US SEC Targets NFTs What Does It Mean for NFTs?

US SEC targets NFTs - implications for the NFT marketAuthor: William M. Peaster, Bankless; Translator: LianGuaixiaozou

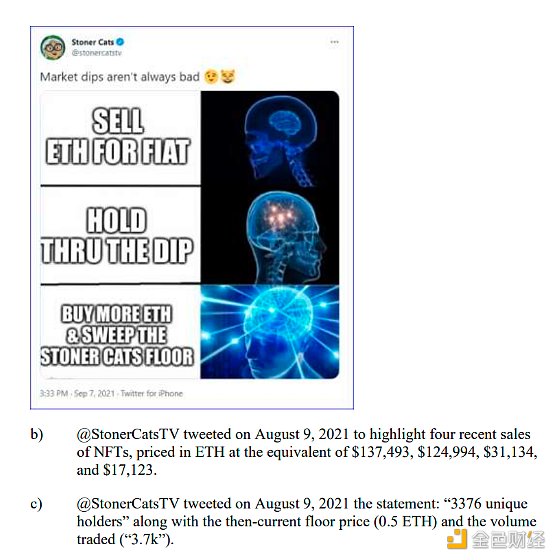

This week, the U.S. Securities and Exchange Commission (SEC) accused the creators of Stoner Cats of issuing unregistered securities, which has raised concerns among NFT fans: what kind of regulatory fate will other PFP projects face?

Stoner Cats is an NFT-based animated short series produced by Orchard Farm Productions. It was launched by actress Mila Kunis and she also voiced one of the characters in the short film.

The project was launched in 2021 along with Stoner Cats Collectibles. The animated short series also features celebrities such as Ashton Kutcher, Jane Fonda, Seth McFarlane, Chris Rock, and even Ethereum creator Vitalik Buterin. NFTs serve as tickets for viewers to watch the series.

- Messari Farcaster’s usage rate has reached a historical high recently. What are the key factors driving Farcaster’s growth?

- Introduction to Aztec.nr Aztec’s privacy smart contract framework allows smart contract developers to intuitively manage privacy states.

- Reshaping the future of Ethereum staking SSV enters the launch phase

The SEC announcement details that the Stoner Cats team has agreed to comply with the cease and desist order, pay a $1 million fine, and establish a “fair fund” to allow their NFT investors to recover their funds.

What is more concerning than the fine is the SEC’s allegations and description of the “crimes” committed by the Stoner Cats team.

Excerpts from the SEC announcement are as follows:

“The court order finds that, before and after the Stoner Cats NFTs were offered for sale to the public, [the creators’] marketing campaign touted the specific benefits of owning these NFTs, including that owners could resell their NFTs on secondary markets. Additionally, the order finds that as part of the marketing campaign, the team touted their expertise as Hollywood producers, their knowledge of the cryptocurrency projects, and the participation of well-known actors in the series, which created investor expectations of profit because the success of the web series could increase the value of the Stoner Cats NFTs when resold on secondary markets.”

It is worth noting that this is the SEC’s second accusation against an NFT project. The first was last month’s accusation against Tom Bilyeu’s media company, Impact Theory, for the unregistered issuance of securities through the Founder’s Key NFT.

1. Why is this case important?

The SEC’s attention is increasingly turning to the NFT space, and unfortunately, it is swinging a big hammer and only seeing a nail.

In fact, if the Impact Theory case wasn’t bad enough, the Stoner Cats accusation indicates that the SEC may view most roadmap-centric projects in the 2021 bull market as securities. This basically covers all PFP projects!

Another concerning factor is that there is now more evidence that the SEC believes royalties influence the determination of whether an NFT is a security.

The SEC believes that royalties incentivize Stoner Cats to drive secondary market activity. However, there is no concrete evidence that Stoner Cats intentionally created market volatility to increase their royalty income. The existence of such royalties itself is seen as problematic and could have broader implications for many NFT projects.

In addition, the SEC emphasizes that the resale of Stoner Cats NFTs on the secondary market before the release of the series is a strange viewpoint. This focus implies that any collectible with a strong resale market, whether it be baseball cards or rare wines, can be considered a security.

Needless to say, this interpretation is completely different from traditional securities law and seems to be an attempt by the SEC to expand its jurisdiction.

2. Objections to the SEC

-

SEC Commissioner Hester Peirce and Mark Uyeda discuss the intensification of legal ambiguity:

“Stoner Cats buyers get what they pay for – a static image of a character from the series, access to all six episodes of the Stoner Cats series, and the excitement of being part of a popular phenomenon. The application of securities laws by the SEC here makes little sense and hinders content creators from exploring ways to create and distribute content using social networks. On a broader scale, this will lead to greater legal ambiguity for artists, writers, musicians, filmmakers, and others seeking to build loyalty and engagement.”

-

Lawyer and professor Preston Byrne discusses the severe challenges faced by creators:

“The only certain outcome of these allegations is that NFT projects will have to undergo extensive and expensive legal analysis and pre-publication review to avoid the fate that Stoner Cats faced in marketing its collectibles, and due to the SEC’s excessive control in this regard, they will never get absolute certainty from lawyers that they are on the right side. This will stifle the creative business and prevent creators from using encrypted collectibles instead of more traditional merchandise.”

-

exlawyer.eth discusses the expansion of SEC jurisdiction:

“The issue lies in paragraph 4, where part of it states: ‘In addition, at least 20% of the Stoner Cats NFTs purchased in the sale will be resold on the secondary market before the first episode of the Stoner Cats series airs (two days after release), and the majority of NFTs purchased in the sale will be resold on the secondary market before the second episode airs on November 15, 2021.’ This has nothing to do with securities analysis and the result is that any collectible with a strong resale market… may be sold as a security. This is not a legal requirement, but it appears that the SEC is essentially issuing orders to expand its jurisdiction.”

3. Conclusion

The recent actions taken by the SEC against projects like Stoner Cats have raised urgent questions about the future development of the NFT field and its intersection with securities law.

As the line between collectibles and potential securities becomes blurred, at least in the eyes of the SEC, many in the crypto community are wondering, “Will the SEC target my NFT startup?”

Although the answer is still uncertain, the power struggle involved has resulted in a sad state of affairs. However, one thing is clear: the regulatory landscape is evolving, and not necessarily in a positive direction. NFT projects must tread carefully in this shifting landscape.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Must-Read for Entrepreneurs – China’s NFT Digital Collectibles Compliance Operation Guide V2.0

- Former Celsius executive admits to criminal charges, previously engaged in price manipulation.

- Ethereum Co-Founder The Future of Cryptocurrency will be Embraced by the United States

- EOS founder BM’s platform Voice announced shutdown a four-year, $300 million attempt

- LD Capital Bluzelle Short-term Funding Analysis

- Is decentralized exchange (DEX) legal in China?

- A discussion on whether Friend.Tech is a flash in the pan or the future of SocialFi