The market is diving again, but the short-selling power is attenuating

Industry interpretation

The decline in bitcoin in recent days has allowed a tense atmosphere to spread throughout the cryptocurrency market. The panic of the leek is even more lingering.

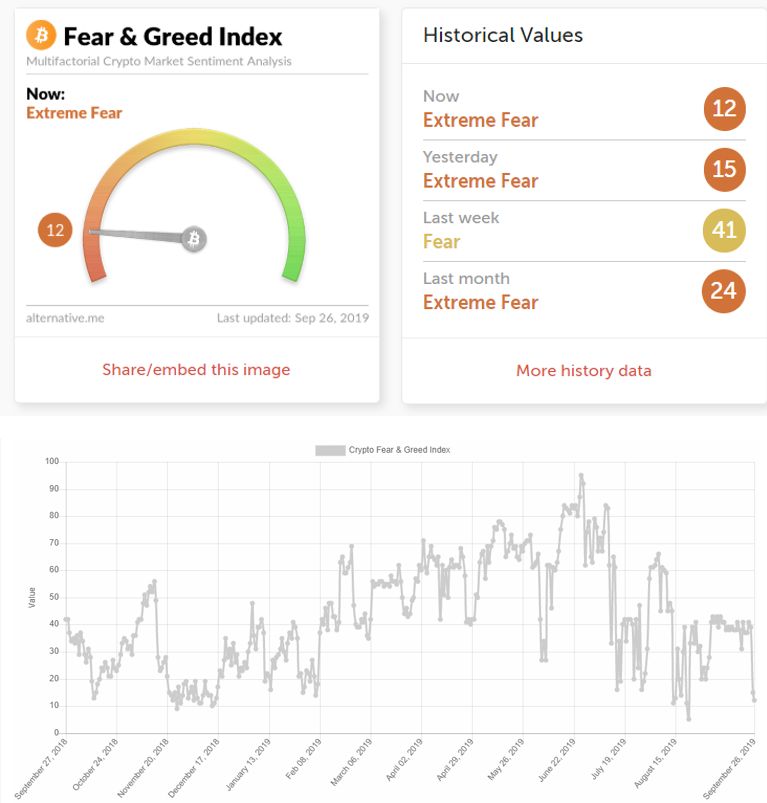

According to Crypto Fear & Greed's panic and greed index, there is extreme panic in the market (note: the panic index threshold is 0-100, where 0 means "extreme fear" and 100 means "extremely greedy"), and this state is not only In the continuation, the degree is even rising, and three index points have dropped from yesterday to today. This can not help but remind everyone of the big bear market in December last year.

- The life-saving grass of cryptocurrency, the big country dream of Turkey

- Ethereum 2.0 shard development is basically completed, the first shard simulation will be demonstrated at the next developer conference

- Platform-as-a-service company StrongSalt receives $3 million in financing, and will soon release an encrypted API platform

This made Xiaobian think of the words of Warren Buffett, "others panic and greedy." When the market is extremely scared, it is a good time to enter. When you hear a taxi driver talking about bitcoin, you have to think about the time to leave.

Today, Mark Creek, CEO of Morgan Creek Capital, said investors should not let the daily fluctuations in Bitcoin prevent them from investing in this valuable cryptocurrency.

The big man said that the daily price of Bitcoin is not important. Since 2009, the user base of Bitcoin has been growing every year, and the price of any asset will fluctuate.

Although I don't know how many bitcoins are held in this big hand, Morgan Creek Digital has teamed up with Bitwise Asset Management to launch the Digital Asset Index in 2018. Fund), designed to allow institutional investors to invest in a basket of cryptocurrencies.

It seems that Mark Yusko is really optimistic about the future of Bitcoin. However, Xiao Bian also feels that investment can not only focus on the present, but also to see a longer-term future. The value of Bitcoin is not just a number, it is not a short-term rise or fall can be determined.

Xiao Bian will also pay attention to the situation of Bitcoin from different aspects. Whether it is the news or the market, it will be shared with you in time. I hope that I can help the amaranth to a certain extent and appease the uneasy mood.

2. Today's market overview

The total market value of today's market is 213.1 billion US dollars, a decrease of about 3.6% compared with yesterday. Last night, the market once again dipped slightly, the intensity is obviously not the same as above, and the market is expected to stabilize. Trading volume decreased by 3.6% compared with yesterday. Although it dipped slightly, the trading volume continued to decline and the short market gradually weakened.

At the news level, Venezuela considers cryptocurrency as the international reserve currency; the French Finance Minister said that changing one cryptocurrency to another cryptocurrency would not increase any capital gains tax obligations; the number of Bitcoin lightning network nodes exceeded 10,000. A record high.

3. Currency fluctuations

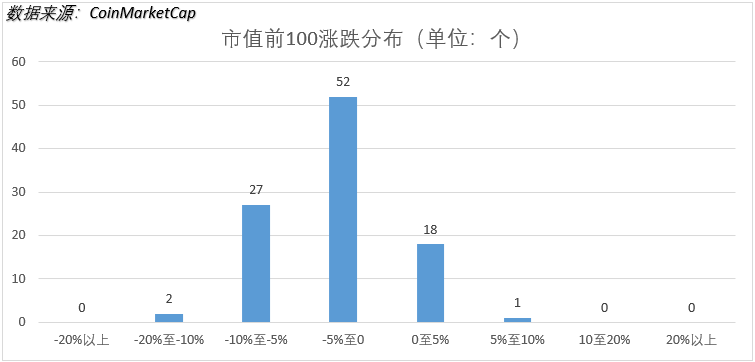

Among the top 100 currencies in the market today , most of the currencies were underperforming, and the price of 80% was down, but there was no extreme situation. The biggest decline was in the RIF of 11%. The RIF has performed well in the past six months. The market was smashed. The unpopular LOOM is 10% in the countercurrent, and the other biggest increase is no more than 5%.

4. Trading volume analysis

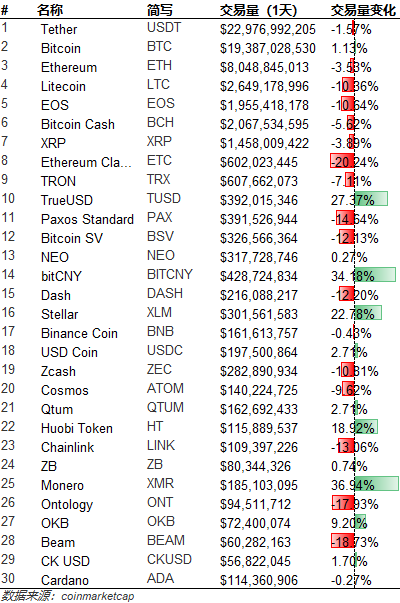

The top 30 currencies of the trading volume were more evenly distributed, and the trading volume of 60% of the coins fell, and the average trading volume changed almost zero. Most of the currencies with increased trading volume were stable and platform currencies, and the stable currency premium rose again, which was related to the second dip last night.

5. Stable currency analysis

The total supply of stable currency market was US$4.44 billion, which was no significant change from yesterday. The largest increase was in USDC, an increase of approximately $1.55 million. The USDT OTC Index reported 101.19 points, up 0.70% in 24h. The USDT FTP Index reported 100.03 points and fell 0.06% at 24 hours.

Note: The USDT on-market discount/premium index is based on BTC/USD, BTC/USDT, USDT/USD and other trading pairs on multiple exchanges. It is the percentage ratio of USDT to USD, reflecting the preference of the market trader for USDT. degree. The USDT Off-Site Depreciation Index is calculated based on USDT's over-the-counter price and offshore RMB exchange rate. It is the percentage ratio of USDT to USD, reflecting the congestion of funds entering and exiting the market. An index of 100 indicates USDT parity, an index greater than 100 indicates a USDT premium, and a value less than 100 indicates a USDT discount.

6. Technical analysis

BTC/USDT secondary market trend analysis (fire coin spot)

5 minutes

30 minutes

[BTC] BTC appeared in the second round as we predicted last night, but did not break the previous 7700 lows. It was hard to be held by the bulls. Although the trend was stable but quite weak. Now directly from the 30-minute level analysis, after the fall of last night, the counter-pumping did not pull above 8220, indicating that the box is exclusive to the current counter-draw. On the other hand, it also indicates that the long-term funds are insufficient, and they dare not take the initiative to attack. Continue to oscillate, you can look at the lower line in the short term; combined with the small level of 5 minutes, the down section of the previous high 8169 can not be confirmed, and will fall slightly from the trend, if it falls, it will rebound to 8014. In the vicinity, the short-term rebound can be expected, and the rebound will not continue until the bottom.

In summary, the BTC's high diving caused a large level of breakage. After a few days of adjustment, the trend has not stabilized, indicating that the market is extremely weak. The short-term rebound of the operation suggestion is not strong short near 8150, stop loss is 100 points.

LTC : Wright's trend is quite weak. Every time there is a deep decline, there is no decent rebound. It means that the bulls have given up their resistance and they have to follow the rebound. The short-term short-term near the operation recommendation 55 is mainly near the stop loss 56.

ETH : ETH consolidation is slightly stronger than BTC, and can be held at a high level, but if there is no money to pull the plate, this trend will not last long. Operation recommendation 166 is mainly short near the stop loss 168.

EOS : The grapefruit has a strong decline. At present, there is almost no repair. In the short term, the trend has already gone, and the rebound will bottom out. Operational recommendations rebounded to short-term near 2.78 short-term short, near the stop loss of 2.81.

BCH: The BCH super-large platform is directly worn, accumulating a large amount of cushioning pressure, and the upward space is quite limited. Operational recommendations rebounded to short-term near 215 short-selling, near stop loss 217.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Explore: How to create a neutral, trust-free, scarce digital currency

- Babbitt column | The end of the retail financing era, the beginning of the institutional financing era

- QKL123 market analysis | Bitcoin plummeted, "delivery day effect" pot? (0927)

- The number of lightning network nodes broke for the first time and increased by 3.17% in the past 30 days.

- Mine pool coin, the next platform coin?

- Invoices, justice, poverty alleviation, government applications have become the blockchain to take the lead in the field?

- Want to put Bitcoin and Ethereum into foreign exchange reserves, Venezuela has finally done a reliable thing?