USDT crisis: cutting amaranth or the issue of digital dollar distribution rights?

The entire world of encryption is connected to the US dollar through an iFinex Inc., which operates both Bitfinex and Tether, the former being the exchange, which is responsible for the exchange of encrypted assets with the US dollar and has issued a Stabilized currency" (digital dollar) – USDT.

In April 2019, at 4:15 pm local time on April 25, the New York State prosecutor brought Tether and its parent company iFinex Inc. and Bitfinex to court. The indictment stated that under the actual controller of iFinex Inc.:

1, USDT issuer Tether related party – crypto exchange Bitfinex customers and businesses of $ 850 million in funds were frozen,

2, in order to make up for the loopholes, Bitfinex "misappropriated" Tether's $850 million.

- When cross-border trade “catch up” with the blockchain, Ping An Financial’s credit account helps SME financing

- Analysis of PoS's deposit mining and currency prices – how to design PoS mining to attract users?

- Market Analysis: How long is the deadlock, what are you waiting for?

3, through the Tether company to issue additional USDT as a reserve.

Behind this is the USDT behind-the-scenes controller who cuts the leeks, or is the compliance digital dollar counterattack, to regain the digital dollar distribution rights?

Why does Bitfinex “appropriate” the $850 million USDT reserve?

In this way, from the business model of Bitfinex, the profit of anyone trading through the exchange is encrypted by legal currency, because even if you earn bitcoin, you can’t use it as legal tender. Exchange between legal tender and bitcoin.

In 2013, the People's Bank of China issued the “Notice on the Prevention of Bitcoin Risk” (Yinfa [2013] No. 289, hereinafter referred to as “Notice”), prohibiting financial institutions from carrying out the conversion and settlement of Bitcoin and legal digital currency. "Claim:

Financial institutions and payment institutions may not use Bitcoin to price products or services, may not buy or sell or trade Bitcoin as a central counterparty, may not cover Bitcoin-related insurance business or include Bitcoin in insurance coverage, and may not directly or indirectly serve customers. Provide other Bitcoin-related services, including: providing Bitcoin registration, trading, clearing, settlement and other services to customers; accepting Bitcoin or using Bitcoin as a payment settlement tool; conducting Bitcoin and RMB and foreign currency exchange services; Bitcoin storage, custody, mortgage, etc.; issuing bitcoin-related financial products; using bitcoin as an investment target for trusts, funds, etc.

For the Bitfinex exchange, it is also difficult to find mainstream banking services that support its cryptocurrency transactions, so Crypto Capital (an agency registered in Panama) as a partner, but also "black". New York prosecutors filed a lawsuit showing that since October 2018, Bitfinix executives have been requesting repayment of funds from Crypto Capital, Merlin (Bitfinex executives):

"Oz we need urgent funding."

"Tether or US dollars, we need to get at least $1 billion in the next week."

“The situation now looks terrible, with more than 500 withdrawals pending, and orders continue to flow in.”

"You have gone too much money, we are now nowhere to go."

"Trouble you to update me with the latest information. If you don't give us any funds this week, we will have trouble."

"We need to make a statement, but the more obscure it is, the more likely it is to cause suspicion."

"This month is almost over, but you didn't even call us for $1.

Goose, Crypto Capital gives reasons: A total of $851 million in funds cannot be returned to Bitfinex because these funds were frozen by Portugal, Poland and the US government. CCC: "We are also trying our best every day. The Polish Financial Bureau has heard the rumors that the bank account of the digital currency exchange has been closed."

But Bitfinex lawyers say that Crypto Capital is lying and is likely to face fraud.

To solve the Bitfinix liquidity, Bitfinex uses Tether's USDT cash reserve to pay for the user's withdrawal needs.

If Crypto Capital did not lie, this was a liquidity crisis caused by the government freezing the cryptocurrency banking service. Bitfinix subsequently misappropriated the USDT reserve to solve the user redemption problem.

USDT crazy "printing money": recovering lost market share

Since April 2019, according to monitoring, Tether has accumulated “printing of additional money” 10 times on Omni, ERC20 and TRC20, with a total amount of US$ 745.9 million. After the issuance, the total market value of various USDTs exceeds US$ 3 billion (Tether Treasury The amount is not included in the total amount of market circulation, it is Tether's own "treasury wallet").

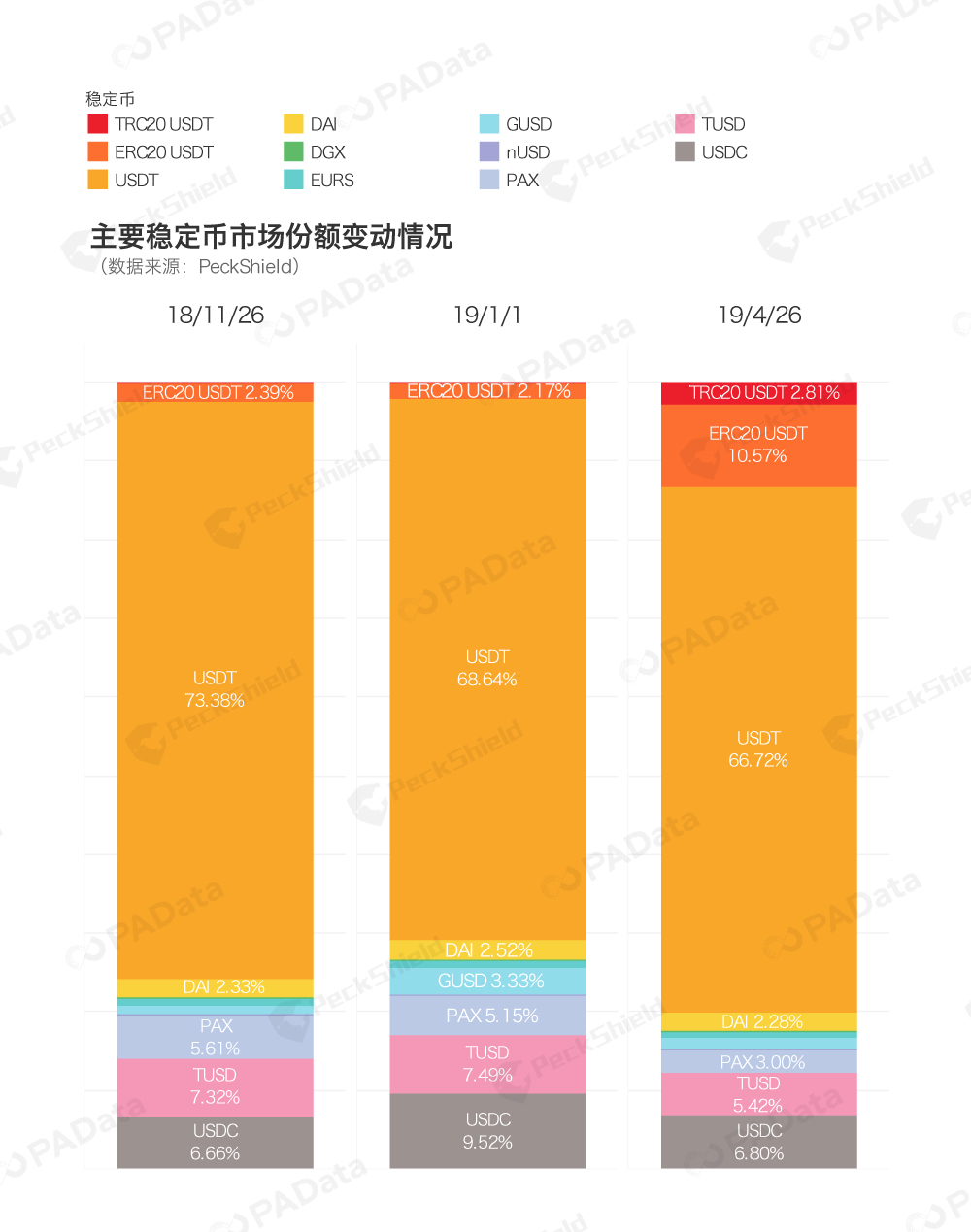

According to PeckShield's monitoring, on January 1 this year, USDT's market share was about 70%, continuing the downward trend since last 10, but USDT recovered the loss of market share through the issuance, and a Chinese coin circle also telegraphed. The group confirmation agent sold $100 million USDT.

Prosecution, or the dispute over the issue of digital dollar rights ?

This obviously has the elements of conspiracy theory.

However, the United States should now consider digitizing the dollar, rather than just focusing on the issuance and trading of crypto assets.

The USDT issued by Tether is equivalent to M0. The current multiple of M2 and M 0 in China is 20, but in the field of encrypted assets, other encryption assets also have the nature of USDT's “foreign exchange”, and the multiple has been estimated to be 200 times. It can be said that Now the currency in circulation (digital dollar, in the form of various types of encrypted assets) has reached 600 billion US dollars.

IMF President Christine Lagarde said in an interview with CNBC on Wednesday:

“I think destroyers and anything that uses distributed ledger technology, whether you call it encryption, assets, currency, or whatever… they obviously shake the whole system. We don’t want innovation to cause too much financial system. Shock, thus losing the necessary stability."

The United States has begun to take action, and for USDT holders, switching to a compliant digital dollar is the right choice.

China should also act.

(Author: Wang Jun Wei)

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- The agenda is big exposure! Hangzhou blockchain week, May 1 special ticket, come and buy

- The latest development of BFX storm, debt-for-equity or debt-to-coin?

- Dry Goods | Staking Economy Operational Expert Complete Manual (Revised Edition)

- Centralized stable currency and breakout of decentralized stable currency

- Opinion | Data autonomy: my data I am the master

- The exchange is robbing the tokens, all of which are behind the interests.

- Blockchain: Casting a new financial civilization