Overview of Ethereum distribution with a total circulation of over 120 million.

Overview of Ethereum's 120+ million total circulation.Author: Babywhale, Foresight News

The current total circulation of Ethereum is approximately more than 120 million plus 233,000. These over 100 million tokens are now scattered in various corners of the Web3 world, including exchanges, DeFi, cross-chain bridges, Layer 2, on-chain ecosystems other than EVM, and many wallets that hackers are afraid to touch for fear of being tracked.

We are bombarded with various data every day, such as Ethereum reaching new highs in cross-chain transactions on a certain L2, and the inventory of exchanges reaching new lows. But has anyone ever considered how these Ethereum tokens are distributed and where they like to go the most?

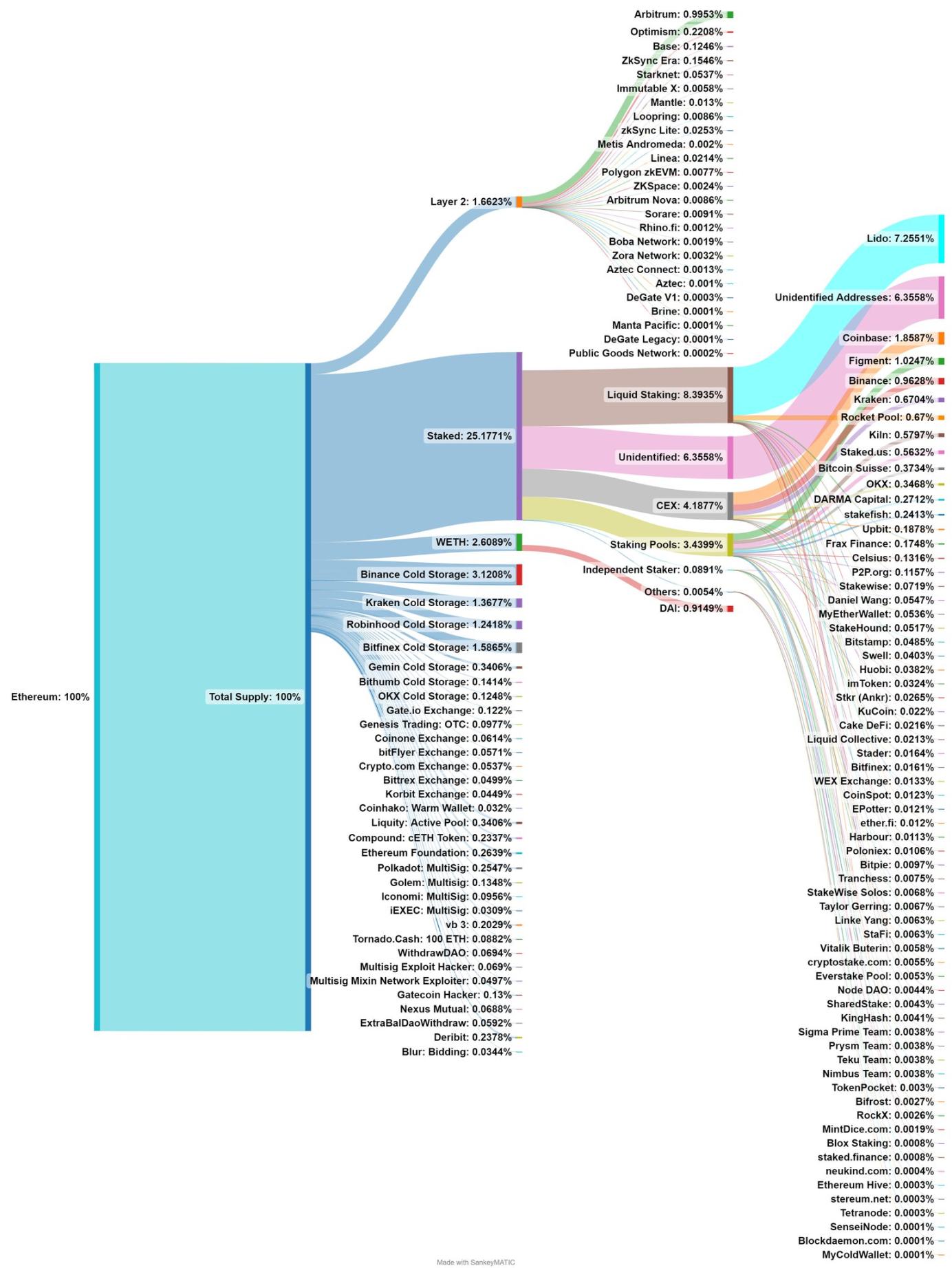

A user named Eth Wave (@TrueWaveBreak) on platform X, who is obsessed with Ethereum, has done a statistic that is not complete but still provides some insights. Although this statistic ignores the destination of many WETH tokens and ETH tokens outside the EVM ecosystem, it roughly outlines a picture of the distribution of Ethereum:

- Celestia’s large-scale airdrop, Eclipse’s release of Layer2 new solution, what other latest developments are there in modular blockchain?

- Chainalysis Research Mass Adoption of Cryptocurrencies in India, the Philippines, and Pakistan

- What makes Fhenix’s first fully homomorphic encrypted blockchain so magical, with Multicoin leading the investment and a gathering of experts?

There are many interesting data points on this chart that are worth discussing separately.

Less than 2% of ETH is on L2

According to the data on the chart, the ETH tokens on all L2 account for only about 1.66% of the total circulation of ETH, which is equivalent to about 1.992 million tokens. At the time of writing this article, the total value of these tokens is calculated to be 3.223 billion US dollars based on the Ethereum price, accounting for 30.87% of the total value locked (TVL) in L2, which is 10.44 billion US dollars.

The ranking of L2 based on ETH inventory on this chart is almost consistent with the ranking based on TVL in L2BEAT. In addition to the two giants Arbitrum and OP Mainnet, the recent development speed of Base has caught many people off guard, and its TVL has surpassed zkSync Era and Starknet, which were launched earlier.

However, even though L2 has performed well, a comparison reveals that the total ETH on all L2 is only slightly higher than the inventory of Bitfinex cold wallets, and even only about half of the inventory of Binance cold wallets.

Based on this, we can also conclude that L2, as a Ethereum alternative that significantly reduces transaction costs, at least for now, has no signs of threatening the status of Ethereum. On the one hand, this may be because the number of users who can skillfully transfer assets between different chains is still relatively low, and on the other hand, it may also be because there are still many irreplaceable applications on the mainnet.

CEX is still the main battlefield for ETH liquidity

According to the calculated data listed on the chart, the identified inventory of ETH on exchanges exceeds 7%. Considering small exchanges around the world and potential unidentified exchange addresses, the inventory of ETH on centralized exchanges may still be close to or even exceed 10%.

This means that CEX is still the main gathering place for ETH liquidity. The so-called “insufficient liquidity” that we observe on the order book is likely just a decrease in users’ willingness to trade frequently, and most of them are likely to be holding their positions.

In addition, institutions such as Robinhood that are not cryptocurrency exchanges but have cryptocurrency trading businesses should not be ignored. For example, Grayscale, which is not mentioned in the figure, has been identified by the blockchain data analysis platform Arkham to hold 3.03 million ETH, accounting for more than 2.5% of the total circulation.

The Chips in the Hands of Hackers Should Not Be Ignored

The figure also lists the holdings of some hackers, such as the hackers who attacked the Polkadot multi-signature wallet, Mixin, and Gatecoin. There are also unlisted ones, such as the notorious North Korean hacker group Lazarus Group. However, those unlisted hackers may have deposited the stolen assets into mixers including Tornado.Cash or stored them in different addresses, making it difficult to identify them all in a short time.

Staked Ethereum

Staked Ethereum already accounts for more than 25% of the total circulation of Ethereum, and this number may continue to rise in the foreseeable future. Among the staked ETH, one-third is deposited into liquidity staking protocols, and more than 86% of this one-third is in Lido. In the staking field, although centralized exchanges also have a share and have launched liquidity staking tokens (LST), they are currently far less popular than decentralized protocols, with staking volume being only half that of the LSD protocol.

Liquidity staking is a track that may be much more complex than it seems. It is not just about staking and obtaining an equivalent amount of tokens representing staked shares. Areas worth further research include how to decentralize to mitigate risks, how to reduce the amount of ETH deposited by users, and how to use LST to maintain the security of other networks (re-staking).

However, on the other hand, liquidity staking is essentially a leveraged behavior. Currently, using LST as collateral for lending and the issuance of decentralized stablecoins by many LSD protocols further magnify the leverage. In the future, if there is a large enough scale and extreme market conditions reappear, it will be a problem that we need to prepare for whether there is enough liquidity to liquidate these assets.

As the author himself said, this chart is not perfect. For example, exchanges, WETH on Layer 2, DEX, etc., are not included in the statistics. In the DeFi field, the figure only shows the proportion of Compound’s cETH and DAI (MakerDAO) minted by collateralizing WETH. Other large DeFi protocols such as Aave, Curve, and Uniswap are not included. The author stated that this chart will be continuously improved and expects more valuable information to be discovered through the improved chart.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Protecting the Future of the Banking Industry Exploring the Synergy between Blockchain and Network Security

- Overview of TON Blockchain Ecological Applications, 551 DApps Covering 16 Tracks

- What are the legal risks of blockchain games in the new trend of NFT digital collections?

- Is NASA interested in crypto too? Their own researchers are testing blockchain storage on the moon base.

- Celestia, a modular blockchain, launches its own cryptocurrency. Take a quick look at the airdrop details and token economy.

- Why is regulatory compliance considered the final step in decentralization for blockchain?

- SBF in the eyes of Western mainstream media Watch the BBC documentary ‘The Fall of the Crypto King’ in 5 minutes.