Sending charcoal in the snow or contributing to the flames? See the pros and cons of CBDC from a practical perspective

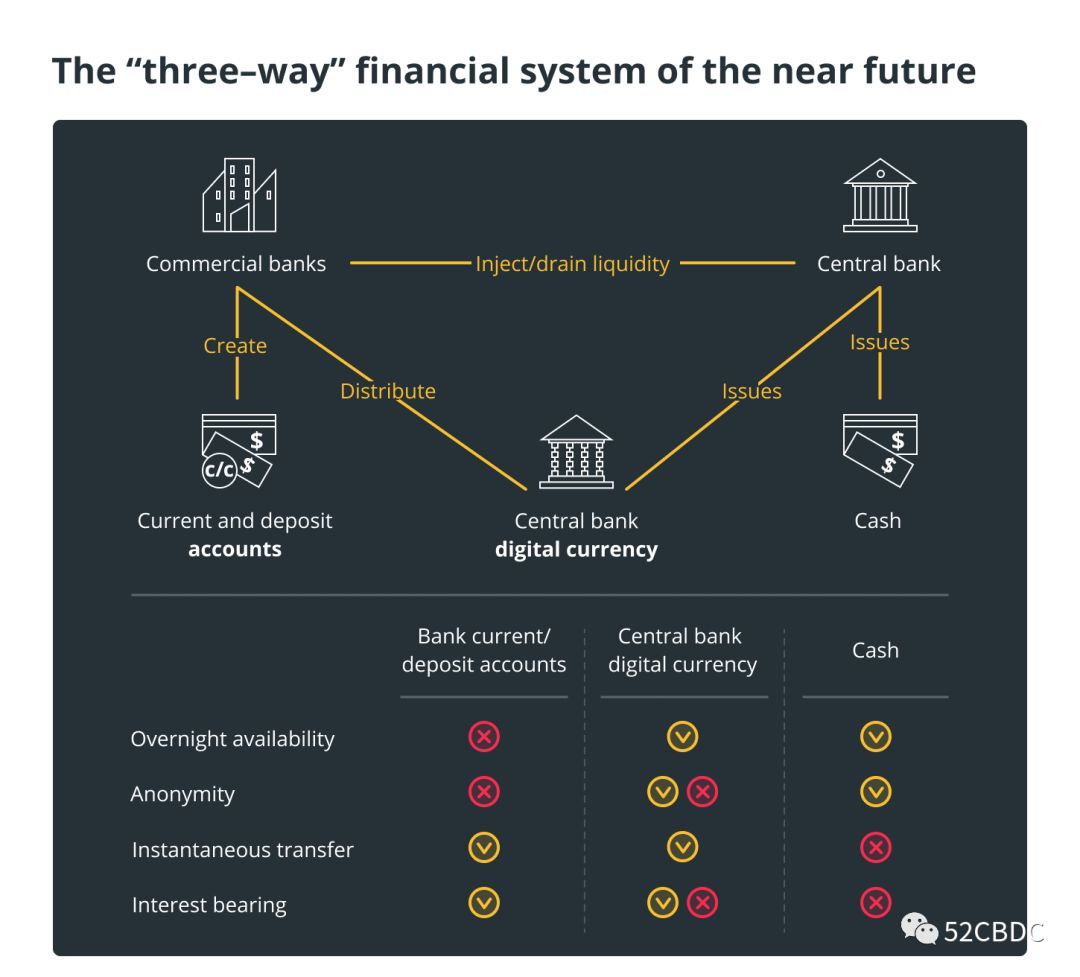

CBDC is a new type of financial model that will expand public digital access to central bank accounts, which are currently limited to commercial banks. Therefore, CBDC will combine the digital nature of bank deposits with the traditional advantages of cash in daily transactions.

However, a key question is: Will CBDC take the form of a central bank personal account that supports positive interest rates, or will it be a form of anonymous digital token like traditional cryptocurrencies ?

Recent research by the International Monetary Fund has demonstrated the best currency and technical characteristics that a CBDC should have- depending on the economy and banking system in which it is circulated . Although it is not the same, in fact, sudden changes in payment instruments may have very bad side effects in the entire economy. Therefore, after the introduction of digital currency, if the frequency of use of other existing payment instruments (such as paper money) is further reduced, it may disappear.

Regardless of the existence form and payment function of the CBDC, only the trade-off analysis can be “just in place and make the best use of it”.

- Review of the state of the blockchain network in 2019: BTC and ETH are far ahead

- Read a history of finance and regulation, as well as a lesson for DeFi

- Eight currencies that are about to halve in 2020

Anonymity and security

In general, cash almost always guarantees anonymous transactions, while bank deposits meet security needs.

Although anonymity may lead to some financial crimes, anonymity has its value. Recently, even the European Central Bank President Christine Lagarde has stated that untraceable payment instruments cannot be suppressed blindly, which can help protect consumption. This protects users from unauthorized use of personal transaction data for credit scoring and other issues.

CBDC has different requirements for anonymity and security in different scenarios, and the design logic is different. The central bank can only guarantee the partial anonymity of users other than itself, but cannot guarantee the anonymity of the current central bank. The specific situation and specific analysis, such as court orders or the setting of different transaction limits for different real-name levels.

interest rate

Increase in loan costs

CBDC may disrupt the financial system to some extent, thus replacing demand for cash or deposits. The ensuing problems are not only that cash may disappear, but the design of CBDC similar to bank deposits will force banks to increase deposit interest in order to maintain competitiveness. The increase in deposit interest rates means that loan interest rates will also rise with a high probability, so it may Trigger a credit contraction for the business.

If corporate loan costs are high, the decline in bank intermediary business will reduce investment, production and employment, even if personal or household deposits have higher interest rates. Therefore, compared with the increase in deposit interest, the impact of lower personal income may be greater.

Of course, in China, whether a commercial bank raises deposit interest or not, it will not affect corporate credit, because there is a "central mother" behind the control and printing money, and general commercial banks rarely raise loan interest rates because of "not enough money."

2. Stimulate negative interest rates

The issuance of digital currencies with interest rates will exacerbate bank intermediation. However, not only can interest rates be positive (for example on a deposit account), they can also be negative. In this case, the issuance of CBDC will stimulate the advent of negative interest rates and encourage consumer spending.

In recent months, various countries ’research on CBDC ’s“ sharp ”shows that the central bank is working on a non-interest-bearing CBDC to protect the banking system from digital currencies. This policy choice will make cash the main competitor of digital currencies, but the cost of eliminating cash may be higher in some developing countries than in promoting a cashless society.

Inclusive finance

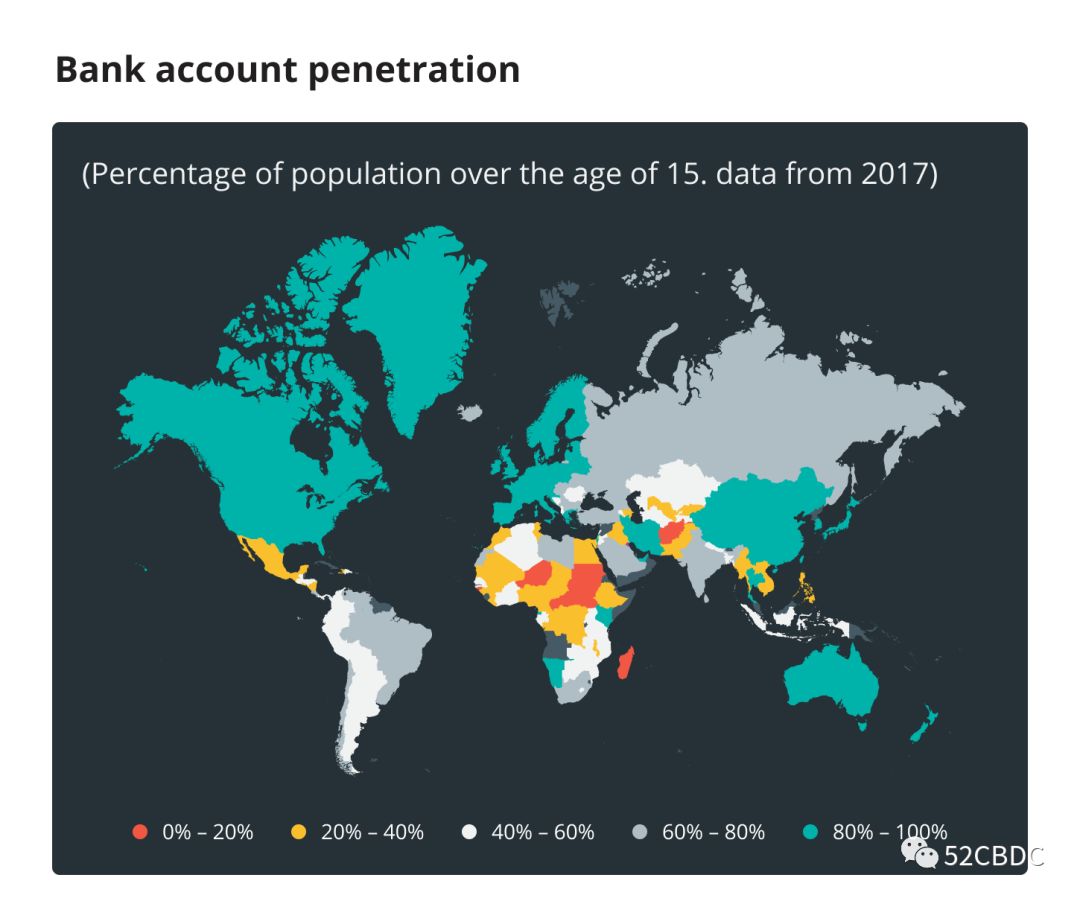

1. Half of the world has no bank account

The latest data show that the global digital divide remains huge when it comes to using payment instruments.

Half of the world ’s people without bank accounts are distributed in South Asia, East Asia, and the Pacific. China has 12% of the population without a bank account, India 21%, and Indonesia 6% . These countries together account for 40% of the global population. According to the World Bank's 2017 Global Index global database, standard financial institutions provide the least amount of services to residents of the Middle East and North Africa, and only 14% of people in the region regularly use bank accounts.

If you want to apply for a bank account, you have to have money first, and you also need government-issued ID cards. In some places, you also need a residence certificate. According to a World Bank report, 1.5 billion people worldwide do not have any form of identification, and most of them live in Africa and Asia. The main reasons include lack of financial knowledge and living in remote rural areas without financial services. In addition, more than 200 million micro, small and medium-sized enterprises have no access to bank accounts and loans.

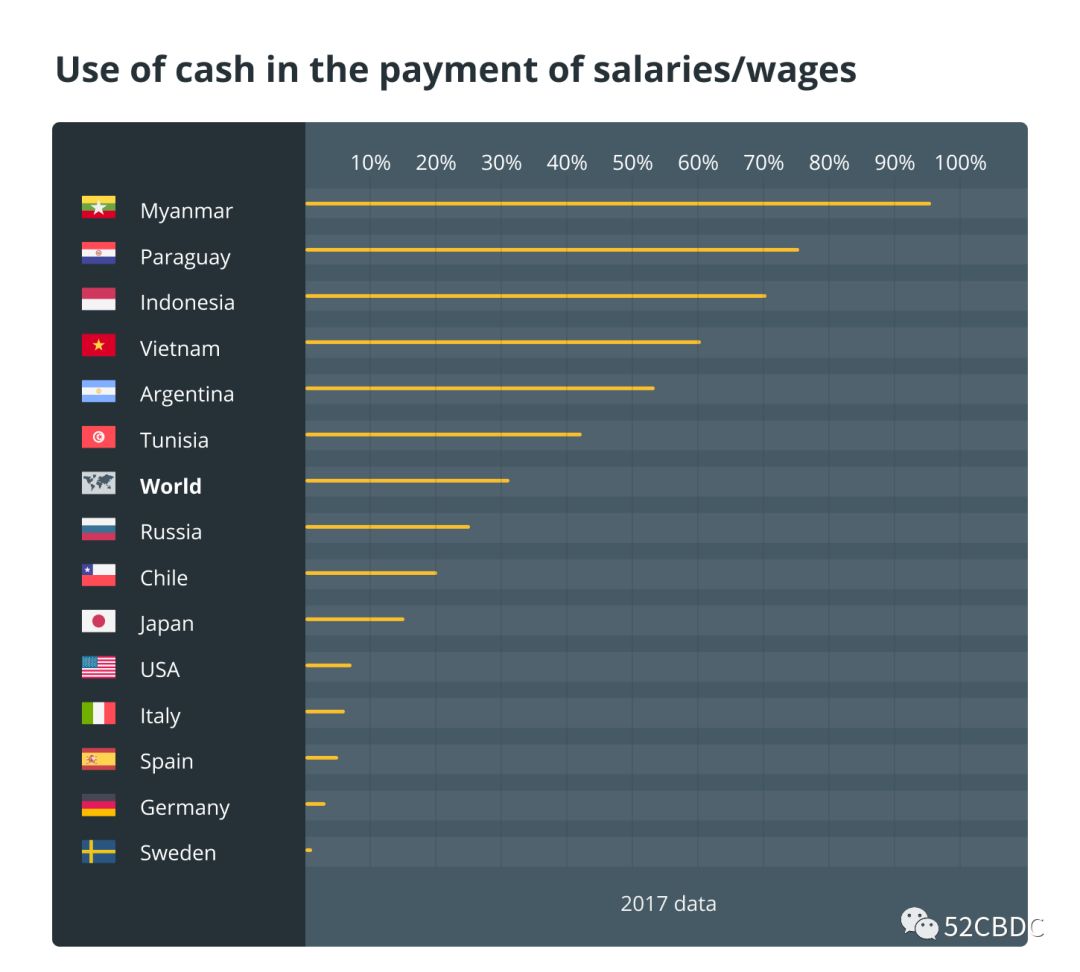

2. The main payment instrument in many countries is still cash

Cash still dominates basic transactions, including wage payments, in many large developing countries.

The Indian government has been trying to strengthen the development of bank intermediary business. The value of banknotes and coins in circulation in India continued to grow at a rate of 14% per year from 2006 to 2015.

In Kenya, cash still accounts for 98% of the value of all transactions. Although 75% of adults pay via mobile devices, a survey of low-income households found that only 1% of spending and 3% of transactions were made in digital cash.

Therefore, the government's attempt to replace cash with a digital payment system is likely to exacerbate the existing currency gap to a new extreme, and may further worsen the social and economic problems faced by those without bank accounts.

In fact, when a digital currency was introduced in an IMF simulation experiment, low-income households tended to use cash longer. Since cash is not like bank deposits and does not pay interest, these households will suffer greater losses than wealthy deposit holders if loans decrease due to the negative impact of the CBDC on the economy. Because rich people earn higher interest on their deposits, and relatively poor people who want to do business may not even be able to get a loan. Although it may not be able to do so now, CBDC increases the cost of loans, both financial and human. cost.

Therefore, from the IMF's simulation experiments, depositors became the main beneficiaries, while cash users became the main "losers." This means that central banks and governments must carefully evaluate their potential impact on income distribution.

Bank deposits with advanced functions such as instant transfer, digital currency traceability, and non-tampering have the potential to save, consume, and invest, thereby ensuring innovation, creating job opportunities, and stimulating the economy. CBDC may also be the key to fundamentally solving tax evasion. CBDC will change the financial system and may have long-term effects because it is a disruptive technological and financial innovation.

The best solution to eventually eliminate the negative effects may not be to eliminate cash or completely eliminate inter-bank intermediation, but to establish a "three-way" financial system in which various payment systems are in a balanced state, thereby satisfying The needs of all economic actors.

Therefore, the pros and cons of the CBDC cannot be viewed in a one-sided manner. For different economies, only the appropriate ones are appropriate, and none should or should not be.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- "2019 Blockchain Panoramic Scan": Global Policy

- Interpretation of the head of China Telecom's blockchain business R & D: Why do telecom operators do blockchain?

- 4D long texts talk about decentralized storage

- Looking ahead to 2020 | Coinbase: What have cryptocurrencies experienced over the past 10 years?

- SheKnows End of Year Debate | Talking about Bubble Discoloration? Layout of blockchain, capital will never sleep!

- Blockchain landing application 2019 statistics: government affairs and finance occupy half of the country, and China's blockchain landing volume has reached the world

- Can Andrew Yang's White House Crypto Party be held successfully in 2020?