Perspectives | Current Liquidity Model for DeFi Applications

As the potential of open financial agreements emerges, some applications are taking the lead. Maker is the leader in terms of the amount of coins and the volume of transactions. Compound and Uniswap are slightly inferior, but are far ahead of 0x, Dharma, Augur and dydx in liquidity. Other applications are still unknown. These three mainstream protocols are designed to highlight the liquidity advantage: users do not need to find a specific counterparty to trade.

The success of Maker, Compound, and Uniswap seems to have little to do with how much their application scenarios are. From the perspective of lending, the type of lending business provided by Maker and Compound can be almost achieved by matching the supply and demand sides in Dharma. Through scalar markets , Augur can also offer Ethereum leveraged trading like Maker, and it offers users more money. The trades on Uniswap are not as much as on the 0x platform, but the volume of transactions is much more than the latter.

Why do these protocols that support fewer types of cryptocurrencies attract more users? Perhaps because they limit the types of transactions that users can perform, they provide trading services in a way that automatically adjusts the supply side .

Take Augur's binary market as an example. Users who see more ETHs need to buy ETH long shares from another user or market maker – a dedicated ERC20 token, or generate a set of long and short shares themselves, and wait until the market stabilizes before taking a short share. Sell to another user and keep a long position. These share tokens have no trading pairs on all decentralized exchanges, let alone centralized exchanges. The liquidity of such long-tailed assets is severely limited, which increases transaction costs while reducing transaction convenience.

- Fully promote the compliance process, is Facebook's cryptocurrency era far behind?

- Market Analysis: Bitcoin Week K closed, greedy index is still high

- 喵 区 blockchain 27 issues | a trick to teach you the fast blockchain hardcore technology "old driver"

The Maker model is much simpler. Users can generate Dai by locking ETH. If the bullish ETH also wants to leverage, the user only needs to switch the newly generated Dai back to ETH, a process that can be easily implemented through many exchanges. In other words, Augur fragmented liquidity by generating a number of different ERC20 tokens, and Maker concentrated the liquidity through the Dai asset . Augur's model is complex and rigid, and Maker's mode is automatically coherent. Therefore, the latter is far superior to the former in terms of cost and ease of use.

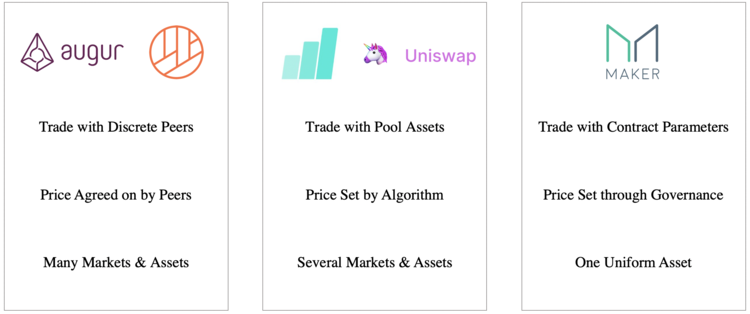

From the perspective of liquidity, the DeFi protocol can be divided into three categories:

- One type (Augur, 0x, Dharma) requires the user to find a counterparty to trade;

- One type (Compound, Uniswap) is to collect the pending assets and provide them to the eater, and collect the handling fee from them;

- There is also a category (Maker) that allows users to trade directly with smart contracts by setting parameters through governance.

Platforms such as 0x, Augur, and Dharma use point-to-point protocols. In other words, users who are bullish must find a bearish user to be a counterparty. Under the peer-to-peer agreement, the type of bilateral transaction concluded between counterparties is a superset of other transaction types. There is no uniform price in the market, only a series of bilateral orders with different prices (usually we define some concepts from these orders that imply global prices). In theory, the limitations of peer-to-peer trading types are small.

For example, we can think of Uniswap and Compound as massively multiplayer online role-playing games ( MMORPGs ): all users are “dummy” on the same map, rather than decentralized peer-to-peer transactions. Users do not need to find a counterparty to trade directly with the asset pool. The prices of all transactions are set according to the algorithm: Uniswap follows the principle of constant product , and Compound establishes the interest rate model based on market supply and demand. The size of the transaction and the size of the market are subject to greater restrictions.

Maker uses a (class) single-player mode , and the user initiates a loan based on the parameters set by the governance (the user can be considered to be trading with the pool representing the system administrator). Currently, Maker only supports one transaction type, and the liquidity is concentrated on the asset of Dai.

On Augur, users can create a predictive market for any event as long as they find a counterparty. On Dharma, as long as a credit is found, the user can borrow any asset with any terms. Maker limits the types of transactions that users can make, but it minimizes the limit on liquidity—that is, single-player mode (based on online parameters) is feasible. The core team of the Maker platform only needs to focus on how to create demand and liquidity for Dai without having to build a complete infrastructure like a multi-asset exchange.

After years of research, we have found that agreements that concentrate liquidity on a small number of markets and assets are easier to adopt. The DeFi peer-to-peer development team has noticed this. Dharma's development team took a step further by building a Dharma lending application called Lever, which exceeded the initial peer-to-peer agreement. One thing to note is that Lever limits the size of the product set, allowing both borrowers and lenders to concentrate liquidity on a few types of loans. In order to solve the liquidity problem faced by the peer-to-peer protocol, the development team of the 0x protocol shifted its focus from the relay side to the market maker .

Even so, many peer-to-peer protocols require more infrastructure, but the DeFi protocol, which limits transaction types, rarely suffers. These infrastructures include mechanisms for mutual negotiation between the two parties (please note that Dharma, Veil/Augur, and 0x all introduce the concept of “relay side”), a mechanism that allows market makers to match the needs of both parties to the transaction, and more Efficiently solve the expansion plan of a large number of independent transactions.

If the DeFi community finds a solution to the liquidity of long-tailed assets (such as non-homogeneous tokens and predictive market share), point-to-point agreements that offer a wider range of assets and transaction types are likely to surpass those of flexibility in terms of usability. Less sexual agreement . In theory, contracts based on such peer-to-peer protocols can expose users to any asset or state. With this flexibility, these systems will create a more profitable market as the market becomes more complete .

The convergent or automated supply side protocol takes the opposite approach. For example, Maker intends to expand its product portfolio with multiple mortgages, and Uniswap is likely to offer more and more trading pairs, but these two networks need to pay attention to many trade-offs while improving liquidity.

While it is unclear who will be the final winner, both DeFi networks seem to focus on providing a broader market choice and providing users with sufficient liquidity. At present, it seems that the network that only deepens the liquidity for a few markets is temporarily ahead of the curve.

Original link: https://www.placeholder.vc/blog/2019/4/9/defi-liquidity-models Author: Alex Evans Translation & proofreading: Min Min & A sword

(This article is from the EthFans of Ethereum fans, and it is strictly forbidden to reprint without the permission of the author.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Sword refers to Facebook! After the $4.2 billion "epic-level" financing, the blockchain giant is going to socialize.

- Huawei Blockchain Zhang Xiaojun: Blockchain empowerment of the real economy needs to face five questions

- Finally, someone said what DeFi is and what it can do | DeFi Series

- Aside from prejudice, talk about Voice, which is the new sustenance of BM social dreams.

- Global STO regulatory status and trend update

- Bystack – seeing the "value loop" of the world

- The annual inflation rate has dropped from 5% to 1%. Is the new EOS proposal reasonable?