The other side of the three strikes of the Argentine bond: the government step by step to push the people from the peso to Bitcoin

On August 12, the Argentine peso fell to 30% against the US dollar, setting a record low. In addition, the same day, Argentina's offshore notes plummeted, the country's 100-year bond fell nearly 27% in New York to 15.66 cents a dollar; on the same day, Argentina's Merval index fell 30%. In Argentina, the exchange rate, stocks and bonds were killed three times a day.

For the Argentine people, cryptocurrency is their optional safe-haven asset. According to the exchange rate and market price on August 13, the exchange rate of 52 US dollars to 52.15 Argentine pesos, 1 bit currency exchange less than 12,000 US dollars, then 1 bit of currency should be exchanged less than 625,800 Argentine pesos. On August 13th, in the OTC market in Argentina, the exchange of 1 bitcoin often cost 700,000 pesos, and the highest counter exchange price is up to 960,000 pesos. The highest premium rate difference of more than 53% indicates the demand for cryptocurrency by the Argentine people.

Argentina's cryptocurrency market

Argentina's openness to cryptocurrency is among the best in the world.

- XRP investors filed a new lawsuit against Ripple to add that it meets securities standards and violates advertising laws

- New breakthroughs in cross-border payments in Latin America: more than 60 banks in 14 countries can use Bitcoin for cross-border transfers

- Viewpoint | Why is the correlation between digital currency prices so high?

Few presidents of a country publicly accepted the recommendation of blockchain investors for cryptocurrency, and Argentina’s President Markley did it.

Mauricio Macri was elected President of Argentina in 2015. He is the first non-radical or Belonist president of Argentina since 1916 and served as the head of the government of Buenos Aires from 2007 to 2015. As a former civil engineer, his interest in Bitcoin is understandable.

According to CNN's earlier reports, from 2014 to 2015, Argentina's Bitcoin users doubled. At that time, some bitcoin media inferred that President Markley might be a supporter of cryptocurrency. Cryptographic companies such as Digital Asset Holdings or R3 have become partners in the blockchain sector for Argentine government and institutional investors.

Inferred to be verified immediately.

In January 2016, Mr. Richard Branson, the founder of the Virgin Group, and the President of Argentina discussed a number of topics, including drug control, space flight and bitcoin.

In December 2017, famous wind capitalist and bitcoin investor Tim Draper met with Argentine President Mauricio Marci and cabinet chief Marcos Pena. . According to media reports at the time, Draper suggested that President Markley should invest in bitcoin.

In March 2019, Tim Draper, a well-known investor who had invested in Hotmail, met with Argentine President Markley and suggested that he promote reforms to attract entrepreneurs. One of his suggestions to the president was to replace the Argentine peso with bitcoin.

Three interviews with three investors, the extent of discussion of bitcoin has gone from shallow to deep – from mention to investment, and finally discussed to replace the Argentine peso.

Such bold ideas, who dare to say in front of the leaders of most countries? It can be seen that Mark's attitude towards Bitcoin is not only support, but even faith.

It’s good, it’s going to be awkward, plus the economic environment in Argentina. In recent years, cryptocurrency has become popular in Argentina and is well known worldwide.

The population of Argentina is only 44.5 million, but according to the data of localbitcoins, there are as many as 4,068 OTC trading counters in Argentina's cryptocurrency, which is second only to Colombia in South America and ranks in the top ten in the world.

Argentina is also the most popular country for Bitcoin ATMs. After the Argentine central bank adjusted its regulatory policy in 2018, allowing ATMs to enter non-bank entities, the Odyssey Group entered the market and launched 4,000 ATMs for the first time. By the end of 2019, 1,500 units had been deployed.

Not only the folks, Bitcoin used commercial and official countertops in Argentina.

In February of this year, Argentina and Paraguay settled an export transaction with bitcoin. It is reported that Paraguay purchased $7,100 worth of pesticides and fumigation products from Argentina and settled for the first time through Bitcoin. The deal is significant because Bitcoin is used as an alternative to traditional SWIFT payment networks.

In May, Argentina's BMV Bank will allow customers to use Bitcoin for international payments and gradually implement it, which means that BMV Bank will become the first banking institution in the world to use Bitcoin as an international payment standard. Subsequently, according to blockchain media Toshi Times reported on May 23, BMV Bank's main shareholder Jose Dakak said that the bank will withdraw (Global Interbank Financial and Telecommunications Association) SWIFT.

Even economist and mathematician DH Taylor proposed that the Argentine central bank include bitcoin in the central reserve currency.

Cryptographic currency or peso

A slap in the face does not sound. Argentina’s debt and economic problems also pushed the trust of the people to Bitcoin, away from the Argentine peso.

In 2017, Argentina's total GDP ranked 26th in the global countries and regions. In 2018, he retired to 21 places. This year, the IMF and other agencies expect Argentina to fall into negative growth.

The turning point was the coming of Mark. In December 2015, after the inauguration, Markley canceled the foreign exchange control overnight, resulting in a large loss of foreign exchange reserves. In order to curb excessive government spending, the public service subsidies such as water, electricity and gas were greatly reduced, which triggered a strong social rebound.

Later, the Macri government borrowed heavily. As of March this year, Argentina’s foreign currency debt ratio reached more than 90%, and short-term debt accounted for more than 30%. There is a large repayment pressure. In terms of foreign debt protection, Argentina’s foreign exchange reserves are less than double the coverage of short-term debt, and can only rely on refinancing to meet debt service needs.

From the beginning of the year to April, the peso depreciated by 15% against the US dollar. Beginning on April 27th, the Argentine central bank couldn't help but couldn't stop it for three times a week. The day announced a rate hike of 300 basis points, the benchmark interest rate jumped from 27.25% to 30.25%.

Then on May 3, the central bank again raised interest rates by 300 basis points. However, the market still does not buy, the day the peso has "accidentally" plunged 8.5%, the biggest one-day drop in two and a half years.

The next day, the central bank once again raised the benchmark interest rate to 40%. The 10-year government bond interest rate followed the rise, the national debt price plummeted, and the Merval stock index plummeted, presenting a three-kill situation of “stock remittance”.

And the Argentine people bought bitcoin in a big way in April. According to the April data of the peer-to-peer trading platform LOCALBITCOINS, the bitcoin transaction volume from Argentina reached the highest level in history.

In addition to Bitcoin, the Argentine people are eagerly awaiting the arrival of Libra, the cryptocurrency launched by Facebook.

Not only is Libra's first 28 alliances, there is an Argentine e-commerce site Mercado Pago, which is the only node in the developing world.

From the public's enthusiasm for Libra, Argentina is one of the hottest countries. Ranked 7th in the world, surpassing the US.

When the Libra white paper was issued, Huang Yiping, director of the Digital Finance Research Center of Peking University, believes that if Libra is really popular in the international monetary system, perhaps the currencies of many small countries will not exist because there is no need to use these qualifications. A less stable currency.

When the public trusts the cryptocurrency more than the domestic currency, it is even worse for Argentina. People buying cryptocurrencies, abandoning the legal currency, causing the devaluation of the French currency debt crisis has become a cycle of death. Will the Argentine peso become a legal currency replaced by a cryptocurrency?

In 2014, the peso was 8:1 against the US dollar, and it reached 38:1 in May last year. Today, it has reached 53:1. This can't help but make people jealous.

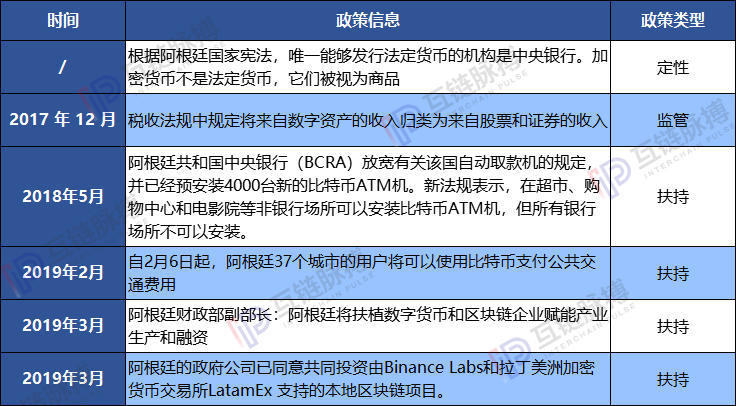

Figure: Argentina's policy on cryptocurrency

This article is [inter-chain pulse] original, the original link: https://www.blockob.com/posts/info/20417 , please indicate the source!

Author | Mutual Chain Pulse Commentator·Yuan Shang

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- The Beijing News: The central bank’s digital renminbi is coming out, and the Bitcoin Librae currency is going to be cool?

- The fund tray project BHB organizer was arrested. The Feng sister, who once stood on the platform, said that the dividend for the day was 11%.

- August 14th market analysis: Gold fast diving with BTC?

- Directly hit the supply chain financial fraud event blockchain technology can effectively solve the pain point?

- Mainstream currencies have different trends, can they break away from the BTC downturn?

- The issuance mode, development process and nine key issues of the central bank's digital currency

- Bitcoin extorted new tricks, Canon SLR was hacked, and White Hat used a hole to redeem the photo.