This "throughput" bitcoin machine has an annualized income of 250%, which is all over the world and troublesome

Only $ 50 on hand wants to buy bitcoin and does not want to register for an exchange account; I only want to bring a mobile phone when traveling abroad, no matter which country I go to, I can get the local legal currency …

These seemingly unrealistic ideas are being completed by a magic machine. They are Bitcoin ATM machines distributed in more than 30 countries and regions around the world. Their existence is to provide convenience for users and operation. While providing huge profits, the merchant also realized the payment concept of Bitcoin in the Satoshi Bitcoin white paper.

With the popularity of cryptocurrencies around the world, Bitcoin Cash, Ethereum, Litecoin, Monero, etc. can also be traded through ATM machines. Cryptocurrency ATMs do not exist in mainland China. The cryptocurrency ATMs mentioned in this article all occurred in areas outside of mainland China.

However, with the rapid increase in the number of Bitcoin ATM deployments worldwide, issues such as taxation, money laundering, and double spending attacks have also followed.

- Exploration | Web 3.0 and the blockchain-driven future

- New Year's largest blockchain funding comes, Lightnet receives $ 31.2 million in Series A funding from six large institutions

- 2019, I'm on the scene | Blockchain memories in five cities: history and future

1 the world's most popular cryptocurrency ATM

In 2013, the world's first Bitcoin ATM machine was launched in Canada, and opened in a small cafe in Vancouver on October 29 of that year.

Since then, cryptocurrency ATMs have spread around the world with rapid momentum, and have increased exponentially. Among them, there were 4 cryptocurrency ATM machines worldwide in 2014, 325 in 2015, 499 in 2016, 963 in 2017, 2058 in 2018, and 4,103 in 2019. As of now, the number of global cryptocurrency ATMs has reached 6,436 The installation speed of cryptocurrency ATM machines has also increased at a rate of 7 units per day, and it is expected that this data will continue to grow.

Cryptocurrency ATM machines look like this!

These ATM machines are mainly distributed in the United States, Canada, the United Kingdom, Australia, Spain, Switzerland, etc. There are more than 20 ATM machine manufacturers, of which Genesis Coin has the highest output, producing 33.3% of the total number of ATM machines, and General Bytes produces all ATMs. 32.5% of the machine, Lamassu produced 7.4% of them.

An industry about ATMs is taking shape.

Regarding the constant landing of ATM machines, Twitter host Dan Tapiero said when he saw the Bitcoin ATM machine next to the Greenwich old- fashioned financial center gas station: "Change is coiming (the future has come, just Not yet popular) ". Weibo blogger William Blockchain said that letting people see for themselves that Bitcoin can be used to take out cash to spend, which can eliminate the negative impact of the media on cryptocurrencies and is the best publicity for cryptocurrencies.

So, why did ATMs land at an exponential speed and were well received?

First , it is easy to apply.

On the tubing, a Mr. Shi who traveled to Hong Kong showed his tubing subscribers how he could get the Hong Kong dollar in just a few seconds with a mobile phone and a bitcoin cold wallet.

In the video, Mr. Shi first selects the language on the machine (optional languages include English, Chinese, French, German, Korean, and Japanese), enters the withdrawal page of the ATM, selects the withdrawal amount, gets the withdrawal QR code, and then uses it The bitcoin cold wallet in the smart phone scans the QR code, clicks the send button, and the ATM automatically spit out the Hong Kong dollar that Mr. Shi wanted in the next second. The whole process is very smooth, without any sense of contradiction. What Mr. Shi needs to pay is the equivalent of a bitcoin in a cold wallet and a small transaction fee.

The entire process is like operating a new type of ATM, and its convenience is even higher, because you do n’t need a bank card or even remember the password when using a Bitcoin ATM machine—all you need is the entire process Smartphone with cold wallet.

In fact, the appearance of bitcoin ATMs is similar to that of fiat currency ATMs, but unlike bank ATMs, which are “embedded in a concrete wall”, the security level of these machines is not as high as that of bank ATMs, and generally only It is fixed to the ground or wall with several nuts and is smaller in size.

Appearance of the withdrawal room of a Bitcoin ATM in Hong Kong

In addition to withdrawing money, these ATMs can also "save money". The process of saving money is almost as simple as withdrawing money.

The process of saving money is just the opposite. After providing the address of the cryptocurrency wallet or choosing the address provided by the ATM machine, the user can deposit cash into the cash machine, and then obtain Bitcoin, Bitcoin Cash, Ethereum, Litecoin, etc. Currency.

Convenience is just one of them. Through investigation, the author found other real reasons for promoting the development of the industry.

2Industry driven by huge profits

"In the United States, it is not difficult to install a Bitcoin ATM, and in some places, you don't even need to apply."

Harrison Blaufuss, a junior student at the University of California, Santa Barbara, who operates cryptocurrency ATMs in the United States, wrote on social media.

Harrison Blaufuss applied for the installation of an ATM machine a year ago. According to reports, the average daily transaction volume of this ATM machine reached 600-900 US dollars. As long as the various costs in operation are calculated, they will soon start to make money.

In the United States, applying for such a machine is also very simple. Go to the US Department of Commerce website ( https://www.commerce.gov/ ) and apply for a currency trading license. In some U.S. states, the state government treats Bitcoin ATMs as vending machines, and does not even require a currency transaction permit—of course, the premise of the transaction is that your money is legitimate.

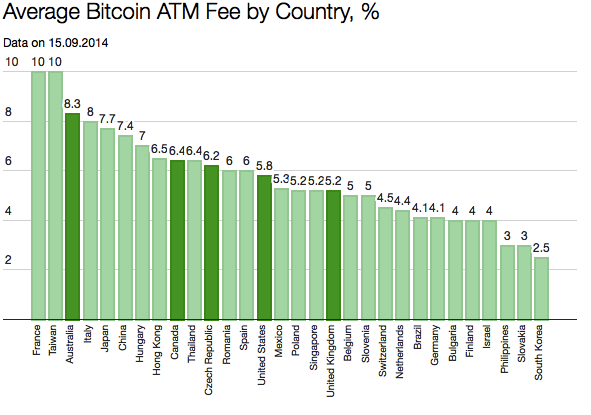

Australia rate 8.3%; Canada rate 6.4%; Czech rate 6.2%; US rate 5.8%; UK rate 5.2%;

So how profitable is Harrison Blaufuss' business? To get accurate information, you must account for costs and benefits, including ATM machine input costs, site rental costs, average daily transaction volume, and maintenance costs.

According to the Bitcoin ATM transaction rate statistics previously provided by coinatmradar, the ATM transaction rate in North America is generally 6%, while in Australia, the rate is as high as 8.3%, which means that for every 100 US dollars you trade, Pay the agent $ 6-8. The cost of an ordinary bitcoin ATM is approximately USD 4,000, which is calculated based on an average daily transaction volume of USD 667. The venue rental costs, maintenance costs and other comprehensive costs are calculated at USD 100 / month.

Through the costing calculator provided on the coinatmradar website, we find that Harrison Blaufuss' profitability is amazing.

One of the most dazzling is the payback period. Such a machine with an input cost of 4,000 US dollars, the payback period is not even half a year-only 5 months.

According to the 10-year average of the investment recovery cycle of traditional industries, such a return cycle is simply a huge profit!

Of course, the profitability of this ATM machine is also amazing. Harrison Blaufuss, a junior at UC Santa Barbara, passed the cost recovery period of the first five months. After that, he will make a net profit of $ 9072. If he had 100 such machines, he would make $ 900,000 a year.

Of course, the real business environment may not be so simple, but in any case these data reveal a truth-the reason why cryptocurrency ATM machines can be spread all over the world so quickly and convenient to use is not the whole truth.

With the promotion of cryptocurrency ATMs, new challenges have also been encountered at the regulatory level.

3 ATM machine raises tax and double spend issues

Citing a Bloomberg report on November 15 , 2019, John Fort, the head of criminal investigations at the US Internal Revenue Service (IRS) , previously stated that the IRS is investigating tax issues that could arise from Bitcoin ATMs and kiosks.

Fort said the IRS is working with law enforcement to investigate the illegal use of new technologies such as cryptocurrencies, and said:

"As long as you can invest in Bitcoin to buy bitcoin, that's the subject of our investigation. Obviously, we may be interested in people using bitcoin self-service terminals. The source of funds for buyers, operators of bitcoin self-service terminals (both Within our investigation). "

Internal Revenue Service (IRS)

According to Bloomberg, there are at least one such machine in every major city in the United States and 4,274 in the United States.

Fort explained that cryptocurrency ATM services must comply with the KYC rules: "They must adhere to the same level of KYC (real-name registration) and AML (anti-money laundering) regulations, and we believe that these regulations in the service have not been fully implemented." The tax issue is an emerging risk factor in the cryptocurrency field, and anonymity increases the likelihood of non-compliance.

In addition to the tax issues that the IRS is concerned about, ATMs are another accomplice in crime.

Globalnews was quoted as saying that on March 13, 2019, police in Calgary, Canada, cracked down on a cross-regional cybercrime. The criminal gang used a Bitcoin ATM to conduct fraudulent transactions.

The crimes against Bitcoin ATMs occurred mainly in seven cities in Canada, and nearly half of them occurred in Calgary, Canada. Criminal gangs carry out cash withdrawal operations through Bitcoin ATM machines placed on the street, and within 10 minutes of Bitcoin transaction confirmation, they receive cash on the ATM machine and then cancel it, causing Bitcoin ATM machine providers to lose 112 fraudulent transactions US $ 195,000 (about RMB 1.31 million).

Police believe that the four suspects carried out a "double spend" attack, that is, one person withdrew money from a Bitcoin ATM machine, and then cancelled the transaction remotely before the Bitcoin ATM machine company processed the withdrawal.

After investigation, the reason why the four suspects were able to achieve double spending in such a simple way is related to the Bitcoin RBF function.

RBF is the abbreviation of Replace-By-Fee, which is literally translated as cost substitution, which means that you can replace the same unpackaged transaction that was previously issued by paying a higher fee. When the user is sending a bitcoin transaction, but the fee set is too low, the transaction cannot be packaged by the miner, or the miner needs to wait in line for a long time before packaging. However, at this time, the Bitcoin receiver needs to get Bitcoin as soon as possible, and the RBF function allows the sender to send a transaction with a higher handling fee to replace the previous transaction.

There is no right or wrong tool, the evil and greed in the tool user's mind.

As the acceptance of cryptocurrencies gradually increases, the number of cryptocurrency ATMs will inevitably continue to increase, whether it is tax issues, high profits caused by high fees, or criminal issues, as the industry becomes more formalized and developed These issues will certainly be curbed.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- 2020: Borderless State of DeFi

- IBM's qubit computer "Raleigh" implements 32 quantum volumes. Will it pose a threat to Bitcoin security?

- Introduction to Blockchain: Shenzhen Stock Exchange 50 Index

- This is the basic ability to ensure that the cryptocurrency does not return to zero. Bitcoin also needs to be continuously improved.

- What if your visa is an NFT?

- View | stateless Ethernet Square: a binary tree experiment status

- Bitcoin computing power hits record high again, global high debt level boosts Bitcoin demand