The world after the Bitcoin inflection point

Author: Kay's Story

Editor's note: This article has been deleted without changing the original intention of the author.

In the article "Bitcoin's turning point signal will appear in December" at the beginning of the month, I clearly described the point that Bitcoin Ethereum encountered last week. At the same time, I also said that we will see confirmation of three things: one is that the US stock market ’s rising signal is confirmed, which will drive market sentiment, which will become Trump ’s highlight stage; the other is the smooth transition of the China-US talks, each of which Prepare for battle in 2020; the last one is that Bakkt Exchange gradually masters the current Bitcoin spot futures trading and the launch of Ethereum 2.0 upgrade.

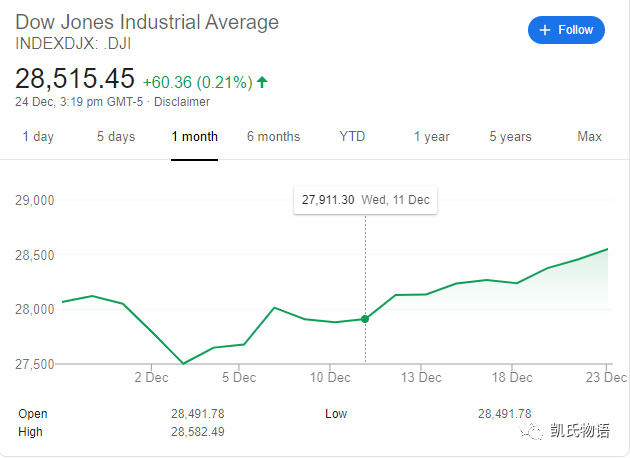

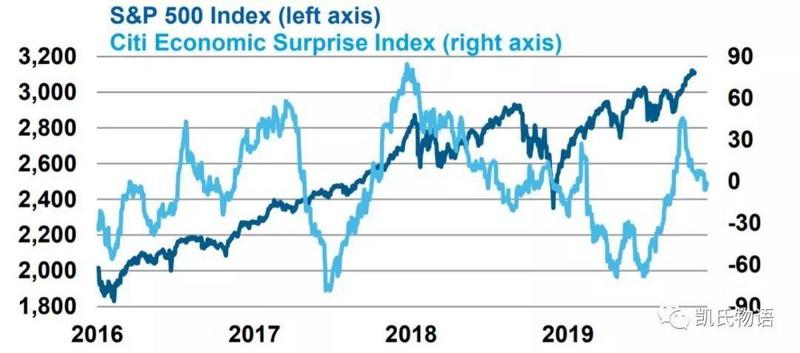

Today, let's review these three things carefully. US stocks confirmed the market's rising signal from a big sun line on December 12, again exceeding 28,000 points, and then continued to start rising prices for several days. The market has been very clear, and the technical pattern of killing shorts has finally been completed.

- Du Xiaoman Releases DeFi White Paper

- Research: 10% Bitcoin allocation in portfolio, which outperforms traditional asset portfolios

- Regulatory review: new US crypto bill, proposal to unify Muslim cryptocurrencies, European Central Bank's European chain

Why is there a rise? The Federal Reserve announced on the 13th that it will inject USD 500 billion of liquidity into the market over the next 30 days. This is the sign of the opening of the US QE. As mentioned in my previous article, now that the United States has expanded its watch, money has flowed into the stock market, which has brought about false prosperity, so US stocks will continue to rise. It is also because of the establishment of the market that we have the opportunity to see Bitcoin Ethereum. Up.

During the same period, we saw the plunge of Bitcoin and Ethereum. Only when the technical pattern of U.S. stocks is determined, the Wall Street bookmakers on Bitcoin Ethereum will sell as short as possible to collect as many chips as possible. Until I reach the point I said. Then there was a rapid rebound.

Remember, next year will be a year of long and short double kills. Therefore, in December, it is necessary to kill shorts first, so it will rebound quickly after falling, and rise after building a bottom.

In fact, the lowest point of last year's Bitcoin Ethereum did not appear around the Spring Festival in January and February, but in mid-December, exactly the same point in time, that is, Christmas in the West and before the Spring Festival in China.

In addition, the State Council Information Office recently issued a Chinese statement on the first phase of the China-US economic and trade agreement. The statement pointed out that with the joint efforts of the Chinese and American economic and trade teams, the two sides have reached an agreement on the text of the first phase of the Sino-US economic and trade agreement, and the United States will fulfill its related commitments to phase out the imposition of tariffs on Chinese products.

2020 is coming soon. Everyone has their own things to do, and the truce will be more beneficial to both sides. Don't you think what Trump is like, many years later, you may understand that in the future, there may not be a US president who understands affairs as well as he does.

Finally, we know that the daily exchange of Bitcoin on the Bakkt exchange has exceeded 5000, and now the news is talking about Ethereum 2.0. Do you think Ethereum is really dead? You see, the DeFi market on Ethereum is now over $ 10 billion. At present, any financial derivative scenario on Ethereum is a market worth more than ten trillion US dollars. Where does this go?

When we think about problems, we must pay attention to the change of information around us. Wealth is in the ever-changing message.

Have you noticed a phenomenon, especially the concentrated appearance in the past two months? The abdication of technology company bosses. On September 10, 2019, just 20 years after the establishment of Alibaba, Jack Ma officially stepped down as chairman of the board of directors of Alibaba Group. In October, Zhang Yaqin, Baidu's president, officially retired from Baidu. In December, the two Google founders left the company together. Just a few days ago, everyone also knew that Lenovo's Liu Chuanzhi retired.

An era is over. What's more important is that the Great Depression is coming soon, and the festival of preservation is very important for big brothers.

Do you remember the core of the Great Depression I mentioned earlier? 2020 will be the superposition of the explosion of the technology stock bubble in 2000 and the burst of the 2008 subprime mortgage crisis bubble, which is even worse than in 1929.

As of December 1, 2019, a total of 327 startups in China have closed. Among them, the largest number of companies closed in June, reaching 265, accounting for 81%. Among failed startups, finance, e-commerce platforms, and local life are among the top three, and these failed startups have more rounds of financing in the angel round and round A.

Among the more than 300 closed startups, financial industry companies top the list. This is not difficult to understand. As the country's efforts to improve Internet finance, especially P2P online lending, gradually increase, up to 1,200 P2P companies have closed down.

In April this year, Meituan ’s Baby Elephant Fresh announced the closure of five stores in Wuxi and Changzhou; in June, Shangpin.com announced its closure; in July, the chairman of the board, Zhang Zhihao, who was invited by Xian Shengyou, and other five management members said: Suspected of illegally absorbing public deposits, the name was taken away; in August, the star beauty beauty e-commerce platform Lebee Gateway, founded by host Li Jing and Vipshop paid $ 100 million, stopped. In December, Ji Hexian, a fresh food e-commerce company with a valuation of more than 80 million, held a full-member meeting, and CEO Tai Luyang announced that the company's financing had failed. Just last week, Taojiji, a star e-commerce startup, announced its failure.

These are typical signals. Let's think carefully about the stories of technology companies in the past 20 years.

Founded in 1998, Tencent faced various market pressures in the first few years of its early development. It was even forced to sell for a time, only because the middle price could not be negotiated, so it was not sold. No one knows how to make money through the Internet. Later, users began to grow rapidly until they found a way to realize advertising. Tencent was listed on the Hong Kong Stock Exchange on June 16, 2004. It was not until 2012 that China formed a BAT pattern. The interval is 14 years.

FACEBOOK was founded in 2004 and has grown rapidly since then. In January 2010, Facebook had 134 million unique IP visits, while Yahoo had 132 million. Facebook has surpassed Yahoo to become the second largest website in the United States, second only to Google, the number one. It went public in February 2012 with a market value of more than $ 100 billion, making it the largest IPO in US history at the time. The interval is 8 years.

Didi was founded in June 2012. In March 2014, there were over 100 million users. From 2015 to 2016, the battle for online car financing has become anxious. The market subsidy war has intensified the competition between Didi, Uber and Yida. In order to seize drivers and users, Didi and Uber have been conducting subsidy wars. . In August 2016, the battle for subsidies ushered in a standstill. Didi Chuxing officially announced its acquisition of Uber China. In mid-2019, Didi plans to raise US $ 2 billion with a valuation of US $ 62 billion. It took 7 years.

Mobike was founded in January 2015 and has grown rapidly, with 232 million registered users worldwide. It was wholly acquired by Meituan in April 2018. The highest valuation is $ 3 billion. It took 3 years.

Taojiji was officially launched in August 2018, reaching a horrific number of 130 million users in just a few months. In October 2019, the capital chain broke and closed. It took 1 year and 2 months.

The general interpretation is that technology is developing faster and faster, and the development of the market is dying. What if we understand these cases in turn?

The lower and lower leverage available to the market, it means that the time that capital can wait to obtain the same rate of return is shorter and shorter. On the other hand, there are fewer and fewer people taking over the market, so they can only die.

The first companies to find the Internet to develop business models have become today's giants, such as Tencent Ali. The new entrants behind are using technology and algorithms to speed up efficiency and reduce costs, such as today's headlines and Meituan. When the market develops into all aspects of society, what future is there for this technology?

For ordinary people, that's it. When a technology can be understood by people far away in rural areas, it has actually reached its limit. What other opportunities can be invested? Kuaishou was born for so many years, in the past who would use this software in the city. Everyone is playing now, and many Internet celebrities rely on fast hands to make money.

This shows that the traffic is extremely saturated, and it is actually a very dangerous signal. The market is about to collapse, and the game will soon break the balance and reorganize a wave of redistribution.

When it comes to redistribution of wealth, we must talk about real estate. Do you think what is the core turning point of real estate policy? It's 2016. Before 2016, everyone felt that real estate was the national economy and the people's livelihood, and no mistake was allowed. In fact, don't be deceived. In 2007, Americans firmly believed that real estate would not collapse, and in the end the subprime mortgage crisis did not occur.

The essence of real estate is the storage of money. House prices are an important way to control the flow of money.

After 2016, a large amount of bank money was used for personal real estate loans. This must be a good asset in the bank. But to be more frank, 2015 is the turning point of global recession to depression, and the world is talking about supply-side reforms. So when we look at the 2016 National Credit Report, the words are very harsh. Do not engage in flooding, do not engage in real estate financialization, and adhere to the principle of not speculating in housing. So, except for areas with special advantages, people who buy a house after 2016 are basically on guard.

Some time ago, I went to Wenzhou for inspection, and the once-famous real estate speculation group was now stunned. If real estate declines sharply, individuals will certainly not be able to support it. After the cessation of supply, banks will run into bankruptcy and bankruptcy problems, which is very serious. Corporate bankruptcy is tolerable, and bankruptcy is certainly unacceptable. So the simplest way is to devalue the RMB.

From 1: 6.14 against the US dollar in 2016 to 1: 7 today, a 13% decrease. Boil frogs in warm water to ensure the stability of people ’s livelihood, but at the same time firmly squeeze out the real estate bubble, engage in targeted reductions in quasi-restrictions and interest rates, and squeeze the money soaked in real estate into other investment products.

Before 2016, did you often hear the news of hype about antique calligraphy and paintings, and these two years have basically disappeared. This year everyone heard the most about speculation in coins and shoes, which shows that funds are looking for faster and faster circulation for export.

When the environment is bad, everyone wants to have liquid investment products. The more illiquid investment products, the harder it is to sell.

I wonder if everyone knows something called Minsky Moment. Named after American economist Hyman Minsky, it describes the moment when the value of assets suddenly collapses, which is the burst of the well-known economic bubble. Minsky believes that under the long-term stable development of the economy, the gradually emerging financial speculation may lead to an increase in state-owned debt and an increase in the leverage ratio, and then trigger a financial crisis and subsequent long periods of deleveraging risk.

At the end of 2018, the overall leverage ratio of China's various sectors was 150%. Last year, our GDP was about 90 trillion yuan, and our debt was 1.5 times GDP. This is the total debt of our company. The United States last year was 247.6, Germany was 174.1, Brazil was 154.1, India was 125.4, and Russia was 78.5. As you can see, this leverage is generally controllable, but on the verge of danger. China is going through the fourth round of deleveraging.

In the past, when China's economy was good, we adopted a more aggressive monetary method. The RMB depreciated sharply. In 2014, it reached 6.14 against the US dollar. The radical monetary policy is that the currency liquidity released after 2008 has entered real estate and large Infrastructure projects. If the control was good at that time, deleveraging today would not be so painful.

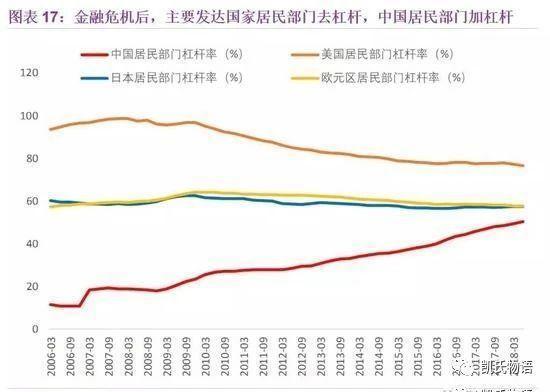

In 18 years, the leverage of China's resident sector was 64.5, and that of the government sector was 39.4. But many hidden liabilities of government departments are counted on the corporate head. If the housing provident fund, margin financing and securities lending and loans from financial institutions are put in, the leverage of the residential sector will be very high. After the leverage of the residential sector reaches 65, the possibility of a financial crisis is twice as high as that of the corporate sector. This is the core reason why the country has been emphasizing financial stability, deleveraging, and real estate bubbles in the past three years.

At this time, many people said, why don't we print more money to solve this leverage problem. Anyway, currency is produced by the state, as long as money is printed. Many people think that currency is valuable because it has a national credit endorsement as a carrier.

In fact, the endorsement of national credit is useless, and any currency must have anchor points. No anchor is like waste paper. Only when the currency is stable can it have a wide circulation value.

You see, Venezuela has been desperately printing money, and it finally turned into hyperinflation. As the country with the world's largest oil reserves, the real reason behind the collapse of Venezuela is neither Maduro's corruption nor US sanctions, but a model of high investment and low profit. Over the past decade, the global petroleum industry has moved from a stage where large-scale, low-cost oil can be extracted to a stage where the cost of extraction is becoming increasingly expensive. For a country with a single economic source, such as Venezuela, falling oil prices and profits have caused it to face a double blow.

Politics is the superstructure of the economy, and the core manifestation of the economy is currency flow. Only flowing currency is valuable.

The reason why Venezuela becomes what it is today is that no one wants to use its currency, and its currency anchor, oil, has another problem. If there is no other incremental market, it is the people's digestion of all the currency produced, and this country does not have enough incremental population dividends. As long as it will collapse, the national government will cut its own national chives.

Why dare we use RMB today? It is not a matter of national credit endorsement. It is because we have entered the WTO in the past two decades. Before the 1990s, before China's accession to the WTO, our consumer goods were scarce, and the main production and consumption came from domestic trade.

Thirty years ago, foreign capital came to China. It was trembling. Second, it was unknown what to buy. You think, land belongs to the state, resources belong to the state, the stock market has just opened, and the financial system is not perfect. The differences in ideology between the East and the West for a long time have made foreign capital both unfamiliar and afraid of this mysterious ancient country in the East. Who dares to use RMB?

In fact, as early as 1980, the yuan against the US dollar reached an all-time high of 1: 1.49. After that, the recovery cycle and boom cycle of the entire Kangbo cycle began to decline all the way until 2004, that is, the peak of the boom of the Kangbo cycle reached the lowest point of 1: 8.27. This stage also corresponds to the rapid development stage of China's demographic dividend.

It was not until 2001 that China joined the WTO. The renminbi has found an extremely important anchor point, which is the US dollar.

Does anyone have an impression, what was the price of the house in 2001? The houses in Beijing, Shanghai, Guangzhou and Shenzhen are only 2000-3000 yuan per square meter. Today, of course, if you knew that today's house is so expensive, you should spend all your money on buying a house. But you have to know that under the circumstances, you can have a mouthful to eat. At the end of the last century, China launched a vigorous wave of laid-offs, and many families are facing unemployment and reemployment problems. The house is not the core contradiction at all, it is the survival.

At the end of the last century, many people said that state-owned enterprise workers will not be laid off, and the state will not allow it. and after? Where are the children of the family who did not change their minds then? History never shifts by individual will. In a large environment, it is the most important thing to take advantage of the trend.

It is precisely because of China's accession to the WTO that the United States will buy a large number of consumer goods with US dollars. China helps the world produce consumer goods. Where can there be any G7 in the world, only G2, other countries are leftovers. In fact, to put it plainly, the United States 薅 Chinese wool, and China anchors the dollar 薅 world wool. We have been the world's largest net exporters for the past two decades. Other countries have looked at the superb industries that have been or will be silently killed by us in the past or the future. But in the future, we may also kill the United States, so the boss is in a hurry.

Why is RMB worth? It's because the country produces 7 yuan for every dollar of foreign trade. The US dollar is to be placed in the foreign exchange administration, and the production of the renminbi can be consumed by everyone. Otherwise why do we need foreign exchange control. This is the ins and outs of everyone's currency. If you send out more money, it will become inflation. If you send out more money, it will become hyperinflation.

Do you see why no one wants the North Korean currency now? Because he does not have a credit system and no currency anchors. Whenever North Korea used the renminbi as an anchor point, maybe reform and opening up really started, and everyone dared to reserve the Korean currency.

Of course, today we see that when the country is rich, we have a lot of leverage. Now that the country is in the process of deleveraging, everyone is better off not borrowing. Now, everyone borrowing means paying for the leverage of the past 20 years. Who is not on guard? It is such a reason to buy a house after 16 years.

What should you do if I am on guard? Then I have to tell you that there are two possibilities: one is that you are lucky enough to support the end of this round of the Great Depression until the beginning of the next round of economic expansion. For ordinary people, you feel that the economy is very cold, and you feel that you have to tighten your belts to live. In fact, this economic cycle has almost developed. Economic development and market perception are generally lagging. The average time is 3-4 years. In terms of the real estate cycle, it is about 3 years. From the stock market secondary market, it is about 4 years.

You see, just a few days ago, a heavy document was published: "The Opinions of the CPC Central Committee and the State Council on Creating a Better Development Environment to Support the Reform and Development of Private Enterprises" was released in full. The full text is more than 5,500 words, and there is only one core: supporting the reform and development of private enterprises. On the 23rd, the State Council Customs Tariff Commission announced that from January 1, 2020, more than 850 goods will be subject to a tentative import tax rate below the MFN tariff rate. This shows that the country is ready for various adjustments and changes.

2015 is the time when the current economic cycle declines into depression. The world is emphasizing supply-side reforms. In 2016, the country began to emphasize financial stability, not housing and speculation. In 2017, the United States began to enter the cycle of interest rate hikes. In 2018, Sino-U.S. Sweaters were in friction. In 2019, there was an inflection point in China's real estate, and a global inflection point appeared. These are signals and are predictable.

The Great Depression will begin in the second half of 2020, and the global market may experience the deepest decline in 2021. This will be the best time for global assets to bottom out.

Then this second one is the real dry goods to be discussed next.

What is the dollar's anchor now? After the collapse of the Bretton Woods in 1970, it was oil. Today, do you think that countries in the world still believe in the US dollar? Credit currency Credit currency, without anchor there is no credit. Now that the US dollar has been surging all the way, all countries are moving gold to their own countries to break away from the US dollar system and stabilize their own currencies.

The same is true of China. In the past two years, it has been selling a large amount of US debt and buying gold to stabilize its currency. This is the anchor point. Any currency must have an anchor point.

The reason why gold is chosen as the anchor of global currencies is because its storage capacity is basically constant and it is also scarce. Metal properties are not volatile and easy to save, which is enough to be the anchor of currency. Most importantly, it has the consensus of global humankind. But gold has a very important disadvantage for the United States today-that is, it is not monopolistic.

The reason why the dollar can become the world currency is because its anchor is oil, and the United States has controlled oil countries through weapons. When countries around the world need oil, they need the dollar. When the oil price plummets and the US dollar loses support due to a large number of over-issues, as long as countries begin to return to gold, they can leave the US dollar system. How can the dollar be the world currency? Dollars without anchors are like waste paper.

Then the problem comes. If gold is not desirable, oil will gradually lose its stability. What does the dollar need to choose as a currency anchor? There is only one answer:

Bitcoin is the only currency anchor that the dollar can choose from in the future.

Bitcoin today has three very important elements: 1. It is growing into a global consensus at a rate that is visible to the naked eye. It took only ten years from Satoshi Nakamoto alone to 40 million digital currency participants worldwide today. . In the next decade, the size of this fission will be even larger, reaching or exceeding 350 million people. 2. The total amount is constant, and the data development is determined by the machine algorithm. It is a completely autonomous network, and no human can intervene to change. 3. 18 million bitcoins have been mined worldwide. The remaining 3 million will be mined in the next 100 years. Among the bitcoin mined, only 15% are held by giants.

This means that today's Bitcoin market is actually a super decentralized market, and the consensus it is about to establish is broad enough. The most important thing is that the miner is no longer important. Whoever controls the fiat channel of Bitcoin will control Bitcoin.

This is the core reason why we see the United States first to open the Bakkt exchange today. As I mentioned in the article "90 years ago, history is actually Bitcoin Apocalypse," the Digital Gold Reserve Act is likely to appear in 2025.

In fact, since August 18, governments of various countries have started the battle for bitcoin. The United States is hoarding bitcoin in large quantities, and the country has also made timely comments to support the development of the blockchain. In the near future, we will see the possibility of the emergence of national digital currency exchanges.

Have you noticed that the European Central Bank claimed last week that it is possible to develop a Central Bank Digital Currency (CBDC) payment system that protects user privacy. In fact, from the beginning, the European Central Bank got it wrong. Of course, this has a lot to do with the EU's own system, and everyone is concerned about privacy protection.

Is the EU's own digital currency valuable? Yes, but not so much value. why? Because no one except the European Union itself uses this digital currency. This naturally determines that this digital currency will eventually be replaced. Going back to what I said earlier, currency must have a wide range of circulating value to make sense. In today's European Union, there is no world factory in China, and even a ball-point pen cannot be produced. Who uses the EU's digital currency in large numbers? Or, to put it more simply, who reserves a lot of euros?

If the EU's digital currency is only a private payment method for the Euro, it means that its anchor point is still gold or the US dollar, and if the US dollar is to abandon gold or oil, the only option is Bitcoin. In other words, in the end, the anchor of digital currency in the EU will return to Bitcoin. Then the EU's digital currency is at most the European blockchain-based WeChat payment or Alipay payment. Without the foundation of the world currency, there is no possibility of internationalization.

Only one country in the world is qualified to be a global digital stable currency, which is China's DCEP.

Why is China eligible for DCEP? Because China is the factory of the world. Today, we can complete self-sufficiency and radiate the world for most industries in the world. Vietnam and India have called for so many years to replace China. What about the shadows? This is determined by the basic factors of a country. The history of China over the past five thousand years has determined that we have gone through a path that no other country in the world has followed. We have precipitated the world's earliest banking and monetary policies. At the same time, we have not had any historical baggage, such as religion. It is a country where the Phoenix Nirvana is reborn.

Because the world needs our products, DCEP will flow to the world. This consensus did not emerge because of the emergence of DCEP, but the consensus of the world's factories has been formed before the emergence of DCEP. Because China's Belt and Road Initiative today, our investment will flow to these countries, which means that these countries will definitely accept DCEP, otherwise they will not develop themselves. And our country has a large population base and application scenarios to use DCEP consumption. The three components of a country's GDP: consumption, trade, and investment are all solved.

If the renminbi is to be internationalized, it will face two important issues. One is to float freely and not to be controlled by a government. The other is to have a carrier. Currency must have a carrier of value, that is, an anchor, in order to be trusted by the world. Having said that, do you understand?

The ultimate form of DCEP is not the M0 of the RMB, but the anchor of the RMB. This is the core of the RMB becoming the world currency: using the blockchain to complete an autonomous stablecoin network, not controlled by a certain government, but trust is given to the machine as a carrier, freely floating, on-chain supervision, and going down to the human economy An era.

I believe that not many people in the world today can make such a point of view, and this decision will be extremely difficult. This is the mission that history has given to the country, and it is also the path that human beings must take to the next stage. I believe that the country will have enough deep thinking and strong wisdom to complete the final decision.

This is exactly the decision made by the 94 countries in 2017 when the national foreign exchange reserves decreased sharply due to the conversion of Bitcoin. At that historical point in time, we have embarked on a fork in the bitcoin anchor. This is both an accident of history and a necessity of history.

The market value of gold is 10 trillion U.S. dollars, which is enough to become the anchor of currencies around the world, which in turn generates global economic activities. The total market value of Bitcoin in the future will also reach or exceed this number, and become the anchor of currencies around the world. Along with this, there will be a DCEP of a fully autonomous blockchain stablecoin network.

When DCEP appeared, my judgment was from the end of 2020 to 2021. Because the emergence of DCEP must accompany the global depression. This will be its initial form, representing M0 of the RMB. When the United States begins to appear similar to the Digital Gold Storage Act, it will be the best time for DCEP to become the anchor of the RMB.

This means that in the next decade, Bitcoin and DCEP will eventually have a battle. Only a fully autonomous currency network will survive. Combining benefits both, but fighting hurts. And the end of this battle will start the next round of Kangbo's cycle.

If you let me guess, I think both will survive and both will attract broader consensus. After all, there will be room for 7 billion people in the world to choose their own consensus, not necessarily one or the other, or both. War is not necessarily a fight between life and death, but may be a great alliance in human history. Humans and machine networks, represented by the state, jointly opened the consensus of the next era.

I have always emphasized that in the past 10,000 years of human history, there have been only four types of currencies: value storage currencies represented by gold, operating system currencies represented by silver, and application systems represented by bronze. Currency, value stable currency represented by credit currency.

And there are only two types of the most widespread human consensus: one is gold, and the other is the global stablecoin. In fact, we carefully trace back. In the entire human currency war, the West and the East have been fighting with gold and silver or bronze or paper money, but today this story has moved towards Bitcoin and DCEP.

Today many friends are asking me why Bitcoin is worth buying. I think this article has given you all the answers.

After this round of the Great Depression, Bitcoin will become the anchor of currencies around the world. We buy gold when the economy is uncertain, but what we need more is bitcoin.

Since 1900, the US dollar has lost 98.2% of its purchasing power, and the price of gold was almost 54 times that of the time. The stories that humans have seen in gold in the past 100 years will happen to Bitcoin without exception, and the speed will be faster and the increase will be more obvious.

When the economy is uncertain, everyone will buy assets with faster liquidity. Bitcoin is not only a global currency asset with 24-hour liquidity, but also the best current asset in circulation, and it is also the anchor of future global currencies. A cognitive revolution that replaces gold for the next century. We are standing on the eve of history today. What is your reason not to join this network and buy Bitcoin? Don't forget that humankind has come to be the earth's hegemon today by imagination.

The position of Bitcoin Ethereum we see today may never be seen again in the future. After this inflection point has passed, the blockchain will start its historical process with the Great Depression of the human economy, and will not be transferred by any national government or individual will. At this moment in history, any short-term judgment of long and short is meaningless. Don't forget the human process because of short-term interests. Anyone can change their destiny only by two words-that is the trend.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Lenovo Group Blockchain Puzzle

- Everbright and Zhongying interconnected and blew up, exploding A-share "currency-related" companies

- Ripple Puzzle: Why is Ripple not short of money financing?

- 2 days countdown! 64.8% of this New Year's Eve speech are new friends outside the circle

- Ethereum 2.0 to be classified as securities by the SEC? Lawyers say it is highly likely

- Babbitt Original | In the era of digital currency, memories and future reflected by a wallet

- Xinbaoyuan He Baohong: Foreseeing 2020, the turning point has arrived