Doodles version of the holey shoes sold out in 3 days, blue-chip NFTs sell to save themselves.

Doodles' holey shoes sold out in 3 days, blue-chip NFTs sold to save themselves.Author: Mu Mu, Metaverse Daily

The encrypted asset market is still in a cold winter. NFTs, which were on fire in the previous bull market, are experiencing their first deep bear market. Countless NFT projects have been cleared out of the market, and players are scrambling to escape. The market is so bleak that even the highest-value blue-chip NFTs have not been able to escape the continuous slump. Some projects have started to save themselves.

Recently, the well-known blue-chip NFT project Doodles teamed up with Crocs to launch a limited edition “holey shoes,” which sold out within 72 hours. Another well-known blue-chip NFT, “Fat Penguin” Pudgy Penguins, combined with physical toys to launch Pudgy Toys. Within two days of its launch on Amazon, it sold over 20,000 units, with sales exceeding $500,000.

In the past, NFTs, which were disguised as “new applications of blockchain,” are now starting to sell goods. Although the prices and sales of these goods are far from the returns of selling a batch of NFTs during a bull market, these IPs that were originally popular only in the niche Web3 community have finally entered the public’s view with physical brands or physical derivatives.

- With the innovative low transaction volume, where is the way out for NFTs?

- After Vitalik’s account was hacked, he released phishing information. Besides phishing attacks, what other ways of fund fraud should users be alert to?

- Opinion If the Bot track cannot achieve an unforkable state, it will be very difficult to achieve sustainable revenue.

Doodles on Crocs Shoes

Even if you haven’t heard of Doodles NFT, you must have heard of Crocs, the holey shoes that are popular worldwide and have been imitated by various knockoffs. Now, Crocs has released a new version of its holey shoes with design elements from Doodles NFT.

Yes, this globally renowned casual footwear brand has crossed boundaries with NFT IP. It collaborated with Doodles to launch a limited edition of holey shoes, and buyers will also receive a unique Crocs Box digital collectible. If the buyer destroys this collectible, they can unlock two Crocs wearable NFTs that are compatible with Doodles NFT images, as well as a Stoodio Beta LianGuaiss card that can be used in the dynamic Doodles 2 NFT series.

Doodles on the limited edition Crocs shoes

Doodles on the limited edition Crocs shoes

The holey shoes went on sale at 12:00 PM Eastern Time on August 29th for $120. Three days later, they were sold out.

Now, let’s learn about this NFT IP that attracts collaborations with international footwear brands.

The Doodles NFT series was launched on October 17, 2021, and was created by three Canadian artists. In the NFT market, it was considered at its peak when it was first listed.

At that time, out of a total of 10,000 NFTs, only 504 belonged to the founding team, and the rest could be minted by users on the Ethereum blockchain by paying transaction fees. The initial minting price (equivalent to the public offering price) was 0.123 ETH (excluding fees), which is equivalent to $471. It sold out quickly, and at one point, the transaction fees for minting it rose to 1 ETH ($3,830).

Doodles is one of the most popular series in the NFT market

Doodles is one of the most popular series in the NFT market

It should be noted that at that time, the NFT market was in a period of explosive growth, and the “Bored Ape” and “CryptoPunks” were the biggest winners that ignited the concept of NFTs. These two NFT series had their own unique designs, with one adopting a gloomy and bizarre style, and the other pioneering the pixel art movement.

The colorful color matching and doodle design bring a fresh and soft aesthetic to the NFT market. Once launched, it became one of the “most popular” series in the NFT market. The rarest Doodles NFT sold for a highest price of 296.69 ETH, exceeding 1.1 million US dollars at that time.

However, even popular NFTs cannot withstand the “crypto winter”. The current starting price of Doodles is only 1.37 NFT, equivalent to 2220 US dollars, with a 24-hour trading volume of only 33.51 ETH. Although this starting price is more than 4 times the initial price, at its peak, the starting price was 23.95 ETH, with a daily trading volume of 2811 ETH.

The price of Doodles has come down, but the trading volume has not increased. Fortunately, the IP value accumulated over two years of operation has not been immediately wasted. The beautiful design has caught the attention of Crocs and turned into shoes, selling for $120 per pair, much lower than the initial sale price of $471 for Doodles.

The founding team of Doodles also understands that NFTs alone cannot sustain. Founder Keast claims that the ultimate goal of Doodles is to become a comprehensive Web3 entertainment company and “build a bridge between Web3 and the real world”. In other words, NFTs can only go so far in the virtual world and need to be practical.

DeepBear drives the NFT industry from virtual to real

Doodles is not the only NFT IP that sells merchandise. Another blue-chip NFT project, Pudgy Penguins, has been researching peripherals since May this year. It has released a series of blockchain technology combined with physical toys called Pudgy Toys and launched the NFT digital platform Pudgy Worlds, allowing each toy to have a digital experience on this website.

According to official information, Pudgy Toys buyers will receive a “birth certificate” to unlock the feature box of Pudgy World Season 1 and receive identity tokens and corresponding NFTs. Users only need an email to register a blockchain wallet and dress up their penguins on the website.

According to Amazon data, Pudgy Toys sold more than 20,000 units and generated sales of over $500,000 within two days of its launch, becoming the top seller on the Amazon new product rankings. This also demonstrates the recognition of NFT users/ordinary users for the design of Pudgy Penguins.

Pudgy Penguins launches physical toys

Pudgy Penguins launches physical toys

The bearish trend in the NFT market is not only affecting individual projects, but even the world’s largest NFT trading platform Opensea is struggling a bit. This trading platform is actively seeking cooperation with “platforms or companies that support e-commerce, ticketing, or any ‘offline’ experience”.

All signs indicate that the speculative frenzy of NFTs has become a thing of the past, and any link in the industry chain that goes against this trend may be abandoned by the market.

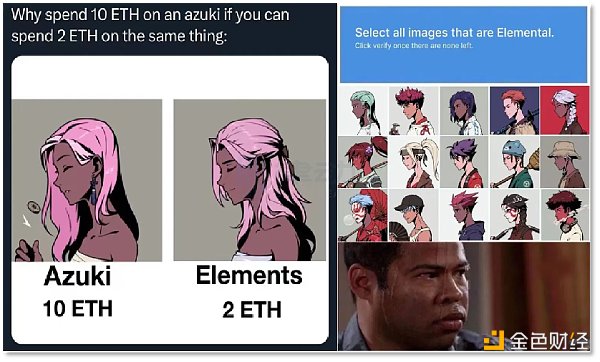

In June of this year, the blue-chip NFT project Azuki released a new image. The new series Azuki Elementals caused community dissatisfaction due to the high similarity with the previous generation of Azuki NFTs. The practice of changing the hairstyle of the original image and turning it into a new NFT was mocked by the community, leading to a drop in the starting price of Azuki to below 10 ETH at one point.

Azuki Elementals Community Biao Picture Tucao

Azuki Elementals Community Biao Picture Tucao

NFT big holder Christianeth bluntly said on social media, “If a team no longer has new ideas, cannot drive the innovation of the community, or has no new business models and development directions, it will be difficult in the next cycle.”

Obviously, Doodles and “Fat Penguins” have already seen this and are trying to find new ways out of the exhausted liquidity, such as cross-border marketing, launching derivatives that combine physical and digital elements, and so on. After all, even physical companies are issuing NFTs, and they have real products. “+NFT” or “+Web3” is just a step towards digital upgrading.

For example, Starbucks’ NFT membership program Starbucks Odyssey, Nike’s NFT sneakers Crypto Kicks, and Visa and Mastercard’s collaboration with different Web3 companies to develop cryptocurrency debit cards, and so on.

Some people are also worried that blue-chip NFTs busy with cross-border endeavors will deviate from the innovative exploration of Web3 and follow the path of centralization. Pudgy Penguins believes that the key to the problem lies in ensuring the rights of NFT holders, “not creating side effects and not intervening in market prices.”

Pudgy Penguins chooses to give the corresponding revenue from physical toys to NFT holders. They propose a solution: Project OverLianGuaiss. In simple terms, it is an “IP licensing market.”

Although various NFTs are designed and initiated by founding teams, the blockchain determines that the ownership of a certain NFT belongs to the person who spends money to mint it on the chain or later buys it from the secondary market. When a certain NFT is selected for commercialization, it is necessary to obtain the authorization of the holder. Even if the initiator of the series wants to “sell goods” with an NFT initiated by themselves, they still need to obtain authorization from the holder.

Binding the ownership of digital assets directly at the underlying technology layer is a unique rule of the blockchain. Project OverLianGuaiss provides a matching market based on this: individuals or companies that need authorization can directly list the NFT series they want on this website, and NFT holders can also set authorization conditions by themselves, such as scope of use and how to reward, etc. Once a match is formed, both parties can complete the authorization and authorization on the chain.

It is reported that 16 “Fat Penguins” have been authorized by Pudgy Penguins to make toys. Similar to the operating method of “Boring Apes”, this head NFT project has transferred the commercial rights and sales rights of the IP to the holders, who can redesign and recreate these “apes” and can also transfer their ownership rights.

Crossing art, fashion, entertainment, and catering, the popular “Boring Apes” has achieved great commercial success. It is no longer just a JPEG image circulating on social media, but an IP ecosystem that has grown from a niche circle to a phenomenal NFT brand.

Compared to focusing on indicators such as bottom price and trading volume all day, the most important thing for NFTs right now is to break through and let people outside the Web3 world see how this blockchain-based visual application can transform existing business models. The integration of NFT intellectual property (IP) and physical IP is, in fact, a two-way breakthrough in cross-border marketing, finding new growth points among the customer bases that both sides want to have.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Will Micro-Rollup be the next wave when applications become Rollup?

- Inventory of Common Scams in the Cryptocurrency Field

- LianGuai Morning News | G20 leaders will discuss advancing the proposed roadmap for cryptocurrency regulation in October.

- Artificial Intelligence and Work Automation

- Jay Chou’s ‘Fantasy Music Universe’ is here. Would you buy the 30 yuan digital collectible key?

- Bankless Why does the US Treasury Bond Trigger the Widespread Adoption of RWA?

- GameFi caught in controversy Is it a bubble that will eventually burst or a completely new game mode?