Traditional institutions are eager to try, and RWA is finally taking off.

Traditional institutions are eager to try, and RWA is taking off.

Source/kitco

Compilation/Octopus Brother

Tokenization of Real World Assets (RWA) has become one of the most powerful use cases for blockchain technology globally, as it is expected to bring higher efficiency and security to financial markets in the digital age.

- Ghost in the Blockchain International Top Hacker Organization Steals Digital Assets Worth at Least $1 Billion

- Why build Onchain Realities?

- The Cryptographic Mars in LianGuairadigm’s Eyes Speculation, Pioneering, and Gambling Tables on the Blockchain

To gain a deeper understanding of the development of RWA in 2023, kitco editor interviewed Benjamin Stani, the Business Development Director of Matrixport.

“With the compression of on-chain yields and the rise in interest rates by the Federal Reserve (FED), there has been a significant divergence between on-chain and off-chain interest rates,” Stani said. “RWA may be able to bridge this gap.”

He pointed out that while the stablecoin market is the cornerstone of the crypto ecosystem, the underutilization of these stable assets has always been a lingering issue, and RWA can address this problem. This has become a disruptive force in 2023, unleashing the potential of this asset class and fundamentally changing the way value is created, transferred, and stored.”

Driving the push for risk-free real world yields to be tokenized, treasury bonds, real estate, precious metals, and art are considered the most feasible tokenized assets.

The launch of Matrixdock’s tokenized Short-Term Treasury Bonds (STBT) has received very positive feedback, raising $123 million in just over five months. Stani noted that with the push for interest rate hikes by the Federal Reserve (FED), people are looking for risk-free rates while avoiding the hassle of traditional trading execution and settlement for bonds, and STBT meets this demand. As the industry evolves, the same logic applies to other real world assets as well.

With tokenized government bonds widely adopted by the industry, there won’t be much difference in exploring other liquid listed securities in a similar form conceptually. In short, RWA can extend to real estate, corporate bonds, and fine wines. The RWA industry is expected to be a major theme in the digital asset ecosystem in the next few years, adding trillions of dollars to the market.”

RWA will greatly enrich the scale and variety of on-chain available assets. With the expectation of continuously rising risk-free rates, it is expected that in the coming quarters, institutions will adopt tokenized notes due to economic incentives, and there will be further DeFi innovations in the market.

Although RWA is still in the early stages of the tokenization cycle, interest from both native cryptocurrency participants and traditional financial players is growing.

Stani said, “The industry has made some notable progress, including the successful use of DeFi in the wholesale financing market, foreign exchange trading, and government bond trading experiments by the Monetary Authority of Singapore’s Project Guardian, as well as Deutsche Bank’s testing of tokenized funds on the Ethereum public network. The adoption rate of RWA is rising rapidly. Continued innovation in clearing strategies and smart algorithms is driving this momentum, with significant progress expected by the end of the year.”

01. The Pros and Cons of Tokenization

One of the biggest advantages of tokenization is that it democratizes the financial market by eliminating intermediaries, speeding up transaction times, and reducing costs. It also opens up investment opportunities that were previously only available to high-net-worth individuals.

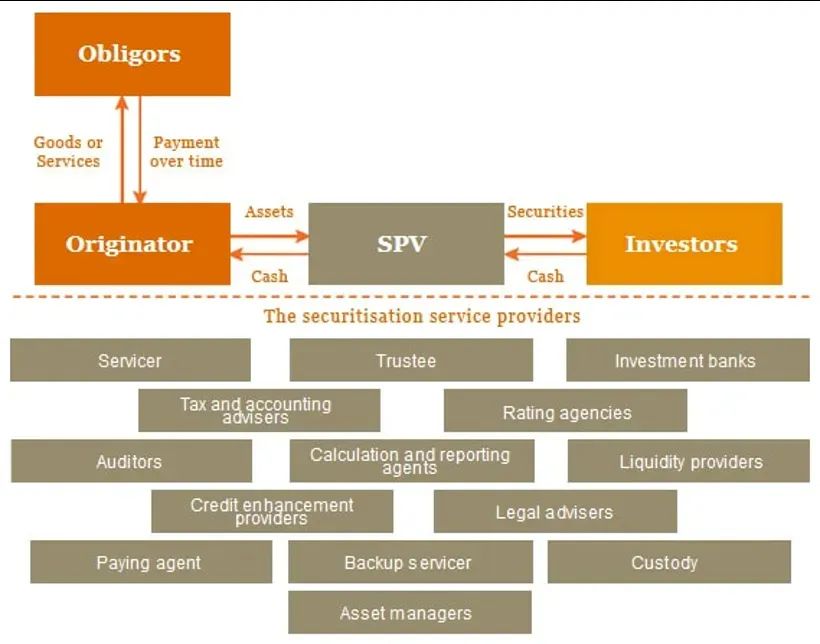

Before the emergence of Real World Assets (RWA), the main limitations of the market were focused on user experience, especially in terms of liquidity. Tokenization has the potential to completely change the financial landscape, create new sources of income, and even establish entirely new markets. We can gain insights into the complexity of the typical combination of external parties and service providers in traditional securitization through the visual representation provided by PwC.

Source: PwC

The orange boxes above the dashed line represent the main parties involved: the debtor (mortgage borrower), the originator (lender creating the mortgage), and the investors (buyers of the pooled mortgages). The core function of securitization is to pool cash from underlying debtors, slice it, and distribute the cash to investors.

Each step in this process incurs costs, and the costs accumulate throughout the entire securitization process. The costs are estimated to increase by 1% throughout the process, which may seem insignificant. However, even a 0.50% decrease in the interest rate of a $500,000 mortgage can save $2,500 per year, which is a significant expense for most people.

Compared to traditional lending, on-chain lending has several key advantages over real-world assets, including greater international accessibility, accessibility to encrypted financial instruments, and a more democratic decision-making process. These factors help make lending more inclusive, transparent, and convenient for a broader range of borrowers and lenders, while also promoting the stability of the lending ecosystem and reducing risks. As the industry develops, we may see the convergence of TradFi and DeFi, creating conditions for a more intelligent and programmable global economy.

One of the biggest obstacles for RWA currently is regulatory uncertainty. Legal frameworks are struggling to keep up with the rapid development of tokenization technology. This is particularly evident in the RWA infrastructure integrated with DeFi, where regulatory agencies must address blockchain scalability issues to accommodate TradFi market capacities.”

To help overcome this obstacle, Stani suggests adopting a progressive regulatory approach, focusing on establishing a comprehensive framework that is fully compatible with DeFi standards. Such frameworks must strictly enforce risk management protocols to enhance transparency and security. The success of Singapore’s pioneering stablecoin regulation demonstrates the power of clear and robust guidelines. They not only protect investors but also create a favorable environment for issuers and financial institutions to innovate and explore new investment channels.

The technical aspect is actually easier to upgrade and develop because there are viable solutions available. The bottleneck is more apparent in regulation and compliance, where we need to clarify what constitutes a security and how to handle on-chain ownership off-chain. Some jurisdictions are more progressive than others, and naturally, we will see innovation being driven in these progressive jurisdictions.

The biggest obstacle may be internal compliance teams wanting to overlay the same framework on these new asset classes, when it’s evident that many things have lower relevance on-chain (such as retaining audit trails) or are even unfeasible (such as reversing transactions).

Currently, regulatory and compliance-related issues are causing delays in the adoption of RWAs, but Stani says that these obstacles will eventually be overcome, allowing RWAs to flourish globally.

02. Conclusion

There is a strong demand for deep liquidity on-chain in the future, especially for large-scale protocols. Although STOs have limitations and licensing requirements, using securities as underlying assets for other products will provide some flexibility. The industry is exploring these possibilities and striving for innovation.

Once RWAs have reached a sufficient scale within the industry, the ultimate result will be the convergence of TradFi and the cryptocurrency world into a single financial realm. This will be astonishing, unlike the trends of past bull markets.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Reflections on Shanghai Blockchain Week Mainland Web3 Walks in the Sunshine, While Darkness Crawls

- Evening Must-Read | The Future of Blockchain in China

- Chen Bin, General Manager of Wanxiang Blockchain Trusted Digitalization of Assets is the Passport for the Integration of the Real Economy into the Digital Economy.

- Commitments will be recorded on the chain Awakening Long-termism

- The future of blockchain is in China

- Vice President of WeBank Qianhai Possibilities of Public Consortium Chain 2.0

- Highlights of the ‘2023 Shanghai Blockchain International Week’ (continuously updated)