The calculation is soaring, the mining ring is warming up. What is the difference between this “beverage period”?

After the bitcoin price has returned to 10,000 US dollars in the previous period, the atmosphere of “the bull market is coming” has become extremely strong. Although bitcoin prices have recently faced fluctuation adjustments, it is hard to survive the delayed rainy season and let the sweeping down losses and supervision The mineral ring with obstacles and haze has once again become lively.

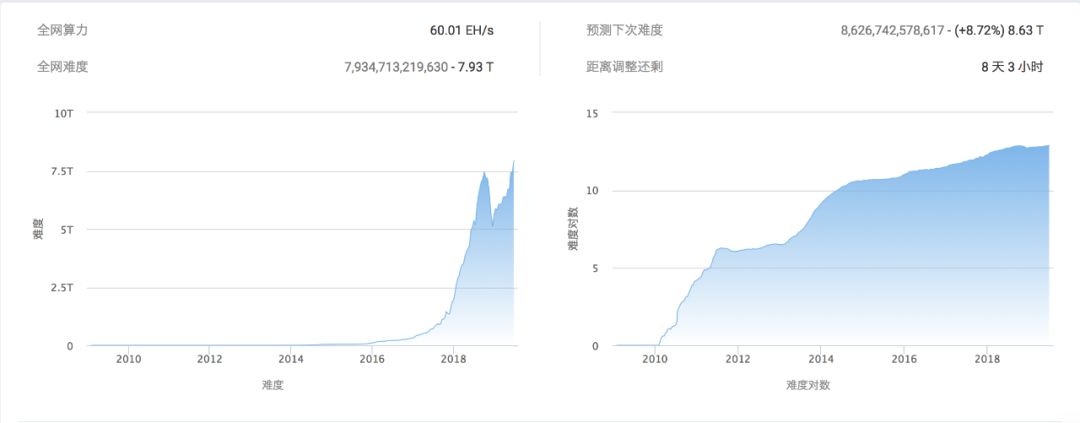

Thanks to the recent high currency prices, mining capacity has risen. The total amount of Bitcoin's total network computing power has recently exceeded its historical peak in October 2018, once surpassing 66EH/s, a record high. And more than doubled from the low level at the end of November last year. According to Bitinfocharts data, as of press time, BTC's total network computing power reached 57.58EH / s.

The BTC.com data further indicates that the average computing power on May 14th-May 31st increased by 53.36EH/s, which is similar to the previous history of the highest difficulty level of 53.33EH/s, and the most recent June 14th. The average power of the day-June 27 re-creates the latest peak of the historical bitcoin difficulty cycle of 56.77EH/s.

- CME Bitcoin Futures Analysis: Is institutional interest rising? CFTC report shows that this is not the case

- Cosmos and Polkadot: Interoperability of blockchains

- German ruling party report: consider launching euro stable currency to realize the digitization of money supply

Corresponding to the increase in computing power, the difficulty of bitcoin mining is also climbing. After the latest difficulty adjustment, the difficulty of bitcoin mining has reached 7.93T, which has exceeded the historical peak of 7.454T last year, which is higher than the end of last year. 46%. In addition, according to BTC.com data, there are still 8 days from the next difficulty adjustment. It is expected that the difficulty of mining will increase by 8.72%, or it will enter the 8T mark for the first time, reaching 8.63T.

According to the shutdown currency price list, when the comprehensive electricity bill is calculated at 0.4 yuan, as of press time, the current currency price is 9870.3 US dollars (about RMB 67714.2 yuan), and the 13 BTC mining machine models in the table except the ant S7 12 None of the models have reached the closing price. The miners M3+, Avalon A741 and Ant T9, which were eliminated last winter, are expected to return to the market in this round.

The dynamic balance between power and currency prices is still being adjusted. After 2018, the “cryptocurrency winter”, the price drop has caused the miners and mines without the price advantage to shut down, and the calculation and mining difficulty Adjust to make room for the survivors. There is a long-standing consensus on the layout of the mines during the flood season. The low electricity prices have brought the miners the space to earn excess profits, and they have begun to attract new visitors. The long-lost mining machine has once again roared.

After experiencing the delay of the early flood season, the doubt of the mine surplus, the silence under the supervision risk, and the return of this round of currency price boost, reviewing the past more than a month, this “beverage period” and all The appearance of people seems to be different.

Twists and turns during the flood season

Shenyu once sighed on Weibo on June 18: "This year's hydropower mining is really a disaster. First, it is not raining or water. It is a lot late than in previous years. Recently, the storm has hit another earthquake today," he said.

After experiencing the splendid period of the past years, the mine has long been a consensus on the layout of the flood season, especially after the cold winter that has just experienced the collapse of the currency price, plus the bitcoin halving market, miners and mines. The owners are eager to make up for the losses caused by the collapse of the currency price from the low price of electricity. Although this year's electricity price is not higher or even cheaper than last year, when such uncontrollable factors are faced with the delay of the flood season, a large number of mining machines that are used in advance for the layout of the flood season are still unable to start mining and create revenue. In turn, it brings the predicament of excess mines.

Coindesk reported that according to a report released by blockchain research firm Coinshare, as of the beginning of this month, 50% of the world's bitcoin computing power came from Sichuan Province. The flood season was delayed by nearly a month, causing some local mines to run less than half of the miner's equipment in the past month. According to BTC.com data, from the beginning of April to the present, the computing power has increased by more than 10EH/s, and before the mid-May flood season, the bitcoin computing power has only increased by about 2EH/s. Miner Laohu is one of the mine owners who laid out many new mines before the start of this round of wet season. His scale of self-operated mines is 50,000 loads. He said to Caijing.com on the financial network. In fact, when we first started in April, there were basically no customers, and we were all over the way. After several twists and turns, it was not easy to recruit before the official flood season began on May 25." In the early stage, the situation of excess mine layout was over-reduced, which was alleviated as the flood season approached and the currency price rose. However, the mine did not sit back and relax because of the arrival of the flood season. During this period, the regulatory issues were particularly sensitive, and its impact was gradually deepened with the implementation of regulatory actions.

In the "Industrial Structure Adjustment Guidance Catalogue (2019, Draft for Soliciting Opinions)" issued by the National Development and Reform Commission on April 8 this year, "virtual currency mining" was included in the elimination category. Although the draft for this opinion, many industry insiders have commented that there is no substantive action at present, and the release of regulatory signals at this stage does not directly affect the development of the mining industry.

Different from the initial optimism, from the recent trend of the mining circle, there are references to the policy risks in the hot topic, and the actual impact seems to be greater than expected. Among them, Sichuan Ganzi, which was the first to bear the brunt, was exposed for “purchasing electricity near the river, building a mine in the river”, and then the mines in the area were investigated and illegally cleaned by the regulatory authorities due to the suspected illegal construction of the mines and projects. The process of approval and compliance in the future seems to be difficult to adapt to the rhythm of the mine layout and mining in the wet season. This is undoubtedly a bad news for the miners and mines that have just waited until the flood season. . Hairball Technology co-founder Weng Yaoyao said in a recent offline event that the Ganzi area mine is currently in a state of large-scale shutdown.

The official documents requested by the National Development and Reform Commission have not yet been released, and the market is continuing to wait and see. The mines that had previously traveled to Iran due to policy factors are also in the midst of a recent sanctions crisis. According to Sina Technology, the news on the morning of June 28, Iranian state television reported that due to the surge in electricity consumption, the Iranian authorities have seized about 1,000 bitcoin mining machines at two abandoned factories.

In contrast, the impact of seismic factors is very limited for mines and mines that have just been put into operation.

Since June, China Seismological Network has reported many earthquakes in Sichuan. The recent earthquakes in Changning and Yixian are relatively frequent. The most recent one occurred in Jixian and Changning County, Yibin, Sichuan Province on the evening of June 30. Class and 3.1 earthquakes, including Neijiang, Aba, Liangshan, Ganzi and Mianyang in Sichuan.

Chen Lei, secretary-general of the Block Chain Club of Peking University, told Caijing.com that the earthquake actually has limited impact on the mine. The intensity and scope of the earthquake are not large. The distribution of the mine in the southwest is wide enough and scattered.

The current miner Colin3 in Mianyang, Sichuan, also said that the earthquake is only a small probability event. For the mine, the earthquake will not be the main consideration, and the electricity price is the most important. Based on the consideration of multiple factors such as construction cost, time and convenience, most of the mines in Sichuan are built with the structure of steel houses, and they are not capable of earthquake resistance. Colin3 said that there may be super-large companies that focus on these issues, but such geological disasters may not be avoided even if they are considered, because the way the mines are built generally does not change.

The layout of the mine is heavy throughout the year instead of water ?

Although the mining investment of the miners Laohu’s mine was barely completed at the beginning of the flood season, he also said that this does not mean that all the mines in the flood season are in such a situation, and each mine is different. Some mines have been established for two or three years. If the operation situation is relatively reliable, this round of flood season may have been scheduled very early, and some new mines may not have a seat yet. Full of recruitment.

For this mine that only digs the flood season, the COO Yuyang said that “the two years focus on the whole year”, the reason why the “all year” is not just the flood season is mainly because Two years are new machines, and electricity costs are smaller.

Chen Lei also expressed similar views. He believes that some mine layouts will pay more attention to the whole year. Instead of just looking at the flood season, the reason is: First, the previous generation of mining machines enters the end, and the new machine has increased the tolerance for electricity costs. There may not be so many used machines in the next flood season; secondly, the new mining machine, especially the mining machine represented by seven nanometers, has higher requirements on the overall operating environment, more sensitive and more delicate. The shortcoming of hydropower is unstable power supply, single The scale is generally small, the high-standard infrastructure is difficult to implement, and the humidity is high. These will seriously affect the operating efficiency and service life of the new mining machine, so the number of new machines to the wet season is not too much.

The electricity bill can not be separated from the performance of the mining machine itself. Those mining machines with high computing power and low power consumption ratio have the opportunity to outperform the dry season, thus achieving continuous mining, and even insisting on the coming of the next wet season. But correspondingly, these mining machines often need to pay higher prices. The high cost of mining machines is unbearable for retail miners. Although the power consumption has decreased, the mining revenue and the saved electricity expenses are saved. In the longer period, it can only be used in exchange for high machine costs, the mining period becomes longer, and the actual benefits are far from being expected for them to mean greater investment risks. The infrastructure of the mine itself is also limited by the cost and scale of the mine construction.

Miner Colin3 said that retail miners are more willing to purchase miners with low stand-alone prices and short payback periods. Especially when the electricity price is low during the wet season, Colin3 said:

"As long as there is a little profit, some people will mine. The law of the market is like this: some people sell the mining machine and some people buy it. Some people buy it and someone digs it. This is the process of continuous iteration of the machine, selling the low-powered mining machine to the low electricity price. People, until the people with low electricity prices can not dig out, the mining machine will be eliminated. And those who can support the year-round mining, or use graphics cards (because the graphics card machine consumes less power, can withstand the rise in electricity costs) Either a mining machine with a large amount of power, or those mines with large capital support."

Previously, in March of this year, the coin-printing pool co-founder Zhu Xi also predicted that the 2019 flood season might be the last battle of the 180W/t machine. Zhu Xi said that low electricity prices are always the core competitiveness. If the price of the currency increases by 50% in the future, then the 180W/t machine can safely pass through the water. The future computing power is likely to exceed 60E, but the 70E computing power is subject to many factors, such as insufficient power, insufficient space, insufficient machines, high computing power and other factors.

At the end of last year, bitcoin prices experienced a trough in the bear market. When Yu Yang was interviewed by Caijing.com and Chain Finance, he said that he believes that the future trend of the mining circle pattern will be “the exit of retail investors, the entry of large households” and the scale of large mining companies. The advantage is not only reflected in the ability to get lower electricity prices than in the cold winter, but also intensive resources in machine, site and personnel maintenance to improve output efficiency.

Mines and miners who have sustained their ability to survive in the bear market, in addition to mining mines at a lower cost and preemptively expanding the mine layout during this period, have more cash flow and can take on more The risk has further occupied a dominant position in this round of power struggle, and the scale advantage has been continuously strengthened.

Mining machine production capacity is very contradictory

Steven Mosher, global sales and marketing director of Jianan Zhizhi, said in an interview with Coindesk that the recent surge in bitcoin prices has led to high demand for mining machines and supply shortages. “This seems to be returning to the third quarter of 2017 and fourth. In the quarter, demand is three times the supply."

And in the same report, Shenzhen Bit Micro CEO Yang Zuoxing added another important reason why the supply of the industry is difficult to meet the capacity of the mining machine, that is, the supply of chips that can be provided by various upstream suppliers is limited. "The growth of bitcoin's computing power can't keep up with the price increase." Yang Zuoxing said, "Production capacity is the bottleneck."

The rise in the price of the coal has driven the demand for mining machines. At this time, the imbalance between supply and demand between the production capacity and demand of mining machines is more obvious. With the upgrading of new mining machines, especially the introduction and blessing of large-scale mining machines, it is unfortunate that there will be much thrust in the growth of mining capacity and computing power this year.

However, compared with the calculation and mining difficulty in October 2018 and now, it can be found that the increase in computing power is actually not as expected. In 2018, the peak of computing power is close to 60EH/s, which is not much different from the current computing power level.

According to the top 20 miners in the popular mining machine, half of the miner models were released in the second half of 2018, and nine models were released in the first half of this year, including 7 in the mines released in April. There are many models.

According to the official website of the mining machine, the hopper mining machine including the latest released S9 SE (16T) and S9k (13.5T), the SHA256 algorithm mining machine has been sold out, the ant S17 (53T) and T17 (40T) delivery date is September of this year. Order delivery for Shenma miners M20s (68T) and M21s (56T) was even scheduled for November.

Consistent with Yang Zuoxing's point of view, some insiders believe that the increase in computing power of the whole network is indeed difficult, mainly because the chip acquisition is difficult. Take Bitcoin as an example. According to the industry insiders, Bitcoin is ranked 16th in TSMC's chip supply list (the top 10 is occupied by mobile phone manufacturers), and the chip tends to supply to 12-month stable suppliers. The relationship between the demand of the machine manufacturer and the price of the currency is too close, so it is impossible to maintain a stable demand for the chip. The mining machine launched by the mining machine supplier has been divided into several computing versions (such as 42, 46, 47, 50 or 56T mining products). The main reason is that in addition to the difficulty of acquiring chips, the yield rate should also be marked with a question mark. In addition, the efficiency of the tape is not very optimistic. For example, the same 7nm chip, but backwards to produce a product with a power consumption of 60j, 70j or even 80j per T.

For the mining capacity, Chen Lei also said that the current production capacity of the mining machine is generally determined three to six months ago when the manufacturer chip orders, the response of the manufacturer's production capacity is generally lagging, and is currently entering the difficulty adjustment stage, with The price of btc is pushing up, and it will continue to grow slowly, or it will approach or even exceed 100EH/s. "Of course, the premise is that bitcoin price, the price is high enough, it will be a new influx."

In addition to the capacity of the new mining machine, the second-hand mining machine market is also facing a situation of short supply. As the price of electricity has decreased and the price of the currency has risen, many of the previously mined out of the mining machine have reappeared. As demand has increased, the chaos in the second-hand mining machine market has also increased.

The main problems are:

1. Good or bad mining machines are mixed and sold, and some machines even have viruses or machines that are too old and have a high failure rate.

Mr. Zhang, a miner, said that during the wet season, he bought 500 ant S9 second-hand mining machines. He had already started laying out before the flood season, but he has only put more than 200 units on the scene, and the failure rate is over 40. %. In addition to being difficult to repair, some of the viruses carried by the mining machine may even be contagious, especially when the technology of repairing the machine is still immature, and it needs to be sent back for repair, which is time-consuming and labor-intensive. In addition, Mr. Zhang also said that, for example, ants T9+ or S9, some of these old machines have already experienced two periods of high water, some of which are still running during the dry season, the machine is already aging, and it may still be possible to move the place. If you make a move, the failure rate becomes extremely high.

2. Difficulties in operation and maintenance in the later period, the time cost of maintenance during the period of high water is high, and the results of later maintenance are not guaranteed.

It is not easy to return the repaired machine to the faulty machine. Especially during the flood season, all the used machines on the market have appeared, and the maintenance market has become extremely hot. During this period of limited water Repairs have to face the treatment of waiting in line, not only to repair the money of the machine, but also to pay the electricity bill of the mine, to bear all the losses. The 24-hour warranty given by the mining industry is actually not very big for some retail investors. Except for the inability to test the machine in time, even if it can be tested, a small number of machines often fail to receive corresponding compensation, and a small amount of maintenance costs are returned for transportation back and forth. Maintenance time and cost, as well as the loss of mining revenue during the period, did not help.

3. The mining industry has no credit guarantee, the mining machine has changed hands frequently, and the mining and logistics have the operation space of private freight profit.

Second-hand mining does not actually need to take over the physical machine. It only needs to obtain the information of the mining machine to conduct the transaction. It may be changed several times during the period, and the second-hand mining itself may not touch the machine at all. The so-called quality assurance is impossible to talk about. In addition, even if the price of the mining machine is properly negotiated, and there is room for price increase in the logistics chain, the packaging fee and the freight bargaining power are in the hands of second-hand mining and physical companies. When the number of mining machines involved increases, there is profit-making space. It is also difficult to estimate.

Colin3 said that basically if you buy second-hand machines all rely on luck, second-hand mining is actually no credibility.

Chen Lei believes that the pit of second-hand mining machine is a typical representative of the chaos in the industry. The quality of the employees is different, the industry standards are lacking, and the supervision is vague. At the same time, this is a profitable space, and the natural fish and dragons are mixed. It is still necessary to look at the industry in the long run. It will move toward the day of standardized division of labor, large-scale deployment, and professional operation and maintenance.

For the wet season, the rule seems to be the same: as long as you can buy a cheap mining machine and find a cheap mine to win. In fact, as far as regulation and industry standards are concerned, as far as electricity prices and mining machines are concerned, miners are facing new challenges and continuing competitions with the currency price.

Author: Xi breeze

Source: Finance and Economics Network on Finance

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- DeFi also works on Bitcoin networks

- Analysis of Facebook LibraBFT and the consensus of the original chain Bystack BBFT

- Bitcoin computing power hit a record high of 69 million TH/s, which is 10 times the total amount of sand in the earth.

- Report | Form of currency: from physical currency to cryptocurrency

- Libra starts applying for BitLicense and may need hundreds or thousands of licenses in the future

- A self-report of a Venezuelan bitcoin "criminal"

- $28 million, the blockchain company bought a bank