Research Report | Macroscopic Observation of American Encryption Fund

US Encryption Fund Overview

The investment industry of US crypto assets reflects the blockchain as a vibrant and growing market. There are currently 150 active encrypted hedge fund managers in the US market, and they have a total management scale of about $1 billion.

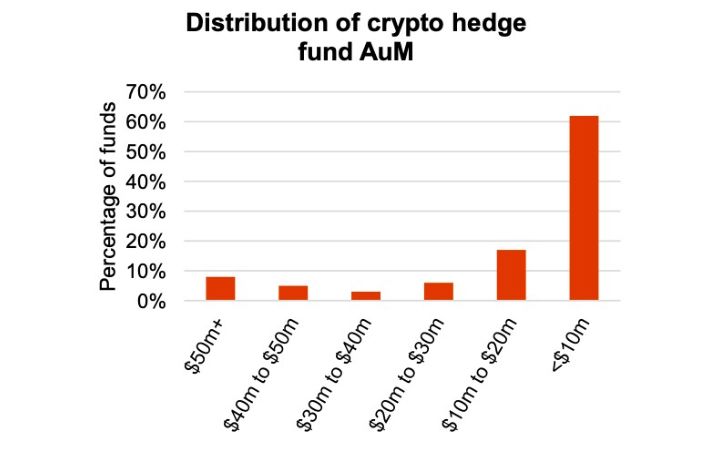

Globally, approximately 64% of encrypted hedge funds are located in the United States. Not only that, but the size of these funds is still growing rapidly. By March 2019, the US had a fund management scale of $4.3 million, more than double the size of the 1.2 million management in January 2018. Despite the tough global market conditions of the past year, crypto funds have succeeded in raising funds. The allocation of encrypted hedge fund management assets is different from that of traditional hedge funds. The total assets under management are large and the management of encrypted funds is very small (Figure 1).

Encrypted fund management fund distribution, Figure 1 Source: PWC

- Opinion: Libra takes a step forward, but not necessarily laughs at the end

- Graphic Tracking PlusToken Asset Transfer Tracking (1): There are 1,203 inflows in the BTC section.

- Opinion: French currency and cryptocurrency are not enemies

At the same time, more and more experienced traditional investment managers are entering the field of encryption. As these professionals bring financial supervision experience and pay attention to investor protection awareness, this behavior makes investors and regulators more comfortable with investment products.

Overall, the current US cryptographic hedge funds present a strong market space from an institutional and regulatory perspective, and the future will continue to grow and move towards compliance.

Fund strategy

Most crypto funds are bitcoin-based, although some diversified funds use CCI30. The CCI30 Index is based on tracking the weighted moving average of the 30 largest encrypted assets, with the aim of avoiding the stability of the index.

Currently, the vast majority of encrypted hedge funds rely solely on their own research on fund strategies, and only 7% of encrypted hedge funds use third-party organizations to assist in research strategies.

According to the PricewaterhouseCoopers report, “There are few specialized encryption research providers in view of the initial stage of the encryption fund category.” The current lack of encryption research institutions highlights the advantages of encryption research companies for encrypted hedge funds.

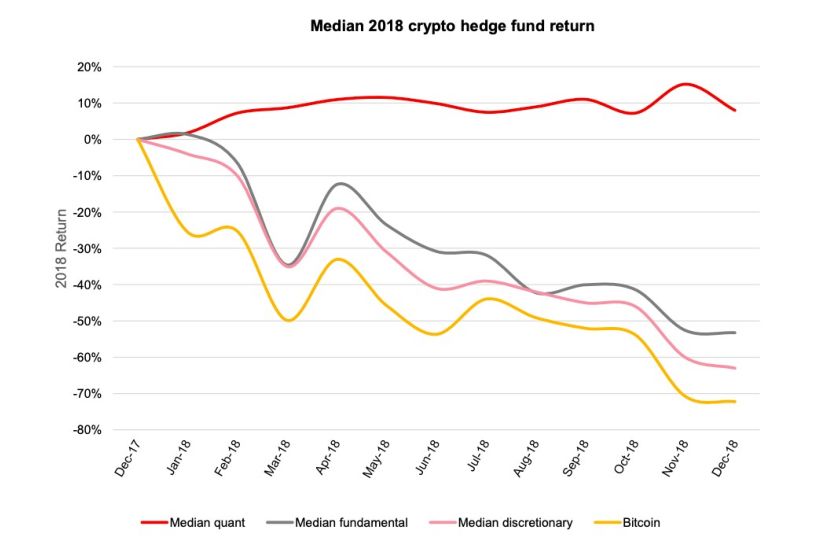

The specific strategies adopted by hedge funds fall into three broad categories: 1. 44% are human trading strategies; 2, 37% are quantitative transactions; and 3, 19% are basic groups. The outstanding thing is that the performance of the quantitative trading strategy in 2018 is significantly better than other funds (Figure 2). In 2018, the quantitative trading strategy yield was 8%, while the other two types of funds had negative returns.

The median rate of return on quantitative trading strategies in 2018, Figure 1 Source: PWC

This may be because human trading strategies and basic group strategies have barely taken any short positions, with Bitcoin losing 72%, which gives the quantitative fund a huge advantage in the year of 2018.

Successful fund case

In the early stages of the fund, three funds were particularly outstanding. The most impressive hedge fund is Polychain Capital, a San Francisco-based company founded in 2003 by Colabase's first employee, Olaf Carlson-Wee, which specializes in investing in digital assets and is the first to exceed $1 billion in managed assets for additional encryption hedge funds.

Polychain Capital's Pantera Bitcoin Fund was launched in 2013, when its fund had a cyclical return of over 10,000% and a fund size of $810 million.

Finally, Galaxy Digital Assets is a New York-based fund with $500 million in assets under management whose mission is to bridge the gap between the encryption market and the institutional world. Because of this mission, Galaxy Digital Assets partnered with Bloomberg to launch the Bloomberg Galaxy Crypto Index to track the largest and most liquid assets in the crypto asset class.

Source: official website

In general, these companies provide opportunities for the real world, especially for the area of cryptographic assets of interest to investors.

Upcoming regulatory changes

A key decision for encryption investment in the future is the regulatory approval of the crypto asset ETF. In the US, the two companies are working closely with the Securities and Exchange Commission to launch the first encrypted ETF.

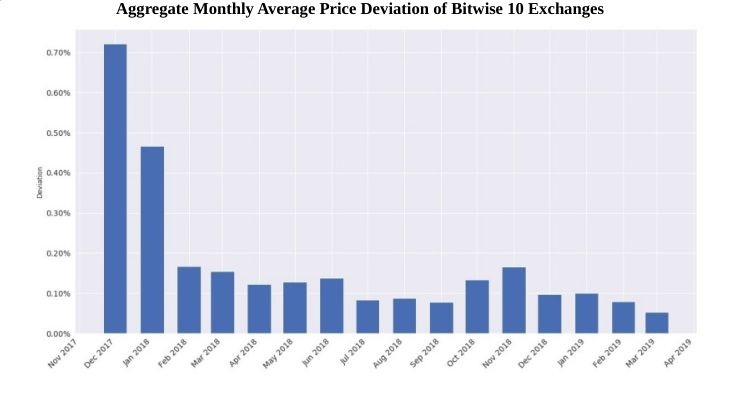

The first is the Bitwise Bitcoin ETF. Its strategy is based on the assertion that it is based on a trading platform that is full of false and exaggerated trading volumes, thus distorting the true order and efficiency of the market. Through testing and research, Bitwise selected 10 trading platforms that it believes contain ETF "actual trading volume." The 10 trading platforms traded in a very uniform manner and showed a significant drop in profitability (Figure 3).

Bitwise 10 trading platforms monthly average standard deviation price, Figure 3 Source: Bitwise

The US Securities and Exchange Commission approved the review of the Bitwise Bitcoin ETF on August 14 and may be delayed again until the October 13 deadline.

The Vaneck Solidx Encryption Asset ETF faces a similar structure with an approved review date of August 19th, which can be delayed until the October 18 deadline. An important warning to these deadlines is that the SEC can always ask the sponsor to withdraw and reschedule the date until the agency is satisfied with the proposal.

According to Jay Clayton, president of the US Securities and Exchange Commission, approval will depend on "better market surveillance and safe custody of encrypted assets." Although the US Securities and Exchange Commission has rejected the Bitcoin ETF proposal in the past few years, solving these problems is only a matter of time. Even according to US Securities and Exchange Commission Commissioner Robert Jackson: "In the end, I reflect on whether anyone will be satisfied with the standards we set there? I believe there will be."

If the Jackson Commissioner proves that it is correct and the crypto asset ETF is approved in the near future, the encryption market will be open to several important types of investments, including public funds and pension funds, and will result in large influx of cash into the crypto assets. . A similar example can be borrowed. When the gold opened the ETF in 2011, the price of gold experienced a huge increase.

in conclusion

The current growth in the size of the crypto fund industry in the United States shows great interest in the industry, as evidenced by the significant expansion in the size of hedge funds.

As more and more traditional players enter the field of encryption, investment opportunities in the field of encrypted assets are also increasing. Why are people so interested in the first ETF? Because ETFs will be open to a large number of ordinary investors and accelerate people's awareness of the true value of digital assets.

Author: Andrew & up Ling think tank

References:

• PwC 2019 Crypto Hedge Fund Report

Https://www.pwc.com/gx/en/financial-services/fintech/assets/pwc-elwood-2019-annual-crypto-hedge-fund-report.pdf

• Financial Times “Crypto Hedge Funds Live to Fight Another Day”

Https://www.ft.com/content/b026aa29-3f84-3eae-b589-50d197e5939f

• Bitwise Asset Management Presentation to the US Securities and Exchange Commission

Https://www.sec.gov/comments/sr-nysearca-2019-01/srnysearca201901-5164833-183434.pdf

• FX Street “Bitcoin ETF approval is inevitable, SEC commissioner reckons”

Https://www.fxstreet.com/cryptocurrencies/news/bitcoin-etf-approval-is-inevitable-sec-commissioner-reckons-btc-usd-stays-in-a-bear-range- 201902071316

• CoinTelegraph “SEC Chairman: Other Market Protections Needed Before Bitcoin ETF Approval”

Https://cointelegraph.com/news/sec-chairman-other-market-protections-needed-before-bitcoin-etf-approval

• Bitcoin.com “SEC Commissioner Says Time is Right for Bitcoin ETFs – 3 Funds Pending”

https://news.bitcoin.com/sec-commissioner-time-right-bitcoin-etf-funds/?utm_source=OneSignal%20Push&utm_medium=notification&utm_campaign=Push%20Notifications

• Bitcoin Market Journal “Best Performing Cryptocurrency Funds for 2019”

Https://www.bitcoinmarketjournal.com/cryptocurrency-funds/

Https://www.bitcoinmarketjournal.com/bitcoin-etf/

• Galaxy Digital

Https://www.galaxydigital.io/services/asset-management/

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Libra, a digital currency that disrupts the existing financial system

- Will investors save Libra from the fire?

- Science | How the blockchain works (annotated version)

- This year's Bitcoiner is not average. Analysts believe that investors are now more willing to hold Bitcoin than to convert to French currency.

- Sell Mt.Gox, leave Ripple to create stars, legendary life of coin technology genius Jed

- Li Xiaolai sends a new coin, build a new group, are you willing to help him pull the head?

- The company that declared bankruptcy was consistent with the FB goal. Can Libra complete its mission for it?