The fissure of the world economy – the civil war, the foreign war and the full battle of money

Foreign war

Foreign war

Currency crack between sovereigns

In the previous section, we reviewed the Triffin problem, the trade relationship between China and the United States, and the imbalance between sovereignty in the Eurozone. These issues point to the exchange rate issue, and the end of the exchange rate issue must be a currency war.

The Triffin problem has caused the dollar exchange rate to be naturally affected by the increase in dollar debt. The US dollar exchange rate has become a simple and pure global market risk factor. Generally, we will simply think that non-Americans can bathe in the environment of depreciation of their currencies and benefit from trade (export), but the fact is – When the currency is appreciated, non-US companies can also use the financial (dollar financing) drive to cash in on their own economic growth.

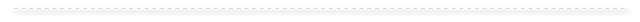

Chart: Exchange rate between the US dollar and the currency of the major trading currency

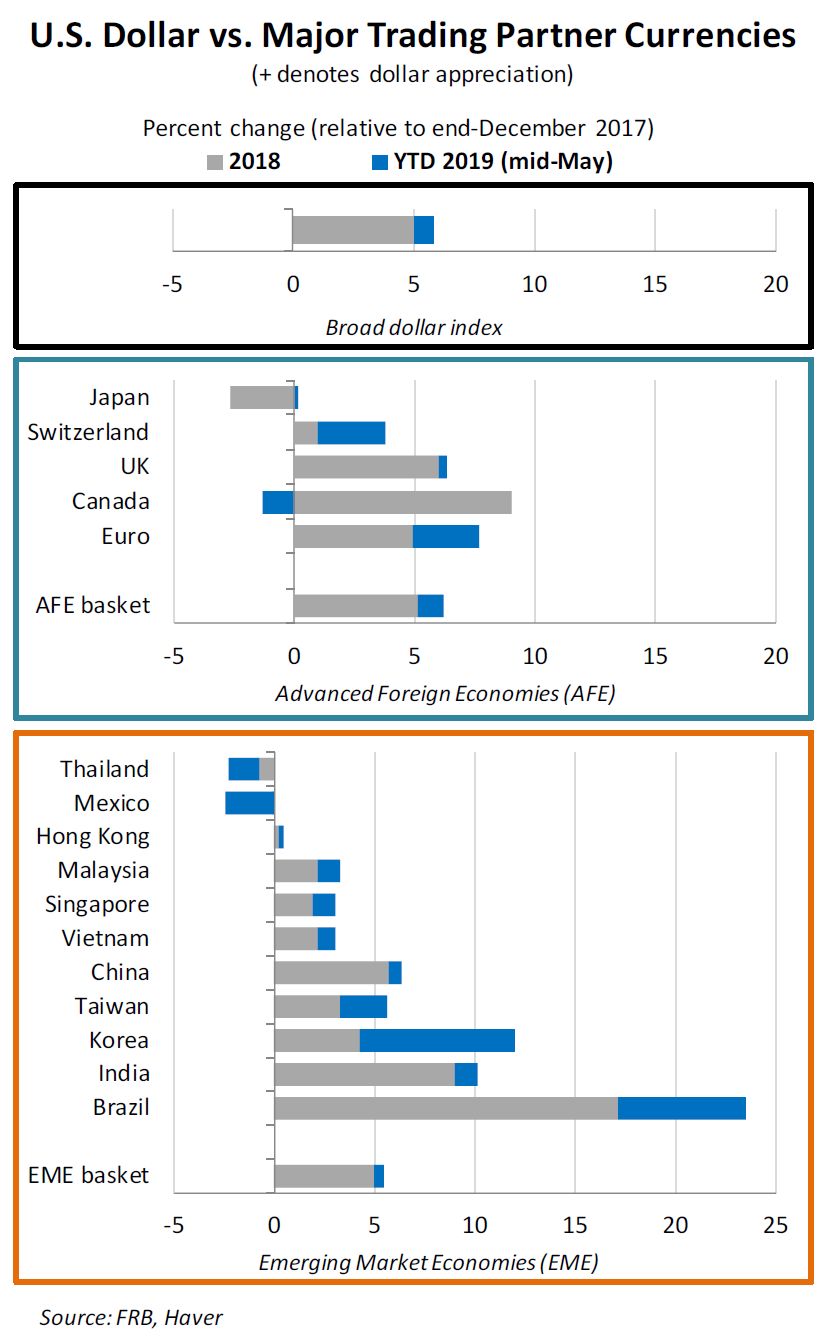

As a typical trade surplus country, China, Germany and Japan have absorbed US dollar income through exchange rate anchoring and domestic trade barriers. The accumulation of surplus while mirroring created the US deficit. The famous "Plaza Agreement" is regarded as the strategy of the United States to counter the surplus countries, but the agreement is to adjust the global surplus/deficit balance directly through the exchange rate, but now the strategy of the United States to counter the surplus countries is through tariff-led adjustments. The premise of effective adjustment is that the exchange rate (anchor) needs to be guaranteed, otherwise it will be invalid under the premise that the surplus country will react against the exchange rate (such as depreciation) .

As a typical trade surplus country, China, Germany and Japan have absorbed US dollar income through exchange rate anchoring and domestic trade barriers. The accumulation of surplus while mirroring created the US deficit. The famous "Plaza Agreement" is regarded as the strategy of the United States to counter the surplus countries, but the agreement is to adjust the global surplus/deficit balance directly through the exchange rate, but now the strategy of the United States to counter the surplus countries is through tariff-led adjustments. The premise of effective adjustment is that the exchange rate (anchor) needs to be guaranteed, otherwise it will be invalid under the premise that the surplus country will react against the exchange rate (such as depreciation) .

- Research | Model currency principle analysis and prevention guide

- Economic Daily | Libra, is the super currency coming? Zhou Xiaochuan said this

- This college student can help you forge the transaction volume, online CoinMarketCap, only 15,000 US dollars

Figure: Global current account imbalance

The internal imbalance in the Eurozone is an example. As the monetary sovereignty of member states is collected into the European Central Bank, peripheral countries cannot balance their national deficits through traditional exchange rate adjustments (including depreciation) – including seizing employment and the government’s fiscal dominance. right. Nobel Prize winner Mundell has asserted before designing the optimal currency zone that if a country does not want to join the optimal currency zone (the euro zone), then the country must hope to maintain a different level of inflation ; hope to use the exchange rate as a "neighborhood" Policy measures to seize employment opportunities from other countries ; hope to use monetary expansion or inflation tax to finance government spending, … but what Mundell did not expect is that these countries used the euro when they used the euro to issue government bonds. Synthetic credit forms a hidden risk sharing. And the debt crisis caused by this part of the debt – in fact, can be regarded as the adjustment cost of depriving the monetary sovereignty of these countries, because the peripheral countries cannot adjust the balance of payments status through the implementation of the independent monetary policy of the central bank, the core countries (Germany) Surplus fanaticism and the staggering deficit of peripheral countries are two sides of the euro, and there is still an exchange rate issue behind it .

The internal imbalance in the Eurozone is an example. As the monetary sovereignty of member states is collected into the European Central Bank, peripheral countries cannot balance their national deficits through traditional exchange rate adjustments (including depreciation) – including seizing employment and the government’s fiscal dominance. right. Nobel Prize winner Mundell has asserted before designing the optimal currency zone that if a country does not want to join the optimal currency zone (the euro zone), then the country must hope to maintain a different level of inflation ; hope to use the exchange rate as a "neighborhood" Policy measures to seize employment opportunities from other countries ; hope to use monetary expansion or inflation tax to finance government spending, … but what Mundell did not expect is that these countries used the euro when they used the euro to issue government bonds. Synthetic credit forms a hidden risk sharing. And the debt crisis caused by this part of the debt – in fact, can be regarded as the adjustment cost of depriving the monetary sovereignty of these countries, because the peripheral countries cannot adjust the balance of payments status through the implementation of the independent monetary policy of the central bank, the core countries (Germany) Surplus fanaticism and the staggering deficit of peripheral countries are two sides of the euro, and there is still an exchange rate issue behind it .

This is why the global imbalance of sovereignty will eventually turn to the cause of the currency war, and it is clear that the situation is moving in this direction .

Most striking is Trump's tweet released earlier this month, accusing Europe and China of playing the game of currency manipulation. It seems that he has found that trading partners that have been hit by tariffs can simply respond through tariff retaliation and exchange rate adjustments.

And the euro zone is not so calm – people may not think that the first country to start a currency war will be Italy. Last year, Italy submitted a budget that was completely inconsistent with the EU's Stability and Growth Pact. It continued to raise its deficit when the debt exceeded the standard (130% GDP, double the standard). The government wants to increase spending to stimulate the economy. . In addition, Italy also said that it wants to issue a special short-term national debt and use it as a “ parallel currency” . Just this month, the Italian parliament unanimously passed a proposal to issue such a “parallel currency”. This short-term national debt is called Mini-BOTs, which has a large amount of fiat currency, nominally debt, but can also be considered as currency.

For the Eurozone and the European Central Bank, this is a very dangerous move. This means that some member states have attempted to circumvent the monetary authorities through the financial sector to circumvent the monetary authorities to relieve their economic and financial problems.

Currency is the most crucial factor in the imbalance between sovereigns in the first dimension. For the euro zone, it seems that only the countries that break through the euro (fixed exchange rate) can be balanced again. If we regard the world as a single dollar with the dollar as the core, the United States can only reach the global exchange rate by anchoring the dollar exchange rate. The goal of implementing a structural rebalancing – does Trump mention in Twitter that the ECB is really just to praise the Dragis sect? Maybe things are not that simple. Ironically, the Eurozone has created a serious imbalance in the monetary zone through a fixed exchange rate, the consistency of interest rates (European Central Bank management) and fiscal austerity (stable and growth conventions), which has led member states to seek to break off the optimal financial means. The currency zone, while the US dominates the global rebalancing strategy is to embrace strategies similar to the optimal currency zone on a global scale – anchoring the dollar exchange rate, requiring allies to cut interest rates (as was done in the 1980s) and even fiscal coercion.

civil war

Civil war

Inter-departmental and intra-departmental currency cracks

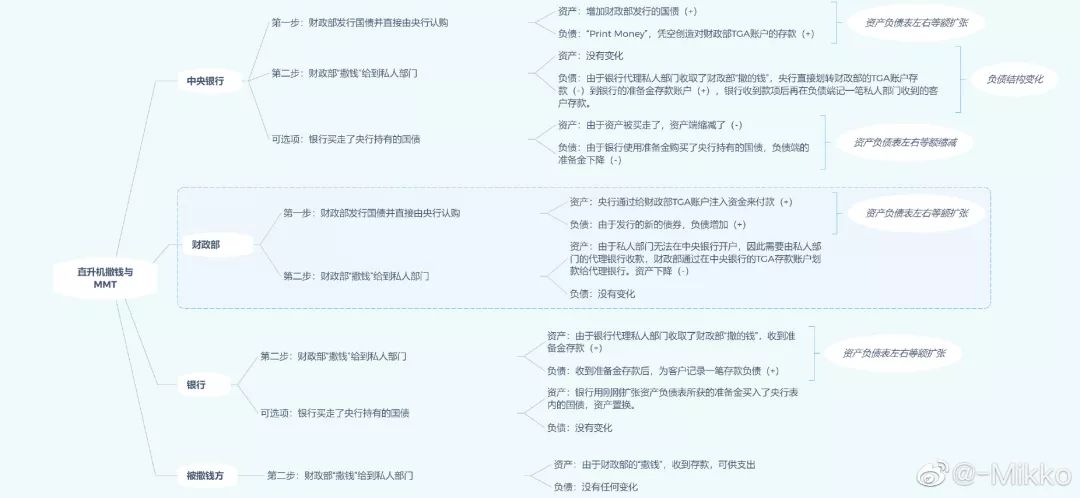

The cross-sectoral imbalance we mentioned in the previous article is based on the “too rich” problem of technology companies. The imbalance within the relevant departments is based on the distribution within the department. In this part, we combine these two imbalances. The reason is simple – for the currency issue, the sovereign sector (the Ministry of Finance and the central bank) and the banking system are inter-departmental, but in the currency perspective, they are trinity (currency, finance and finance). Therefore, it is difficult to demarcate boundaries between departments and departments from a currency perspective.

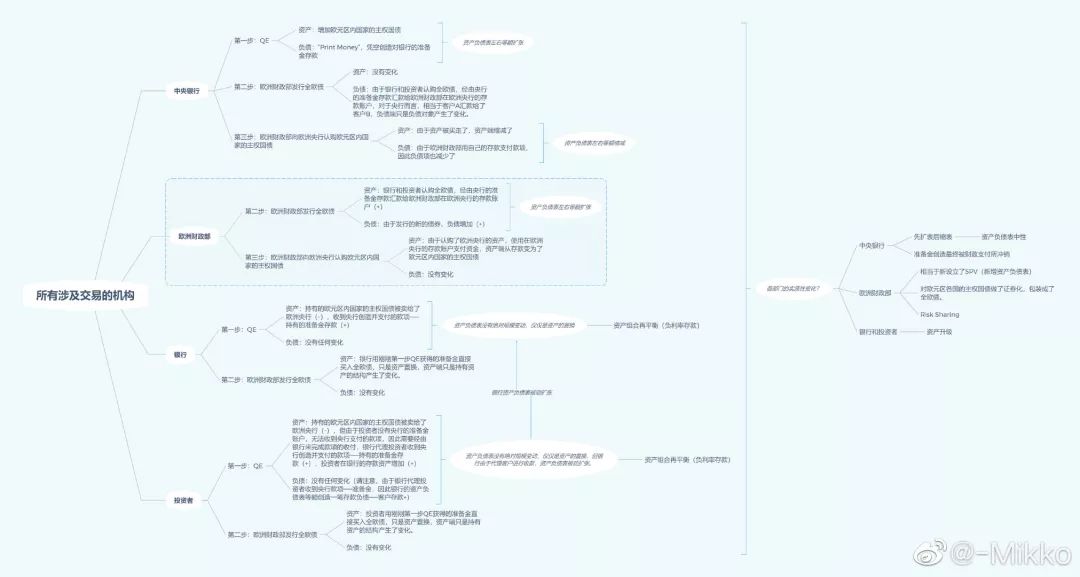

Currency wars not only occur between sovereign states, but also occur within a country at all times. This kind of "civil war" usually has a three-pronged position. The monetary authorities (the Federal Reserve), the fiscal authorities (the US Treasury) and the banking system (JPMorgan Chase) all have the ability to create money directly or indirectly, and these different departments serve different purposes. Governance and business objectives – inflation goals, governance, ROE and shareholder returns, net worth levels, etc.

My pen pal Peter wrote in his paper: In the discussion, people often equate central banking (central bank) with monetary policy (monetary policy enforcement authority). This alternative use makes people directly think that central bank independence is equivalent to monetary policy independence, as if they are logically inseparable.

Perhaps the central bank only has “monetary policy independence” and has never had a truly complete independence.

This paragraph does not expand for obvious reasons

Taking a country as an example, the asset side of the central bank re-expands the claims of the banking system after the external reserve is down, and the banking system is highly tied to the entire local financial and public system. A central government with monetary sovereignty can always afford any expenditures denominated in its own currency (through debt monetization), but local governments cannot (no monetary sovereignty) and therefore face the possibility of bankruptcy . This kind of constraint can be resolved through the binding of the financial sector and the central bank. Local governments only need to bind the financial department's balance sheet, and they can graft their credit risk into the financial sector's table, while the financial sector's assets. The balance sheet is usually considered to be under the escort of the “final lender” of the central bank . In other words, the three are linked together. Fiscal imbalances are absorbed by the financial sector's balance sheet, and the financial sector's balance sheet imbalance is eventually absorbed by the central bank's balance sheet.

The so-called civil war of money, that is, the structural (coordinating) contradiction of the balance sheet. The financial sector's balance sheet space serves political achievements, the financial sector's balance sheet space serves the shareholders' returns, while the central bank is burdened with financial stability . It needs to prevent over-leverage and balance sheet imbalance while supporting monetization . This is why the central bank will always be the target of public criticism. This cross-sectoral rebalancing is almost impossible task – look at the Fed, which is rushing to stop shrinking.

currency

Total war

Total war and great unity

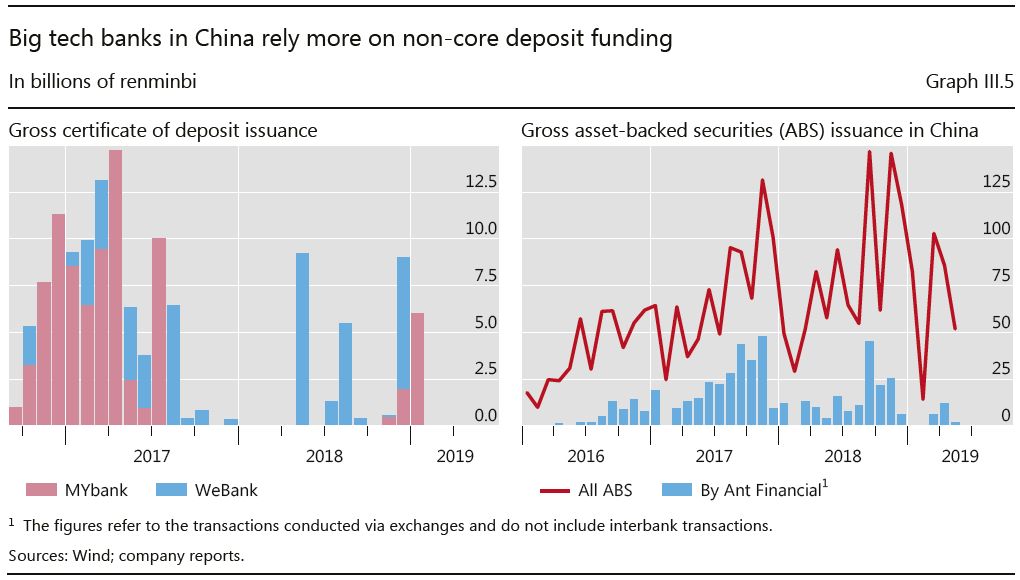

Over time, currency wars have escalated from civil wars and foreign wars to full-scale wars – the all-out war here refers to a melee without borders (super-sovereignty) and involved in all economic sectors, and the initiator of this full-scale war may be It is a highly evolved technology giant. As mentioned in the previous series, the technology giant, as a representative of the comprehensive power of the private sector, has deepened the trinity structure of traditional credit currency in the currency field. They use a variety of legal currencies to link many central banks and banks and hold Various types of risk-free assets include sovereign debt:

Facebook's Libra is the initiator of this full-scale war, although Libra's white paper is very raw. But at least Facebook's move shows that it has a strong interest as a private entity in the business of currency, a public property. Although its design structure is still subordinate to the trinity structure of traditional credit currency, namely the legal currency reserve (central bank credit), bank deposits (bank claims) and government bonds (for government claims), Libra's ambitions and Facebook's ubiquitous tentacles Inevitably, people think about it – just as the Fed built a gold asset and abandoned the gold collateral after the two world wars, does Libra have plans to borrow central bank claims, bank claims, and synthetic credit for government claims on a global scale? Own cross-border currency network, and then look for new collateral to silently replace these three?

Keynes's Bancor is on paper, and the IMF's SDRs are defeated by the US dollar system. It is an almost impossible task for Libra to challenge the existing dollar standard from 0. Perhaps Libra's short-term limit is only Ali. Baba has already completed the task – to establish a payment system . But if you want to embed financial services in currency creation and currency trading, the private sector will face very high barriers to entry, and even the threshold for risk trading is already very high. The poor hearing performance made people disappointed with Libra.

Figure: In the development or shrinking, at a glance…

Although it is very difficult for the private sector to embed the sovereign monetary system through digital money and blockchain gimmicks, due to the cross-sovereign nature of the corporate sector mentioned above, the monetary authorities' attitude towards this issue is quite embarrassing. This is because the concept of super-sovereign currency is anti-dollar system. On the one hand, the sovereign sector does not want the private sector to take away its share of its monetary business: including payments, banking (financial business) and data. It does not want digital currencies to impact domestic exchange rate controls and fiscal sovereignty; but, on the other hand, one is in the world. The dominant super-sovereign digital currency can infiltrate the financial system, payment system and data of other countries, and can also disrupt exchange rate control and fiscal sovereignty of other countries, and even assimilate the tax system. Launching a currency war through the private sector is like a knife killing, and there is no need to guard against it.

Bank of England Governor Carney has already stated that the Bank of England can consider opening its deposit reserve account and RTGS clearing system to enterprises ; the People’s Bank of China has long let payment institutions open equipment payment accounts directly in the central bank, which seems to be The act of strengthening supervision essentially opened the balance sheet of the monetary authority directly to the technology companies, and the payment institution obtained the credit protection of the debt side of the monetary authority while losing interest.

The attitude of the Fed is quite embarrassing, although Powell talked about Libra at the FOMC conference in June and did not express a clear objection. But in the first quarter of this year, the Fed has just refused to give a green light to the innovative narrow banks. Narrow Banks have enjoyed the policy interest rate (ie excess reserve interest rate, IOER) by depositing the absorbed savings funds in the Federal Reserve. In order to attract depositors with interest above the retail deposit rate and 100% reserve. Although narrow banks cannot be equated with digital currencies, the stable currencies in many digital currency worlds today are similar to the reserve structure of narrow banks. Therefore, the attitude of the Fed to narrow banks can be a wake-up call for stable digital currencies. .

The chairman and CEO of the Fed’s TNB (Narrow Bank) was James McAndrews who retired from the New York Reserve not long ago (he worked in the New York Fed for 28 years). In response, the New York Fed filed a refusal motion to the court in early March, and the Federal Reserve Board also issued an announcement on its official website to publicly seek comment on the revision of the rules that would reduce the interest rates on certain deposits deposited with the Fed. This "two-pronged" operation conveys the clear intention of the Fed – want to eat the interest of IOER? There are no doors. At the same time as the narrow-minded bank headed by TNB, the Fed did so, and warned other small banks that have opened a main deposit account in the Fed, and they have to think about the "lei pool" half-step.

Whether it is Libra or a money-related business led by people retiring from the monetary authorities , they will eventually urge people to start thinking about a native problem – why is money a public good? Even public goods, why can't it be provided by the private sector? If so, where are the boundaries of such entities and banking systems?

If you follow the currency we mentioned above is a financial vassal, and the financial subordinate to the administrative context, you will feel extremely fearful…

The final chapter

The truce

Stop the battle

The great economists always hope to resolve the contradictions caused by the currency from the top down and bridge the gap. Earlier there was Sir Kannes's Bancor program, and some recently had the Soros program. And those pragmatic politicians and central bankers have already seen everything. Officials of the European Central Bank have repeatedly mentioned "financial support" this year . They are all very clear that the Eurozone has not even completed the trinity of the monetary system . Apart from the solitary European Central Bank, people (including me) will hardly care about where the banking alliance and fiscal integration are being implemented.

Picture: Soros Project

Although the author is also an idealist, he still fails to construct a new spontaneous order in his own brain, can have the ability to counter the dollar system, and freely link all sovereign countries, economic sectors, and each individual. stand up.

Even if this new order is really formed and replaces the dollar, perhaps I will regret the dollar system.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Carry out the cryptocurrency road to the end! The Japanese government is creating a global cryptocurrency payment network similar to SWIFT

- At the Libra hearing, I found an alternative member of the book about Ben Satoshi and Bitcoin.

- Lost! In this cryptocurrency innovation competition, the United States is too late.

- QKL123 market analysis | Bitcoin dark moments, waiting for the dawn (0718)

- A Preliminary Study of Cryptography: The Art of Hidden Information——The Eleven of the Blockchain Technology

- BTC "blood sucking" is fierce, only 6 coins have won BTC in the past year

- Chief Technology Officer, Bitfury Group: Blockchain accelerates e-commerce and reduces trust costs