Because of DeFi, Ethereum is now impossible to fork

Written by: Leland Lee, Haseeb Qureshi (Partner of Dragonfly Capital)

Compile: Zhan Wei

Source: Chain smell

After the 2016 DAO hacking incident, the Ethereum community faced a survival challenge: Should the community roll back the blockchain, return to the hacker attack, or let the event remain?

- Interview with Academician Chen Chun: Blockchain and artificial intelligence, 5G, etc. can be integrated and developed, cross-border integration (recorded full text)

- China blockchain standard past events

- The global watershed of blockchain policy in October: China ushered in strong support, and the United States strengthened tax regulation against Libra

Those who answered yes forked the so-called "Ethereum Square". And those who say no to the fork and do not agree to roll back, they are now the "Ether Classic" (ETC) . This is a classic example of blockchain governance: by creating a new fork, the minority coalition can effectively break away from the majority.

But in the future, Ethereum will never have a meaningful minority split, mainly because of the inherent vulnerability of DeFi.

a thought experiment

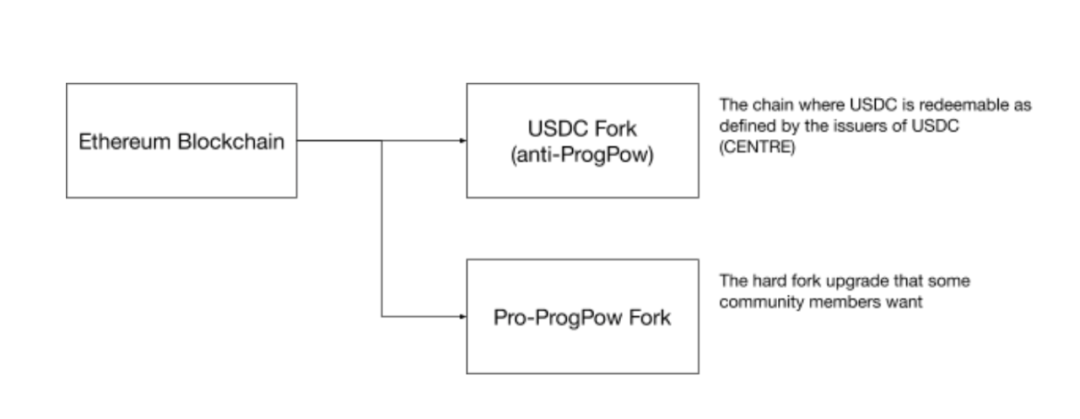

Imagine the ProgPoW controversial Ethereum Improvements Recommendation (EIP) being integrated into the code base and deployed to the upcoming Ethereum upgrade. What happens. This EIP represents the extreme view of this generation of ASIC miners, which will make the community guilty. Soon, the community is divided into different factions: anti-ProgPoW and pro-ProgPoW. Reddit and Twitter users will revise their online nicknames to show their attitude. A civil war is brewing, and everyone must choose to stand on the sidelines.

At the same time, DeFi operators are watching with anxiety. Their hands and feet are tied: they can't stand the line early. why? Because for DeFi operators, choosing the right fork is vital to the survival of their systems, and no one wants to provoke additional conflicts because of the selection and be embarrassed.

The USDC was the first to make a choice. The CENTRE, the organization that issued the USDC , announced that they do not support ProgPoW and that the USDC will not be able to redeem back to the US dollar on the ProgPoW fork. Of course, this means that on the ProgPoW fork, the USDC will be worthless – after all, the USDC is a US dollar-guaranteed “IOU” system, and only one record can correspond to the true liability of CENTRE, so that USDC The book is actually meaningless on another chain.

Seeing CENTRE's choice, all DeFi operators had to follow the footsteps of USDC. They can't go against the CENTRE's will, for the subtle reasons, which is increasingly becoming a feature of Ethereum DeFi.

Combinable specifications and limit everything.

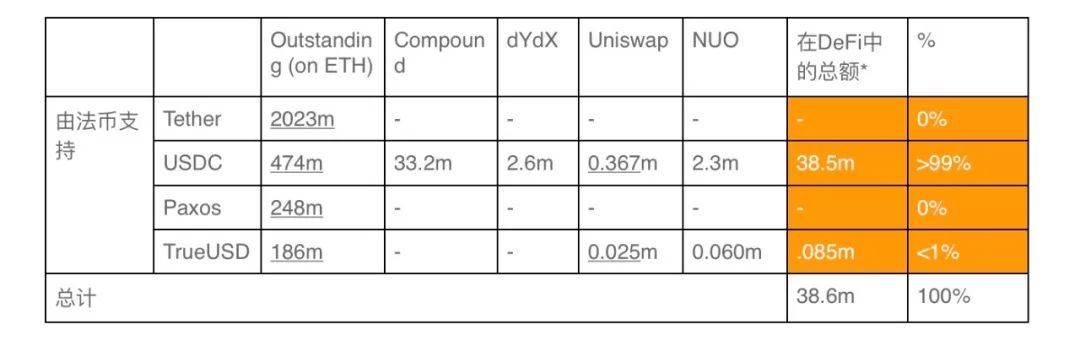

In decentralized finance, USDC is the second stable currency, but in another proportion, USDC represents 99% of the shares, which is locked in the counter currency supported by the DeFi application, USDC The market share is 99%.

USDC has a disproportionate influence

As of October 21, 2019, the total balance of several major stable currencies supported by the French currency (in terms of their respective stable currency values) in the main DeFi project.

The total lock-in value of the stable currency in several of the largest DeFi projects (however, the total lock-in value is an imperfect indicator because it does not consider different loan interest rates and encumbrances)

The total lock-in value of the stable currency in several of the largest DeFi projects (however, the total lock-in value is an imperfect indicator because it does not consider different loan interest rates and encumbrances)

The use of other currency-backed stable coins in DeFi is minimal. But you might say that it doesn't matter, after all, this is a problem that the market can solve. For example, letting Tether and TUSD stand up with billions of dollars in stable currency, replacing the USDC position, the problem is not solved.

But what about existing financial instruments that use USDC directly or indirectly? Without the USDC, DeFi might survive in theory, but it is now too entangled with the USDC, and it will be extremely complicated to get out quickly and safely.

Divided pain

Any DeFi application that does not follow the USDC team needs a multi-party coordinated extraction process: after the fork, all USDC-denominated things will become worthless. Given the composability of DeFi, this segmentation must be coordinated across the ecosystem. Let's imagine what happens:

- Regular USDC loans or derivatives must be terminated early (Dharma and Nuo networks) .

- When people leave the market and try to sell USDC positions in their hands, arbitrageurs ( people who convert USDC into dollars) cannot handle these orders quickly, and the price of USDC will plummet.

- In contracts such as Compound, a run may occur because most of the USDCs are actually being lent out and the lender cannot get back their deposits. This will push up the USDC borrowing rate.

- Those passive USDC holders have to go online, and those who use cold storage will be more troublesome.

- Operators of the DeFi abstraction layer, such as Outlet.finance or Astrowallet, will have to integrate other alternative stable coins.

In the face of such a painful segmentation process, DeFi operators will have no choice but to stand with CENTRE and do their best to support this share of the USDC's heart. They don't have to think about the opinions of the Ethereum community. If they choose the other side, the loss will not only be technically snoring, but the real pain will come from the breakdown and loss of trust of its users.

Financial systems and smart contracts are based on assumptions of predictability, and once this assumption is broken, users are unlikely to come back.

If the DeFi operators are inconsistent, their financial ecosystem will be in chaos. This is a classic game theory scenario: incentives overwhelmingly encourage collaboration, so all DeFi are forced to act together.

Therefore, all DeFi are selected to stand on the USDC side. So what do those who choose to stand on the other side of the team encounter?

Deep valley of D-ETH

Finally, a small group of people chose another way through the fork. They are still very optimistic, giving their blockchain the name " Decentralized ETH " (D-ETH) . What do they encounter in this new chain? As with all forks, the overall state of all smart contracts will be migrated – but what happens if there are no operators to maintain their operations?

The predictor stops publishing the data stream and the quote will no longer be available. Any tool that uses price streams is no longer available.

All centralized stable coins are now worthless. Tether, USDC, TUSD, PAX… everything is gone. Most operators will freeze the contract, and now the token will not be transferred and cannot be converted into legal currency. For the smaller stable coins, no one even cares.

Any borrower who uses USDC as collateral has gone with a free token. Of course, unless the borrowed token is Dai, they are actually worthless—even the “D-REP” (forked REP token) market, because Augur is no longer running. All long-term bets on Augur have actually depreciated. Few D-REP holders will come out to report the results of the game. There isn't even a user interface pointing to the D-ETH version, although some people will post some complicated tutorials on a topic on Github. In the end, this contract is completely unreasonable.

The 0x contract is still running because they don't need any external participants, but at this point its liquidity is already insufficient, and only some inexplicable repeaters occasionally charge a fee in the form of "D-ZRX". Uniswap is also fortunate to maintain some trading volume in different trading pairs because there are speculators playing inside.

Of course, the elephant in the house is actually Maker . It has too many D-ETHs locked in the minority forks, so it cannot be ignored. They can let the system survive the crisis safely, but because the system is now supported by D-ETH instead of ETH, the system will soon run into problems with insufficient guarantees after the fork. Almost every mortgage debt (CDP) must be liquidated, and D-PETH must be auctioned and converted to D-Dai (the system will destroy the token to de-leverage itself) . However, the demand for the auctioned D-PETH is very small, and most D-Dai holders will not pay attention to the bifurcation of this minority, so the supply of D-Dai is very depressed. This led to a severe supply shortage of D-Dai and a large supply of D-PETH into the market, resulting in a deleveraging spiral and a significant surge in D-Dai prices.

Seeing this ominous sign, the Maker governor will decide to trigger a global settlement directly on this minority fork. It’s not worth it to worry about it. All D-Dais on the chain are cleared and converted to D-ETH balances. The D-Dai holders who noticed this point requested to pay their D-ETH. However, when they turned to sell their newly acquired D-ETH, the sell-off would lead to a wave of oversold, causing the price of D-ETH in the hands of other D-ETH holders to plummet.

This will cause any things that depend on D-Dai to crash immediately. Uniswap D-Dai Market, Compound D-Dai Market, Augur v2, almost everything that uses D-Dai is now fundamentally broken. Even if they have fail-safe measures for global settlement, most operators do not have the infrastructure and deployment process to manage the systems on both chains, so many operators simply scrap them directly.

All websites, interfaces, block browsers and wallets end up pointing to the majority chain. Game operators like CryptoKitties will lock their D-ETH contracts to avoid confusion for users. The minority chain has become so poor that it has basically become an empty blockchain.

You can imagine a movie version of this legendary story: the minority chain looks like an abandoned metropolis. There was no one in the towering building, the alarm sounded, no one responded, and the smoke in the distance. No one even worried about rebuilding the city.

The minority community has complained about this conspiracy. However, once the liquidity of D-ETH slows down, it is clear that exchanges will not list the depreciated D-ERC-20, and the economic mechanism will not be able to bring the rebels together. Early volunteer developers no longer appeared, and the community gradually withered. In the end, this project will be abandoned, just like all other ETH forks, disappearing into history.

The value of ETH

Ethereum is no longer what it used to be. In 2016, it is still a proof of concept, and ETC has reason to claim that it is another better version of the evolution of the "world computer." But today, it is clear that ETH is more valuable because of the system based on it. Bitcoin's books are simple, so their forks are functionally equivalent to airdrops. ETH is different, and its ecosystem has become incredibly complex. Because its system is intertwined with non-divisible components, the entire system cannot be forked. Any minority of the forks is destined to take the bamboo basket to the water.

DeFi eventually became the voice of any crisis in the future – users, miners and developers certainly have a say, but the confusion caused by the demolition of DeFi will get everyone together. With all new higher-level financial applications coming online next year, DeFi may only become more vulnerable.

If the ETC type of fork does not reappear, then "governance through the fork" will become history. Welcome to the post-forked era !

Thanks to Dan Robinson and Tarun Chitra for their feedback and insights on this article.

Chain Wen received the author's authorization to publish the Chinese version of the article.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Security Monthly | 10 security incidents occurred in October, DeFi lending platform into a new choice for hacker money laundering

- Joseph Lubin: Ethereum 2.0 will eliminate professional hardware that wastes resources and significantly reduce user barriers

- Bank of Korea official: China's central bank digital currency helps the internationalization of the renminbi

- Chen Chun talks about blockchain: the key application space is that industrial manufacturing cannot use this name to stir up coins

- Degree Universe, Netease Planet, Love Diamond… Can the blockchain projects of these big factories take the opportunity to respawn?

- Deng Jianpeng: Blockchain supervision legislation, may wish to "chain the chain"

- BTC repeatedly shocks the dish, try to avoid frequent operations