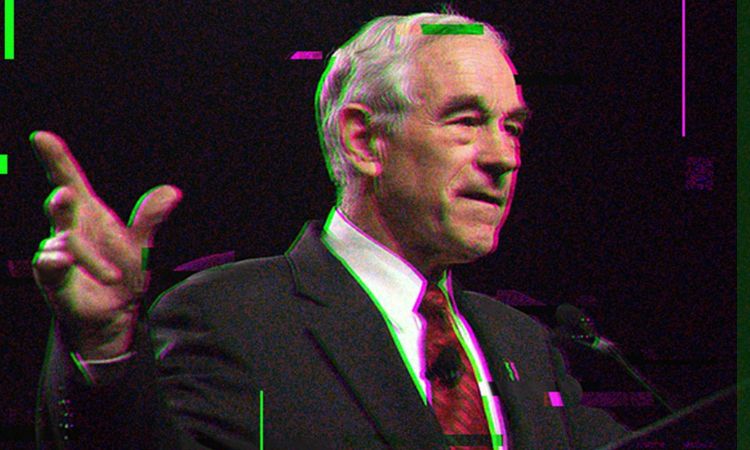

Ron Paul talks about bitcoin: "The dollar will eventually destroy itself"

Dr. Ron Paul has a deep understanding and interest in the monetary system for a long time.

Before becoming a student at the Austrian School of Economics, he worked as a flight surgeon in the US Air Force and as a private obstetrician in Texas. After reading the work of Ludwig von Mises and Ann Rand, Ron changed his beliefs and decided to run for Congress after the Bretton Woods conference in the 1970s.

Nixon’s decision to withdraw from the agreement had a lasting impact on US monetary policy, and Dr. Ron Paul began his political career. As opponents of these changes, he believes that there are many risks in the legal currency system. He served as a Texas congressman from 1976 to 1977, from 1979 to 1985 and from 1997 to 2013, and participated in presidential elections in 2008 and 2012. Because of the fame of the modern right-wing liberal movement, he is keen to advocate the idea of the gold standard, and he also firmly criticizes the risk of the Fed and its monetary policy.

- Bitcoin and Modern Monetary Theory

- Put the eggs in a basket, BTC core developers say that holding bitcoin is enough

- BM: The reason for not using EQ to purchase EOS is that B1 cannot have more than 10% share.

As a member of Congress, his position in the House Banking Committee provides a platform for disseminating Austrian economics. His 2009 best-selling book, The End of the Fed, and the 2012 presidential campaign can be seen as the pinnacle of his career, and it also condenses his ruling philosophy: freedom, revolution, and a stable monetary system.

Therefore, it is not surprising that Ron Paul is interested in Bitcoin. He and his son, former presidential candidate, Kentucky Senator Rand Paul, accepted Bitcoin as their campaign fund.

Dr. Ron Paul attended the Consensus conference this year as a guest of the Digital Asset Policy Network (DAPNet). DAPNet is a public interest digital currency policy lobbying organization led by experienced campaign manager Jesse Benton and Bitcoin Center founder Nick Spanos. During the conference, Bitcoin Magazine interviewed Dr. Ron Paul and consulted his views on Bitcoin as a disruptive mainstream asset. Our conversation also shows that bitcoin is not limited to a specific age – not every old man like Buffett does not like bitcoin.

Question 1: How did you first understand Bitcoin and when did you start to hold it?

Once I read an article that touched me. I only heard about it at the time, but I didn't care too much. Then I finally had enough interest to observe the entire digital currency market – I like to watch the market – you know, bitcoin can range from $0 to $20,000, which is a fascinating thing. What does this mean? I don't know because no one knows where its ceiling is.

This made me very interested, then I looked at the technology, even though I am not a computer fan. If I have to explain blockchain technology, I won't do well. I am interested in how to replace the traditional currency, what happens when the market crashes, how to protect the market environment and whether people will have other new ideas, which may help solve the problems we are facing now. I think this is what Bitcoin can offer: a substitute for French currency and a more free market.

Question 2: In an interview with CoinDesk, I heard that you mentioned the free market related to Bitcoin. I would like to ask you about Mr. Sherman's point of view on the digital currency ban. What do you think this means for Congress? Do you think Congress will be unfriendly to digital assets?

It may not be friendly at the moment, but Congress needs dignity. They will work behind the scenes and set up roadblocks where possible. The more successful the digital currency is, the more the government wants to participate. There are people like Sherman, but they don't talk like that. I don't think he has influence because he is on the top. They don't suddenly pass a bill, I don't even think he will propose a bill. It won't be a sport, he just attracts everyone's attention.

Q3: Do you think that Congress's attention to these matters is beyond its capabilities? We see that Congress is somewhat incompetent on technical issues.

I don't think many people in Congress know better than me in this field. Their interest in market principles is far less than me. And they are not willing to let big problems in the future, so they are less interested in Bitcoin. If Congress did a poll on whether to ban or tax Bitcoin, they might not have thought about it. On the whole, Republicans will be more tolerant. But supporters of big governments like Brad Sherman know what will happen in the future. His reaction, his emotions are his beliefs, because he can see what happens to the Fed's monopoly on the monetary system. He does not want people to talk about or use French currency substitutes. Therefore, he will think of ways to punish these people.

Q4: In your opinion, Sherman seems to have thought about this problem. If you listen to his point of view, he basically said that the cryptocurrency dominates the dollar and the United States poses a threat to internationalization.

This illustrates a lot of problems. He represents deep government agencies, military personnel, and others in the banking system. He represented their position, "Do not interfere with the US dollar." But I am not worried about this because the dollar will destroy itself.

Q5: The dollar is like a time bomb and can explode at any time. What do you think can accelerate its development?

I think so, but other people are needed to answer this question. I just want to determine if I can allow hedging. In our country, for many years we have not been allowed to own gold as a hedging tool. I think there are still a lot of time bombs. It is difficult for us to figure out what our foreign policy is. You know, relations with Syria, North Korea, and Iran are often good or bad.

The people of John Bolton and Abraham, and the wild senators – as long as they are in power, bad things can happen or make bad judgments. This will change everything. This may change the dollar system, or it will change the stock market.

Q6: You talked about a financial crisis that was more serious than from 2008 to 2009. Do you think that our market foundation has begun to shake? Is this a bad omen?

I think so, but it has been around for a long time. I believe that this trend was established after we announced that we would no longer pay the US dollar. This is actually a statement that declares bankruptcy, and the problem has been gradually accumulating. The trust in the dollar now makes the bubble bigger and bigger. It lasts for a long time and will only make the crash worse.

Q7: I am very glad that you mentioned the word "bubble", which is a common occurrence in this industry. And, what do you think about the volatility of Bitcoin?

Bitcoin prices will fluctuate. The dollar will also fluctuate. From the perspective of the supply and demand of the dollar: you need to know how many people really want to use it, and how quickly the Fed prints money. Many people consider prices from the perspective of supply and demand, but they do not consider the purchasing power of the dollar, which is difficult to calculate. One thing I realized in 1971 was that since Nixon let us abandon the gold standard, it became a different world. Now that we have digital currency, I think they will follow the same economic laws, but they will be subject to some subjective factors. It is undeniable that there are some subjective factors driving when Bitcoin reaches $20,000. But does this mean that it is worthless? No, I don't think so – that's the way it is. There are ups and downs in emerging things.

If we see that it is threatened, when someone walks over, "We need a law to ban cryptocurrencies to eliminate this uncertainty." For me, this situation will continue and will change Worse.

Q8: Do you think the best way to supervise is to be completely unregulated? Or do you think there is a way to make these bitcoin and blockchain companies grow fast and at the same time provide protection for investors?

I believe in regulation, and it must be strict, but who is the regulator? Since the Great Depression, we have established thousands of rules and regulations to regulate the financial system, but we still use the system from 2009 to the present. There is no benefit to strong supervision. When the government decided to save the system, they ended up frantically rewarding those who were already exploiting us: mortgage companies. But those who lost their mortgages did not get help.

Question 9: I want to return to the era of the gold standard. Have you seen Grayscale's Drop Gold ad? The company is trying to use bitcoin to knock out gold. The company says Bitcoin is a gold substitute.

But they did not grasp the point. If the gold is out of date, the market will announce that it is out of date. Even if people use bitcoin in a crisis, gold will be used. If you have a bag of gold coins in Venezuela, I will also think that you are a very wealthy person.

Bitcoin has recently seen a crazy uptrend, while the Dow, the Standard & Poor's (S&P) and other traditional markets have shown a downward trend. Do you think it is too early to say that it is decoupled from the traditional market?

Yes, I think it is too early to say it now. I don't think anyone knows. It's hard to say, but obviously people have enough confidence to buy bitcoin. But is the buyer one million or fifteen? This can be very important.

Question 10: The last question, do you have bitcoin?

Do I have bitcoin? No. We accept Bitcoin as our campaign fund, but we will sell it immediately because we need to pay the bill.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Tether: We did use some of our reserves for investing in assets such as Bitcoin.

- An American man who registered with the BTC system in 2016 said that anyone can register

- May 22 madman market analysis: BSV rose 300%, Ownen Cong is Nakamoto Satoshi?

- The value of bitcoin or cryptocurrency goes far beyond investment!

- What happened to the man who bought the pizza at the BTC Pizza Festival at the beginning of the 10,000 BTC?

- Lawyers acknowledge that part of Tether’s reserves are supported by Bitcoin

- Ethereum Foundation announces details of planned use of $30 million in network development funds