Institutional Strategy Research | People still want to miss the altcoin for a while

Core point of view:

- The market volatility structure is similar to 2016. The short-term volatility is slowing down, but the long-term volatility is at a turning point. In the second half of the year, the market will continue to fluctuate with wide volatility;

- The market started a rebound structure of about two weeks from the end of July, subject to short-term optimism, this rebound is not expected to be strong, and still needs to oscillate and fall to the MA120 in the later stage;

- Although the Fed’s interest rate cuts are expected to fall, the effectiveness of interest rate cuts has disappointed the market, triggering a shock in the global financial market. In the short term, the macro factor influence margin has weakened, and the real news is relatively vacuum, and the market will remain weak overall.

Bitcoin has been slowing down and shrinking for more than half a month. The mainstream currencies such as Ethereum continue to fluctuate in a narrow box, delaying the direction, the overall liquidity of the market has fallen sharply, and the trading volume of small and medium-sized market capital has plummeted, making all investments The people are suffering. If the next definition is to be made, the current market stage seems to be neither a “bull market” nor a “bear market”, nor a “monkey market” that jumps up and down, but rather a “cat market”.

Trading in the current market environment is like teasing a cat. People tend to think that they can tame a cat, but in reality people are more like being domesticated by cats. This is the case with investors. Investors generally expect and expect a large market direction in the near future. They will enter and exit in different varieties and contribute a lot of fees to the exchange, but the market is bleak and clear. "Cat City" has his own rhythm and temper. The more you want to play with it, the more it ignores it and will never respond to your call; but when it is too late to be excited, you You have to play with it – the point is that it's hard to really know when this "cat" will be excited.

If there is anything more annoying than a cat who ignores you and can't catch the cat's "defects", it must be that there is no chance to speculate in a market that is inherently volatile. After all, in the digital currency market, Chaos is not a pit, chaos is a ladder.

- The quilt cover for 40 days, the Algorand photographed by investors can finally be solved in advance.

- Capital events black swan frequently, the marginal effect on BTC is weakening

- QKL123 market analysis | Risk aversion surge, Bitcoin strong Hengqiang (0802)

Chaos is not an abyss, chaos is a ladder.

On July 22, 2019, KCB's first batch of 25 new shares were listed on the market, and the first show was very eye-catching. The 25 new shares opened an average of 140.95% on the first day. The closing price was 84.22% to 400.15%. The closing PE ratio was nearly double the comparable company premium, and the highest PE was close to 476.95 times.

The enthusiasm of the investors for KCB trading is also very high. KCB has about 3.1 million investors, and 25 new shares have a market capitalization of 68 billion yuan on the first day, accounting for 0.16% of the market value of A shares. The total turnover is 48.508 billion yuan, but it accounts for To the total turnover of A shares is 11.72%, the average turnover rate is about 78%, the main turnover is basically completed within 30 minutes after the opening – except for the T+1 trading mechanism, the investor behavior and IEO's hype presents very similar characteristics.

Recalling the first show of the GEM in October 2009, the first batch of 28 new shares of the GEM was listed. The average increase on the first day was as high as 106%. These 28 stocks have been listed for 10 years, some have increased 12 times in 10 years, and some have been 10 years. The decline was over 50%, and even one stock was on the verge of delisting. The return on long-term holding depends on the day of eating, and it seems that only the new attraction has never changed.

Relative to the fierceness of the equity market, the digital currency market has recently been relatively deserted. In the past two months, Bitcoin has continued to deepen the market, and the overall market is lacking in brightness. However, the industry-leading exchanges still maintain a relatively fast SGD rhythm. People can't help but think of a recent hot comment on social media:

The largest casino on the beach in the Republic of China is No. 181, Fushun Road, covering an area of more than 60 acres. Du Yueying’s gold glory, the manager is Qian Zengshao. He has a famous saying: “Opening the casino, not afraid of gamblers’ luck, winning more. I am afraid that the guests who have passed the road will not win any more. "How to solve it? One depends on human nature. Everyone knows this. Second, it depends on small and cheap, and it is not necessary to pay for white, white, white, and no money. Third, it is to rely on new and push new bets. Law, new stalls, new venues, don't hesitate to come. "

The facts also prove that although the secondary market has different standards, the essence of the secondary market is still the same, and it is all transactional. In the past, major exchanges have been renewed through IEO or various discount purchases and innovative credits, robbing stock users and traffic, and successfully attracted the attention of “cats” adults. However, the performance of various SGDs on the line has been greatly reduced. The trading sentiment is sluggish and the quantity is thin. These tactics are obviously starting to be shot on the cat legs. Perhaps the "paradigm shift" that Ray Dalio, the founder of the Bridge Foundation, has recently promoted Contagion to the digital currency market can not help but start to wonder if digital currency trading is also facing a "paradigm shift . "

In the past two weeks, the “paradigm” of the digital money market has shifted very quickly. The investor's mood is fluctuating and the trading behavior is very frequent. From the BVC sentiment index, the market trading sentiment fluctuated sharply when Bitcoin rebounded in mid-July. At present, the overall situation is still at a relatively high level of optimism. The short-term sentiment is too optimistic to suppress the duration and intensity of this rebound.

BVC Emotional Index Data Source: BlockVC Strategy Research

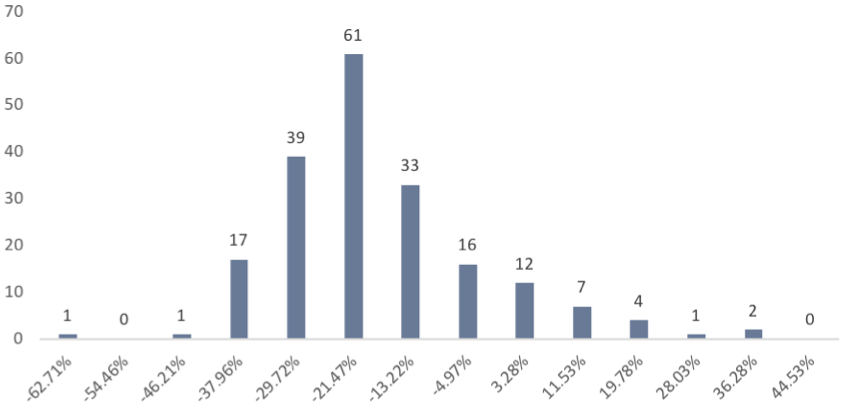

Although traders are generally optimistic, the market's money-making effect is cooling. More than 80% of the TOP200 currency achieved negative returns, with Bitcoin falling 19.41%, representing the market average.

TOP200 Revenue Distribution Source: BlockVC Strategy Research

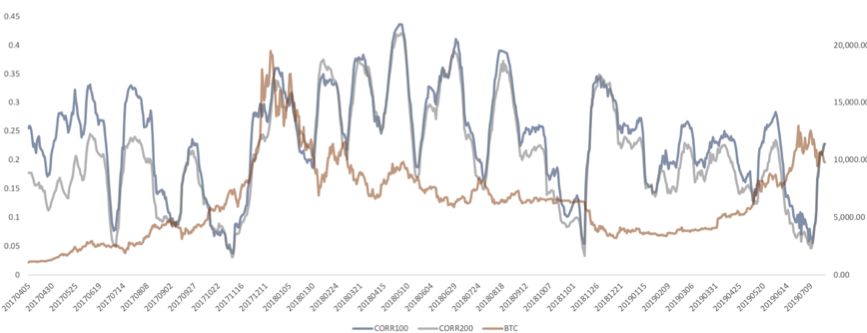

From the average correlation coefficient between TOP100 and TOP200, the average correlation between the market performance at the end of June and the beginning of July was extremely low. The funds in the market were not enough to support the scattered market hotspots, and then the market showed a sharp correction. During the overall deep correction of the market in the past two weeks, the average correlation coefficient has risen sharply, and the window of short-term rebound is opening.

Market average correlation coefficient Source: BlockVC Strategy Research

From the point of view of transaction concentration, the recent market transaction concentration has increased very fast, and the transaction volume is rapidly concentrated to the head of the large currency. On behalf of the market, the short-term selling pressure has basically been released, and the probability of supporting the rebound has greatly increased.

TOP50 transaction concentration Data source: BlockVC strategy research

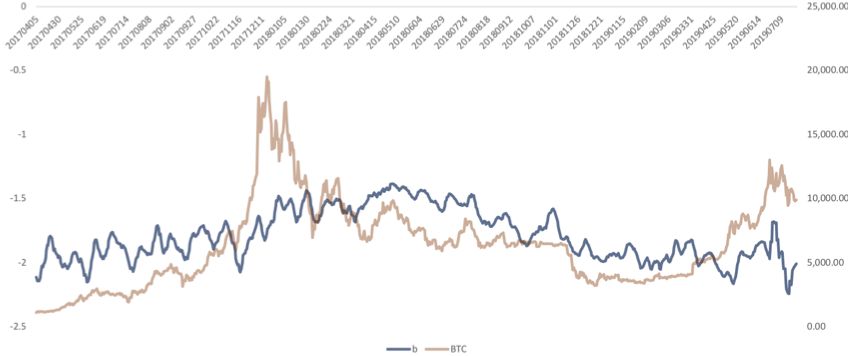

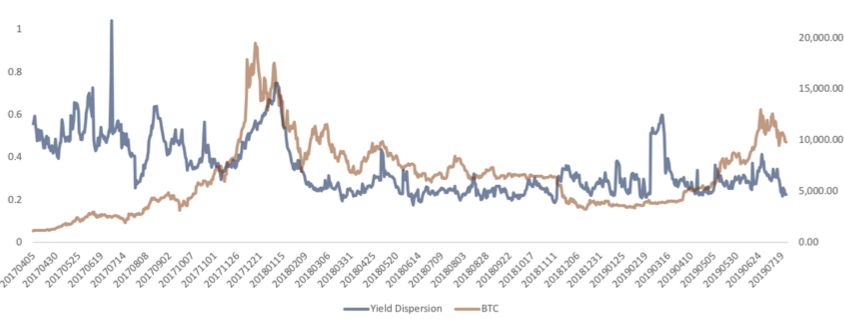

From the perspective of revenue differentiation (revenue discrimination refers to the difference between the average of the top 1/10 currency of the highest increase in a portfolio and the average of the last 1/10 currency of the largest decline, which is used to measure short-term overreaction in the market. The indicator), the degree of revenue discrimination has fallen back to the stage low, the market has basically put in place the emotional venting of this callback.

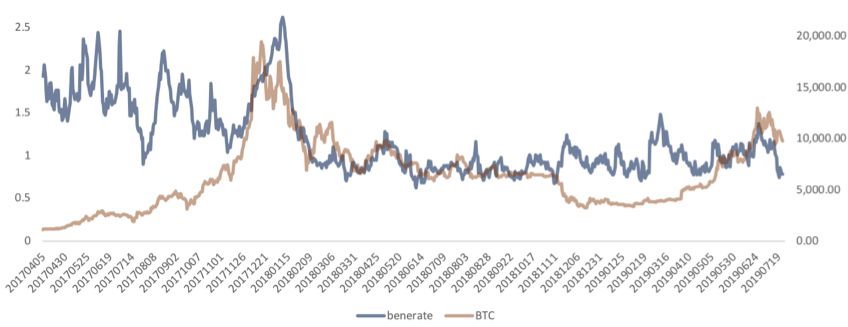

From the point of view of the dispersion of income, the degree of market disparity is generally low and there is a rising trend. Market participants have strong consensus expectations. At present, it is suitable to grasp the short-term rebound through mainstream currency, and the momentum effect of strong varieties will be improved.

Revenue Discrimination Data Source: BlockVC Strategy Research

Revenue dispersion Data source: BlockVC strategy research

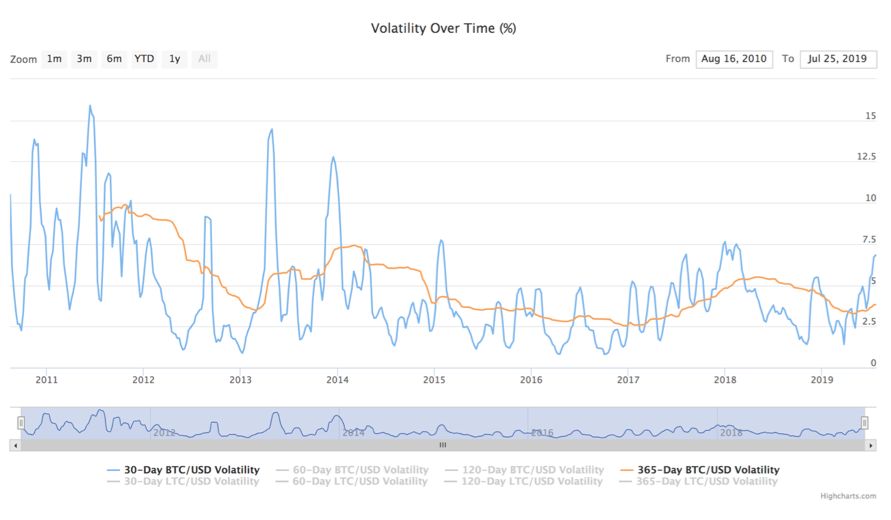

From the characteristics of bitcoin volatility, the current market stage is at a high point of 30-day volatility, but the volatility of the 365-day (year) volatility is most similar to the January and July volatility in 2016. In the next month, the 30-day short-term volatility will return to the low level, which means that Bitcoin will maintain a monthly volatility down trend after the short-term rebound, and continue to move closer to the MA120. From the perspective of annual volatility, the annual volatility has entered the bottom of the history, and the future will turn a big turn upwards. Bitcoin will continue to create large and wide fluctuations in the second half of the year. The high probability will be in September-October 2019. Regain the upswing.

Bitcoin Volatility Source: Bitvol.info

Not only the digital market, but also the recent global financial markets are in a low-volatility structure, mainly in the face of the recent Fed FOMC interest rate decision. On the morning of August 1, Beijing time, the Federal Reserve announced that it had cut interest rates by 25 basis points for the first time since 2008, and terminated the contraction two months ahead of schedule, basically the same as market expectations. However, after the meeting, Fed Chairman Powell hinted at the press conference that the interest rate cut is an insurance interest rate cut. The main purpose is to counter the global economic drag on the US economy, the uncertainty of the hedging trade war and the 2% inflation target as soon as possible. It is not necessarily the beginning of a loose cycle, and the possibility of raising interest rates is not ruled out in the future.

The market can be extremely disappointed with Powell's wording. Last night, the global market shocked, the dollar rose, the short-term debt rate rose, the long-term debt rate fell, gold fell, the three major US stock indexes fell more than 1%, and the VIX index rose 15%, including In addition to Bitcoin, risk assets use short-term diving to express sentiment about the Fed’s interest rate cut.

The BlockVC strategy released on July 9th, " Why is your bitcoin halved in advance?" It has been judged that the Fed’s interest rate cut is expected to be Price-in, and once the interest rate cut is reached, there may be a short-term price high in gold. As we expected, interest rate cuts have fallen within the expectations of market participants, and the most important factor affecting the market is the change to the judgment of the effectiveness of interest rate cuts. The Fed’s dovish hawkish remarks raise doubts as to whether this rate cut has become the starting point for confirming the US economy’s entry into recession and the weak dollar currency.

The global economic fundamentals continue to be weak, central banks will follow the pace of interest rate cuts, the global currency competitive devaluation may kick off, the global monetary system will usher in a period of turmoil, and the plan of the four countries' unified currency is a clear signal. Whether the US can ease the demand pressure of the non-financial sector by cutting interest rates and the depreciation of the US dollar is still in the fog, so the major assets may be in a relatively chaotic state of volatility in the next nine months. If the US dollar can be as weak as expected , Gold and bitcoin will also have continued purchases from institutional investors. But in the near term, the marginal decline in the influence of macro factors will lead to the return of gold and bitcoin to the emotional game, especially for bitcoin, institutional investors will come to an end in the short term based on macro-driven purchasing power. The digital money market is likely to be in a wide-ranging volatility. This kind of shock is more like endogenous chaos. It is expected that it will be difficult to see structural opportunities of scale.

Although the market is now standing at the same level as in 2016, the confidence of many blockchain project parties is collapsing. In the end of 2018 and early 19th, it is still possible to use the price of the currency to follow the market down, so the price does not follow the bit. The rebound of the currency has destroyed the confidence of all people. The diehard community of many project parties has also begun to waver and disintegrate. These phenomena are just the echoes of the historical path of 2016. The digital currency market will have structural changes, but the hype There has never been a "paradigm shift." All bubbles are essentially monetary phenomena.

There has never been a “paradigm shift” in speculation. Apart from the fact that Bitcoin has the property of non-financial assets, the small and medium-sized market capital continues to “lie down”, mainly because the economic environment in which the main speculative countries are currently located is different. During the recession, people generally have very low risk appetite. Countries' “recessive easing” can't resist deflation. The liquidity of speculation is actually marginal contraction . The people are not so much missing the altcoin, but rather the early days of the recession. Good Old Times, where financial freedom is prosperous, liquidity is abundant, and hot money is flowing around, such a loose economic environment may not be likely to appear before the end of the year. It is difficult for the market to be "chaotic" in the next six months .

Chaos is not an abyss, chaos is a ladder. Many people want to climb up but fail, and never have a chance to try again. They fall and die. Some people had the opportunity to climb, but they refused. They kept the kingdom, kept the gods, kept the love, and all illusions. Only the ladder exists, climbing is the whole of life.

Chaos is not a pit, Chaos is a ladder. Many who try to climb it fail and never get to try again. The fail breaks them. And some are given a chance to climb, but they refuse. They cling to the realm or the Gods or love.

Illusions. Only the ladderis real. The climb is all there is.

The complete investment opinion should be based on the full report issued by BlockVC. The source of the information contained in the full report and the source of the opinions are considered reliable by BlockVC, but BlockVC does not guarantee its accuracy or completeness, and the content of the report is for reference only.

In any case, this Push Information or the opinions expressed do not constitute investment advice for anyone. In no event shall BlockVC be liable for any damages resulting from the use of the contents of this Micro Signal, except as expressly provided by laws and regulations. Readers should not use this micro-signal push content to replace their independent judgment or make decisions based solely on this micro-signal push content.

This push content only reflects the judgment of the BlockVC Strategy Researcher on the date of the full report, and may be changed at any time without notice.

The copyright of this micro-signal and its push content is owned by BlockVC, which reserves all legal rights to this micro-signal and its push content. No institution or individual may reproduce, reproduce, publish, reproduce or quote in any form without the prior written permission of BlockVC, otherwise all adverse consequences and legal liabilities arising therefrom shall be borne by the person who revamps, copies, publishes, reprints and references.

Source: BlockVC Strategy Research Team

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Introducing bitcoin futures for physical settlement? LedgerX and CFTC entangled

- Analysis of more than 48,000 posts, the most popular on the foreign currency base Reddit is not BTC but it

- Has Dharma plunged too much? Decentralization is not enough, the mode is difficult to sustain is the key

- Twitter Featured: 15% off, cancel the Dutch shoot, Algorand open cuts?

- Algorand announced an early repurchase, Algo rose 45% in a short time

- How to understand the market cycle of cryptocurrency

- QKL123 blockchain list | The overall market heat is reduced, but the media heat is not reduced (201907)