Foresight Ventures: Review of meme coin investment rules

One: meme opportunity

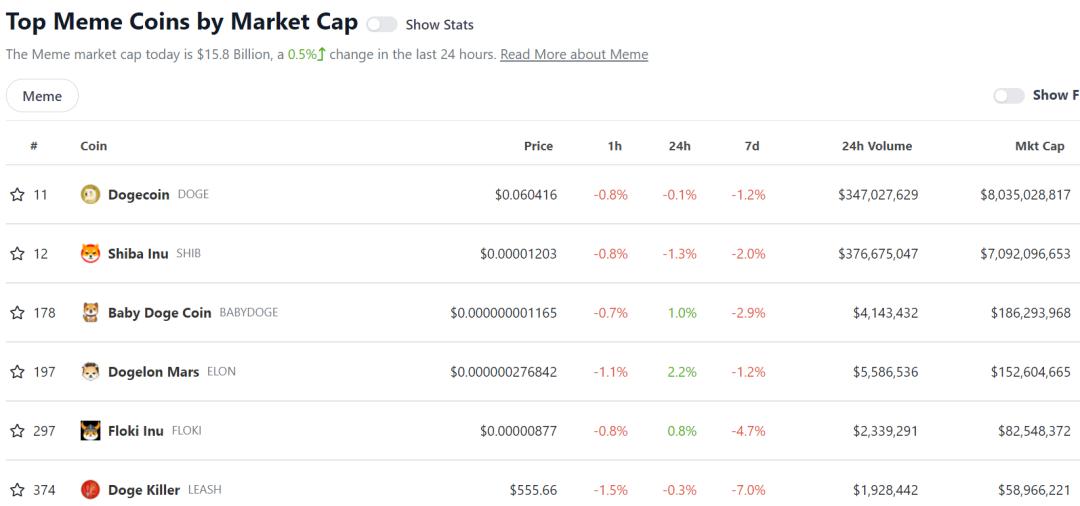

The meme coin concept has become one of the most talked about investment opportunities in the cryptocurrency space. According to CoinGecko statistics, there are about 200-300 projects on the meme currency track, with an overall market value of about $16 billion. Normal projects will have a high probability of 5-20 times the return in the bull market, while DOGE has risen by 400 times and SHIB has risen by 500,000 times, all entering the top 20 of the overall market value. To a certain extent, it can be said that the success of DOGE and SHIB is the realization of the meme culture.

Figure 1: CoinGecko’s meme categories

Two: the hype element of meme

a) Attention:

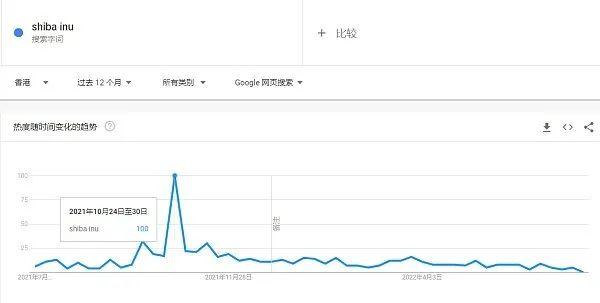

meme is the attention of the whole network. For example, the celebrity effect Musk called a single DOGE; SHIB rubbed against the concept of V God and Musk; LUNC used to be the top 10 blue-chip projects by market value, etc. Virality can trigger the success of meme coins, but the extreme volatility that is influenced by celebrities still means high risk. So, tracking community engagement and measuring market sentiment can help predict price movements. For example, Google Trends is one of the common ways to measure market interest in a topic, and the Twitter Sentiment Indicator helps measure the sentiment of market participants and can sometimes be a leading indicator.

Exhibit 2: Google Search Trends for SHIB

- The ATOM 2.0 white paper is about to be released, can the value capture capability of Cosmos be improved?

- How Blockchain Is Impacting Online Poker

- Canada Overtakes U.S. in Percentage of Cryptocurrency Investors

b) Small market capitalization:

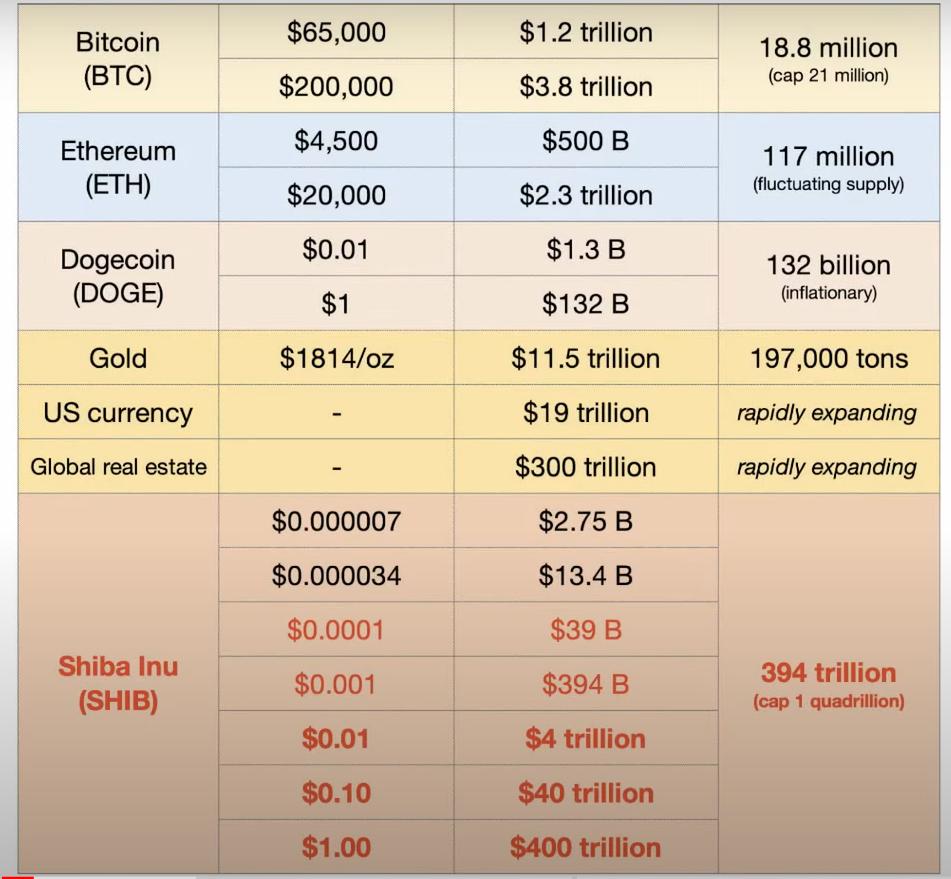

If the market value is too large, it is not easy for trading to skyrocket. Before the hype, the market value of DOGE, SHIB, PEOPLE, or LUNC was very small. The price is extremely low, usually less than $1, and most can be bought for a few cents. For example, the price of SHIB starts at 0.0000000000000000000000000000000000000000000000000001.

c) Narrative consensus value:

The meme currency needs to have a more interesting story in order to convert the attracted players into holders. Most of the narrative culture is made up now, and it doesn’t matter whether it can be implemented or not, as long as the logic is smooth. For example, DOGE’s reward culture; SHIB said to build a defi public chain ecology; PEOPLE said to buy the US Constitution, LUNC took measures to destroy deflation, TSUKA spread the spirit of Tibetan Buddhism, and so on.

d) Exchange KPI driver:

In the operation process of the exchange, a very important idea is to constantly have a wealth effect and create a hot currency. Only in this way can we always attract the attention of the market, attract more users, and create a better reputation. The meme coin has a low success rate and a high value of getting rich. It is the first stop for new leeks to reach the currency circle. Therefore, the exchange will drive the meme emotional hype to form a joint force. For example, SHIB has rapidly increased in the listing effect of Huobi, OKX, Binance, and Coinbase.

Chart 3: SHIB price performance in October 2021

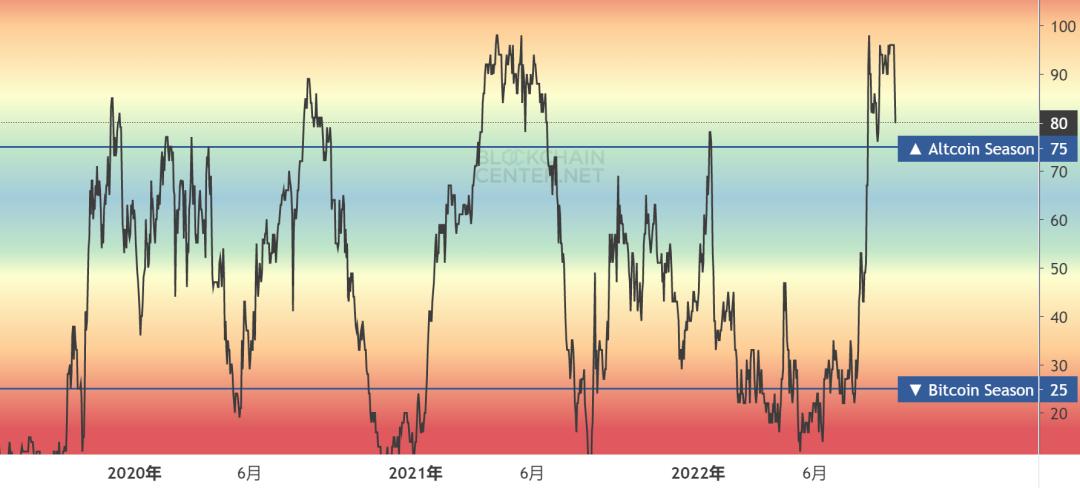

Four: the rotation cycle of meme

The difference in certainty is the reason why the rotation cycle of meme coins is in the middle and late stages of the bull market. We often see such a cyclical pattern: cash → mainstream currency → popular sector → future concept → meme currency → cash. If it is the last bull market cycle, the corresponding investment route is: Cash→BTC/ETH→Defi/L2→Gamefi/Metaverse/NFT→DOGE/SHIB/Animal Coin→Cash.

If you had Buffett’s amount of cash on hand, would you opt for a steady 20% growth, or would you risk losing all your principal and go for 10x? Obviously the former. The choice of big money in a bull market is similar: it all prioritizes certainty. Why divert funds to other currencies when BTC is rising? This is the reason for the BTC blood-sucking phenomenon: the difference in certainty. When BTC does not rise or trade sideways, big funds in the bull market will flow out and choose hot sectors with high growth potential. The reason is that the same benefits can be achieved with less capital, and the risks are relatively controllable. Therefore, when the overall market value of cryptocurrencies rises and the domination rate of BTC declines, it is the critical point for the rise of meme coin owners to take off. Similarly, after the meteoric rise of meme coins, it is difficult for the market to make money for a month or two.

Figure 4: Crypto market sector rotation

Four: meme speculative ideas

meme coins are characterized by high volatility. Up 10 times, then cut in half. 10 times more, and then cut in half. A meme coin that is out of the circle will rise more than 10 times for the first time, and there will be a second surge in 2 weeks to 2 months. Therefore, timing is particularly important for meme coins.

a) Breaking the whole number to buy method:

For the first time, the meme coin breaks through integers such as 1 and 100. Once it stands firm, there will be a 10-20% upside space, so buying at this time is quite a good income safety pad. Jesse Livermore of “Memoirs of a Big Stock Operator” especially likes to buy when the breakout is accelerating. The first time to break the whole number, it is quite safe. If it is not the first time to break an integer, it can be done after more than half a year, but the effect will be weakened. Specifically, if an integer bit has 1, there will be 2, and if it is not 3, it will not be 4. Breaking 1 and 2 can participate, 1 gives the most meat, because breaking through the order of magnitude is the most difficult, so it has the greatest impact. For example, when SHIB goes to 0, and LUNC goes back to Binance to go to 0, the rising effect is very obvious.

Figure 5: De-zeroing effect of SHIB

b) Break the all-time high buy method:

The all-time high is the chip pressure level, and a new high is the strongest trend. Generally, when the price enters the 80% area of the historical high, it will touch the absorption point of the historical high. At this time, it is necessary to closely monitor the market to confirm. Breaking the key position and chasing in, the price is that it may give up the profit in the range before and after the key position. The advantage is that it can completely let go of the retracement risk. This approach looks dangerous, but it is actually relatively safe, because the rapid rise of stocks will have inertia, and the key is to effectively stop losses. In theory, you should only buy hot meme coins that hit new highs, and don’t touch meme coins that have not broken record highs. If you cooperate with heavy trading volume, the investment profit and loss ratio will be very high.

Five: risk solutions

Divide the funds in the field into two parts, the stud meme currency part and the basic operation part. When to use the stud part? When you think you can earn at least 50%. The correct selling position of meme coins is usually after the daily K line has risen by 20% for two consecutive days, or doubled in half, and sold it to earn forever. Soros said that world economic history is a series based on falsehoods and lies. The way to get rich is to recognize the illusion, get into it, and get out of the game before the illusion is known to the public.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Viewpoint | How will bitcoin prices react when US companies reopen?

- Market analysis: bearish pattern continues, BTC may test $ 5800

- CITIC Securities Research: What are the deep meanings behind the central bank's digital currency acceleration?

- DeFi total market value returns to 1 billion US dollars, new DeFi agreement surges

- Introduction | Reflective Bonds: The New Building Block of Ethereum DeFi Ecology

- Leading the country! Haidian District applies blockchain technology to administrative approval

- The first application scenario of the central bank's digital currency is implemented, and the "digital wallet" will be used as a payment channel