CITIC Construction Investment Securities: Bitcoin and "Blockchain + Gold" Possibility

Source of this article: CITIC Securities Research

Author: CBM Comprehensive Utilization Qin source

Summary

Bitcoin and blockchain twins

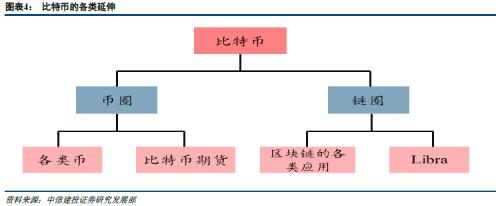

Since the release of the Bitcoin white paper in November 2008 and the creation of the genesis block in January 2009, Bitcoin and the blockchain have risen rapidly in just over 10 years, becoming a new thing with global influence. Not only are the "currency circle" and "chain circle" growing savagely, but also related concepts such as fintech and digital assets are rapidly rising. In particular, Facebook's plan to launch the Libra project is a sign of mainstream institutions' intention to make them bigger and stronger.

- What if I don't want to sell coins? Finnish government forced to become hodler stumped by 1666 bitcoins

- Legal Watch | Blockchain Governance: Embracing the Chain of Law and Strictly Controlling the Risk of Coins

- It took two years! Mysterious miner rolls away 9,000 BCHs misplaced in Segregated Witness address

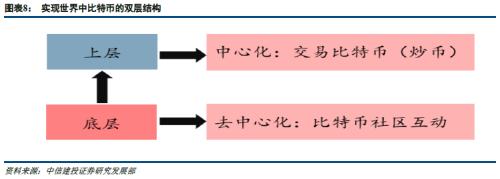

Bitcoin's double-layer structure in the real world

Bitcoin is a system based on a distributed database that can implement electronic payments without a centralized third party, integrating payment settlement and valuation. But from a real-world perspective, this is just the bottom of the Bitcoin ecosystem. For the general public, the speculation on the centralized trading website is the upper layer of the Bitcoin ecosystem. Bottom mining and upper layer speculation result in the fact that bitcoin is both a currency and an asset. The liquidity of the bottom layer and the upper layer results in the liquidity of bitcoin being significantly larger than that of general assets, which further aggravates the price volatility of bitcoin .

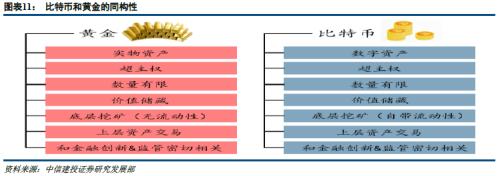

Gold and Bitcoin are highly isomorphic

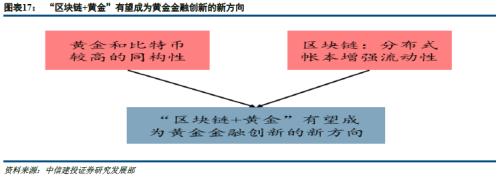

Both gold and bitcoin are value stores, super-sovereign assets, with a limited number, and they are also two-tiered structures with lower-level mining and upper-level trading assets, and both are closely related to financial development supervision. The high degree of isomorphism and blockchain will enhance liquidity determines a potential direction of combining with blockchain or gold financial innovation .

"Blockchain + Gold" should highlight the asset attributes of gold rather than create new coins

It is difficult to return to the gold standard, endorsement of physical gold, a large market size, a large number of investors, a high degree of linkage with other markets, and the existence of financial supervision have determined that the "blockchain + gold" assets are difficult to reproduce the crazy speculation.

"Blockchain + Gold" Architecture Assumption

Here we try to put forward two ideas of "upper alliance chain + lower public-private mixed chain" and Libra as a teacher. The former is largely a mapping of the existing gold market based on the blockchain.

"Blockchain + Gold" can serve as an experimental field for financial supervision sandbox

Compared with the grass-roots nature of the "currency circle" and "chain circle", institutional participants in the gold market are basically licensed institutions under traditional financial supervision, giving them a certain degree of innovation freedom in the "blockchain + gold" field. It is conducive to traditional financial institutions to explore financial innovation in blockchain, and it is helpful for regulators and ordinary people to improve their understanding of "currency circle" and "chain circle" through "blockchain + gold".

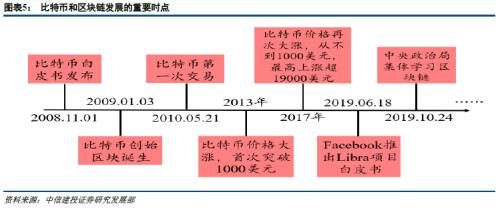

"Bitcoin" and "blockchain" twinned

On November 1, 2008, a self-proclaimed Satoshi Nakamoto released a Bitcoin white paper "Bitcoin: A Peer-to-Peer Electronic Cash System" on the P2P foundation website. On January 3, 2009, the Bitcoin Genesis Block was born. Since then, Bitcoin has entered human society. As the underlying technology of Bitcoin, "blockchain" technology has also entered human society. In a sense, Bitcoin and blockchain can be considered as twin brothers.

As a new thing, Bitcoin has experienced an early dormant period after its birth, staying at the level of fans and enthusiasts . On May 21, 2010, a programmer spent 10,000 bitcoins for two $ 25 great John pizzas. This is Bitcoin's first recorded payment transaction. Following this transaction, Bitcoin was initially trading at $ 0.0025. But after that, Bitcoin started a skyrocketing price journey.

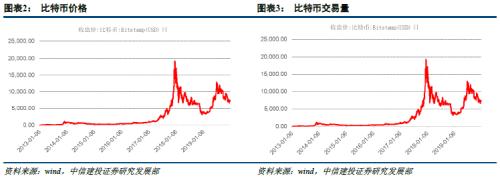

On July 15, 2010, Bitcoin was traded on the Bitcoin exchange Mt.Gox for the first time at a price of approximately $ 0.05. On February 9, 2011, the price of Bitcoin exceeded $ 1 for the first time. On June 2, 2011, the price exceeded $ 10 for the first time. On April 1, 2013, the price exceeded US $ 100 for the first time; on November 28, 2013, it exceeded US $ 1,000; on January 2 , 2017 , it exceeded US $ 1,000 again ; on May 20 , 2017 , it exceeded US $ 2,000 ; after that, Bitcoin The price soared, and by December 16 , 2017 , Bitcoin had hit its highest price ever, at $ 19,187.78 . A correction occurred afterwards. On December 15, 2018, it closed at US $ 3,179.54, the lowest point after the correction. Bitcoin prices have rebounded since then. On January 1, 2020, the price of bitcoin closed at $ 7,178.68.

From the first transaction on May 21, 2010 to the highest price of $ 19,187.78 on December 16, 2017, the price of Bitcoin has soared by more than 760,000 times in 7 years and 7 months. The back of this huge increase is the violent impact and subtle influence of Bitcoin on human society. The "coin circle" and "chain circle" have been derived around Bitcoin and blockchain. Vocabulary such as "cryptocurrency", "digital currency", "mining", "computing power" and "coin speculation" have also become popular words and hot topics.

Any new thing that is born, forms influence, and eventually integrates into the mainstream will be accompanied by esteem and doubt; it may be an effective solution to existing pain points, or it may be just an unconstructed destruction. The characteristics of Bitcoin and blockchain with strong infrastructure attributes and the attributes of reconstructing production relations determine that both are even more so. For example, referring to the stock IPO, various ICOs (tokens) derived from bitcoin and blockchain were defined as "the announcement on the prevention of financing risks of token issuance" by 7 ministries including the central bank on September 4, 2017, as " It is essentially an unlawful and illegal public financing and must be stopped immediately. "

However, the potential of Bitcoin as a digital asset and the application of blockchain technology in various scenarios has gained more and more recognition .

At the level of digital assets, Bitcoin is called "digital gold" because it is similar to gold in many ways. Federal Reserve Chairman Powell said in a Congressional hearing on July 11, 2019, "Few people pay with bitcoin, and they use it instead of gold. This is a store of value; it is a speculative value The storage method is like gold. "In September 2015, the US Commodity Futures Commission (CFTC) will for the first time reasonably define Bitcoin and other virtual currencies as commodities in official documents. This means that financial derivatives of bitcoin and other virtual currencies need to receive the same regulation as commodity derivatives.

From digital assets to financial innovation, on December 11, 2017, CBOE launched the Bitcoin Futures Contract (XBT) (on March 7, 2019, CBOE announced that it would not renew XBT contracts, and all XBT contracts were delisted at the end of June); 2017 On December 19, 2014, CME also launched the Bitcoin Futures Contract (BTC). There are also rumors of a Bitcoin ETF.

At the application scene level of the blockchain, all kinds of attempts are endless. Blockchain has become a must-have topic for Fintech . According to the definition of the Financial Stability Board (FSB), "Financial technology mainly refers to emerging business models driven by emerging frontier technologies such as big data, blockchain, cloud computing, and artificial intelligence, which have a significant impact on the financial market and the provision of financial services. , New technology applications, new products and services. "Blockchain technology is the underlying underlying technology of fintech.

On June 18, 2019, Facebook launched the Libra project white paper, which is another major event in the history of blockchain development. As a cryptocurrency project, its great significance lies in the identity of the promoter Facebook. Facebook is recognized as a global Internet giant, with more than 2.4 billion users worldwide. Its market value on January 22, 2020 exceeded 630 billion U.S. dollars, and its technological innovation capabilities are among the best in the world. Compared with Facebook, the size and influence of participants in the currency and chain circles were much smaller. The launch of the Libra white paper marks the first global Internet giant to vigorously promote encrypted digital currency projects and blockchain applications .

On October 24, 2019, the Central Political Bureau conducted a collective study on the current status and trends of blockchain development, pointing out that the application of blockchain technology has been extended to digital finance, the Internet of Things, intelligent manufacturing, supply chain management, and digital asset trading. field. To promote the deep integration of the blockchain and the real economy, it is necessary to guide and regulate the development of blockchain technology, attach importance to the security guarantee of the blockchain, and promote "blockchain + all walks of life".

Whether it is the collective learning of the Central Political Bureau on the blockchain, or Facebook pushing Libra , these iconic events will greatly promote the application of Bitcoin and blockchain from the previous niche to the public, and never understand "Frying coins" turned to real applications .

"Blockchain" is expected to become a carrier of a new round of financial innovation in gold

Bitcoin's double-layer structure in the real world

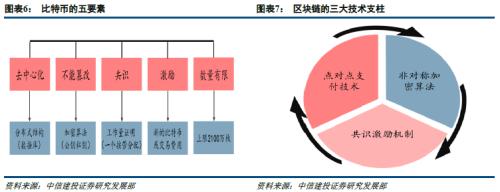

The original intention of Satoshi Nakamoto to create Bitcoin was to introduce an electronic payment system that does not require credit intermediation and prevents double payments . To realize this ideal, Satoshi Nakamoto created an open autonomous community similar to utopia. The absence of a credit intermediary means decentralization and past payment results cannot be tampered with . And maintaining autonomous communities without a center requires consensus and incentives .

Decentralization is both the goal and premise of the Bitcoin community. This premise is based on the existence of a common ledger for each node in the community. The storage of each node is an equal institutional arrangement, but the common and unique ledger is also the center of this community to some extent. The goal lies in its original intention, that is, no central node is required to realize payment or bookkeeping. But the price of this decentralized node is to involve the entire community. The mapping of the Bitcoin community on data is a distributed ledger or a distributed database.

In order to prevent tampering and anonymization, Bitcoin has arranged public and private keys, and encrypted them with an encryption algorithm. The encryption algorithm is a technical guarantee to ensure that it cannot be tampered with and anonymized. For some time in 2019, the concept of "quantum computing" is relatively hot. The theoretical quantum computing power is powerful. Bitcoin's existing encryption algorithms may be deciphered, thereby technically overcoming Bitcoin's immutable modification. Of course, quantum computing is still in the early stages of development.

If the distributed database and encryption technology are the body of Bitcoin, the consensus and incentive mechanism is its blood system . Bitcoin's consensus mechanism is the right to confirm transaction records. The so-called mining to achieve a random number that meets the requirements and the value of 0 is a proof of work. Bitcoin's workload proves that it is a distribution according to work based on the contribution of computing power in terms of large number probability. Proof-of-work is a contribution to the community and needs to be motivated. Bitcoin's incentives are new Bitcoin or transaction fees paid by both parties to the transaction.

Currently, the Bitcoin community generates 12.5 Bitcoins every 10 minutes as a reward for proof of work, and the number of rewards is halved every 4 years. In May 2020, the third award will be halved. In theory, the total number of Bitcoins is 21 million, and as of October 19, 2019, 18 million have been mined.

The entire system of Bitcoin, in theory, has an upper limit, and the founder Satoshi Nakamoto's evaporation from the world has given Bitcoin a mystery and attracted a large number of fans. In the eyes of fans, Bitcoin is a totem and an ideal country. But from a public perspective, this is just the bottom layer of Bitcoin . Bitcoin's success since its birth is largely due to financial innovations at the bottom: centralized trading Bitcoin, the so-called speculation on various trading platforms . Each trading platform is the center of trading Bitcoin. Therefore, in the real world, Bitcoin is far from being decentralized.

In the real world, this double-layer structure of Bitcoin gives Bitcoin dual liquidity . The bottom liquidity lies in the interaction of the blockchain community itself, and the upper liquidity lies in the various investments and speculations of Bitcoin as an asset. The bottom liquidity creates assets for the upper liquidity, such as mining to mine new bitcoins; the upper liquidity digests and absorbs the assets created by the bottom liquidity, such as the more bitcoins are needed for the speculative speculation, the higher the bitcoin price Will fuel the underlying interaction. Dual liquidity has a liquidity amplification effect, which naturally enhances the speculative nature of Bitcoin .

At present, the regulation of Bitcoin and blockchain is still in the exploratory period from a global perspective. There are still many variables in how it will evolve in the future, but we believe that an important focus of regulation lies in this two-tier liquidity.

Blockchain: a technology platform that supports the completion of complete contracts

The Bitcoin-associated blockchain is a technology platform that is based on a distributed database and is supported by three major elements: peer-to-peer payment technology, asymmetric encryption algorithms, and consensus incentive mechanisms. As far as the blockchain technology itself is concerned, this technology platform is to achieve the completion of a complete contract. This complete contract for Bitcoin is to implement an electronic payment function in all participants that does not require a credit intermediary and can prevent double payments.

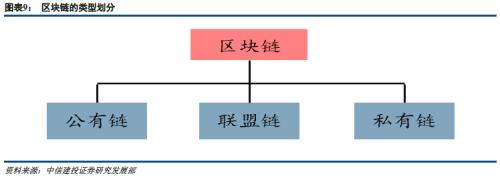

However, Bitcoin's blockchain application scenarios are limited, and all nodes will be involved, which will also lead to excessive system interaction, slow response speed, and low practicability. In order to improve the performance of the blockchain, increase its practicality, and apply it to more application scenarios, the blockchain is further subdivided into public, alliance, and private chains.

We believe that the core difference between public chain, alliance chain and private chain is the consensus incentive mechanism on the chain . Different consensus incentive mechanisms determine whether the chain needs decentralization and its degree, whether it can absorb the existing members of the new members, whether they can withdraw, and the content and scope of information sharing. These determine the efficiency of the chain itself.

The public chain operates based on consensus and incentive rules among all members. Generally speaking, the consensus of all members requires high degree of decentralization and openness of the chain, and low efficiency. Bitcoin is a typical representative of the public chain. Regarding the public chain, there is a saying worth paying attention to, that is, if the public chain is to run effectively, it must issue coins.

The alliance chain operates based on the consensus and incentive rules between alliance members. Compared with all members of the public chain, the number of alliance members is much smaller. If the size and weight of a single member is large, its openness will be lower, but the requirements for information sharing between members may be high and the efficiency is high. The Hyperledger project launched by the Linux Foundation in December 2015 is a typical alliance chain.

Private chains operate based on consensus and incentive rules within the organization. Organization is the product of centralization, and there is usually consensus and incentives in the original. Therefore, private chains are more on-chain with the original consensus and incentives within the organization. Top-down commands are the main means of communication within an organization, and they require high efficiency. Legend has it that the central bank digital currency will take the form of a private chain, that is, the central bank formulates rules to be the central node, and other members act in accordance with the rules.

Isomorphism of Bitcoin and Gold

Bitcoin and gold are often used for comparison. There are differences, but they are more similar and isomorphic.

Gold is a product of nature and a metallic substance; Bitcoin is a product of human creation and a string of numbers in a virtual space. From this point of view, there is a significant difference between gold and bitcoin, but the form of gold, gold coins, gold bars, gold bricks, and their purity have been highly standardized by humans. Financial assets such as paper gold, gold futures, and gold ETFs were created by humans.

Both gold and bitcoin have super-sovereign qualities and are naturally global. The super-sovereign nature determines that the regulation of them requires global regulatory coordination. Both are also value stores, which do not change with time and space, and the total amount is also limited. Gold is a recognized value store that connects billions of people worldwide. Bitcoin is the most fundamental connection within its community.

Both gold and bitcoin are limited in quantity. Thanks to Satoshi Nakamoto for this isomorphism. The limited amount of gold comes from nature itself, and the amount of gold elements on the earth is limited. At present, about 170,000 tons of gold have been mined globally. In recent years, the annual output of mineral gold has been about 3,500 tons. The limited number of Bitcoins comes from the fact that Satoshi Nakamoto limited the number of Bitcoins to 21 million at the time of creation. However, we also need to observe the impact of hard forks on the limited number of Bitcoins. In theory, a hard fork is to split a bitcoin, and it does not affect the total number of bitcoins.

In the previous section, we summarized the bitcoin of the real world into a double-layer structure, and gold also has this double-layer structure. At the bottom, bitcoin is "mining" to mine new bitcoin, and gold is mining to produce new gold. At the upper level, Bitcoin is used as an asset transaction in the core trading platform; gold is used for asset transactions through the financial system. However, there is still a fundamental difference between Bitcoin's "mining" and gold mining. Bitcoin "mining" itself is a kind of liquidity creation; while gold mining is only production and does not create liquidity. However, from the perspective of mining costs, both are on the rise.

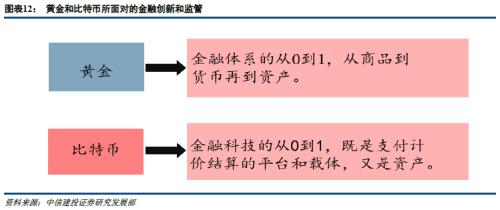

Financial innovation and regulation are a main line that runs through the history of gold. Financial innovation and supervision basically determine the basic attributes of gold to society. In the early days, with the demand for general equivalents by commodity exchanges, gold stood out as a currency with its good quality, and provided a certain degree of credit enhancement for the early financial development of mankind. The currency's "gold standard" system arrangement pushed gold to its peak. Later, with the continuous improvement of the sovereign governance capacity of the sovereign state, the credit creation ability of the financial system has been greatly improved, and the stability has become stronger. Arrangements to replace the "gold standard" made gold's currency attributes fade and became a class of assets.

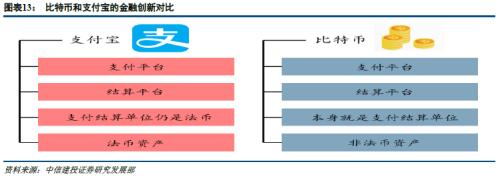

The birth of Bitcoin in late 2008 and early 2009 was the time when the global financial crisis was raging. Excessive financial innovation and loose financial supervision were an important cause of the 2008 financial crisis. Bitcoin itself may be the embodiment of the ideal financial system in the eyes of Satoshi Nakamoto. Bitcoin is essentially an innovative combination of "technology + finance". As a nascent thing, Bitcoin has caused a lot of regulatory attention, but the regulation itself is still less. But whether it is Bitcoin itself or bitcoin in the real world, it contains very advanced financial innovations. Compared to Alipay's platform innovation of pure payment settlement, Bitcoin is not only a payment settlement platform, but also directly plays the role of a valuation settlement currency. At the same time, Bitcoin's asset properties have also been amplified by various Bitcoin trading platforms.

If we say that the process of gold from commodities to currency to assets is an important part of the modern financial system from 0 to 1. Although Bitcoin has not experienced this from 0 to 1, but Bitcoin itself as the origin of fintech and the trend of fintech as the future financial system infrastructure means that financial innovation and supervision of bitcoin, blockchain and related derivatives Will be an important part of the fintech process from 0 to 1 .

Blockchain may become a new carrier of gold financial innovation

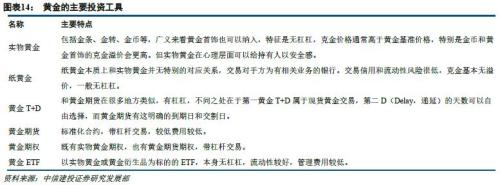

After the collapse of the gold standard, gold, as an asset, began various financial innovations to meet the needs of investors. Especially in the context of inflation, the depreciation of the US dollar and the bull market of commodities, its financial innovation tends to climax. There is often a positive feedback relationship between financial innovation and the price of gold. Rising gold prices stimulate financial innovation in gold, and financial innovation often stimulates the rise in gold prices once they are implemented .

The financial innovation of gold has basically evolved along the direction of improving liquidity. Compared with physical gold, paper gold, through virtualization and credit innovation, acts as a counterparty to banks to lower the gold investment threshold and improve gold liquidity. Gold T + D, gold futures, and gold options are under the promotion of centralized exchanges to innovate derivatives. By introducing a margin trading system, gold liquidity has been greatly improved. Gold ETFs are used to enhance gold liquidity through securitization.

In March 2003, the world's first gold ETF, Gold Bullion Securities (originally initiated by the World Gold Council and HSBC's US branch as the gold custodian), was listed on the Australian Securities Exchange. In November 2004, by far the most successful gold ETF, SPDR: Gold ETF was listed.

From the point of view that gold and Bitcoin have many aspects of isomorphism, and that the distributed ledger of the blockchain will enhance liquidity, "blockchain + gold" may be a potential direction for future gold financial innovation. This potential possible innovation, on the one hand, can allow gold to ride on the fintech innovation vehicle, and on the other hand, it can also enrich the application scenarios of the blockchain.

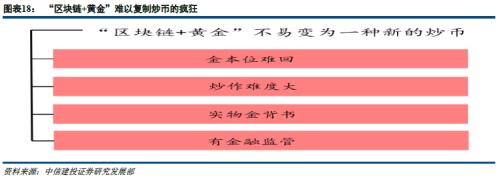

"Blockchain + Gold" should highlight the asset attributes of gold rather than create a new coin

"Cryptocurrency" is almost the first impression of the public on Bitcoin and blockchain. If the "Blockchain + Gold" project is launched, will it also become a new type of speculation? We believe that "blockchain + gold" should highlight the asset attributes of gold rather than create a new coin. This requires guidance at the level of financial supervision, adheres to credit endorsement with physical gold or derivatives, and it is easy to lead to asset attributes because of the characteristics of the gold market itself, rather than speculation.

Of course, we must also see that gold, as an asset, is also the object of speculation, and it will also experience periodic ups and downs. For the gold market, "blockchain + gold" is both a financial innovation that enhances liquidity, and combining it with the blockchain will also enhance its liquidity. Theoretically, it is possible to amplify the volatility of gold. However, from the historical performance point of view, the volatility of gold in the commodity market is low.

"Gold Standard" is difficult to return

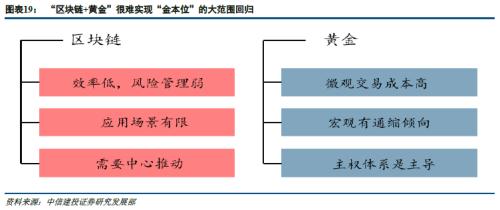

Gold is a natural store of value and has historically played the role of currency. Marx said that "money is not gold by nature, but gold is money by nature." Will "blockchain + gold" return the "gold standard"? We feel that a large-scale return of the "gold standard" is almost impossible. This is related to both blockchain and gold.

Whether the blockchain is a public, alliance or private chain, as long as it pursues some form of decentralization, it means sacrificing efficiency. Whether it is a public sector government or a private sector company, it is a centralized production capacity. In addition to the pursuit of efficiency, this centralization has the function of redistributing risks. The disadvantages of blockchain in terms of efficiency and risk management lead to its application scope. Limit . The high probability of the impact of blockchain on the social structure is to follow the Internet, greatly increase the level of interconnection of the whole society, add a large number of connections, and further strengthen the flattening trend of the whole society, but the centralized nodes will still exist in large numbers and play a key Sexual role. And as far as specific blockchain projects are concerned, the central node is also the main promoter of promoting these projects.

Gold, as a super-sovereign asset, has physical credit endorsement, but physical gold is directly used as currency, and the transaction cost at the micro level is very high. At a macro level, gold, as a currency, does not have a strong central bank and financial support. It will have a natural tendency to deflate during times of crisis, which is not conducive to the sustainable and healthy development of the economy. The sovereign governance model is the global dominant governance model. As long as the dominant status of the sovereign governance model remains unchanged, the fiat currencies issued by sovereign countries will not be subverted by gold.

These attributes of blockchain and gold make it impossible for them to achieve high-efficiency currency coverage in all scenarios like fiat currency even if "blockchain + gold" appears.

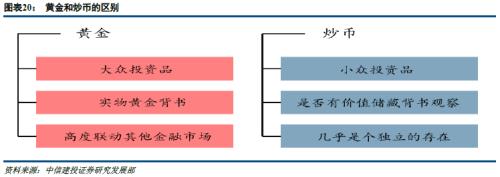

Difficult to hype

The madness of speculation is difficult to reproduce in the gold market. Except for Bitcoin, there are big doubts as to the value of the speculation currency. As long as gold investment products are linked to physical gold or gold derivatives, there will be gold endorsements. The gold market is a mass market, and speculation is a niche market. The market size of gold is large, with many investors and many types of investors.

The size of the gold stock market is 170,000 tons, and about 3,500 tons of new gold are added each year. Based on the value of one ton of gold of 50 million US dollars, the market size of physical gold alone is 8.5 trillion US dollars, an increase of 175 billion US dollars. If you consider the size of the gold derivatives market, it will be even larger. Bitcoin is calculated at USD 20,000 per bitcoin, and the market capacity is only USD 420 billion.

There are many gold investors. If gold jewelry is also regarded as an investment, the number of gold investors worldwide will be in the hundreds of millions. As for the types of investors, in addition to the widespread individual investors, there are a large number of institutional investors in the gold market. There are both financial institutional investors and industrial investors upstream and downstream in the gold industry chain.

The natural connectivity of gold leads to arbitrage opportunities between different gold markets. As a category of large-scale assets, gold and bond markets, foreign exchange markets and even stock markets are highly linked.

Have financial supervision

Different from the grassroots of the currency circle, the gold market as a mature market has complete financial supervision.

Take China as an example. In April 1950, the People's Bank of China formulated the "Gold and Silver Management Measures" (draft), freezing private gold and silver trading, and clearly stipulating that domestic gold and silver trading is uniformly managed and managed by the People's Bank of China. In June 1983, the "Government Regulations of the People's Republic of China on Gold and Silver" was promulgated, clearly stipulating "the state's policy of unified management of gold and silver, unified purchase and allocation". In April 2001, the People's Bank of China announced the abolition of the planned management system for the unified purchase and allocation of gold and the establishment of a gold exchange. In October 2002, the Shanghai Gold Exchange officially opened. The Shanghai Futures Exchange launched gold futures in 2008. In 2010, the People's Bank of China and other ministries and commissions issued "Several Opinions on Promoting the Development of the Gold Market" (Yinfa [2010] No. 211).

"Blockchain + Gold" technology realization: "Union + public-private" mixed chain or Libra as a teacher

In this section, we try to explain the technical implementation of "blockchain + gold". This part of the content is very exploratory, and our explanation is only a very basic discussion.

Through the compilation of public information, we found that both DGX coins and Tether Gold coins are "blockchain + gold" projects. The earliest news of the Tether Gold project was reported on January 24, 2020. It is not clear whether it has been launched now. Regardless of the specifics of DGX coins and Tether Gold coins, both are items in the "currency circle" category. We do not discuss them too much here, or explain our ideas in accordance with the previous ideas.

There are two ideas for specific technology implementation. One is the "upper alliance chain + lower public and private chain" model. The other is based on Libra's model. In terms of promotion, you can start by selling physical gold and let ordinary investors hold investment gold assets through the blockchain. From the perspective of future development, it is still necessary to take advantage of the advantages of blockchain in smart contracts and peer-to-peer interaction to allow ordinary investors to hold blockchain gold assets and flow.

Why not recommend a unified public chain?

Bitcoin's public chain can operate effectively because it not only has a consensus mechanism but also an incentive mechanism. There are two sources of incentives. One is to dig out new bitcoins. The other is that both parties to the transaction are willing to transfer some of the benefits to a third party that completes the accounting in order to facilitate the completion of the accounting. But so far, the Bitcoin community's incentives have come from the first type of mining of new coins, and the second type of incentive has not been heard. Therefore, the validity of the second type of incentive cannot be confirmed or falsified.

We believe that the success of Bitcoin community incentives also has a great relationship with the founder of Satoshi Nakamoto. Satoshi Nakamoto is very mysterious. Does anyone even have questions? Although there are rumors that Satoshi Nakamoto may hold 1 million bitcoins. But so far, it has not been seen what kind of benefits Satoshi Nakamoto has gained from the Bitcoin community.

If "blockchain + gold" uses a centerless public chain, what incentives are used? Who will do the selfless "Satoshi Nakamoto"? And for assets such as gold that already have a mature market, if there is no strong institution to promote "blockchain + gold", I am afraid that even specific application scenarios cannot be achieved.

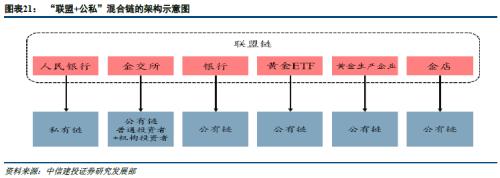

"Alliance + Public-Private" Hybrid Chain

The "upper-level alliance chain + lower-level public-private chain" model is mainly based on a blockchain mapping of existing gold market participants. As far as the domestic gold market is concerned, the main participants can be divided into two types: institutional participants and ordinary investors. Institutional participants include the People's Bank of China, the Gold Exchange, the Shanghai Futures Exchange, commercial banks, gold ETFs, gold production enterprises, gold shops, and industrial enterprises that use gold as raw materials.

The People's Bank of China is not only the regulator of the gold market, but also directly participates in gold trading. The gold exchange and futures exchanges are mainly market providers, and businesses will provide both gold trading services and gold traders. The gold ETF is a dedicated gold long-term investor. Except for the People's Bank, gold production enterprises, and industrial enterprises using gold as raw materials, other gold market institutional participants will face ordinary investors. This has formed two levels of institutional participants and ordinary investors.

Institutional participants can jointly form a "blockchain + gold" upper-level alliance chain. The members of the alliance chain jointly maintain the alliance chain, and discuss the specific operations of the alliance chain. Each alliance member specifically does what business in its own chain. The data interface between a single alliance member and the alliance chain.

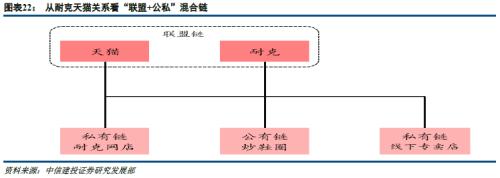

Individual alliance chain members can choose public, private, or alliance chains according to their specific business on the chain they lead. The public chain here is not a decentralized public chain, but a centralized one, but the lower-level members under the centralization have a higher degree of freedom of interaction. Another point that needs to be explained is why the upper layer is the alliance chain, but the lower layer will have a public chain instead? This can be referred to the interactive model in the real economy.

Looking at the relationship between Taobao Tmall and Nike, from the perspective of economic division of labor, the relationship between the two can be regarded as the alliance chain. Offline Nike has its own specialty store, which can be regarded as Nike's own private chain. But online Nike will also open an online store on Tmall, which means that Nike is also a node on the Tmall chain. Due to the emergence of "fried shoe loops", Nike shoes are the focus of hype. In a sense, the group of fried shoes is a public chain under the Nike chain.

Using Libra as a teacher

The concrete realization of "Blockchain + Gold" has another idea, which is to copy as much as possible the digital currency project Libra promoted by Facebook. The difference is that Libra uses its basket of stable currencies as a store of value behind it. According to the information disclosed by the Libra project, the US dollar accounts for 50%, the euro accounts for 18%, the yen accounts for 14%, the British pound accounts for 11%, and the Singapore dollar accounts for 7%. And "blockchain + gold" can directly use physical gold as the value store behind it .

The disadvantage of "blockchain + gold" compared to the Libra project is the lack of a heavyweight promoter like Facebook. But if the Libra project successfully launches other Internet giants, it may follow up. As for technical capabilities, application scenarios, etc., if Libra has landed, these aspects can be copied quickly. Although Facebook connects more than 2 billion users worldwide, Gold also has hundreds of millions of audiences.

You can start selling gold

Regardless of the upper-level alliance chain, if institutional participants in the gold market intend to launch their own "blockchain + gold" project, they can start by selling physical gold. The physical gold itself is stored in a credible vault, and gold block coins can be issued in grams or other units, allowing investors to indirectly hold physical gold by holding gold block coins. As an average investor, this may be similar to buying a physical gold ETF.

In the long run, the activity of many underlying distribution nodes should be enhanced

If ordinary investors are allowed to hold gold only in the form of blockchain, compared with investment instruments such as gold ETFs, there is no special influence. The advantages of interactiveness and smart contracts emphasized by the blockchain have not been brought into play. Therefore, in the long run, if the "Gold + Blockchain" project is to succeed, it must work hard to increase the activity of the many distributed nodes at the bottom. The activity of a distributed node can be reflected not only in the interaction between the distributed nodes, but also in the interaction between the distributed node and the central node .

From the perspective of the scene, in addition to enhancing the price of gold, it can also make gold an asset that can generate interest through credit connections , such as gold financing lease business or the introduction of structured financial products linked to gold.

"Blockchain + Gold" is an experimental field for financial supervision

With more and more digital assets, the impact is greater and greater, and the regulatory requirements for digital assets are also becoming stronger. Digital asset supervision has become a traditional regulatory department, and the public, practitioners and other stakeholders have to face issues that need to be addressed. The issue of the supervision of digital financial assets, represented by Bitcoin, is the most important. In general, the supervision of digital assets is still in the early stages of exploration. It may be useful to use "blockchain + gold" as an "experimental sandbox" to explore related financial supervision.

Bitcoin regulatory challenges

We pointed out in Figure 8 above that Bitcoin in the real world is a two-tiered structure. The lower layer is a decentralized Bitcoin community in a standardized sense, and the upper layer is a centralized Bitcoin exchange. Figure 13 indicates that unlike Alipay, which completes payment settlement based on sovereign currency, Bitcoin completes payment settlement based on itself, creating a super-sovereign asset other than sovereign currency. The idea disclosed in the Libra white paper, especially the institutional arrangement of its stablecoin, makes it closer to Bitcoin than to Alipay.

This double-layer structure in the real world makes Bitcoin both a currency and an asset . Currency refers to its role in the Bitcoin community, and asset refers to its object of trading speculation in an upper-level centralized exchange, which is essentially an asset. ICO has replicated this "both currency and asset" routine. Unlike the limited number of Bitcoins and the difficulty of mining, many ICO projects raise funds from the public under the background of endless valueless deposits or high project risks, which has become a de facto illegal fundraising.

Bitcoin's price volatility is largely due to its characteristics of being both a currency and an asset .

Currency-like characteristics are the root of Bitcoin. First, the Bitcoin community has strong self-sustainability. As long as there are members who identify with the community, it is difficult to forbid it by law. Second, because Bitcoin payment settlement and settlement pricing units are integrated, if it is banned, it means that Bitcoin does not exist.

And if the global coordination can restrict or even prohibit the speculation of Bitcoin's upper-level centralized trading website, the speculative nature of Bitcoin will greatly decrease. However, as an asset, and an asset with a strong value store, Bitcoin itself is an ideal investment object. Whether the ban on upper-level liquidity is reasonable is worth exploring.

At a macro level, the current monetary and financial market system is also an ecosystem in which central banks, various institutions, and markets coexist. Various behaviors and innovations of various institutions and markets will affect the effectiveness of monetary policy, but in general monetary policy is still effective. At the micro level, speculation and investment in financial markets are always associated, and it is difficult to draw a clear line between the two.

In addition, as far as the current underlying Bitcoin community is concerned, there are no other particularly influential applications other than mining. In the interaction with the real economy, in addition to "coin speculation", no other large-scale application scenarios have appeared. Crudely speaking, bitcoin is not particularly useful except for speculation. This is why the current demand for Bitcoin regulation is not urgent .

For the future supervision of Bitcoin, a potential idea is to see if it can find new and influential application scenarios outside of "mining" and "coin speculation." Targeted regulatory considerations for new application scenarios.

"Supervisory Sandbox" Experimental Field

Sandbox was originally a security mechanism in the field of computer security, providing an isolated environment for running programs. Experiments are often provided as a procedure whose source is not credible, destructive, or where the intention of the procedure cannot be determined.

The “Regulatory Sandbox” in the field of technology finance was first proposed by the British government in March 2015. As defined by the Financial Conduct Authority (FCA) in the UK, a “regulatory sandbox” is a “safe space” in which fintech companies can test their innovative financial products, services, business models and marketing methods, while There is no need to be immediately bound by regulatory rules when problems arise in related activities. That is, under the premise of protecting the rights of consumers / investors and preventing risk spillovers, regulators will proactively and reasonably relax regulatory requirements, reduce the regulatory barriers to fintech innovation, and encourage more innovative solutions to actively change from ideas to reality. In this process, a win-win situation of fintech innovation and effective risk control can be achieved.

China has also taken action in terms of "regulatory sandbox". In 2019, six departments, including the People's Bank of China and the National Development and Reform Commission, launched pilot projects in fintech applications in Beijing, Shanghai, and Guangdong provinces. On December 5, 2019, the Beijing Municipal Financial Supervision Bureau announced that Beijing was the first country to pilot a fintech “supervision sandbox”.

Compared with the grass-roots nature of the "currency circle" and "chain circle", institutional participants in the gold market are basically licensed institutions under traditional financial supervision, giving them a certain degree of innovation freedom in the "blockchain + gold" field. It is beneficial for traditional financial institutions to carry out financial innovation exploration on the blockchain, and it is also beneficial for regulators and ordinary people to improve their understanding of the "currency circle" and "chain circle" through "blockchain + gold". Explore some experiences.

risk warning

This report discusses the potential of Bitcoin, blockchain, and "blockchain + gold". As a new thing, bitcoin and blockchain have been increasing in influence for a little over 10 years since they were born. The “currency circle” and “chain circle” have continued to innovate in various ways, and a large number of innovations have been adopted. Falsification, some have been confirmed in stages. But even if these stage-proven innovations are the last projects that can truly benefit the society, or the Ponzi scheme, it will take longer to observe. Even if Bitcoin and the blockchain itself are reliable, there is still controversy.

This report is based on our knowledge of Bitcoin, blockchain, and gold. Although we hope that this report can further help the public to improve their understanding of Bitcoin, blockchain and gold, there is uncertainty about how much they can do, and some of our knowledge of Bitcoin, blockchain and gold also exists in the future. Possibility of falsification. In particular, although the concept of "blockchain + gold" has already been implemented in individual projects, it still belongs to a concept as a whole. Whether it can obtain supervision and industry approval, it remains to be seen whether it will actually be implemented .

Fortunately, this report only discusses our understanding and conception of Bitcoin, blockchain, and "blockchain + gold". It does not involve any investment advice, nor does it constitute investment advice. We hope that customers and readers will realize when reading this report This .

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Where can you spend Bitcoin in 2020?

- Blockchain security company CoolBitX completes USD 16.75 million in Series B financing, led by Japanese SBI and Monex

- Observe digital currency mining from a statistical perspective

- U.S. Department of Commerce requires companies involved in cross-border cryptocurrency transactions to report

- Canada: Retail CBDC has plans, release time has not yet come

- Opinion and interpretation: the differences between Jiang Zhuoer and Bitcoin Core

- Inflation drops to 1%, Voice goes live … EOS holders are still confused