Blockchain Capital: Looking Ahead to the “Consumer Era” of Cryptocurrencies

Blockchain Capital's view on the future of cryptocurrencies: the "Consumer Era".Original author: KINJAL SHAH, Blockchain Capital GP

Original source: Blockchain Capital

Original title: Crypto’s Consumer Era: A Retro & What’s Ahead

Translation: Yvonne, MarsBit

- AI in the Web3 Era: Exploring the Infinite Potential of Blockchain and Artificial Intelligence

- Analysis of Lybra Finance, the LSDfi leader: How stable is it? What are the risks of “layer 2 nesting”?

- Long article by V God: What are some non-financial use cases of blockchain?

What happened?

About two years ago, NFTs began to enter the public eye. For a time, we saw a wave of consumer use cases launched by hundreds of influential people, millions of dollars in venture capital, and a large number of builders.

It was a period of growth. The world witnessed a renaissance of cryptocurrency – one that returned ownership to users and provided new sources of income for creators. We saw digital and generative art receive praise and attention from mainstream media like never before. The conversation turned to the more human side of what this technology could achieve.

However, as with all major run-ups, the trend quickly shifted. Security and user experience proved unsuitable for the masses. Soon, the chains became crowded, raising barriers to entry, particularly on the Ethereum chain. We saw traders lament network congestion, a sentiment that was short-lived and sometimes even comical. Principles and ideas existed, but execution was lacking.

Looking back on these two years, we have observed and learned some lessons through investing, reading, and collaborating with builders. We will share some of these experiences to tell you what has failed, what has succeeded, and what we are excited about.

Failures

Speculative communities

The survival and development of PFP or “avatar-like NFTs” depend on the community they belong to. Initially, this was a means of bringing people together on the internet, but it quickly became a community full of incitement, advocacy for high sales, and no consideration for long-term sustainability and value consistency, jumping from one new NFT to another and chasing the next hot spot. Looking ahead, we are pleased to see communities positioning themselves around a set of specific beliefs, creating meaningful value, which is no different from the most passionate fans we see on existing social media.

GM, WAGMI, and UpOnly

We want a positive community movement. Unfortunately, this has turned into a slogan, which then evolved into a hypocritical belief – that Web3 can solve all problems. This industry has always been filled with fun and vitality. This is one of the most unique aspects of building in the crypto space. But this also brings a problem, that we should not blindly pursue loud slogans and mainstream narratives, but should dare to raise sharp questions.

The current form of DAO

People describe the potential of decentralized autonomous organizations in a hundred different ways. DAO is a new field of community – soon, everything became “DAO”. Frankly, the experiment is benign and exciting. However, it is obvious that not every organization is suitable for a decentralized autonomous structure. Governance (a controversial topic that has existed in the crypto field for a long time) has not been solved through rapid experimentation with consumer DAOs. We believe that the human factors of DAOs are more difficult to define and will truly affect the development of the narrative.

Successes

NFT will continue to exist

NFTs will not disappear. When NFTs first entered the public eye, we saw PFP NFTs become the main use case. However, now millions of people around the world know what NFTs are. They understand that NFTs can be a carrier for almost anything – game assets, financial contracts, data containers. NFTs have infinite possibilities and will not disappear.

Mainstream brands enter the NFT market

NFT creators have earned over $1.9 billion in royalties. The world’s largest brands are launching NFT products, such as Starbucks, Reddit, Nike, Adidas, Gucci, Louis Vuitton, and Tiffany & Co. In the bear market, companies such as Amazon, Google, and eBay continue to delve into NFTs. Imagine what the consumer world will look like in five years. Especially in the digital world, marketing and consumer acquisition are changing – especially with the demise of cookies. NFTs may play a role in the market trends in the coming years.

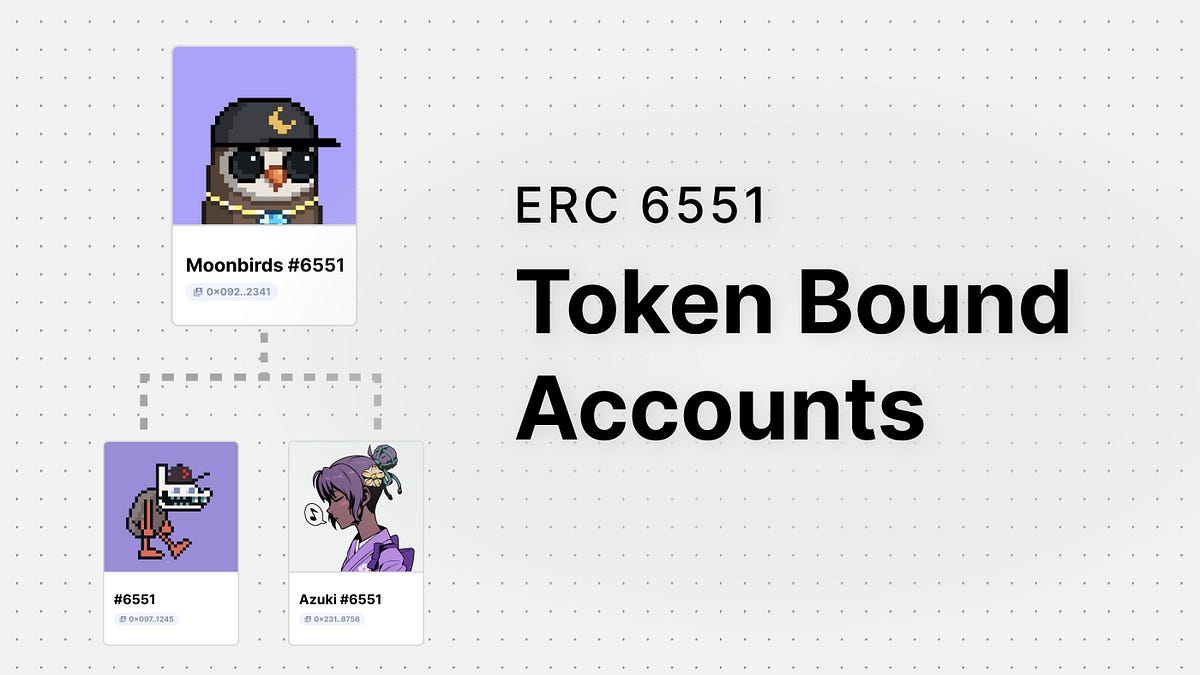

Technological innovation

We see new technological creations and innovations emerging in the market. New NFT design mechanisms, such as dynamic NFTs, exchangeable NFTs, and digital concepts, are exploring the direction of e-commerce. We tried creator royalties – largely a social contract enforced by the market. Over time, I expect creator royalties (in some form) and secondary market sales to become the lifeblood of a healthy NFT market. After this time, we have ideas that need to be tested, validated, and executed.

What are we excited about?

Over the last five years, speed, cost, and usability have been top concerns for end-users. With improvements in L2, zk tech, and security, we have made significant progress in infrastructure. Block space and throughput will soon enable high-volume use cases like gaming and social media. Now is the time to start experimenting with new consumer behaviors uniquely supported by cryptocurrencies. Online time is the most limited resource for any user. Wallets will become a gateway, linking not just to financial assets but purchase behavior and user preferences. In the Web2 era, the rise of cookies led to every user action being tracked. With cookies disappearing, on-chain activity may become the new frontier for advertising and marketing. The internet will form in a way that is non-invasive of user privacy and personal sovereignty – we need people like you to build it.

Created with NFTs

Creating content on the internet has never been easier. Millions of creators are publishing new music, art, and performances on the web every day. NFTs, as data containers, provide a new mechanism for creating immutable digital content. Through proper structuring, NFTs can help realize the monetization of intellectual property, facilitate collaborative creation through incentivization mechanisms (such as through tokens), and allow creators to directly engage with fans. The IP (intellectual property) market has always been an opaque market, with large holders selectively holding and distributing rights. Digitally native intellectual property, such as the Nouns project, allows for collaboration to move in a more decentralized, community-owned direction. There are many ideas worth exploring in NFT-enabled use cases, including membership and reputation.

Chain Games

Nearly half of all adults globally engage with gaming in some way. Blockchain provides an open global database upon which games can be built and distributed. Chain games allow users to own in-game assets with a universal, real source (i.e., the blockchain) and limited platform risk. These games may benefit from these inherent features, creating richer player experiences, with ownership at the core of the game. We are seeing record growth in the gaming space – accounting for nearly 50% of all on-chain dapp activity.

Social-first Wallets

We live in a world full of targeted advertising, with identities recognized across hundreds of accounts and privacy not being protected. Social networks are moving from posting updates to the masses to gamified experiences, and connections with smaller groups. By using cryptocurrencies as a driving force, we can see social marketing strategies becoming a way to bring billions of people into using crypto. Wallets, as a new online profile, will allow users to influence how they interact with the internet through the interoperability of their data and preferences. Whether through games or interesting new applications, your digital identity can be found in these wallets and experiences.

Normally, the cryptocurrency world gives the impression of being more focused on short-term gains than long-term growth. In reality, builders have been working hard to ensure that the upcoming infrastructure can support consumer demands and use cases on a large scale. There is still great uncertainty about the future. However, looking ahead, we are optimistic that cryptographic building blocks will achieve better digital identity, privacy protection, and fundamentally help build more open and coordinated consumer networks.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Interpreting Gensyn: Blockchain AI Computing Protocol that Raised Over $50 Million in Funding Led by a16z

- US lawyers discuss the future of the SEC’s case against Binance and Coinbase: the outcome may be very different

- Vitalik: To achieve large-scale adoption, Ethereum must undergo three transitions: L2, wallets, and privacy.

- Web3 without AI has no soul. How ZKML Reshapes the Relationship Between AI and Blockchain

- Blockchain’s Ambition: Anti-Keynesianism, Public Life, and Transhumanism

- Evening Must-read | How Blockchain and Ethereum are Changing the World

- Interpreting the Performance of 14 L1 Public Chains in Q1: Stacks Emerges as Dark Horse, Network Usage Rate Generally Decreases