.call.value (amountToWithdraw) () indicates the transfer operation; userBalances [msg.sender] = 0; It means that after withdrawal, the user's withdrawal amount will become 0.

Under normal circumstances, the user withdraws once, and this logic will only be executed once, and the transfer operation is performed first, and then the withdrawal amount is set to 0, so there is no problem.

However, the hacker used the characteristics of the smart contract to write a sub-contract, so that during the execution of the transfer code (msg.sender.call), the execution of withdrawBalance logic and a new round of transfer were triggered again, which means that the hacker can Before the user's withdrawal amount becomes 0, the same amount of transfer operation is performed multiple times.

In the end, hackers carried out more than two hundred attacks, and successfully transferred more than 3.6 million Ethereum, which exceeded one third of the total number of Ethereum raised by the project, and the impact was very large.

It did n’t take long for the community to discover the hacker ’s attack. At that time, Ethereum founder V God issued an emergency announcement: “We suspended the transaction and we were attacked.”

The Ethereum community had a fierce discussion on how to deal with this loophole. Finally, most people agreed to a hard fork of Ethereum, forming two chains, one as the original chain (Ethereum Classic, ETC), It is a new fork chain (ETH).

In fact, there are many other known smart contract security problems, such as transaction sequence dependence vulnerabilities, timestamp dependence vulnerabilities, etc., which greatly restrict the development of DAO and also bring a very large security risk to DAO And risk, it also needs to be continuously optimized to solve.

▌2. Man-made manipulation risk

Unlike robots in smart warehouses, people are selfish, and people have their own thoughts.

In the governance form of the DAO organization, voting is a very important link, and all proposals in the community need to be decided by voting.

But how many people vote and how many tokens each holds is completely uncontrollable.

On November 18, 2019, MakerDAO launched a new version that supports multiple collaterals and requires the entire community to vote: which assets can be used as collateral?

The head of MakerDAO stated that the governance of MakerDAO should be determined by the holder of the MKR (Management Token issued by the Maker team) token to determine the future of the entire system. If the proposal fails, the upgrade plan will be shelved.

It seems fair and just, but what about reality?

We analyzed the voting participation of the MakerDAO multi-collateralized version proposal. According to vote.makerdao, this proposal has only a total of more than 150 addresses to vote, which is already one of the highest turnout proposals so far.

But statistics found that 5 of them accounted for more than 50% of the vote. That is to say, the remaining 140-plus votes are just a form, basically useless.

However, this voting result was actually expected.

Most MakerDAO proposals have fewer than 30 addresses to vote.

Image source: vote.makerdao

According to the statistics of the addresses held by MKR, it can be found that the number of addresses holding MKR has reached 18,025, but the top 10 largest account holders hold up to 61.2% of the currency, and it is still rising significantly.

This shows that the concentration of MKR is very high, and large households have absolute voting rights.

Image source: non-small

This version upgrade is of great significance to MakerDAO, but it exposes the governance difficulties of many DAO projects:

Even if the smart contract is open source, the teams and big players behind the development and operation still have great influence.

Sure enough, there are rivers and lakes where there are people.

▌3. Legal risks

Blockchain can break national boundaries and gather people from all over the world to work for a vision. However, it also brings great challenges to the current legal system.

DAO's smart contract does not define legal or illegal, as long as the transaction conforms to the contract logic, even illegal transactions will continue to be executed. Coupled with the fact that the data on the chain cannot be tampered with, local enforcement agencies will also be unable to abolish this illegal transaction.

Secondly, due to the characteristics of decentralization, cross-border and anonymization of members, it is difficult to blame once there are legal problems in the actual operation process. For example, The DAO was attacked, which caused the price of Ethereum to fall by 30% and suffered such a large loss Community members can only beat their teeth and swallow in their stomachs.

The vision is beautiful, social civilization continues to progress, and the rise of DAO follows the general trend.

But the reality is cruel. Uncle Jian believes that distributed autonomy based solely on smart contracts needs to overcome the weaknesses and greed of human nature, and the current human society is far from ready.

In Liu Cixin's novel Three Body, the three body society is actually a DAO, a highly distributed autonomous blockchain community.

Every three-body person is a natural blockchain node. All nodes are connected through transparent thinking, and others can see what they want in their hearts.

This is why the three-body civilization is far superior to human civilization. Transparent thinking allows information to be shared quickly and unerringly, and promotes scientific progress .

But for human beings, wouldn't it be unthinkable to think without privacy? Once a person has no privacy, what does it mean to be alive?

So this is why Uncle Jian feels that we are not ready for DAO yet.

Perhaps with the continuous development of human civilization, we will get used to being transparent and treating each other honestly. But at that time, you will give the code the right to decide right or wrong, will you be at ease?

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- The hardware wallet is upgraded again, Cobo joins hands with Chain Node and Chain Store to officially release a new generation of products

- Blockchain startup Dltledgers handles more than $ 3 billion in trade financing

- My understanding of the investment process: the way to fight anxiety is "long-term thinking"

- A brief history of stablecoins: the master key that unlocks the crypto world

- Popular Science | How is the Ethereum block size determined

- The crisis under the iceberg: DeFi financial crisis and challenges

- Data: Demand for Bitcoin from institutional and retail customers explodes