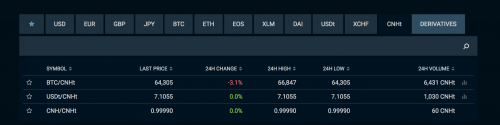

Tether issued a stable 24-hour trading volume of anchored offshore RMB, only 0.1BTC

CNHT transaction pair

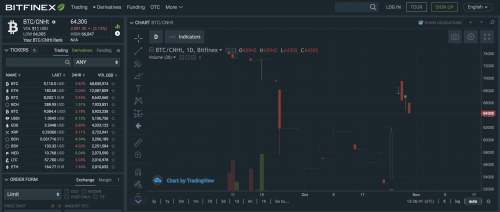

The transaction of anchoring CHNT has been on the line for nearly two months. From the K-line chart, these transactions are not liquid. BTC/CNHT has repeatedly appeared for 24 hours in a row for a few days.

As of October 30, the CNT/CNHT transaction has a trading volume of only 60CNHT for 24 hours, equivalent to RMB 60, and there are two consecutive weeks when the trading volume is 0 in 24 hours.

- Swing up to 90,000 miles: the five major logics of bitcoin's positive bullishness

- On November 7th, the most mysterious dinner in Wuzhen came | Guide to the blockchain conference

- Dry goods | Vitalik: Eth2 segmentation chain simplification proposal

CNT/CNHT fluidity

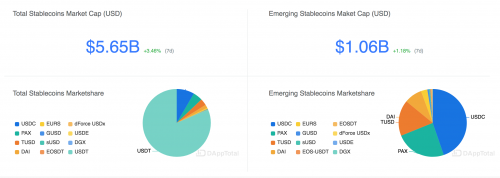

Dapptotal data shows that the current stable market value of the market reached 5.65 billion US dollars, of which USDT's market share is over 81%, the market value is nearly 4.2 billion US dollars, and the remaining 12 emerging stable currencies account for less than 20% of the remaining.

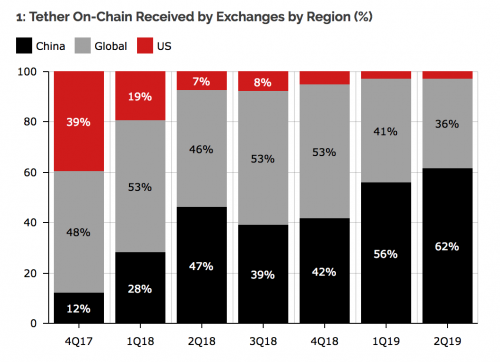

The main trading force of USDT was gradually transferred to the Chinese market. According to Diar data, USDT's trading volume on the China Exchange was up in 2019. As of the second quarter of 2019, the USDT's USDT transaction volume exceeded US$10 billion, accounting for 62% of USDT's chain trading share, while the US USDTT transaction volume decreased from 39% in the fourth quarter of 2017 to 3%, that is, in the United States, only USD 450 million worth of USDT was traded in 2019, which is nearly $10 billion less than the USDT chain transaction in China. According to the research report, USDT mainly flows to OKEx, Firecoin, Coin, Poloniex and Bittrex.

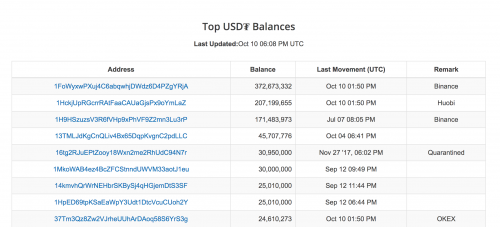

On the Tether Rich List, the top ranked addresses are currently dominated by the three exchanges of Binance, Fire, and Okex. The USDT balance of the Binancecoin exchange totaled nearly 550 million, the USDT balance of the Marcoon exchange exceeded 200 million, the USDT balance of OKEX was approximately 25 million, and the USDT balance of the three exchanges accounted for nearly 20% of the total USDT circulation.

Tether Rich List

Author: LornaQ

Source: Financial Network · Chain Finance

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Bitcoin is 11 years old. Has he grown up?

- Genesis Capital's third quarter report analyzes opportunities for cryptocurrency lending

- The domestic public chain Yuanjie DNA released the digital identity application Bitident (Bidden) to help the rise of the digital economy

- The digital currency of Chinese listed companies (below)

- The contract market will add another fierce will explain the currency China strategy

- SpaceX also engages in IEO? Musk is forced

- How to develop a "no coin" public chain?