The Flow of Traffic behind Tip Coin User Profit Expectations and Internal Market Game

Traffic and Profit Expectations in Tip Coin User MarketAuthor: @Confetti4bot

Flow Conduction of the Web3 Community in PVP Mode

Recently, the number of stablecoins in the cryptocurrency market has been steadily shrinking. Without new incremental funds injected, traders’ profits mainly rely on internal market games, which we call the PVP mode. In the PVP mode, due to the lack of external funds, every short-term speculative opportunity becomes particularly valuable and becomes the focus of traders’ attention. In such opportunities, information transmission is key. So, how do these speculative information spread and propagate among traders?

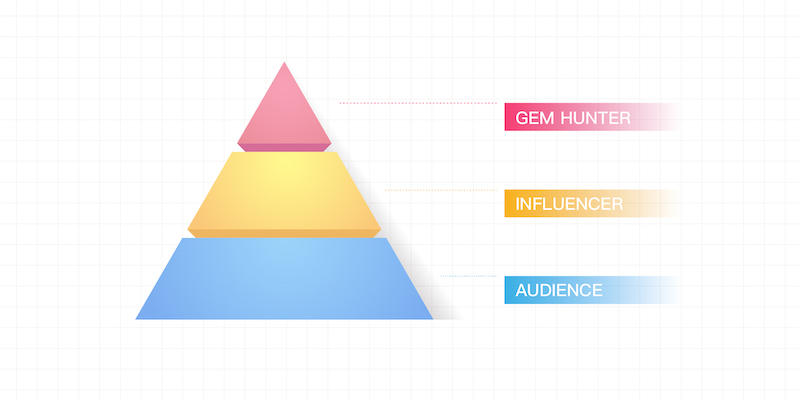

In the cryptocurrency market, the process of information transmission forms a hierarchical structure. From the source to the end, there are obvious differences between the recipients of the information and their interests.

- Gem Hunters: These players are the first contactors of information. They are usually able to quickly capture opportunities and buy in when a project is still in its initial stage or liquidity is first deployed. Their investment amounts are usually small, about 0.1-1 ETH, and when they buy in, the market value of the project is low, usually between 2-20 million USD. Once the price stabilizes, these players choose to exit with profits.

- Influencers in the CT community: When the market value of a token has stabilized and demonstrated significant growth potential, these influencers will take notice. Due to the potential of these tokens, the influencers in the CT community will promote them publicly to enhance their influence in the community.

- Audience in the CT community: These are the end recipients of the information. They are mostly passive information consumers. They rely on the recommendations of the influencers and then make investment judgments based on the information they have obtained.

These three levels together form the information transmission and decision-making mechanism in the cryptocurrency market.

- Approval of Bitcoin ETF may trigger the withdrawal of $1 billion in funds from Grayscale’s GBTC.

- LD Capital Will the market remain bearish until the end of the year? What is the core of market speculation?

- The Rebirth of TON Renewing Ties with Telegram, Enabling Web3 Applications for 800 Million Users

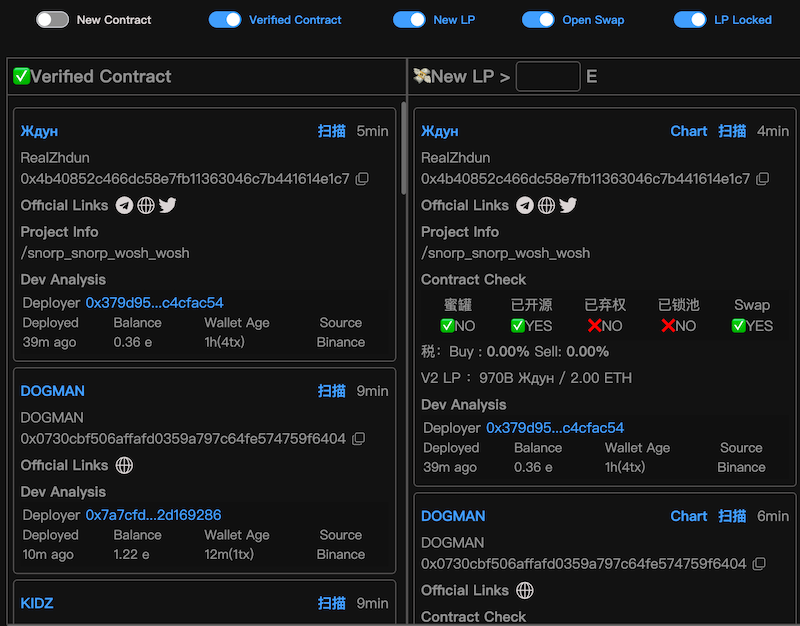

To help readers better understand, this is the interface commonly used by gem hunters:

The Social Mining Algorithm of Tipcoin

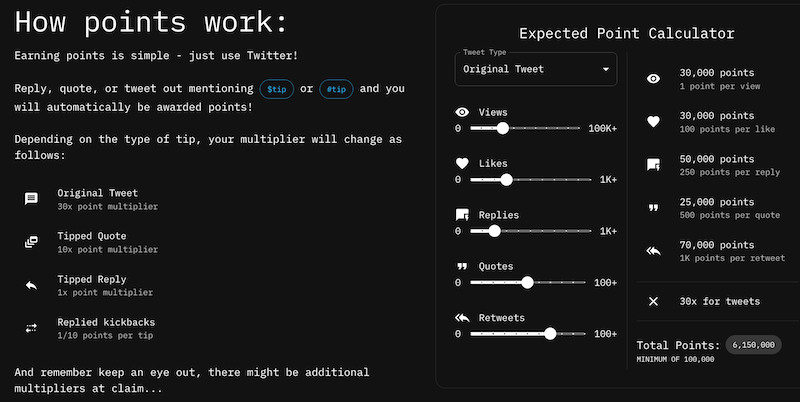

In addition to the 10,000 point reward obtained from the initial tweet, TipCoin also provides four ways for users to earn additional points through “daily tasks”. Unlike Epoch1, in Epoch2, points will only increase within 24 hours after the original tweet is posted. Each task, such as reading, liking, replying, quoting, and retweeting a tweet, has a detailed point calculation formula, which can be viewed on the official website.

- Original Tweet: Posting original tweets with the $tip and @tipcoineth tags is the main way to earn points, with a base point multiplier of 25. Depending on activities such as reading, liking, replying, quoting, and retweeting the tweet, additional points will be given. Up to 5 such tweets can earn points per day.

- Tipped Quote: If your original tweet with the $tip and @tipcoineth tags is quoted by others, you can earn points with a base point multiplier of 10. Up to 10 such quotes can earn points per day, with a maximum limit of 1 million points. However, excessive quotes may result in points deduction, with a maximum deduction of 10,000 points.

- Tipped Reply: Replying to others’ tweets with the $tip and @tipcoineth tags can earn points with a base point multiplier of 1. Up to 50 such replies can earn points per day, with a total point limit of 25,000. In addition, these replies can also earn additional points based on factors such as reading and liking.

- Replied Kickbacks: When you receive replies from others, you can also earn points, but the multiplier is 1/10 of the original points. There is no daily limit for this method of earning points, and these points will not be displayed on the user dashboard.

The Secret Behind the Success of TipCoin

Facing a limited budget, achieving maximum exposure is undoubtedly a challenge. If I had enough funds, I could choose to sponsor Zhou Yuyu’s F1 car or name the Miami Heat’s stadium. But the reality is that my budget is limited. So how do we solve this problem? Here, I would like to share a keyword: expectation.

Take TipCoin as an example. If it has already issued tokens, users can clearly calculate the $TIP earnings they can get by publishing tweets. If this income exceeds the market price, there will be a large influx of people until the resources are exhausted; otherwise, if it is lower than the market price, TipCoin may be overlooked.

And points, initially promoted by Blur, have become an effective strategy to attract users to achieve specific goals. Point mining has two major advantages: 1. It can guide users to achieve predetermined KPIs without explicitly revealing the calculation formula; 2. Although points continue to grow, the corresponding token quantity is fixed, allowing users to engage in strategic games within a limited budget.

Creating enough expectation is the first and most crucial step.

TipCoin Product Analysis

TipCoin’s product page belongs to a product with strong implied messages, just like the pink lights in a barbershop, the lewd smile of a massage parlor manager, and the second floor of a water house: the homepage of the product clearly shows a message: we have airdrops, what do you need to do to get more airdrops, and are you eligible to receive them.

Although this product design is intuitively simple, it is often overlooked by many Web3 product developers. You may ask why this point is worth mentioning separately. The answer is: because many Web3 products do not fully understand and consider their target users. I fully understand that as developers, we always want to present every detail and every feature of the product to the users. But in reality, Web3 users often pursue efficiency, and they don’t have much patience to delve into every detail. (Usually, the product details you develop are not as good as the user experience of Web2 products) So, for developers, the key is to highlight the most important and core features (preferably related to transactions and tokens), simplify other operations, and make the user experience smoother.

Token Economy

35% of the TIP tokens will be used for platform rewards, 5% will be allocated to the market, and 5% will be allocated to the team’s lock-up. The remaining tokens will be allocated to three Epoch rewards. The distribution ratio of TipCoin’s airdrop tokens will be adjusted according to different Epochs. In Epoch 1, 15% will be used for liquidity provision and 15% for airdrops; in Epoch 2, 20% of the tokens will be used for airdrops; and in Epoch 3, 5% of the tokens will be used for airdrops. It should be noted that unredeemed points at the end of the next Epoch will be destroyed.

The goal of TipCoin is to reward early users, successful product launches and platforms, and expand emission to achieve a balance between price appreciation. TipCoin reserves 35% of tokens for users and locks 5% of tokens, increasing a significant portion of liquidity supply to facilitate issuance and price stability, as well as Epoch rewards, gradually injecting new tokens into the ecosystem, and ultimately using tokens on the new platform to bring quantity and demand.

Some users have pointed out that the activities of certain users on the leaderboard have been manipulated. However, TipCoin did not immediately pull each user, but chose to internally mark them, allowing the system to have a more comprehensive understanding of robot activity in order to handle it quickly and effectively in future Epochs. During the point redemption phase, manipulated accounts will lose a large amount of points, flowing back to the hands of truly supportive users.

Summary

Friend.Tech used the user “reputation” inherited from X (Twitter) for cold start, while TipCoin achieved cold start through X’s traffic algorithm. Faced with the initial appearance of TipCoin, I encountered two different views: some believe that this viral cold start strategy is extremely efficient and should be adopted by more projects; while others are concerned about how long such heat can be maintained when social interaction is no longer based on real interaction, but rather focuses on KPI-driven point accumulation.

Personally, I tend to support and encourage this focused innovative strategy. In the Web2 field, the most profitable area is targeted advertising. Taking TikTok as an example, it generates approximately $10 billion in revenue annually through targeted advertising. Targeted advertising focuses on optimizing ad decisions using machine learning models, and this field has matured after 20 years of evolution. In comparison, the social field of Web3 is still in its early stages, and its development trajectory is very similar to the early stages of targeted advertising. Regardless of whether Epoch 2 of TipCoin can be sustained, it is a meaningful social experiment.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Opinion Still optimistic about structured opportunities in the cryptocurrency market

- Hackathon Review | Web 3 & AI Innovation Challenge

- Weekly Cryptocurrency Market Summary (09.09-09.15) NFT Market Continues to Be Lackluster, When Will the Winter End?

- End of support, survival of the fittest, the battle of NFT exchanges

- Wu’s Weekly Picks CoinEX attacked, FTX’s coin selling rules, Binance US layoffs, and Top 10 news (September 9-15)

- Analyzing the two pairs of rivals – Sushiswap and Uniswap, LooksRare and OpenSea, explaining what vampire attacks are.

- Analysis of the current status of the four mainstream Layer2 solutions Arbtrium occupies more than half of the market share, while Zora’s monthly number of creators has increased by over 97%.