The era of personal crypto bonds: NBA players, Ethereum, and personal bonds

* The personal bond of the first professional player in history

* Personal bonds based on the Ethereum blockchain

* Tokenized tradable personal bonds

Specifically, Spencer Dinwiddie issues 90 personal bond tokens through the STO platform called Securitize. The tokens are issued based on Ethereum, each token is worth $ 150,000, and a total of $ 15,000,000 is issued, which is approximately equivalent to Spencer Dinwiddie has about 40% of the $ 34.4 million contract revenue over the next three years.

- Latest report: Lightning Network's privacy and scalability advantages are lower than expected

- Israeli startup Atomic closes $ 2.5 million seed round, led by Hexa Group

- Babbitt Column | Cai Weide: The entire financial system can be replaced by blockchain

Investors who purchase Spencer Dinwiddie crypto bond tokens are not allowed to trade the tokens for one year, which means that the tokens are locked for one year. As the income of personal bonds, investors can earn 4.95% interest every month, and the principal will be repaid after maturity. Expiration is three years later.

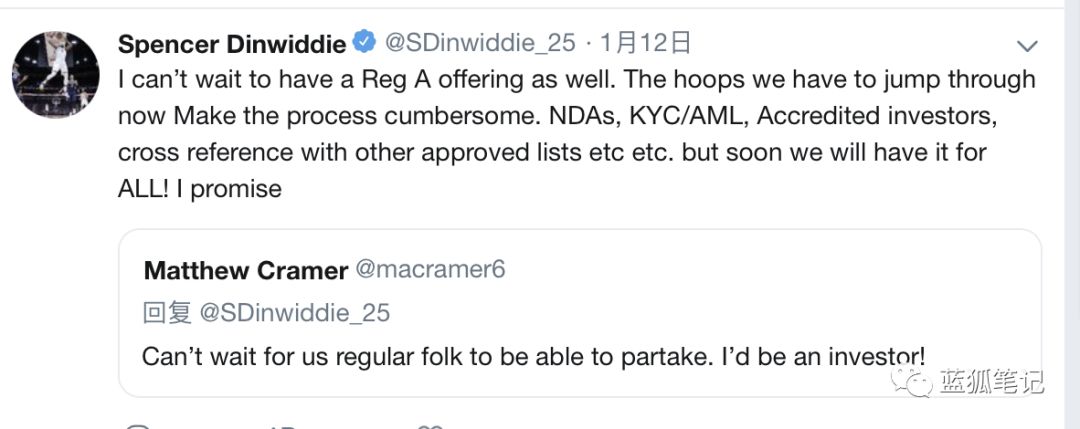

Currently, only qualified investors are allowed to participate, so the procedures are very complicated and require AML / KYC verification.

Significance of "Dingweidi Crypto Bonds" to the crypto world

This matter has almost no direct impact on the market value of crypto assets. However, the important point is that it opens up new concepts.

First, it opened the era of personal crypto bonds.

If the "Dingweidi Crypto Bonds" case can be successful in the future, it will cause other professionals to follow suit. Not only NBA players, but also tennis players, football players, singers, artists, etc.

Maybe one day, "Spencer Dinwiddie Bonds" will become synonymous with personal crypto bonds. The token issuance will end on February 10th. If successful, this will be one of the important events in the history of crypto. Because it opened the era of personal crypto bonds. It may not be difficult for a well-funded company to successfully issue $ 15 million in bonds, but personally, it is worth paying attention to successfully issuing $ 15 million in bonds.

Secondly, it broadens the usage scenarios of public chains.

Professional players can issue personal bonds. This was difficult to achieve before. Nowadays, with the public chain infrastructure, it is feasible to issue personal bonds based on Ethereum or other public chains (EOS, Harmony, Nervos, etc.). If the "Spencer Dinwiddie Bond" is successful, it will enrich the use of public chains.

In the end, it widens people's imagination.

Since individuals can issue bonds, are there more derivatives to be born based on individuals? If individuals can issue crypto bonds based on future income, can other organizations, such as companies, also issue crypto bonds based on future contract revenue or other assets? Even if it is not possible for a while due to regulatory and compliance reasons, it will open the door to discussion.

Ding Weidi may be the most forward-looking player in NBA history

Ding Weidi was the first person to eat crabs. In order to realize the issuance of personal bonds, he and the consultant team have negotiated with the NBA league and made some concessions. In the beginning, he and the team also designed the token value to be tied to the third year player option. If a higher-yielding contract is available, investors will also benefit. But this design was rejected by the NBA. If you can agree, this is equivalent to the token's future performance and income of the player, of course, the risk and return have also increased year-on-year, but there will be more room for imagination and operation.

From the above design and operation, Ding Weidi looks more like an investment genius that has been delayed by basketball. There is gossip that he invested in bitcoin in 2017 with a purchase price of less than $ 4,000, which has benefited a lot.

Issuing personal bonds has many benefits for him. His contract revenue for the next three years is $ 34 million. After this issuance of personal crypto bonds, if he succeeds, he can cash out $ 15 million in cash immediately. As a veteran Bitcoin investor, will he invest some of it into Bitcoin? If he allocates some of them to Bitcoin, if the appreciation of Bitcoin in the next three years far exceeds the interest paid every month, is this a good financial and investment operation? For a professional NBA player, this kind of forward-looking investment vision is rare. In this regard, perhaps he is the most forward-looking investment brain in NBA history.

The appeal of Ding Weidi crypto bonds to investors

Ding Weidi's personal crypto bonds are only open to qualified investors and are not open to ordinary individual investors for the time being. This is also related to compliance and supervision, so its impact will be limited to a certain range. However, this will still be of interest to investors. The reasons are as follows:

- Ding Weidi's personal bonds are based on tokens issued by Ethereum and can be traded on the exchange. Although there is a one-year lock-up time, they can be traded at any time after one year to obtain a transaction premium.

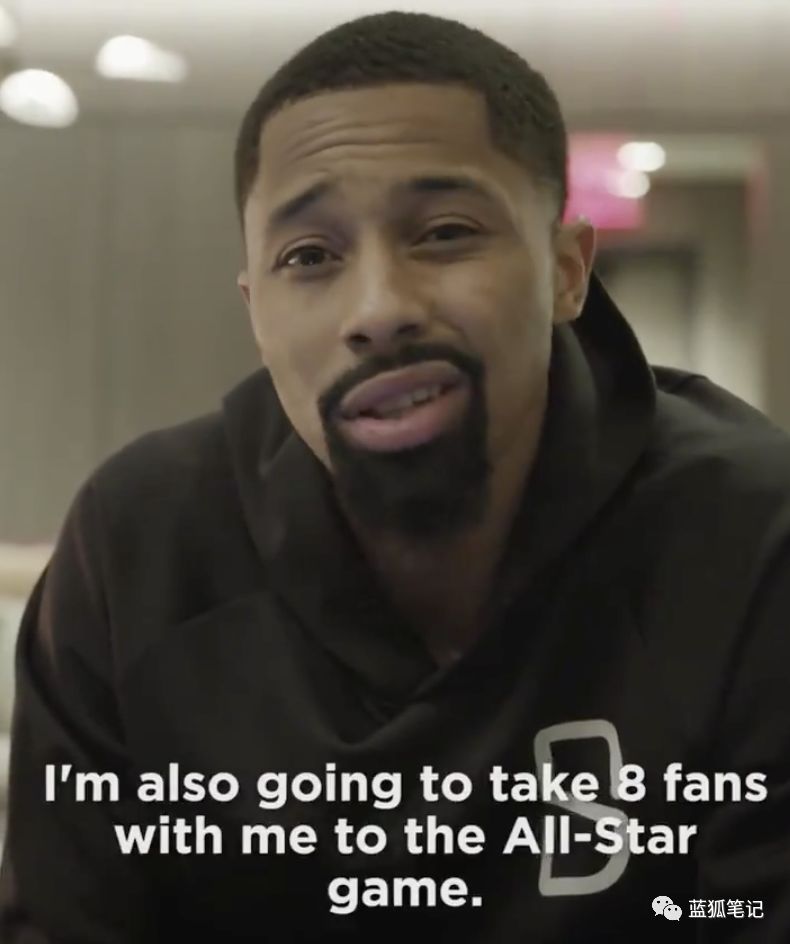

- Ding Weidi promised that if he can enter the All-Star Game, 8 of them will be invited to participate in the All-Star Game. This is a kind of fan welfare, which is the embodiment of fan economy. Ding Weidi won the NBA All-Star Skills Challenge in the 2017-18 season.

- (Ding Weidi said in the video that if he is selected for the All-Star Game, 8 investors will be invited to participate)

- Ding Weidi's personal crypto bond yields good returns. The interest rate of 4.95% per month is very good compared to other investments, and the risks are relatively moderate. He has a contract income of $ 34.4 million over the next three years.

Risk warning: All articles of Blue Fox Note can not be used as investment advice or recommendations. Investment is risky. Investment should consider personal risk tolerance. It is recommended to conduct in-depth inspection of the project and make good investment decisions.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Interview with Li Lihui: Where is the next place for the digital economy?

- Blockchain Weekly Report | "Future domestic exchange licenses should not be issued in the future" 14 financing cases ushered in a small peak last week

- What projects should we focus on in 2020? 44 big coffees gave a list

- "Battle cannot be fought", Iranian miners dodged the war but could not "speak"

- Let us show you in non-technical language how zero-knowledge proofs can change the blockchain

- Long-term data shows that bitcoin and gold prices remain uncorrelated

- After CME officially opened bitcoin options trading, single-day trading volume has shaken off Bakkt