Comparing the current regulatory status of stablecoins in various countries and looking forward to future policy trends

Regulatory status of stablecoins in different countries and future policy trendsAuthor | TaxDAO

The Current Situation and Prospects of Stablecoin Regulation

A stablecoin is a cryptocurrency that is anchored to a fiat currency or other assets, aiming to reduce price volatility, improve payment efficiency, and promote financial inclusivity. As stablecoins are pegged to sovereign currencies, they can have implications for financial stability, consumer protection, anti-money laundering, taxation, and even threaten the status of sovereign currencies. This article aims to explore the current state and issues of international stablecoin regulation, analyze the importance of stablecoin regulation, review the regulatory attitudes and policies of various countries towards stablecoins, discuss the relationship and impact of stablecoins on fiat currencies and DeFi, and put forward suggestions and prospects for future stablecoin regulation.

1. The Imperative of Stablecoin Regulation: Concepts and Background

1.1 Concepts and Classification of Stablecoins

1.1.1 Concept of Stablecoins: Development in Practice

A stablecoin is a cryptocurrency that is anchored to a fiat currency or other assets, aiming to reduce price volatility, improve payment efficiency, and promote financial inclusivity. The emergence of stablecoins is to address the issues of high volatility and low liquidity of traditional cryptocurrencies, while retaining their advantages of decentralization, transparency, and programmability.

- Opinion The blockchain industry is transitioning from narrative logic to application logic.

- Innovation of Application Chains Can Mesh Security revitalize the Osmosis ecosystem?

- Understanding Farcaster, the decentralized social network strongly promoted by Vitalik’ OR ‘Understanding Farcaster, the decentralized social network strongly advocated by Vitalik

The earliest stablecoin projects emerged in 2014, such as BitUSD and NuBits, which issued stablecoins collateralized by other cryptocurrencies. Stablecoins issued in this way have lower stability due to the significant market fluctuations of other cryptocurrencies. In 2015, Tether introduced USDT, a fiat-collateralized stablecoin pegged to the US dollar, which is currently the highest market capitalization and largest trading volume stablecoin.

In 2018, fiat-collateralized stablecoins thrived, with notable stablecoins like USDC, LianGuaiX, and TUSD appearing during this period. They all claim to have sufficient reserves of fiat currency and undergo audits and supervision by third-party institutions. In addition, there are also commodity-backed stablecoins, such as LianGuaiXG and DGX, which are anchored to physical commodities like gold.

In 2019, Facebook announced the Libra project, which is an algorithmic stablecoin anchored to a basket of fiat currencies and bonds, aiming to create a global payment network. However, due to its large scale and influence, it sparked strong opposition and concerns from governments and regulatory agencies around the world.

Since 2020, algorithmic stablecoins have become a new trend. They do not have any anchors or collateral, but achieve price stability through algorithmic adjustments to the supply. Representative algorithmic stablecoins include Ampleforth, Basis Cash, and Frax.

1.1.2 Classification of Stablecoins

The historical development of stablecoins also reflects the differences between different types of stablecoins. Stablecoins can be classified into four categories based on their stability mechanisms: Fiat-collateralized Stablecoin, Crypto-collateralized Stablecoin, Algorithmic Stablecoin, and Commodity-backed Stablecoin.

- Fiat-collateralized Stablecoin: This is the most common type of stablecoin, which uses fiat currency or other traditional assets (such as gold, US bonds, etc.) as anchors and is held by centralized issuers or custodians. The price of this type of stablecoin remains consistent or close to the anchor, and it has high liquidity and convertibility.

- Crypto-collateralized Stablecoin: This is a type of stablecoin that uses other cryptocurrencies (such as Bitcoin, Ethereum, etc.) as anchors and achieves decentralized management through smart contracts or other mechanisms. The price of this type of stablecoin is negatively correlated with the anchor, meaning that when the price of the anchor falls, the price of the stablecoin rises, and vice versa.

- Algorithmic Stablecoin: This refers to stablecoins that do not have any anchors and achieve price stability through algorithmic adjustments of supply and demand. The price of this type of stablecoin is positively correlated with market demand, meaning that when market demand increases, the algorithm increases the supply to lower the price.

- Commodity-backed Stablecoin: This refers to stablecoins that use commodities (such as gold, silver, oil, etc.) as anchors and are held by centralized or decentralized issuers or custodians. The price of this type of stablecoin remains consistent or close to the anchor, and it has high resistance to inflation and serves as a store of value.

1.2 Market Status and Risks of Stablecoins

The market size of stablecoins has been rapidly growing in recent years. According to a report by CoinGecko, as of September 2023, the global market capitalization of stablecoins is $138.4 billion. Among them, USDT accounts for 49% of the market share, while USDC and BUSD account for 30.9% and 11.4% respectively. At the same time, the importance and influence of stablecoins in the cryptocurrency market are also increasing. In January 2022, stablecoins accounted for 7.3% of the total cryptocurrency market value, and this proportion increased to 12.9% in January 2023.

However, behind the rapid growth of the stablecoin market, there are also growing concerns in several aspects.

Firstly, like other cryptocurrencies, stablecoin transactions involve tax regulatory risks and financial business risks. The cross-border nature and anonymity of stablecoin transactions increase the risks of tax evasion and tax leakage, and the transactions also involve multiple areas of financial business, posing regulatory challenges for tax authorities in various countries.

Secondly, centralized stablecoins are subject to potential credit risks, which have drawn the attention of governments around the world. Taking USDT as an example, Tether claims that for every USDT issued, it deposits 1 USD in the reserve account to ensure the stability of the value of USDT. However, the issuance of USDT does not have national credit endorsement and lacks sufficient regulatory mechanisms. Therefore, Tether is often suspected of the risk of over-issuing USDT for profit. If the collateral deposited by exchanges is insufficient, the value of stablecoins will decouple from the assets they are anchored to, leading to a contraction of the financial market.

More importantly, the development of stablecoins brings currency policy risks. If stablecoins (especially global stablecoins) are widely used, they may affect the currency supply of various countries, thereby affecting the effectiveness of exchange rates, interest rates, and other monetary policy tools, and even threatening the monetary sovereignty and financial stability of various countries.

In view of the above risks, the International Monetary Fund (IMF) has called for the establishment of a global unified regulatory system for stablecoins on multiple occasions. In a blog post titled “Crypto Contagion Underscores Why Global Regulators Must Act Fast to Stem Risk” published by the IMF in January of this year, it stated that without proper regulation, stablecoins may undermine the effectiveness of monetary policy and trigger financial crises, both in developed and developing economies. Previously, in a fintech paper released in September 2022, the IMF emphasized the need for strong, comprehensive, and globally consistent regulation of crypto assets.

2 Regulatory Status of Stablecoins: Seeking Unity in Diversity

2.1 Origin of Stablecoin Regulation

Overall, stablecoin regulation has gradually gained attention from governments around the world since 2019. Prior to that, stablecoins were usually subject to unified regulation along with other digital assets, rather than having their own regulatory requirements.

In 2019, the issuance plan of Libra drew global attention and concerns about stablecoins, and financial risk issues related to stablecoins began to come to the forefront. The G7 Stablecoin Working Group released the “Global Stablecoins: Assessment Report” in October 2019, formally introducing the concept of “global stablecoins” and pointing out its potential challenges to financial stability, monetary sovereignty, consumer protection, and other aspects. Subsequently, the G20 entrusted the Financial Stability Board (FSB) to review the Libra project and released two regulatory recommendations on global stablecoins in April 2020 and February 2021, respectively.

2.2 Overview of Stablecoin Regulatory Developments in Major Countries and Regions

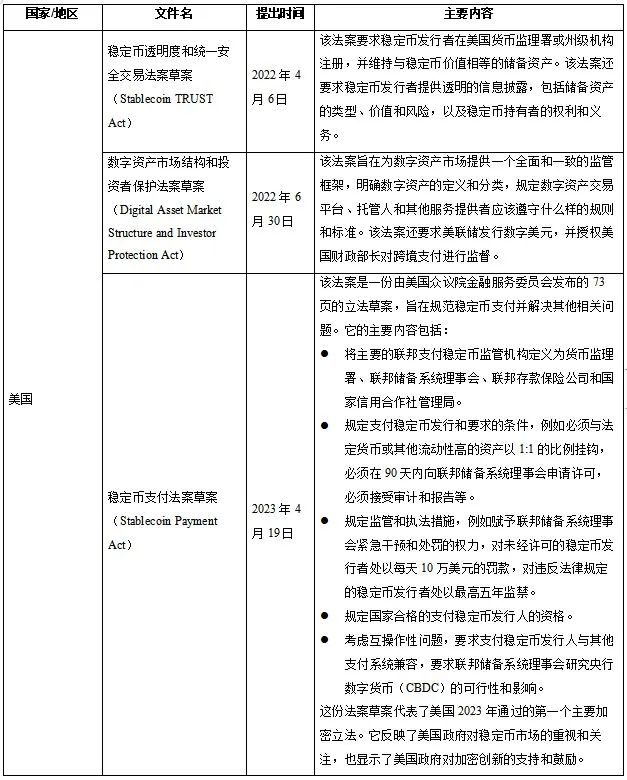

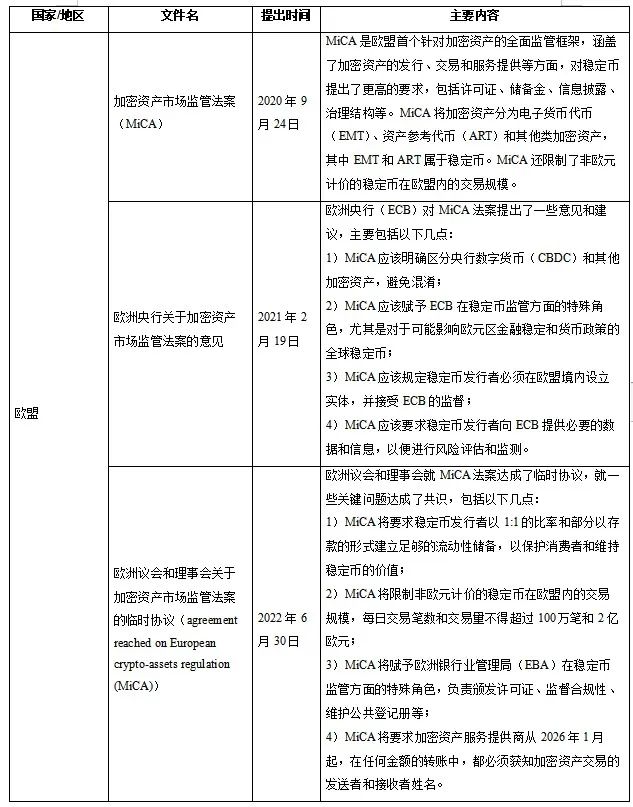

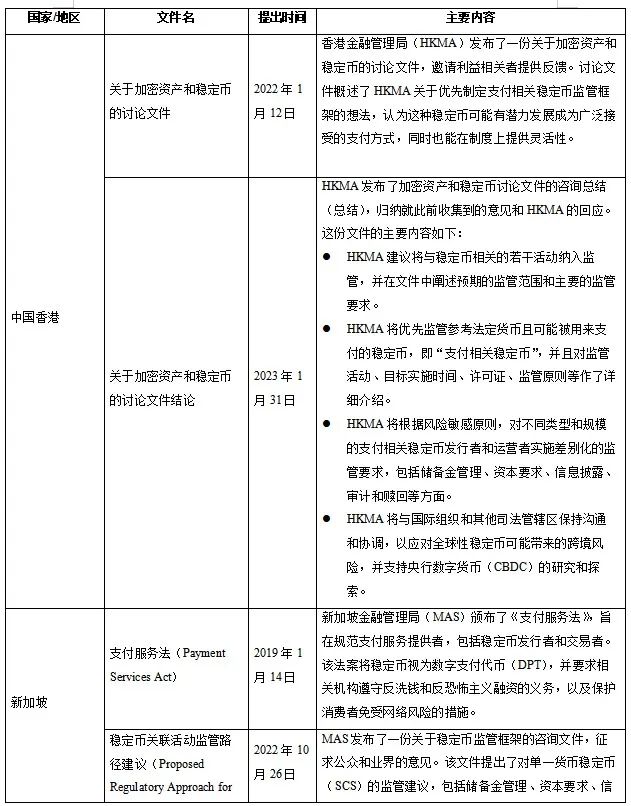

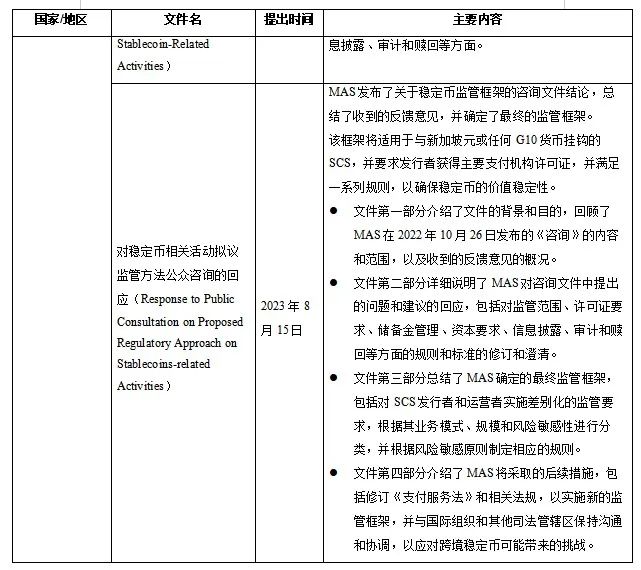

Under the guidance of the FSB regulatory recommendations, some countries and regions have also proposed their own stablecoin regulatory policies, with the United States, the European Union, Hong Kong (China), and Singapore having more advanced regulatory policies. This article summarizes the major regulatory policies of these four countries/regions since 2019, as shown in the table below.

Among them, the “Stablecoin Payment Act” draft in the United States is expected to become the world’s first official legislation specifically regulating stablecoins, while the policy discussions in Hong Kong and Singapore are still some distance away from formal legislation. Looking at the current legislative trends, the following common points can be found in stablecoin regulation:

- Stablecoins are treated as special cryptographic assets and are subject to dedicated regulation, rather than being included in existing financial regulatory frameworks;

- Stablecoin issuers and operators are required to obtain corresponding licenses or registrations and are subject to supervision and auditing by relevant institutions;

- Stablecoin issuers and operators are required to maintain reserves equal to the value of the stablecoin and provide transparent information disclosure on the type, value, and risks of the reserves;

- Stablecoin issuers and operators are required to comply with anti-money laundering and anti-terrorism financing obligations and have measures in place to protect traders and prevent network risks;

- Restrictions or prohibitions on stablecoins denominated in foreign currencies to maintain the sovereignty and stability of the domestic currency;

- Maintaining communication and coordination with international organizations and other jurisdictions to address cross-border stablecoins.

3 Regulation of Stablecoins: Policy Outlook

3.1 Stablecoins and Fiat Currency: Conflicts and Future

In the cryptocurrency trading market, stablecoins primarily serve as a “replacement” for fiat currency, serving as a measure of value for the trading of other assets. This is because the exchange between fiat currency and cryptocurrency usually requires centralized exchanges or other third-party institutions, which increases transaction time, costs, and risks. Stablecoins, on the other hand, can facilitate decentralized transactions directly on the blockchain, improving transaction efficiency and security.

Stablecoins rely on fiat currency, but fiat currency is also influenced by stablecoins. On one hand, fiat-collateralized stablecoins rely on fiat currency as an anchor to maintain their value stability and are also subject to regulation of fiat currency policies. For example, according to the proposed “Stablecoin Act” in the United States, fiat-collateralized stablecoins require centralized issuers and custodians to hold fiat assets and provide mechanisms for proof of reserves to demonstrate sufficient collateral assets. However, on the other hand, stablecoins also have the potential to challenge the status of fiat currency, as they offer higher transaction efficiency, anonymity, and transparency, which may attract more users and capital inflows. If a certain stablecoin (such as USDT) is widely accepted, it may play a role similar to M0 or M1 in the national monetary system, thereby affecting the money supply. At this point, the money supply is no longer solely determined by the central bank, but rather jointly determined by the central bank and stablecoin issuers, which means that the country has lost some of its coinage rights.

As a result, countries often adopt a cautious approach to regulating stablecoins, especially those that are pegged to fiat currencies. Based on existing policy directions, it is expected that the regulation of fiat-collateralized stablecoins will become increasingly strict.

3.2 DeFi and Stablecoins: A Blossoming Relationship

Stablecoins serve as the underlying assets and transaction media for DeFi, facilitating its development and innovation.

Stablecoins are crucial to DeFi. They anchor prices in the highly volatile realm of virtual currencies, thereby separating the risk/reward calculations of DeFi services from the high volatility of digital assets. For financial transactions in DeFi services, stable prices are necessary for value exchange. Investors also require stable units of account. Stablecoins play multiple roles in DeFi, including:

Stablecoins can be used as loans or collateral in lending markets, providing low-cost, efficient, and collateral risk-free lending services. For example, MakerDAO is a decentralized lending platform based on Ethereum, where users can generate DAI (a decentralized stablecoin pegged to the US dollar) by over-collateralizing crypto assets such as ETH. Users can use DAI for trading or investment, or redeem the collateral at any time.

Stablecoins can be used as trading pairs or liquidity providers in trading markets, offering low slippage, high liquidity, and no market-making risks. Take Uniswap as an example. It is a decentralized exchange protocol based on Ethereum, where users can deposit tokens into liquidity pools to earn transaction fees. Stablecoins account for a significant portion of liquidity pools in Uniswap because they can reduce impermanent loss and improve trading efficiency.

Stablecoins can be used as compensation or insurance funds in insurance markets, providing low barriers, broad coverage, and no trust risks in insurance services. For instance, Nexus Mutual is a decentralized insurance platform based on Ethereum, where users can purchase or provide insurance against smart contract failures on the platform through the mechanism of a Risk Sharing Pool (RSP) to earn interest, rewards, or assume insurance claims responsibilities. In Nexus Mutual, stablecoins are the only assets that can be used to purchase or provide insurance.

In conclusion, stablecoins and DeFi have a mutually reinforcing and interdependent relationship. Stablecoins provide a stable value foundation and transaction medium for DeFi, while DeFi offers extensive application scenarios and innovative space for stablecoins.

References

[1] CoinGecko. (2023). Global stablecoin market capitalization.

[2] European Banking Authority. (2023). Agreement reached on European crypto-assets regulation (MiCA).

[3] European Central Bank. (2021). Opinion of the European Central Bank on a proposal for a regulation on markets in crypto-assets, and amending Directive (EU) 2019/1937.

[4] Financial Stability Board. (2020). Addressing the regulatory, supervisory and oversight challenges raised by “global stablecoin” arrangements.

[5] Financial Stability Board. (2021). FSB roadmap to enhance cross-border payments: Phase III implementation plan.

[6] G7 Working Group on Stablecoins. (2019). Investigating the impact of global stablecoins.

[7] Hong Kong Monetary Authority. (2022). Discussion paper on cryptoassets and stablecoins.

[8] Hong Kong Monetary Authority. (2023). Response to public consultation on proposed regulatory approach for stablecoin-related activities.

[9] International Monetary Fund. (2022). Crypto contagion underscores why global regulators must act fast to stem risk.

[10] International Monetary Fund. (2022). Fintech notes: Regulatory issues related to crypto-assets.

[11] Monetary Authority of Singapore. (2019). Payment Services Act 2019.

[12] Monetary Authority of Singapore. (2022). Proposed regulatory approach for stablecoin-related activities.

[13] Monetary Authority of Singapore. (2023). Response to public consultation on proposed regulatory approach on stablecoins-related activities.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Traditional institutions are eager to try, and RWA is finally taking off.

- Ghost in the Blockchain International Top Hacker Organization Steals Digital Assets Worth at Least $1 Billion

- Why build Onchain Realities?

- The Cryptographic Mars in LianGuairadigm’s Eyes Speculation, Pioneering, and Gambling Tables on the Blockchain

- Reflections on Shanghai Blockchain Week Mainland Web3 Walks in the Sunshine, While Darkness Crawls

- Evening Must-Read | The Future of Blockchain in China

- Chen Bin, General Manager of Wanxiang Blockchain Trusted Digitalization of Assets is the Passport for the Integration of the Real Economy into the Digital Economy.