The Fed’s worst nightmare: other factors that are getting closer to a turnaround

Since September, geopolitical and financial risks have come to the fore, as global markets, led by the super-hawkish policies of the Federal Reserve, have moved into increasingly uncharted territory. By analysing the latest developments in three local markets, we may be getting closer to the Fed’s turn.

1. The Liquidity Crunch in debt is at March 2020 levels

In early October, the liquidity problem in the U.S. Treasury market entered a new phase: A Bloomberg Measure of treasury liquidity showed that the market had reached levels last seen in March 2020.

In March 2020, when the Treasury market collapsed in Selling climax, the Fed stepped in as a buyer of last resort. And the current level of liquidity may point to the possibility that the Fed is ready to step in — even as it conducts so-called quantitative tightening.

“The Treasury market is the most important securities market in the world and the lifeblood of our nation’s economic security,” said Douphy, vice president of the Federal Reserve Bank of New York. You Can’t just say, ‘we want it to be better, ‘ you have to take action to make it better. “

- Foresight Ventures: Review of meme coin investment rules

- The ATOM 2.0 white paper is about to be released, can the value capture capability of Cosmos be improved?

- How Blockchain Is Impacting Online Poker

The U. S. Treasury Secretary said in an Oct. 11 statement that he sees nothing to worry about in financial markets. He changed his tune a day later, saying, “The lack of liquidity in the treasury market is a concern.”. “

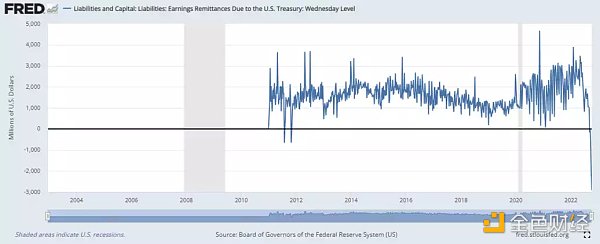

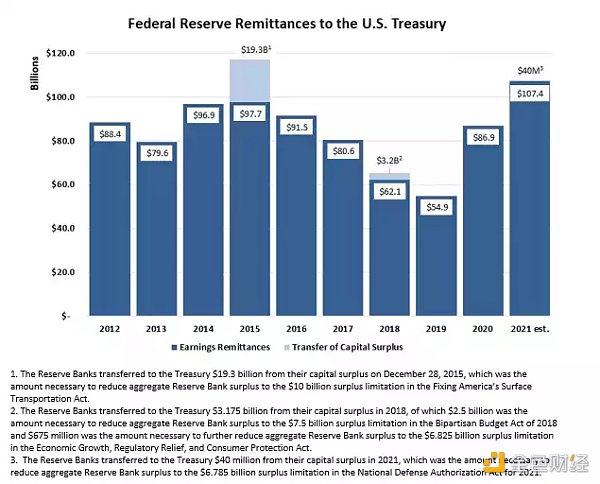

2. The Fed’s yields are turning negative

After several rate hikes, the Fed’s interest payments have exceeded the interest income it generates from its portfolio of bonds held through QE.

Over the past decade, the Fed’s revenues have been roughly $100 billion, all of which have been transferred directly to the Treasury. Some estimates suggest that the deficit this year could be as high as $300bn -L800BN00bn or so last year) because of higher interest rates. At the same time, because of Qt, bond prices plummet, so that the Fed may have to accept a much lower price than the purchase price when it sells bonds, which becomes an unrealized loss (non-cash item) .

The Fed will not go bankrupt and face a huge hole, either it can simply ignore it or it can start printing money again.

In short, higher interest rates will only increase the drain on cash throughout the Fed and treasury. They will soon realize they are completely trapped. They can not tame inflation without effectively bankrupting themselves. Of course central banks don’t go bust-on the contrary, they can turn in a storm of higher interest rates and inflation.

Reyman Time 2.0 is getting closer

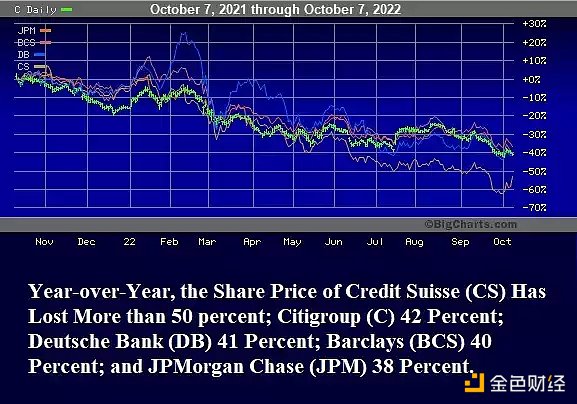

Recently, the market is not calm, Credit Suisse, the British pensions have been in danger.

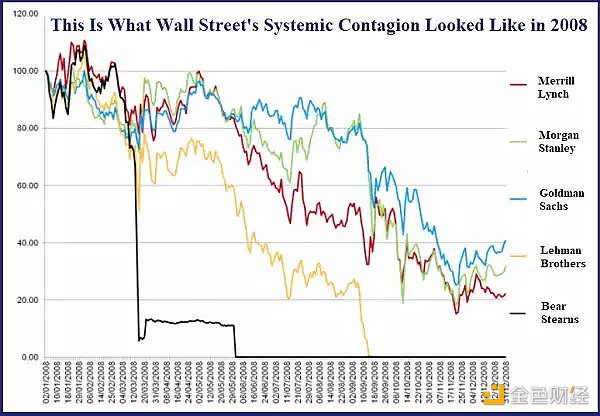

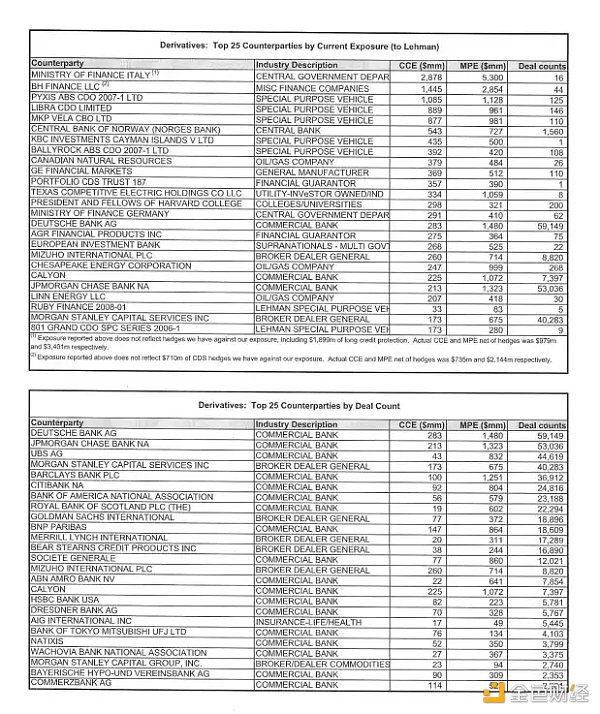

In the 2008 financial crisis, this type of inter-agency risk transmission is similar to the following graph:

So after the 2008 financial crisis, is there any possibility of a new banking crisis?

Ahead of the National Day holiday, several news outlets questioned whether credit suisse heralded another“Lehman moment”. The “Reyman moment” refers to the collapse of the 158-year-old former Wall Street investment bank Reyman brothers on September 15,2008, during the widening financial crisis on Wall Street. Reyman is the only major Wall Street Bank the Fed has allowed to fail.

At the time of Reyman’s collapse, it had more than 900,000 outstanding derivatives contracts and used Wall Street’s largest bank as counterparty to many of those trades, according to the FCIC. According to the data, Reyman has more than 53,000 derivatives contracts with jpmorgan, more than 40,000 with Morgan Stanley, more than 24,000 with Citi, more than 23,000 with Bank of America and nearly 19,000 with Goldman Sachs.

According to the agency’s concluding report on crisis analysis, the financial crisis of 2008 was mainly due to the following reasons:

“OTC derivatives contributed to the crisis in three important ways. First, a derivative, credit default swaps, drove the development of mortgage securitisation. CDS are sold to investors to prevent defaults or declines in the value of mortgage-related securities backed by risky loans. “

“Second, CDS are critical to the creation of synthetic cdos. These synthetic cdos simply bet on the performance of real mortgage-related securities. By allowing multiple bets on the same securities, they amplified the losses from the bursting of the housing bubble and helped spread them throughout the financial system. “

“Finally, when the housing bubble burst and crises ensued, derivatives were at the Centre of the storm. AIG was not required to set aside capital reserves as a buffer against protection from its sales but was bailed out when it failed to meet its obligations. The government ultimately committed more than $180 billion, fearing that AIG’s failure would cause cascading losses across the global financial system. In addition, the existence of millions of derivatives contracts of all kinds between systemically important financial institutions-invisible and unknown in this unregulated market-increases uncertainty and exacerbates panic, help to motivate the government to provide assistance to these institutions. “

In the 15 years since the crisis, have we seen similar systemic risks in the financial system?

In a Sept. 29 working paper, the Office OF Financial Research, an arm OF the Federal Reserve, analyzed who banks are choosing as counterparties in the over the counter (OTC) derivatives market, the authors found that banks were more likely to select higher-risk non-bank counterparties that were already in close contact with other banks and were exposed to other banks, leading to a denser network of connections. In addition, banks do not hedge these risks but increase them by selling rather than buying CDS with these counterparties. Finally, the authors find that, despite increased regulation after the 2008 financial crisis, common counterparty exposures are still associated with systemic risk measures.

Put simply, if a systemically important bank goes wrong, the financial system will have the same systemic ripple effect as it did in 2008.

So does the fed need to turn, as the BOJ and the Bank of England have done?

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Canada Overtakes U.S. in Percentage of Cryptocurrency Investors

- Viewpoint | How will bitcoin prices react when US companies reopen?

- Market analysis: bearish pattern continues, BTC may test $ 5800

- CITIC Securities Research: What are the deep meanings behind the central bank's digital currency acceleration?

- DeFi total market value returns to 1 billion US dollars, new DeFi agreement surges

- Introduction | Reflective Bonds: The New Building Block of Ethereum DeFi Ecology

- Leading the country! Haidian District applies blockchain technology to administrative approval