Speed Reading | Dragonfly Capital: Ethereum can't be forked because of DeFi; Bitcoin developer funds analysis

Author: True Satoshi

Editor's Note: The original title is "Tenmoto Cong Kee | Dragonfly Capital: Ethereum can't be forked because of DeFi"

Today's content includes:

1 Dragonfly Capital: Because of Defi, now Ethereum cannot be forked

- The cryptocurrency business is the cornerstone of profit, and the Japanese financial giant SBI turned around

- Poca founder Gavin Wood's new work: Polkadot, Substrate and Ethereum

- Ethereum 2.0 Progress Update: Simplified Phase 0 and Phase 1

2 The darknet market cannot tolerate bitcoin, but market competition does not allow

3 Bitcoin Developer Fund Analysis

4 The United States of Shitcoin

5 Gavin Wood: Polkadot, Substrate and Ethereum

1, because Defi, now Ethereum can not be forked

There will never be another ETH Classic. This is the third research article from Dragonfly Capital (which may be the second in a strict sense) by Leland Lee and Haseeb Qureshi. After joining Haseeb, Dragonfly Capital seems to be paying attention to content output. If it is really, I am looking forward to their future content sharing. This article, mainly because of Defi's characteristics and vulnerabilities, will make Ethereum no longer possible to have the same bifurcation of DAO events. The author cited the USDC example, but the length is too long, I only left His conclusion, the illustration can be seen in the original text.

After the 2016 DAO hacking attack, the Ethereum community faced a survival dilemma: Should the community roll back the chain to restore DAO hacking, or let the hacker escape? Those who say yes are now called Ethereum. Those who refused and did not roll back are now known as the Ethereum Classic.

Ethereum is no longer the past. In 2016, Ethereum remains a proof of concept, and ETC can reasonably claim to be a better idea of how the “world computer” should evolve. But today, it is clear that ETH is valuable because of the systems on which ETH exists. The ledger with Bitcoin is so simple that the forked coins are functionally different from airdrops, and the Ethereum ecosystem is extremely complex. Because its application is intertwined with non-branchable components, the entire system becomes indivisible.

Regardless of where the community's opinions fall, DeFi operators have no choice but to stand by the big forces and go all out. If they are flawed, the damage will be more than just technical trouble: the real damage will come from the destruction of the user and the loss of trust. Financial systems and smart contracts are based on the assumption of predictability, and once the predictability is violated, users are less likely to return.

DeFi will eventually become the determinant of any future governance crisis – users, miners and developers certainly have a say, but DeFi's fragility will bind the hands of everyone else. With all new higher-level financial applications coming online next year, DeFi may only become more vulnerable.

If there is no such thing as a fork like ETC, then “forking governance” seems to have become a thing of the past. Welcome to the post-forked era.

Full text link: https://medium.com/dragonfly-research/ethereum-is-now-unforkable-thanks-to-defi-9818b967738f

2. The darknet market cannot tolerate bitcoin, but market competition does not allow

Earlier this month, the US Department of Justice (DOJ) announced the confiscation and ban of "WTV," one of the world's largest markets for child pornography.

All bitcoin transactions in and out of WTV are traceable. In addition to secret investigation techniques, the pseudo anonymity of Bitcoin has become an important part of how investigators locate and occupy the dark market and its global user base.

Then why use bitcoin?

It will take a long time for other cryptocurrencies to replace Bitcoin as the most commonly used cryptocurrency on the dark network. ”

Moreover, since bitcoin is the most mature and true payment method in these illegal markets, it is obviously unfavorable for many companies to not accept bitcoin payments. The purpose of talking about the general dark web platform is to try to attract as many people as possible to the market, and this means doing bitcoin trading, then people may think that if this means getting a bigger goal, it is a risky market. . ”

This is the paradoxical nature of using bitcoin to engage in criminal activities. From an operational safety point of view, the closure of the WTV proves that this may be one of the worst payment methods for such criminal activities.

However, at least in general terms, bitcoin is by far the most widely used and accepted method of payment for dark space economics. Evidence shows that until a few months ago, almost all of the dark-net drug market, which only received Monroe, eventually failed or died due to lack of customers.

Although Monroe seems to be better at illegal activities, the market still prefers Bitcoin, and if you don't accept Bitcoin trading, your growth will be limited.

Full text link: https://bitcoinmagazine.com/articles/darknet-markets-cant-live-with-or-without-bitcoin

3. Bitcoin developer funds analysis

Hasu's new work analyzes the importance of raising funds for open source development, exploring funding mechanisms, and analyzing different funding mechanisms and their respective trade-offs.

- Unpaid volunteer

So far, volunteers are the most common participants in open source protocols. They contribute and maintain software without direct monetary compensation, but they may have other motivations, including the establishment of skills and/or reputation, ideology reasons, or just passion for contributions.

Bitcoin itself, starting with Nakamoto. It was completely maintained by volunteers until 2012, when Bitcoin developers' external funding sources first began to emerge.

Volunteer models have many advantages. First, the lack of funds tends to attract missionary developers who are passionate about the project and maintain long-term strategic prospects in improving software. Second, developers in this model tend to be more collaborative and willing to work with others.

Fred Wilson believes that "the decentralized approach to development in many projects is not well suited for deadlines and delivery dates."

- sponsor

The biggest benefit of the patron model is that they often coordinate interests between donors and developers. If the project creates a lot of value, companies based on these projects will be motivated to continue to fund them. In addition, missionary developers now have the resources and support to contribute long-term

- For-profit company

If these business applications can establish their position in the market, they can be a powerful source of sustainable funding. The company is very interested in the long-term success of open source projects and will continue to provide support and dedicated resources.

- Protocol monetization

ICO relies on the issuance of tokens as a local unit of the network. On the plus side, ICO can quickly raise billions of dollars. This provides developers with a lot of resources to develop the protocol, compared to previous efforts to monetize open source technologies.

Full-text link: https://blog.deribit.com/insights/an-analysis-of-developer-funding-in-bitcoin/

4. The United States of Shitcoin

The work of foreign female writer Meltem Demirors focuses on the new narrative. Combined with the recent Facebook Libra and the central bank digital currency, the rules of the digital currency game may also repeat the old path of the Internet era. The addition of giants leads to the complete giant. Monopoly without hope of escape.

Bitcoin introduces the world to a new idea when we need it most, that is, the idea that the state and money should and can be separated, and that money can be digital, scarce, unchanging, and open source.

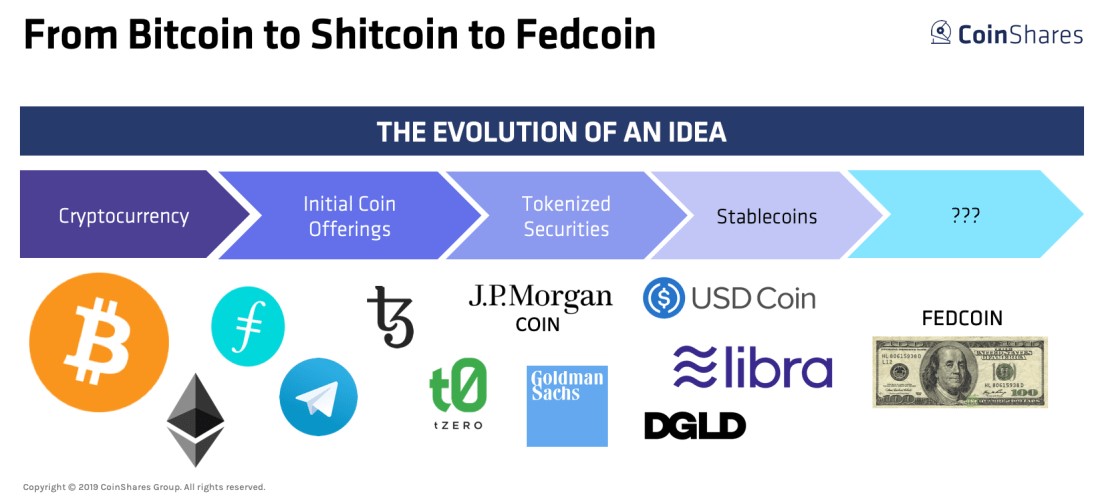

Bitcoin has been around for ten years and is basically all (well, 70% of it) cryptocurrency market. Although Bitcoin has attracted a lot of attention, for most companies and institutions that have missed the Bitcoin wave, money is thinking about ways to create and capture the next wave of Bitcoin. The evolution of ICO from public, anonymous fundraising to private fundraising, and fully regulated securities is a good example of this shift. Regulatory capture is a powerful force in our world, and cryptocurrency is no different from any other industry. Regulatory capture can also allow incumbents to squeeze out competitors. When popular narratives move from bitcoin to ICO to securities tokens to stable currencies, to the current central bank digital currency, every successive wave will concentrate power. In the hands of fewer and fewer, this is not surprising. This is the rules of the game in the world.

But like everything, this growth is not evenly distributed. Our digital age overlord – composed of five Internet companies – occupies the vast majority of this value. When they sat here watching the world and this crazy bitcoin thing, they began to ask: "Why are we not?"

Internet giants are begging to cryptocurrency communities (and larger financial technology communities) to borrow and steal funds to take advantage of new possibilities in digital finance. We've seen this taste in Facebook's Libra project – because it's been analyzed and carefully researched, there's no further comment at the moment, but I think it's just the beginning of a long and dystopian digital expert entering Google. Our liberation tools are likely to have the opposite effect, leading to a complete monopoly without the hope of escaping.

Given the marketing power of these companies and the absolute strength of their balance sheets, this new narrative will be an epic development. I mean, the reserve cash on Apple's balance sheet is more than the market value of the entire cryptocurrency.

Full text link https://medium.com/@Melt_Dem/the-united-states-of-shitcoin-1362a6e0a40e

5. Gavin Wood: Polkadot, Substrate and Ethereum

Poca founder Gavin Wood's new work focuses on Parity's efforts to connect the Boca and Ethereum ecosystems and highlights three of them. Here are some excerpts: ""

Regardless of how Ethereum is defined, Parity is as committed as ever to supporting and bridging Ethereum to Substrate and Polkadot. While we are making Substrate and its associated smart contract infrastructure the most powerful and convenient framework for creating new blockchains and dApps in the world, we absolutely understand that many people like the Ethereum ecosystem. Created, whether based on the main network or in a larger development community. We will do our best to support the establishment and interconnection of these teams.

Our commitment involves three different projects, and I would like to take some time to explain: the Poca/Ethernet Public Network Bridge in Substrate, Substrate/Parity-Ethernet-PoA Bridge and Ethereum-compliant EVM Smart Contract Execution Module.

In fact, in this model, nothing prevents the same Substrate chain from having both the EVM-Contracts module (for executing the original Solidity / EVM code) and the Substrate-Contracts module (for executing Solidity / Wasm or Ink!Wasm code). The two can interoperate and even post messages to a separate Parity-Ethereum chain that is bridged, or if deployed as a parallel chain, can be spread to the broader Polkadot community, including the Ethereum main network!

Currently, we focus on developing and enhancing the final core components of Polkadot 1.0, so we can't always spend a lot of development time on these projects as we hope. That is to say, Polkadot's reason for existence is to integrate disparate projects with multiple technical assumptions. The Ethereum community is the most important developer community on the planet, with the most free thinkers and the most meaningful developments – ignoring this is a short-sighted performance. After two years of development, the core infrastructure of Polkadot and Substrate has matured, and we can really start thinking about building peripheral components and diversifying the world to make the connection chain a reality.

Full text link https://medium.com/polkadot-network/polkadot-substrate-and-ethereum-f0bf1ccbfd13

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- 8 moats for blockchain entrepreneurship and investment in the 2020s

- Babbitt column | We are talking about the blockchain, is the same concept?

- Because of DeFi, Ethereum is now impossible to fork

- Interview with Academician Chen Chun: Blockchain and artificial intelligence, 5G, etc. can be integrated and developed, cross-border integration (recorded full text)

- China blockchain standard past events

- The global watershed of blockchain policy in October: China ushered in strong support, and the United States strengthened tax regulation against Libra

- Security Monthly | 10 security incidents occurred in October, DeFi lending platform into a new choice for hacker money laundering