"Reverse refers to the king" Goldman Sachs strongly bullish bitcoin, the letter still does not believe?

Recently, although Bitcoin has come out of the callback, Goldman Sachs, the world's leading investment bank, has been bullish on Bitcoin for nearly $14,000 in the short term.

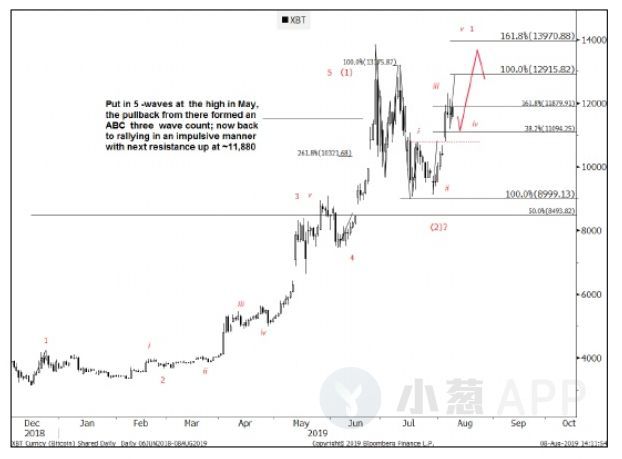

In a report to investors, Goldman Sachs predicted bitcoin prices based on Elliott Waves theory, which predicts market movements by identifying extreme emotions and price levels.

According to Goldman Sachs' analysis, Bitcoin is expected to rebound from the support level of around $11,094 in the short term, and the rebound space can be seen from $12,916 to $13,971. This means that Bitcoin has more than 20% upside from its current position.

- The other side of the three strikes of the Argentine bond: the government step by step to push the people from the peso to Bitcoin

- XRP investors filed a new lawsuit against Ripple to add that it meets securities standards and violates advertising laws

- New breakthroughs in cross-border payments in Latin America: more than 60 banks in 14 countries can use Bitcoin for cross-border transfers

(Goldman Sachs report screenshot)

According to Goldman Sachs's 5 wave theory, from the end of last year to the beginning of August this year, Bitcoin has completed a round of 5 wave market structure, from the low point around 4,000 US dollars, the highest approach to 14,000 US dollars, an increase of about 250%.

The analysis said that the rebound in the next round of $13,971 will open the first wave of another round of five waves. In this way, with reference to the trend of the last round of 5 waves, Bitcoin will have a huge profit margin in the later stage. Even a bitback in the late bitcoin price has become a buying opportunity unless Bitcoin falls below the previous low of $9084.

In addition, Goldman Sachs said that in the short term, $10,791 is the stop loss position of Bitcoin.

However, Goldman Sachs has always been known as the “king of anti-indicators”. When Goldman Sachs predicts the price, investors will “tremble” because it often proposes opposite price predictions, especially in the field of traditional assets, maybe this bitcoin is right. It is about to fall.

Since Bitcoin hit a new high in 17 months in June this year, Bitcoin has rarely broken through and stabilized the key position of $13,000 despite repeated attempts. At present, there is a $12,000 mark in front of Bitcoin. In recent days, Bitcoin has fallen back to around $11,300 after trying to hit the mark.

Therefore, it is difficult to judge whether Bitcoin will break through $13,000 again and stand firm.

(Fire currency bitcoin market chart)

Bitcoin "Digital Gold" utility is more obvious

Affected by global risk aversion, the safe-haven property of Bitcoin “Digital Gold” has become more and more recognized and accepted. The late trend of Bitcoin may be affected by the global situation, and the current global stock market down signal is still relatively obvious.

Cointelegraph reported that bitcoin just rose to more than $12,000 in the period of geopolitical events.

Cryptographic analysts have also turned to price trends in gold to determine the price trend of bitcoin. Recently, the relationship between precious metals and bitcoin has become closer.

Analyst RideTheLightning pointed out that gold is currently at the top of the short-term range and is seeking a breakthrough. "The price of gold is currently experiencing resistance. If the price of gold breaks through, I don't know if Bitcoin will follow up."

This means that if the gold price breaks further, Bitcoin may rise to $12,000 again, and the current sideways position of Bitcoin is similar to that of gold.

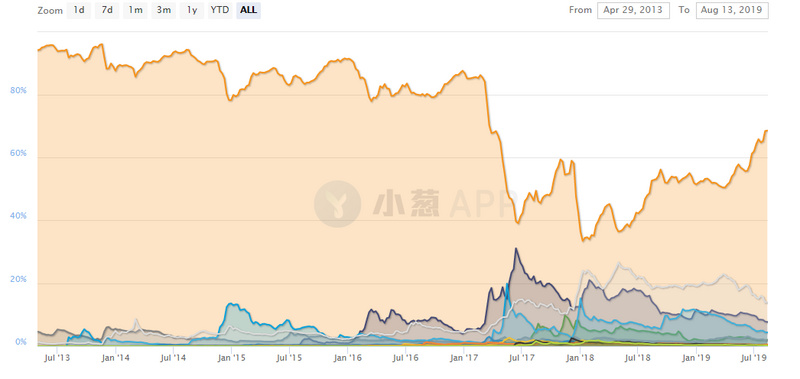

In addition, the market share of Bitcoin is still rising further, and the money in the currency circle continues to flow to Bitcoin. Its current market share has approached 70%, setting a new high since the end of March 2017.

Source: Shallot blockchain

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Viewpoint | Why is the correlation between digital currency prices so high?

- The Beijing News: The central bank’s digital renminbi is coming out, and the Bitcoin Librae currency is going to be cool?

- The fund tray project BHB organizer was arrested. The Feng sister, who once stood on the platform, said that the dividend for the day was 11%.

- August 14th market analysis: Gold fast diving with BTC?

- Directly hit the supply chain financial fraud event blockchain technology can effectively solve the pain point?

- Mainstream currencies have different trends, can they break away from the BTC downturn?

- The issuance mode, development process and nine key issues of the central bank's digital currency