Research | Model currency principle analysis and prevention guide

Some people think that all digital currencies are pyramid schemes; some people think that except for Bitcoin, they are all pyramid money; some people think that A-shares are not as good as…

This year's "pattern currency" frequently made the public think that the currency circle is a pyramid scheme. However, a one-size-fits-all argument is always one-sided. This article hopes to jump out of the traditional definition of pyramid schemes, from the history, to interpret the two most common strategies in pyramid schemes – takeover and Ponzi. Let everyone have a more thorough understanding of "model currency" to avoid being deeply covered.

First, the takeover strategy: the price increase game of the middlemen

In traditional economic theory, it is generally assumed that the pricing of goods is the buyer and the seller have the final say. In this hypothesis, vendors compete with each other to provide affordable goods, and customers carefully select their own needs. The trading of goods in reality is not that simple. Before the goods are delivered to the customers, they need to go through a lot of intermediary and dealers to change hands. This also makes the manufacturer's goods in addition to meeting the needs of consumers, but also needs to meet the "transaction needs" of the middlemen, that is, the demand for the next round of middlemen.

- Economic Daily | Libra, is the super currency coming? Zhou Xiaochuan said this

- This college student can help you forge the transaction volume, online CoinMarketCap, only 15,000 US dollars

- Carry out the cryptocurrency road to the end! The Japanese government is creating a global cryptocurrency payment network similar to SWIFT

(Image from the network, invade)

This picking strategy

More appear in the real economy, especially in the consumer goods sector. As the birthplace of MLM, the United States has also divided it into multi-level distribution (MLM: Multilevel Marketing) and Pyramid Schemes (Pyramid Schemes). The latter is actually the extreme performance of the former, and it is easier to form a scam. What is the stability of this strategy? Let's take a look at the following two cases.

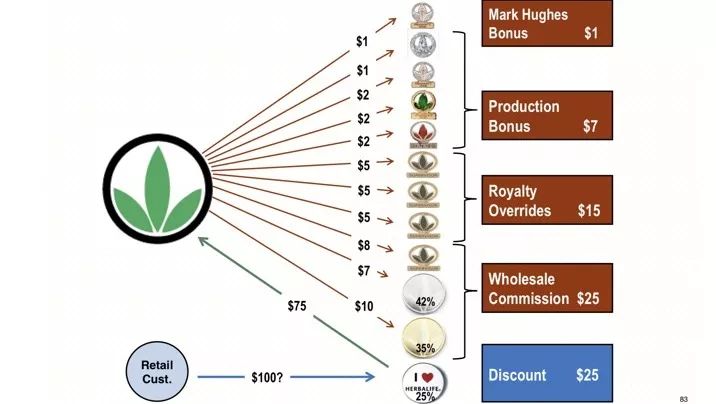

"Unbreakable" Herbalife?

A typical example of a pick-up strategy is Herbalife. In 2012, Ackerman publicly shorted Herbalife. He pointed out that most of Herbalife's products were sold to dealers at a high price through the pick-up mode. It is difficult for dealers to make profits by selling products only. It is necessary to pull more customers to pay for membership or sub-distributors to earn money. Under this vicious circle, the company will be abandoned by investors due to falling growth and fraud, and will go to the final stage of bankruptcy.

Bill Ackman, Who wants to be a Millionaire, 2012

However, after Herbalife accepted the multi-party investigation, the business did not receive much impact. This fully demonstrates how powerful Herbalife is in the take-over mode. In fact, no matter how detailed Ackerman's argument is, if the following two key points cannot be overthrown, then the Herbalife building cannot be destroyed.

First, Herbalife has expanded rapidly through the take-over model, and there is not much “pumping” due to the sale of goods to dealers. Most of the revenue from high product pricing is owned by the company. Dealers can only get a small amount of sales and headcount fees. In the lap, the key to this approach is to control the “dial ratio”, which is the proportion of the project’s share of revenue from marketing incentives to total revenue. Successful consumer goods companies will strictly control this ratio to prevent them from being shackled by channel vendors. Therefore, MLM does not absorb blood, but continuously supplies blood to the company. Second, about 30% of dealers will go bankrupt due to inventory backlogs and losses, but the tragedy of these people can't affect the growth of company performance and moral hazard. This is due to the growth of the company's overseas business expansion. On the other hand, the vast majority of dealers who took the last step were those who did not have the commercial ability, illegal immigration, and wanted to get rich overnight. When the business can't go on, the bankrupt dealers either recognize and leave, acknowledging that their business ability does not work; or they try to defend their rights, but they lack access to rights because of illegal immigration status.

In this way, is the pick-up model in the industry unbreakable? Not always. The next case will tell us that only if the manufacturer is shut down by violence or the industry is hit hard, the project will not be able to continue operations.

Encountering black swan's alcoholic wine

The 2012 liquor plasticizer incident caused a continuous depression in the entire liquor industry. The domestic liquor industry has entered a rapid development channel since 2009. Alcoholic wine is a typical example. Since 2011, the performance of alcoholic liquor has been rising at a rate of 100%. Although it is not a pyramid scheme, its market model is somewhat similar to the pick-up strategy.

Its model is actually to attract dealers to continue to buy liquor through continuous supply to the market in short supply and expectations of rising prices. Due to the increase in income, the dealers also bought a large number of stocks of liquor. Even stock investors are buying wine, which makes the price and sales of liquors bloom, and the stock price is climbing.

(Image from the network, invade)

By the end of 2012, black swan appeared. The quality supervision department detected that the plasticizer in the alcoholic liquor exceeded the standard. After the four pressures of industry, capital, public opinion, and supervision, the entire liquor industry was almost uprooted, and the drum-and-drum game between dealers came to an abrupt end. The alcoholic wines who are known for their radicalness also ushered in bad luck. Although it did not directly close the door like Sanlu, it also suffered from the loss of income and the continued loss of performance. When the industry recovered in 2016, the dealers began to perform again. Taking Moutai as an example, the ex-factory price of the company is currently 969 yuan, but the retail price is close to 2,000 yuan, and the dealers have earned nearly double the income. This is nothing more than one of the announcements of the former chairman of the board of directors being "double-opened": "Dayu is an illegal dealer to facilitate the operation of Moutai, which seriously undermines the marketing environment of Moutai."

The pick-up strategy was born with the trade. It originated from a large number of intermediaries and distributors brought about by transaction demand, prospered in the consumer goods industry and carried forward in the United States, a big country of MLM, and will only end the enforcement measures of external violent organs. The main risk of such manufacturers is that when the industry enters a recession, once the manufacturer loses its sales, it can only go bankrupt. The past antique transactions, futures speculation, the current online postal card, sneaker transactions, the same principle. This is quite different from the Ponzi strategy discussed below.

Second, Ponzi's strategy: paying high interest on schedule

The "Ponzi scheme" was in the early twentieth century when an Italian named Charles Ponzi launched a high-yield wealth management project in the United States. It is actually just a fund game that borrows new and old, and disassembles the east wall to make up the Western Wall.

(Pang's scam ancestor – Charles Ponzi)

Under the Ponzi strategy, the debts and claims of the buyers and sellers are not commodities. So its key is to promise revenue, not price. The seller does not need to manipulate the price, and does not even need to manage the assets. As long as they pay interest on time, they get favorable comments, do large-scale, and prevent the run. Therefore, in the actual transaction, the core requirement of the Ponzi strategy became “pay on schedule”. Doing this well will enable more and more customers to generate trust and invest in the project.

But in fact, "pay on time" will be affected by changes in the true value of the redemption. In order to reduce the pressure on redemption, the project party is more inclined to use various means such as currency depreciation, debt-to-equity swap, etc. when final payment. Due to its natural capital attributes, the Pond's strategy is mostly seen in financial markets.

interest

The key point of the Ponzi scheme is "high-yield", which is "high interest." The earliest record of interest appeared in a relic of Sumer in 2400 BC. The above inscription records: "The leader of Uma should borrow 1 Guru barley from Nanshe and Ninggesu, which will generate interest. 8.64 million guru. The background of this matter is: there are two ancient cities on the plains of Mesopotamia – Lagos and Uma, both of which are hostile. Uma seized a piece of land in Lagosh and occupied the time of two generations. When Lagos defeated the opponent to retake the land, he asked Uma to compensate by "rent" plus interest. Barley with a compensation of 1 unit is compounded for 33 years at a 33% interest rate. Of course, such an astronomical compensation party can of course not be repaid, so in essence this debt became the enslavement of Lagosh to Uma.

It can be seen that the ancients not only used interest rates, but also learned to calculate compound interest and understand the truth of exponential growth. Interests are much earlier than financial management, and financial historians believe that past interest-bearing lending between neighborhoods has encouraged communities to respond to crises. Debt allows borrowers to use future money to meet current demand, smoothing the gaps and cycles of consumption.

Financial management

The combination of financial management and fixed interest returns can be traced back to the invention of bonds and annuities. Historically, creditors and debtors have raised funds for common interests and have paid back interest, such as national wars, local construction of water conservancy, and pensions. In the early days, people only used financial support if they had real needs. However, with the increase of social wealth and the expansion of financial management behavior to civilians, the nature of capitalists and fundraisers has changed. Because the money raised by the fundraising is much faster than the money earned by the project, it is much easier. In pursuit of more revenue, high-risk products were eventually sold to investors who could not afford high risks. After the fundraiser gets the money, in order to attract more people to invest, it is often advertised, such as luxury decoration, buying landmarks.

(After the investigation of the rented treasure, the company headquarters of the Yicheng Group Building demolition)

The collapse of the Ponzi strategy depends on the degree of financial convenience and the relaxed macro environment. The higher the financial convenience and the looseness of funds, the more difficult it is to go wrong. Because with the increase in the size of funds, high-quality investment targets can always be found in a highly financial environment, and a successful investment can always be made, and high-quality assets can easily appreciate in a relaxed environment, and mortgages can be easily used. , refinancing and other tools to delay the pressure. In places with low financial convenience, it is prone to asset shortages, lack of financial instruments, and thus the idling of funds, and the process of ending Ponzi is accelerated.

In general, the Ponzi strategy originated from interest and borrowing, and the prosperity of the general public to participate in high-yield wealth management will only end in the financial crisis and economic crisis. Such institutions are actually not worried about the financial crisis, and even hope to unload the burden through the financial crisis. If they can survive the storm, they can buy cheaper quality assets.

VS Ponzi

The pick-up strategy requires manufacturers and distributors to continuously create new concepts for their products. In addition to meeting people's basic needs, they can further meet people's additional needs such as income increase and identity. The deep binding of interests makes it able to withstand the fluctuations of the economic cycle and survive the industry's winter. The Ponzi strategy, under the credit currency system, allows institutions with strong loans to obtain a large amount of funds, and gives the space and tools for the capital operation of listed companies, which promotes market prosperity and economic operation.

The two were originally major inventions of human development in the commercial society, but the tools were unreasonably used, and even the malicious combination of the two would bring a scam that was destined to end in tragedy.

Third, the model currency: take over + Ponzi

The model currency of the currency circle makes better use of these two strategies. The steps for a typical model currency project are as follows:

Preparation stage: selecting the target, confirming the rules

1. The model currency team controls the currency ABC that has already been on the exchange; 2. The investor manages the money through the wallet app or game app in a fixed-cycle return; 3. The investor pays the mainstream currency such as USDT, ETH, etc. 4. The financial management mode is a fixed-cycle redemption. If a 100-day return is announced, the dividend will be paid to the investor for 1% of the principal currency of the ABC currency for one year; 5. The investor will receive the highest price of the day. The team traded the currency ABC as interest.

Operation stage: promotion, pull

6. The project party will reduce the number of coins that will be distributed every day by continuing to pull the disk; 7. In order to shorten the return cycle, the investor will not sell the currency, and will change the selling pressure to reduce the pressure; 8. The price increase also attracts two Investors and traders in the market provide liquidity; 9. Financial investors will also promote and attract people to ensure that the team has sufficient funds;

Can you invest in model currency?

Reference materials:

"Betting on zero" "Unveiling the Alcoholic Wines to Do the Inside Story: Dealers Selling Wine and Buying Shares"

Millennium Financial History

Author: Wang Runyu

Source: Generation (Public Number)

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- At the Libra hearing, I found an alternative member of the book about Ben Satoshi and Bitcoin.

- Lost! In this cryptocurrency innovation competition, the United States is too late.

- QKL123 market analysis | Bitcoin dark moments, waiting for the dawn (0718)

- A Preliminary Study of Cryptography: The Art of Hidden Information——The Eleven of the Blockchain Technology

- BTC "blood sucking" is fierce, only 6 coins have won BTC in the past year

- Chief Technology Officer, Bitfury Group: Blockchain accelerates e-commerce and reduces trust costs

- Is the libra hearing really good? However, the rebound has not broken