The quilt cover for 40 days, the Algorand photographed by investors can finally be solved in advance.

Algorand, the Turing Award winner, once again screened the currency, but this time it was not a "pizza cut".

On June 19th, Algorand Holland auctioned tokens, and the main exchange opened on the same day. The ALGO token price soared to $4.2. When everyone started to revel, ALGO ran all the way, falling to a minimum of $0.5. Many investors in the secondary market have said that they have been deeply involved, and there are even news that investors will defend their rights.

Prior to this, the Algorand Foundation issued a statement warning private investors that “selling or short selling may be terminated”, suggesting that private investors may be selling tokens on the market at very low cost because Private stock prices and market prices have a spread of up to 48 times, which makes it difficult for the market to accept excessive selling pressure, resulting in a sharp fall in prices.

- Capital events black swan frequently, the marginal effect on BTC is weakening

- QKL123 market analysis | Risk aversion surge, Bitcoin strong Hengqiang (0802)

- Introducing bitcoin futures for physical settlement? LedgerX and CFTC entangled

Subsequently, the ALGO price steadily dropped to $0.5 until the Algorand Foundation issued a new refund announcement.

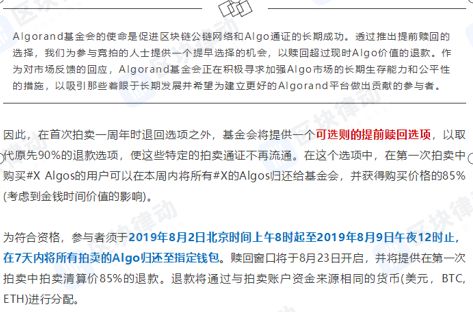

The block rhythm BlockBeats news, Algorand Foundation announced on the morning of August 2, the first batch of Dutch shoot participants can choose to refund in advance, the refund amount is 85% of the auction price. Stimulated by this news, according to BitUniverse quotes, at 10:50 am, the price of ALGO soared 41.67% to 5.4 yuan. The discussion on the Algorand in the currency circle is once again in full swing.

Why does this news boost the price of the currency?

According to the original rules, as long as the auction settlement price is above US$1, participants of ALGO Holland Auction can apply for a refund within 7 days after one year, and 90% of the investors' funds can be returned.

According to the new rules released on August 2, participants in the Netherlands can choose to apply for an 85% refund in advance this week (August 2 to August 9), no longer waiting for 1 year.

So it is not surprising that the price of ALGO has skyrocketed:

First, at the micro level, investors who participated in the first round of Dutch auctions to sell ALGO in the secondary market premium and waited for the approaching refund right to approach the buyback chip had to act early this week.

Second, although the refund ratio has dropped by 5%, funds can save the opportunity cost of nearly one year.

Thirdly, from a macro perspective, the move is essentially to wipe out the net of the Dutch auction, so that the chips on the market are limited to the part of the private placement.

ALGO, you must know the arbitrage opportunity

In ALGO's financial game, someone extracted another coin "TALGO" or "ALGO619" (BiHODL), which abstracted the ALGO return right into an option product. So, what new opportunities for making money in this incident?

First, the first Dutch auction settlement price is $2.40, then the 85% refund price is equivalent to $2.04.

By 10:50, ALGO's secondary market price is about $0.78, and the returning currency TALGO is about $0.93.

0.78+0.93=1.71 USD<2.04 USD

In other words, if you go to the exchange to buy x copies of ALGO, then go to Tigers or BiHODL to buy x copies of TALGO, you can risk arbitrage and earn without considering the depth of the transaction, the handling fee and the ALGO staking. 2.04-1.71) x share of income!

Wait, is there a time limit for this income?

Yes, one week! In other words, you can achieve a stable profit (2.04-1.71) / 1.71 = 19.29% in a week. This rate of return is probably the killing of most of the so-called quantitative wealth management products.

Of course, think again and again, since the market has this opportunity, why is the arbitrage space not being smeared?

First, this shows that the development of the cryptocurrency market is still in its early stages, and market participants have limited awareness and mobility.

Secondly, objectively speaking, whether it is BiHODL or Hufu, the amount of participation in the Dutch auction is not large, and the liquidity of the RMGO is relatively poor. This leads to the arbitrage of large funds, and only retail investors can participate. Many retail investors are not aware of the nature of TALGO's European put options.

(Blocked BeatBeats Note: Before the release of the draft, the return of the rights of the BiHODL exchange ALGO619 has risen to 1.1 US dollars)

ALGO, you must be aware of the risks

There are many people who may ask, can the ALGO currency price reverse this V-type, and how much risk does the secondary market participate in Algorand?

We interpret it from two angles.

First, qualitatively, ALGO's private placement cost is around $0.05. As of 10:50, ALGO's secondary market price is about $0.78, and private equity returns are about 15.6 times. In terms of private placement multiples, investment institutions have reason to continue selling chips in the later stages. In addition, as of August 2, the total amount of ALGO is 10 billion, and the circulation supply is about 2.697 billion. After deducting 2.5 billion from the team and the foundation, the actual liquidity is about 197 million. In terms of valuation, Algorand has a total market capitalization of US$7.8 billion, a total market capitalization of approximately US$2.1 billion, and an actual market capitalization of approximately US$154 million. For the Tezos, Cosmos, and Polkadot, the market is priced at $600 million to $1.5 billion for the head PoS public chain. So, even now, ALGO's valuation is still not cheap. In terms of comprehensive private placement costs and market pricing, private equity investment institutions still have a large reason to sell in the secondary market.

Second, quantitatively, the current profitable disk in the market = private equity – (market liquidity – the number of first rounds of the Netherlands). The ALGO token allocation model is: auction 30%, Staking incentive 17.5%, relay node 25%, team and foundation 25%, community incentive 2.5%. The first round of Dutch shots accounted for 0.25%. According to calculations, at a price of 10:50, the potential profit-taking disk still has about $1.815 billion. According to the release rules, private investors' coins are released 1.7 million a day, equivalent to a potential selling pressure of about $1.32 million per day. Combining total profit taking and daily selling pressure, we find that these two figures are not small.

(Blocked BeatBeats Note: The calculation results in this article are subject to the time of writing, and the specific situation will change due to price changes)

ALGO, you must know the gameplay follow-up

Some people may ask: If private equity investors participate in the first round of Dutch auctions, the three major exchanges on the line will skyrocket to $3, and the money will be returned at the same time, the private equity will be locked, and then the cheap ALGO will be bought now. Not a beautiful one?

At present, there is such a possibility. Of course, we believe that Algorand officials will certainly not allow such operations. It is already too much to tolerate private investors to go to the secondary market to sell coins. Can we tolerate private investors to reverse the project?

We also can't predict whether Algorand will change the next round of auctions, but as far as the current rules are concerned, we can refine how the retailers participate in Algorand's gameplay:

First, ALGO's investment food chain is private equity → Dutch auction → secondary market, so for retail investors, if you really like the Algorand project and want to hold it for a long time, the Dutch auction is more than the secondary market. Good choice, because you get a "insurance" that can be refunded if the price of the currency falls.

Second, from the arbitrage opportunity, if after a round of auctions, the ALGO secondary market price is significantly higher than the auction price in the short term, then the RMGO will lose its value because of the lack of exercise space. At this time, if Algorand's valuation has been significantly higher than the market price, and you arrive at an unreasonable situation, you can go to the cheap TALGO. Since the price of the currency falls below the strike price and even plunges, these TALGOs will change from "no value" to "fragrant". In addition, there may be a situation in the market where the prices of ALGO and TALGO are lower than yesterday, that is, the price of ALGO is significantly lower than the auction price. When ALGO+TALGO is much smaller than the exercise price, it can also be properly priced at TALGO. The time value of the option.

The impetuous blockchain is playing a new story every day. Say good to technology to change the world, but you are busy modifying the rules of financial games.

* Block Rhythm BlockBeats prompts investors to guard against high risk.

Author: 0x22

Source: Block Rhythm BlockBeats

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Analysis of more than 48,000 posts, the most popular on the foreign currency base Reddit is not BTC but it

- Has Dharma plunged too much? Decentralization is not enough, the mode is difficult to sustain is the key

- Twitter Featured: 15% off, cancel the Dutch shoot, Algorand open cuts?

- Algorand announced an early repurchase, Algo rose 45% in a short time

- How to understand the market cycle of cryptocurrency

- QKL123 blockchain list | The overall market heat is reduced, but the media heat is not reduced (201907)

- The most comprehensive analysis tells you: Why LegderX did not launch bitcoin futures trading on time