LD Capital Bluzelle Short-term Funding Analysis

LD Capital Bluzelle Funding AnalysisAuthor: Jill, LD Capital

1. Project Introduction

Bluzelle (BLZ) is a decentralized data management system that aims to provide tools, resources, and technical capabilities for storing and managing data. It is supported by BFT and Cosmos technologies, bringing scalability and censorship-resistant data storage to dApps.

Essentially, Bluzelle is a peer-to-peer database hosting marketplace that connects users who want to rent storage space with users who have extra storage space, with maximum security and scalability. Memory providers are rewarded in the form of BLZ tokens, the native token of the network, which can be used to acquire additional storage space, while users can pay a reasonable fee to use it.

2. Project Progress

- Is decentralized exchange (DEX) legal in China?

- A discussion on whether Friend.Tech is a flash in the pan or the future of SocialFi

- Analysis of the current status of generative AI usage by consumers

Bluzelle was founded in 2014 and initially provided payment systems to financial institutions such as AIA, Maybank, and Temenos.

In August 2017, it raised $1.5 million in funding and established its vision to build a decentralized database.

In 2019, the project released a new version of its whitepaper, introducing a new product called “Bluzelle DDN,” which is a decentralized edge cache comparable to centralized CDNs. This product was launched in May 2019.

In November 2019, the team announced a new product, Curie, and shifted the focus of development from decentralized databases to decentralized cache databases. The testnet was launched in March 2020.

In August 2020, the team announced that the mainnet would be launched in two phases. The soft mainnet was launched first, allowing users to purchase Bluzelle (BLZ) tokens and earn rewards by participating in the network’s validation process.

In February 2021, the Bluzelle production mainnet was launched, along with a new roadmap that plans to integrate the latest version of Cosmos Stargate and enter the Cosmos ecosystem.

On May 20, 2021, Bluzelle announced the postponement of the new phase’s launch due to the current market conditions until the market stabilizes.

In February 2023, the Stargate upgrade is completed, enabling Bluzelle to connect with the Cosmos ecosystem. BLZ token holders will be able to move their tokens in and out of Cosmos and Osmosis.

3. On-chain Data

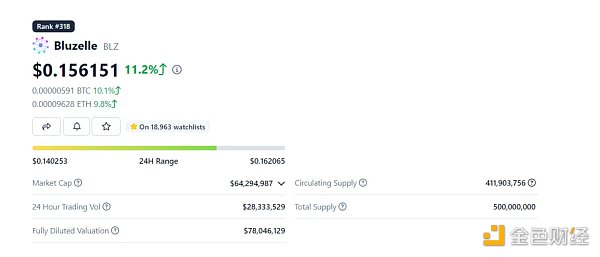

The total supply of BLZ tokens is 500 million, with a current circulation of 410 million, accounting for 82% of the total supply. The remaining tokens are held in Bluzelle’s company wallet.

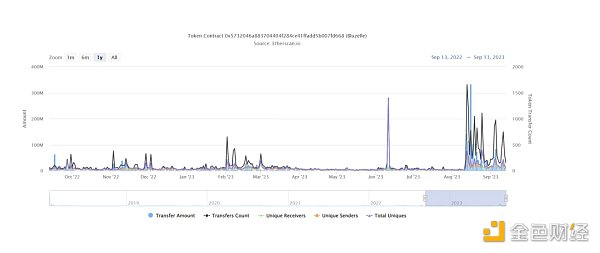

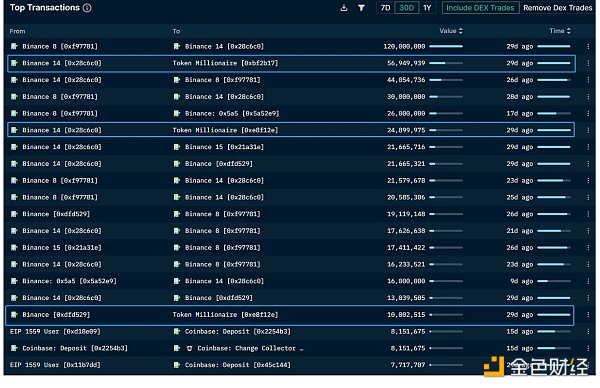

Looking at the on-chain address activity, there has been a significant increase in on-chain activity in the past month, with a significant large-scale transfer occurring on August 16. Unusual large transfers on-chain may require attention, and whether this abnormal behavior represents large holders accumulating positions may need to be judged in combination with token price trends and changes in holding addresses.

Looking at the changes in holding addresses in the past month, two addresses have made significant transfers:

-

On August 16, the address 0xbf2b1 withdrew a total of 56.96 million tokens from Binance.

-

From August 15 to August 18, the address 0x8ef12 withdrew approximately 38.9 million tokens from Binance.

These two addresses currently hold a total of 110 million coins, accounting for 21.96% of the total supply.

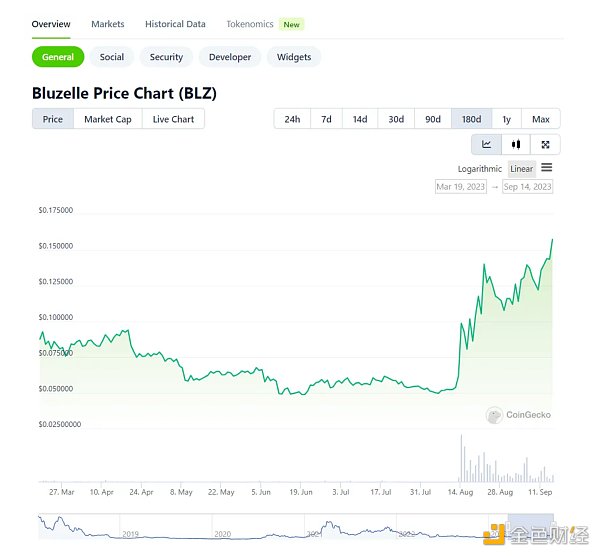

At the same time, looking back at the price trend of BLZ in the past six months, it can be observed that there was a sudden surge in price starting from August 12th. Prior to that, BLZ was trading at a relatively low price range, which coincided with the timeline of large holders withdrawing coins from exchanges. And so far, BLZ has been steadily rising.

If we look at the token distribution of BLZ addresses, we can find:

1) The top 30 token addresses currently account for 87.77% of the holdings, with the first address being the official BLZ address.

2) Exchange addresses account for 39.42% of the holdings, with Binance being the exchange with the highest liquidity for BLZ, accounting for 32.55% of the holdings.

3) Large holder addresses account for 31.97% of the holdings, and the two whale addresses mentioned above already account for 21.96% of the holdings.

Summary: Bluzelle is a relatively old project with slow development progress and no significant fundamental changes recently. It is currently trading at a relatively low price range, and there are whale addresses accumulating coins.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- a16z The Most Basic and Feasible Password Security Configuration Solution

- Exploring the true potential of RGB What possibilities are there?

- Interpreting the Economic Impact and Risks of the Launch of the Cosmos Liquidity Staking Module from Three Perspectives

- Milady, the fog of civil war, founders or indirectly serving US intelligence agencies.

- Review of Permissionless II SocialFi Transforming Social Into Money

- The Stablecoin Landscape after MakerDAO’s EDSR Transformation, Response, and Opportunities

- Phishing attack results in Fortress Trust losing $15 million worth of cryptocurrencies.