USDT reenactment of Waterloo

Napoleon is familiar to everyone, and Waterloo is familiar to everyone, but what everyone is not familiar with is the story of wealth behind it.

The story took place in 1815. After the defeat of the Napoleonic army, the French Empire was destroyed. However, whoever wins and loses is not important to investors, nor is it "glorious". For them, there is only wealth.

At that time, different today, there is no such developed communication equipment, and people can only slowly wait for the return of the person who sent the letter. And it takes more than a week for Waterloo to send a letter to London.

Those who really wait a week are undoubtedly "iron-headed leeks."

- I have lived in Australia for 7 years. Where did the former Ali programmer talk about the gap between China and Australia?

- If the way to attract developers is wrong, it is useless to do more marketing activities in the public chain.

- In the 1 year of Babbitt, I rejected 2000 submissions.

The "smart" person has already stared at the "position" of the market's big bookmaker Rothschild, and is ready to "follow the order."

Rothschild got the news a lot earlier than everyone, everyone knows, so people pay close attention to Rothschild's movements.

When Nathan Rothschild got the news, he walked into the Royal Exchange, backed by a pillar, and sorrowfully "opened a single": selling British bonds worth tens of thousands of pounds.

Smart people know: Britain lost. So the crazy sell-off came along, and the British public debt of the victorious country actually fell to only 5% of the value.

5% of the victorious national debt, cheaper than the e-commerce occasional Bug price, and this can be "guaranteed delivery", no one actually bought. At this time, Rothschild began to perform real technology – a large-scale bargain-hunting.

After dozens of hours, the British authoritative newspapers got the news, which is the news that everyone knows – Britain won a big victory, and Napoleon was defeated. As a result, the British government bonds naturally went up in full swing, and the Rothschild family became famous and became the number one player on the Royal Exchange.

Why do you say this story at this time? Because of the USDT incident last night, it was like this story 200 years ago.

The USDT was the first to raise the enthusiasm and mobilize the market sentiment. After that, the Wall Street Journal brought us a report that we actually had prepared in mind, and Bitfinex used the money earned by USDT to make up the other holes.

In fact, I don't think this is a big deal, and the USDT violent crisis should not let people buy bitcoin to hedge, is it the same as last year? On the contrary, this time brings Bitcoin Falls, and the “source” of the waterfall is Bitfinex.

It’s so smart.

If it is correct, then soon after (even when you see this article) the market will return, and USDT will "walk out two steps" like nothing else, and nothing seems to have happened.

In addition to the futures market where blood flows into the river, and the small fish and shrimp that have been affected.

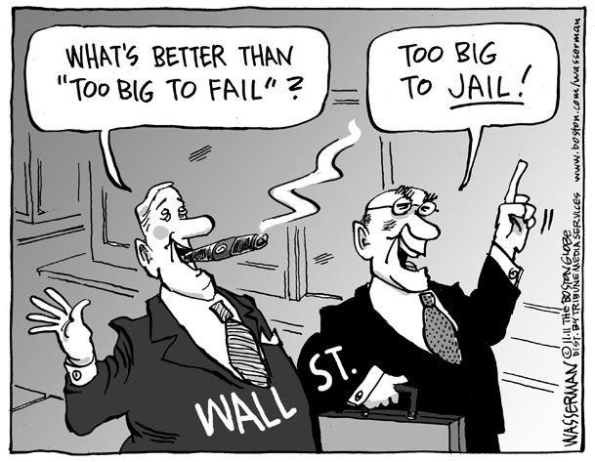

The more satisfying conspiracy theory should be that the USDT and the B-net are actually the tools for the real international Zhuangzhuang, similar to the "Rosschild" of the story.

After all, the Office of the Attorney General of New York was not a statement made before the plunge. The Attorney General was not likely to be the B and Tether companies that were investigated yesterday. The Wall Street Journal was not immediately sent to the news.

There is too much space in the middle to operate, isn't it?

However, this is only to satisfy everyone's conspiracy theories. I personally do not think that conspiracy exists.

I think that a decentralized market is a big negative impact on a cryptocurrency because it is greatly affected by a centralized product/company. Sooner or later, it will be cashed sooner or better.

Just like the last USDT thunder, many other stable coins have been spilled into the market. I believe that there will be more funds flowing to other stable currencies.

We can't leave the stable currency for a number of reasons. For example, some countries and regions cannot buy bitcoin directly through legal currency. They need to stabilize the currency as a bridge for transition, or when people are not optimistic about short-term prices, they hope to pass the stable currency. Safeguarding, avoiding the possible plunge, etc., the existence of stable currency is very important and crucial for the cryptocurrency world, this is undeniable.

But in many cases, a big one will always have a big problem. Tether’s news as a rare company can affect the rise and fall of Bitcoin, and even some “big but not down”, which is obviously going to the center. The world is not good news, so on the one hand, I hope that Tether can do it well, and no such "violent" incident will affect the market. On the other hand, I hope that other stable coins will work hard to make the market share more. Health is a bit. If the market allocation of stable currency is healthy enough, then a stable currency violent thunder will only benefit other stable currencies, and it will not affect Bitcoin.

Finally, in the story I just mentioned, if you are not a well-informed Rothschild family, the choices you can make are actually limited, but both options are deceived by Rothschild’s fake actions. Good: One does not believe that the United Kingdom will win. It sold British public debt before the war; one is that the United Kingdom will win, even if the public debt plunges into zero, it is also convinced that the real news will not follow suit.

Because of my own cognitive loss, is it better than being decent as a monkey?

Therefore, during this period of "Monkey City", which is not a bull market, I suggest that you still reduce the operation. If you believe Bitcoin, you should keep it steady. If you don't believe it, don't be embarrassed.

Everyone wants to be a personal person.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Is the encryption market really a rational market?

- Rereading the "fat agreement", why the domestic blockchain team is going in the wrong direction

- Advertising, traceability, deposit, and blockchain are all false propositions?

- Investing in cryptocurrency with artificial intelligence thinking

- "Insurance + blockchain": I have a chain, who is coming to the league?

- Getting started with blockchain | Why does EOS recharge to the trading platform and need to fill in the notes but not present?

- Internet vs blockchain revolution: the origin of the giant company