USDT Alchemy: Concealment, Additional Issues, and Manipulation

There is not much information on how the Dutch Ludovicus Jan van der Wilde, the Italian Jancano Devassini and the New Yorker Philip Porter met, but from 2013 Bitcoin created an opportunity for them to work together.

In May 2014, the "Wiley Robot Scandal" that emerged after Mt.Gox's bankruptcy revealed a reality: in a low-circulation venue, the price of Bitcoin can be manipulated.

This is a terrible thing for Bitcoin investors. But for the three above, it became an opportunity.

- One article to read Singapore's central bank digital currency plan, Ubin

- Overview: What are the DAOs on Ethereum?

- QKL123 market analysis | Blockchain organization innovation, crypto assets are indispensable (1126)

In 5 or 6 years, the team with these 3 people as the core has used 8 companies and several shell companies and shadow banks to build a "rich money machine" in the cryptocurrency, a low-liquidity, high-volatility emerging financial world. .

Just add a "T" after the short name of USD, the USD, and claim that each USDT is supported by 1 USD and supports two-way payment. The company named Tether became a cryptocurrency within 5 years of its establishment The largest stablecoin issuer in the market has created a stablecoin with a market value of more than $ 4 billion.

After the closure of Mt.Gox, the exchange named Bitfinex became the leader in digital currency trading platforms in the same period, creating a daily turnover of $ 6.3 billion at the peak.

It wasn't until November 2017 that offshore investment documents involving more than 100,000 companies or individuals were leaked that people discovered that Tether and Bitfinex were controlled by the same people, Van de Wilde, Devassini and Porter Is the main controller of these two companies.

Later, more transfer records showed that after Tether issued USDT, the first transfer always flowed to Bitfinex. After USDT broke away from the dollar's price anchoring fluctuations twice, there are more and more doubts: Tether over-producing leads to "deanchor"? Is there an equivalent amount of USD reserve support behind USDT?

Two companies involved in US dollar transactions have also attracted the attention of the United States judicial department. Several corporate accounts, mainly Crypto capital, serving as "shadow banks" have been frozen or sealed.

As the snowball rolls bigger and bigger, the marks left behind become more and more obvious.

In October 2019, the US District Court for the Southern District of New York received a class-action lawsuit against Tether and Bitfinex. Five U.S. citizens holding cryptocurrencies served as plaintiffs, bringing the two companies to court, the allegations that attracted the most attention from the outside world It is listed in the first place by "market manipulation".

If this is confirmed, the USDT thunderstorm does not rule out an avalanche in the cryptocurrency market.

"Excellent" market

When Raphael Nicole announced the establishment of Bitfinex on the cryptocurrency forum Bitcointalk in 2013, Mt.Gox was already the world's largest Bitcoin exchange, "processing 70% of the global Bitcoin transaction volume."

Nicole has not been in charge of Bitfinex for long. He stated on his LinkedIn page that after the successful launch of Bifinex in 2013, "a competent team of experienced investors took over this growing company to ensure its continued success, and I acted as a technology Consultants continue to help. "

On April 1 of that year, the price of bitcoin, which had been developed for more than four years, exceeded $ 100; 10 days later, under the continuous stimulation of the Cyprus economic crisis, bitcoin was regarded as a safe-haven asset, and the price reached a record high, reaching $ 266; On November 28, Bitcoin exceeded $ 1,000 for the first time, and the total market value rushed to $ 20 billion.

Later, a wave of Bitcoin exchanges appeared, including Huobi and OKCoin, which were born in China at that time. That year, the total market value of China's A shares alone exceeded US $ 2.8 trillion, which is more than 140 times the market value of Bitcoin.

Compared with the securities market, bitcoin has a small market value, a scarce trading market, and large fluctuations, which is really not a highly liquid asset. According to financial theory, such markets can be easily manipulated. But in the eyes of liberals, dark web traders, and speculators, it is an excellent choice.

In February 2014, 850,000 bitcoins worth $ 500 million on Mt.Gox were stolen. CEO Mark Capelles filed for bankruptcy, and a large number of investors suffered losses.

Three months later, an anonymous trader released the "Willie Report", which analyzed the leaked transaction log of Mt.Gox and pointed out that there was a robot account Willy on the exchange. Buying 10 to 20 Bitcoins in 10 minutes greatly affects the price of Bitcoin and is the key to Bitcoin's rise to $ 1,000.

In 2017, Mark Cappels also admitted in court that he had controlled the trading robot.

Since then, more academic articles have reached the same conclusion. Last year, some researchers observed Willy's account again and found that during the 50 days that Willy was active, the price of the US dollar against BTC increased by $ 21.85; while on the days of Willy's inactivity, the price of the U.S. dollar against BTC dropped by $ 0.88- The behavior could cause the exchange rates of all exchanges to soar.

Since Mark Cappels is in charge of the exchange and controls "Willie", there is most likely a situation where he does not need to pay for Bitcoin, he can buy a large amount of Bitcoin, which interferes with price discovery Process, market manipulation.

After the theft of Mt. Gox, the "Willie Report" brought a terrible "market manipulation theory", and market confidence was severely hit. Throughout 2014, Bitcoin has been falling, and there have been no "thousands" of quotes.

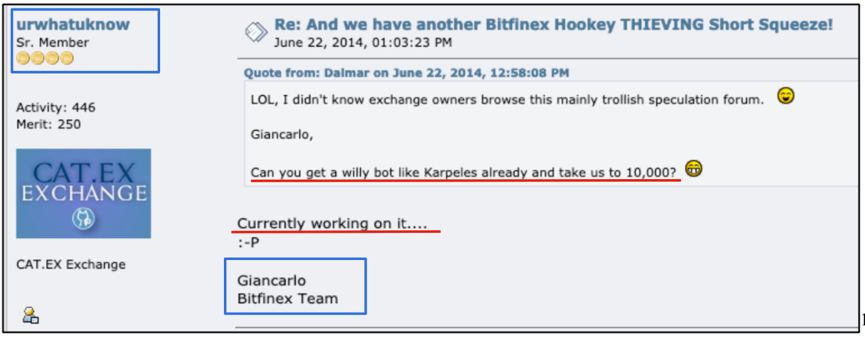

The person who wrote down Giancarlo responded that he was developing a "Wiley robot"

The person who wrote down Giancarlo responded that he was developing a "Wiley robot"

But some people have found opportunities in the Wiley Report. In June 2014, one month after the report was published, when a user with the ID "urwhatuknow" on the BitcoinTalk forum responded to someone else's post, he was developing his own "WillyBot" and the deposit was Janka Luo, Bitfinex Team.

Two secret devices

Similar to Bitfinex after a change of ownership, Tether did not call this name at first. Even the concept of "stable currency" comes from Realcoin, the company before it was renamed.

In July 2014, the company claimed that it had generated "stable currency 1: 1 backed by audited USD" stablecoin, trying to "digitize the USD and make digital USD accessible to the Bitcoin blockchain."

Four months later, Realcoin was renamed Tether and the coin REACOIN became USDT. A "T" is added after the USD. Tether claims that it can be exchanged with the US dollar 1: 1, and each USDT has a US dollar support. "When you want to redeem them, we will give you cash."

The generation of USDT is completely controlled unilaterally by Tether, and the early period was mainly based on the OmniLayer protocol of the Bitcoin network. After April of this year, Tether began to generate USDT under these two standard protocols based on ETH, Tron and other public chains.

Its operational logic is also not complicated. According to the company's open process, users who want to purchase USDT must first deposit USD into their Tether account to receive the equivalent USDT; users can also exchange USDT back to USD at any time, and Tether will occasionally transfer The excess USDT is destroyed.

In November 2014, when Tether officially acquired the new name, it announced the establishment of a new partnership in the bitcoin field, "including the conclusion of a cooperation agreement with the Hong Kong Bitcoin Exchange Bitfinex." In the announcement, neither side disclosed Tether Team. Since then, Bitfinex appears to be a spokesperson for Tether.

The close relationship between the two is not just that. Some people find that the first transfer of USDT is always transferred from Tether's "treasure wallet" to Bifinex instead of other exchanges. This exclusive relationship also seems to prove that Bitfinex is the only exchange in Tether client. After USDT flows to Bitfinex, it will gradually flow through the exchange to other trading platforms.

In September 2017, China, an important market for bitcoin trading, encountered the most stringent regulations on ICOs and digital currency exchanges. Local exchanges were required to shut down and liquidate user assets and buy bitcoin with RMB. Never return.

Following the international line of Huobi Global Station and OKEx, USDT was listed on the platform one after another, and the remaining Chinese users knew about this stable coin that had developed for three years. Hit an all-time high of $ 20,000.

During the peak period, USDT carried 98.7% of the transactions in the global stablecoin market. The low volatility around the USD price made it a safe haven for the cryptocurrency market, and some even regarded it as a digital USD.

In the past 5 years, Tether has issued 82 additional cumulative issues, of which only 5 were destroyed. The value of USDT is entirely derived from the USD reserve guarantee promised by its issuing entity, Tether. As of now, USDT has a circulating market value of $ 4.05 billion, which means that Tether should have a $ 4.05 billion deposit in its bank account.

5 years after issuance, USDT circulation market value reaches 4.05 billion USD

5 years after issuance, USDT circulation market value reaches 4.05 billion USD

However, contrary to USDT's open and transparent issuance mechanism, Tether has never disclosed where exactly its reserves are.

Unlimited issuance

Since the birth of the first batch of USDTs in October 2014, the number of USDTs issued by Tether has increased every year.

- May 18, 2015

200,000 new USDTs were produced, and the overall supply reached 450,000.

- December 1, 2015

Tether issued another 500,000 USDT, and the overall supply rose to 950,000.

- December 31, 2016

Tether issued 6 million USDTs throughout the year, six times the volume of the previous year.

During the continuous issuance of USDT by Tether, Bitfinex was accordingly in constant trouble.

One of the troubles is the problem of user compensation caused by hacking. On May 22, 2016 and August 2, 2016, Bitfinex stole 1,500 BTC (valued at $ 400,000) and 120,000 BTC (valued at 7,200). Ten thousand U.S. dollars). The second theft was the largest hacking incident in the history of Bitcoin after Mt.Gox. Due to the heavy losses, Bitfinex was unable to lose money and tried to weather the crisis by issuing a bond currency BFX with an initial price of $ 1 , But BFX once fell to 0.3 dollars.

Another trouble is fines-On June 2, 2016, the U.S. Commodity Futures Trading Commission due to Bitfinex's provision of illegal over-the-counter financial retail commodity transactions for Bitcoin and other cryptocurrencies, and failed to register as a futures commission as required by the Commodity Exchange Act The merchant imposed a fine of $ 75,000 on Bitfinex.

The chain reaction caused by these two troubles has appeared one after another since 2017.

On March 31, 2017, Wells Fargo no longer provided correspondent bank services to Bitfinex and Tether, and the US Commodity Futures Trading Commission's fine on Bitfinex was an important reason. The two companies have since filed a lawsuit against Wells Fargo.

It was then known that the early use of Bitfinex and Tether to meet customer demand for US dollars had been completed by their US correspondent bank accounts with banks in Taiwan.

The unavailability of bank accounts has directly blocked the USD deposit and withdrawal channels of Bitfinex and Tether: once, their income from operating digital currency businesses cannot be turned into cash; furthermore, without user deposits, they cannot continue to issue in the way they claim, etc. Worth USDT; moreover, if there is no USD account, where does Tether's so-called reserve fund go?

"Funding is getting harder and harder." Two weeks after Wells Fargo stopped serving it, Porter, Bitfinex's chief strategy officer, told the cryptocurrency trading community WhalePool that Bank of America is exiting offshore bank clearing operations because "in In many money laundering and criminal cases, banks have been held accountable for their correspondent banking business, "and" money laundering is their biggest concern. "

But Porter also said that Bitfinex will continue to circumvent the law,

"We have other ways. Engaging in the bitcoin industry is actually playing cat and mouse games with correspondent banks … The disadvantage of being a big company is that we have a lot of deposits in banks, and we can no longer avoid the 'radar' as before. Was found … "

He also mentioned in discussions with others during the same period,

"Open a new account or transfer to a new corporate entity, etc. Every bitcoin practitioner must learn the tricks of these cat and mouse games."

Some evidence shows that Bitfinex has been using shell companies to open and use bank accounts as a "trick" to open access to the US dollar. From 2013 to 2018, these channels include Hong Kong's Renren Bee (which claims to be independent, Bitfinex provides companies such as KYC / AML compliance services), HaparcB.V. Of the Netherlands and Rongli Commercial Co., Ltd. of Hong Kong, etc. Among them, its most trusted company is Crypto Capital registered in Panama, which is more like a " "Shadow Bank" has been helping Bifinex and Tether to handle US dollar deposits and withdrawals.

Following the outbreak of the Wells Fargo incident, USDT dropped to 0.91 US dollars for a short time. As a stable currency that claims to be anchored to the US dollar 1: 1, it appeared "instability" for the first time, and the questioning of US dollar reserves began to spread.

In September, the accounting firm hired by Bitfinex, Friedman LLP, audited the employer ’s balance sheet and stated that Tether ’s US dollar reserves ($ 443 million) matched the amount of USDT in circulation on the market, but the report did not disclose the banks that held the reserves Name or place.

The fact that the U.S. dollar is so difficult to move in does not prevent Tether from issuing a new USDT in 2017.

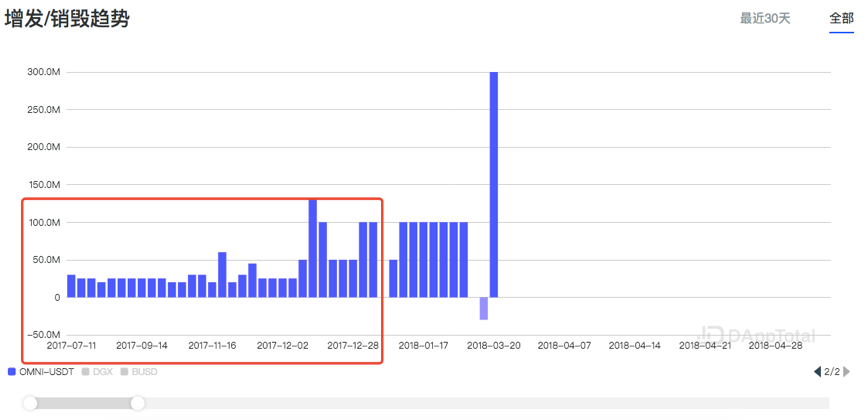

USDT intensive in 2017

USDT intensive in 2017

Throughout 2017, Tether issued approximately 1.4 billion USDT. During this process, bitcoin also rose all the way. Even if the local exchange in China, one of the largest markets at the time, suffered a regulatory blow, the price of the currency quickly rebounded after only falling for half a month.

Relationship exposure

An audit report by accounting firm Friedman LLP for Bitfinex stated Tether's US dollar reserves. This once again makes the outside world suspect that Tether and Bitfinex are somehow closely related.

Until November 2017, the close relationship between the two sides was officially confirmed.

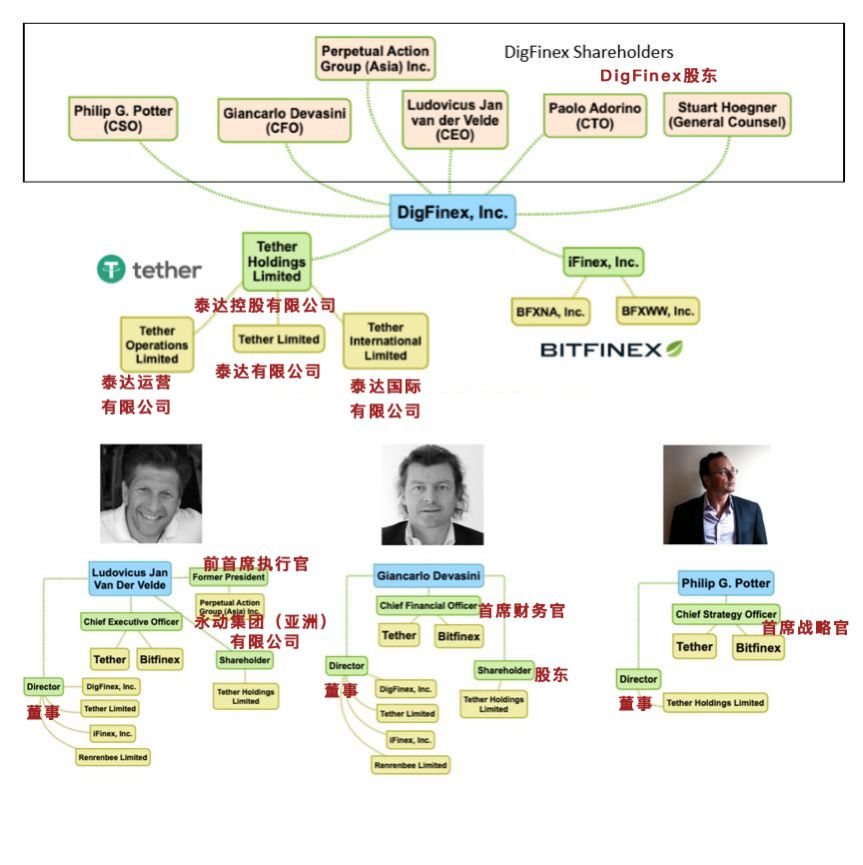

An offshore investment document involving more than 100,000 companies and individuals in a "tax haven" country was leaked. This document is called a "paradise document" and it completely broke the same group of people controlling Bifinex and Tether. Fact: Bitfinex's Chief Strategy Officer Potter is a director of Tether, CFO Devassini is a shareholder of Tether, the two established Tether in the British Virgin Islands in 2014; and the company's CEO Ludovico Jane van der Wilde is also the CEO of Bitfinex.

3 people control Tether and Bitfinex

3 people control Tether and Bitfinex

There is not much information on how the Dutch Ludovicus Jan van der Wilde, the Italian Jan Carlo Devassini, and the New Yorker Philip Porter met and then got together " "Planned" two companies.

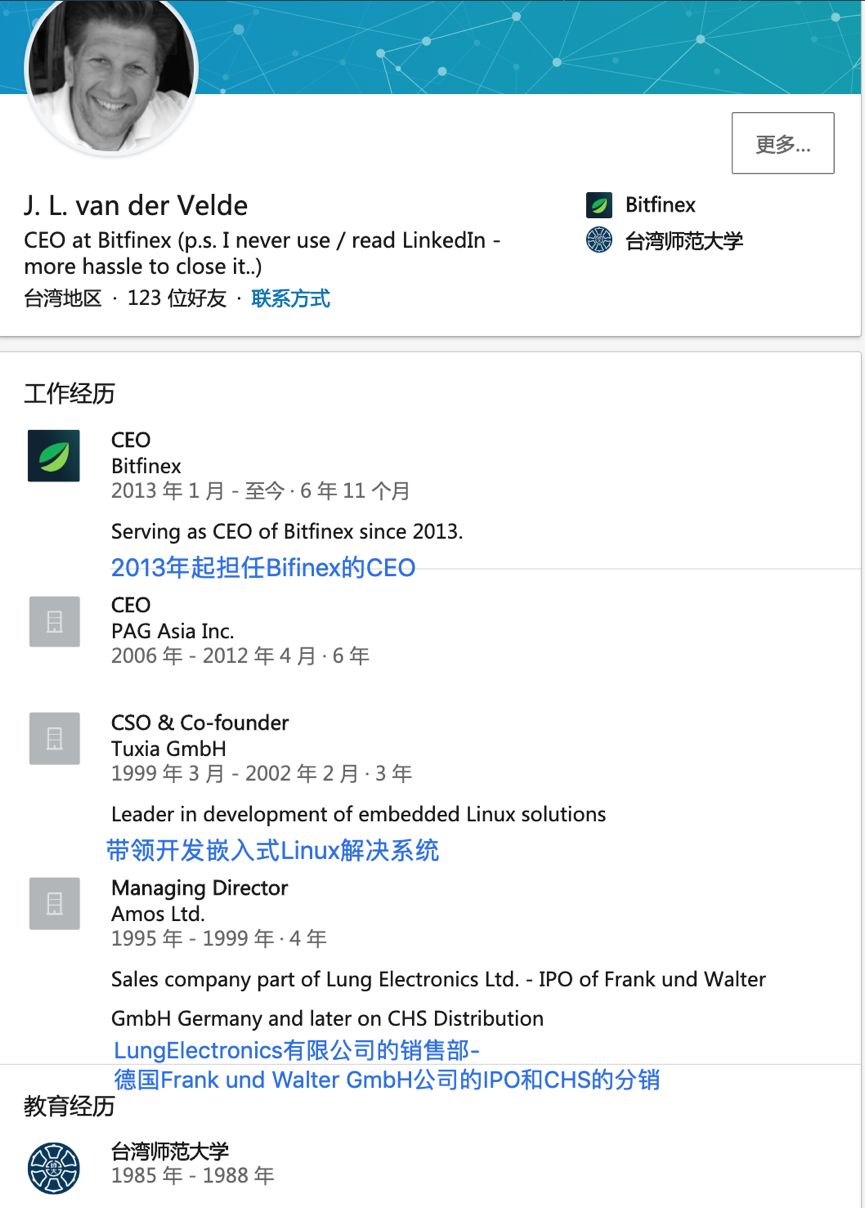

A year ago, a netizen posted a question on Reddit, "Who is Ludovicus Jan van der Wilde?" He said he couldn't find much information about the Bitfinex CEO, LinkedIn There are only sparse personal information, the photos are blurry, and when the media reports on him, the name is often written differently, "Who is he? Is he just keeping a low profile? Is there anything else here?"

Indeed, Bloomberg's website and LinkedIn have different information about him. The former shows his position at the Taiwan University of Science and Technology, while the latter does not list this part of his professional resume. However, his educational experience shows that he was from 1985 to 1988. Studying at Taiwan Normal University.

Van der Wilde's resume on LinkedIn

Van der Wilde's resume on LinkedIn

From his resume, Van de Wilde seems to know both sales and IT technology. However, he rarely shows up in public. More often, he speaks to the company, users and the outside world by email.

More often represented by Bitfinex is its chief strategy officer, Philip Porter, who is more informative. After graduating from Yale University in 1994 with a degree in physics, he worked for a period of time in a hedge fund and joined Morgan Stanley in November of that year. As a result, in 1997, Porter, 25, was fired from the company for bragging about his $ 3,500 Rolex, extravagant lifestyle, and aggressive money-making strategies in the New York Times.

The exchange's chief financial officer, Giancarlo Devassini, was not a peacekeeper. He founded a computer hardware company in the 1990s and was later fined 100 million Italians in 1996 for selling pirated copies of Microsoft software. lira.

In any case, 3 people from 3 different countries, starting in 2013, then disappeared the clear connection between the exchange Bitfinex and the stablecoin issuing company Tether, while controlling these two commercial systems: one responsible for issuing It is said to be equivalent to the USD stablecoin, and another set is responsible for replacing this USD with the stablecoin and sending it to the market to buy Bitcoin and other cryptocurrencies.

The question is, are there any dollar support behind these "gold", which are regarded as deposits? If not, then USDT has become the scariest "air coin" in history.

Market manipulation?

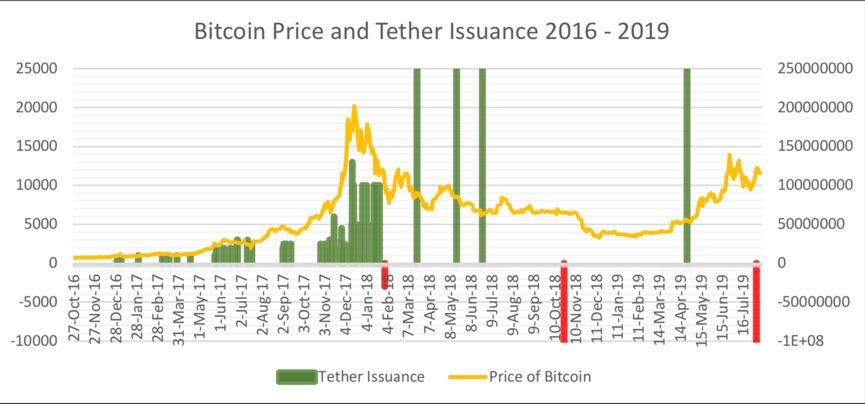

The relationship between the Bitcoin price and the USDT issuance from 2016 to 2019

The relationship between the Bitcoin price and the USDT issuance from 2016 to 2019

He believes that the USDT issued by Tether during this period is more in line with the role of "supply-driven" rather than the issuance under real market demand. Because Tether controls the right to issue, Bitfinex and it can set a strategic price ladder and trigger the execution of a buy order with unsupported USDT. "Like Willie Robots, continued purchases will cause the price of Bitcoin to rise."

After Griffin checked over 10 different sources and over 200G of transaction data, he concluded that when Bitcoin fell, USDT was issued to buy Bitcoin, but when Bitcoin rose, there was no redemption of data. Reflect this. Therefore, he believes that USDT is used to stop the decline, not real market trading behavior.

Regulators are also beginning to notice the special relationship between the two companies. On November 20, 2018, Bloomberg reported that the U.S. Department of Justice is conducting a criminal investigation in cooperation with the Commodity Futures Trading Commission (CFTC).

"The issues the Department of Justice is investigating include how Tether companies are creating new coins and why they are entering the market primarily through Bitfinex."

A week later, the New York State Attorney General summoned Bitfinex and Tether. After half a year of entanglement with legal issues between New Zealand and New Zealand, in September this year, a report from the New York Attorney General confirmed that Bitfinex was capable of implanting trading robots like "Willie Robots". Some 'special order types',' are only useful for professional automated traders using complex algorithmic strategies. Under this strategy, orders can be submitted or withdrawn in order to deal with those that are not visible (or even impossible to see) by ordinary traders. Market signals. "

Questions from public opinion, academic analysis and research, judicial investigations, and multi-party evidence point the two "sister companies" in the direction of controlling the bitcoin market.

In October 2019, five U.S. citizens holding cryptocurrency as plaintiffs filed a class action lawsuit against related companies and natural persons such as Tether and Bitfinex. In the lawsuit filed with the Southern District Court of New York, the first charge listed was "market manipulation."

"Poor liquid markets such as Bitcoin can be easily manipulated." Devassini may not have thought that the public statement he made on December 5, 2012, now appears as "testimony" in the Sued him on legal documents.

The cryptocurrency world has to pay attention to this matter, and once the crime of "manipulating the market" is substantiated, its impact may be greater than the bankruptcy of Mt.Gox. Because in large and small digital asset exchanges, USDT almost always covers independent trading areas.

When the stablecoin with the largest market share crashes, investors may have nowhere to go.

(Comprehensive USDT Class Action Report)

When can USDT symptoms be resolved?

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Headless Brands: From Corporate Management to the Community-Driven Brand Era, Taking Bitcoin as an Example

- BOSCore co-founder Winlin: Blockchain technology should serve the principle of application landing and detailed explanation of airdrop coin burning proposal | Chain Node AMA

- French central bank deputy governor calls for the establishment of a settlement and payment system based on DLT technology, and open trial of blockchain technology

- Public chain survival note: I want to do outsourcing

- Why does everyone need to understand blockchain technology?

- Dean of CCID Blockchain Research Institute: Blockchain is about to erupt in the field of e-government, and ordinary people will eventually get used to the existence of blockchain

- Research on Layer 2 protocol review attack, Vitalik claims to synchronize 99% fault-tolerant consensus or solution