LianGuai Observation | All In Imports Elements of the Coin Circle, Coin with the Same Name Rides on the Heat

LianGuai Observation | Coin with Same Name Rides on Coin Circle's HeatAuthor: Climber, LianGuai

On August 5th, the crime film “All-in” with the theme of “anti-fraud” began its test screening. In just two days, the film’s presale box office has reached 500 million yuan. The “Sci-Fi Coin” that appears in the movie has also been simultaneously launched by many cryptocurrency projects in the industry, attempting to develop it into the next “Dogeking” or “SQUID”.

As “All-in” officially releases on August 8th, and considering the hot presale box office, FOMO sentiment has started to spread, and many members of the cryptocurrency community claim to have invested in this meme coin.

Although the movie contains many elements related to the cryptocurrency industry, its main theme is to raise awareness about online financial fraud. As for these new “Sci-Fi Coins” that have emerged as similar projects named after the movie, they belong to the category of cryptocurrency scams mentioned in the movie itself. However, many people still have a similar mentality to the character in the movie who jumps off a building due to being bewitched, driven by greed and unwillingness, and hoping to get rich quick.

- The Success Story Behind the Explosion of TG Bots A Successful Tale of On-Chain Marketing and Grassroots Counterattack

- Will going online mean the end? BALD plummets a thousand times, what is the future of Base public chain?

- The hype of room-temperature superconductor triggers the meme token craze of LK-99 Innovation or cutting-edge?

Cryptocurrency Elements in the Movie

“All-in” is based on tens of thousands of real internet fraud cases in China. The protagonist, programmer Pan Sheng (played by Zhang Yixing) and model Anna (played by Jin Chen), are lured by high-paying overseas job offers but end up falling into the trap of an overseas fraud factory. In order to escape, they engage in various fraudulent activities, which also involve cryptocurrency transactions.

In the movie, the master’s student Gu Tianzhi (played by Wang Dalu) is naive and greedy, dreaming of getting rich overnight. After multiple failed gambling attempts, he chooses to steal his family’s property ownership certificate to cash out 8 million yuan and use the money to buy the virtual currency “Sci-Fi Coin,” gambling on the so-called “last” chance of winning. In the end, he loses everything and jumps off the building in despair, committing suicide.

It must be said that even in the real world, there are many people who have had similar experiences to Gu Tianzhi. They are tempted by the greed and allure of cryptocurrency projects in the industry, become addicted to gambling, lose their rationality, and ultimately lose all their assets and go down a path of no return.

According to the audience member @keenz_eth, in the movie “All-in” adapted from the theme of telecom fraud, the cryptocurrency plot is the last link in which the victims are deceived, and it is also the ultimate reason for the victims committing suicide. In addition, the contract-leading app “Coincoin” also appears multiple times in the movie as a tool used by the fraud group.

What surprises people in the cryptocurrency industry the most is that the “Sci-Fi Coin” mentioned in the movie is displayed in the English subtitles as the well-known cryptocurrency project Ethereum. Therefore, some speculate that the token that the fraud group lures Gu Tianzhi into buying in the movie is actually Ethereum’s token, ETH.

Therefore, lines like “Can we bring him into the coin circle?”, “There is insider information, guaranteed profit”, “Too dangerous, let’s switch to Ko Tai coin” quickly became the catchphrases of many members who purchased the same-name Dogecoin project CX.

In and out of the play: Zhang Yixing in the cryptocurrency world?

Actor Zhang Yixing is the protagonist of “All In”. In a sense, he can be considered a spokesperson for anti-fraud publicity on the internet. However, in the drama, he plays a character who helps the fraud group set up a cryptocurrency project and deceive investors. In real life, he may indeed be a person in the cryptocurrency world.

Zhang Yixing’s tags on the social platform X include music producer, singer, dancer, actor, and other identities, but various signs in the past imply that he may have another identity: a person in the cryptocurrency world.

In March of this year, Zhang Yixing and Japanese artist Takashi Murakami, as brand ambassadors for the watch brand Hublot, jointly promoted the NFT series of watches.

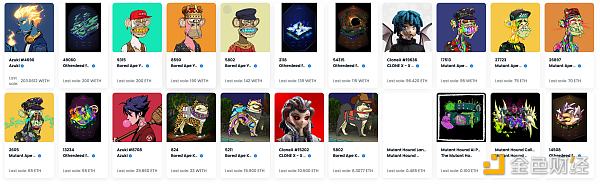

At the end of last year, well-known Chinese NFT community KOL @inSmallhome revealed that Zhang Yixing had purchased multiple well-known NFT works, such as Bored Ape, Azuki, CLONE X, and other series. Netizens estimated that the value was over ten million at that time.

What aroused speculation in the cryptocurrency community the most was a close-up photo of Zhang Yixing and Sun Yuchen, in which both were smiling and standing side by side.

On this matter, some netizens exclaimed that with Zhang Yixing’s understanding of cryptocurrency, he wouldn’t have become a student of Sun Yuchen, would he?

The crazy same-name Dogecoin

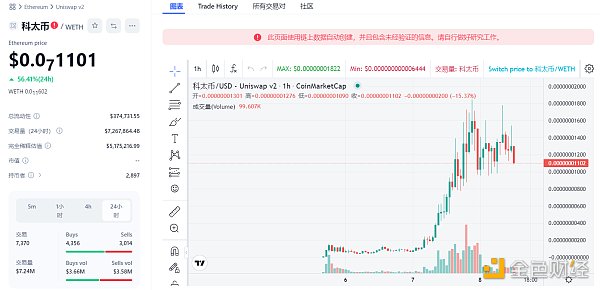

Almost simultaneously with the preview of “All In”, a “Ko Tai Coin” dogecoin project appeared rapidly on the Ethereum blockchain.

Capitalizing on the popularity of the movie, the project frequently published articles promoting the project’s prospects and stated that their goal was not just a bottom pool of around 20 ETH and a market value of several hundred thousand, but to become the leader of the Chinese Meme.

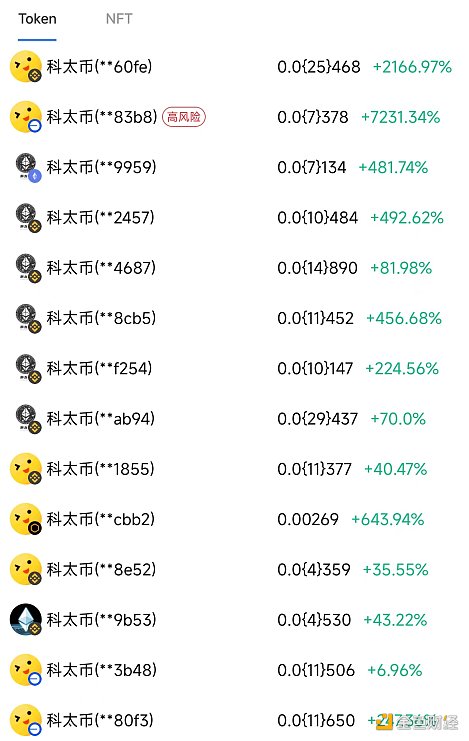

Due to the inherent Fomo nature of celebrity dogecoin projects, this same-name coin did experience a surge in value. According to CoinMarketCap data, since its launch on August 5th, the token has risen by 240,729.43%.

And other same-name tokens have also risen sharply under the leadership of this flagship token, and similar projects can be found on multiple chains.

The rise in prices of these same-name dogecoin projects has attracted many whales. The largest holder of the Meme token, Harry Potter, bought Ko Tai Coin for 6 ETH, and foreign investor @IHunt100xGems bought this token for $500,000 using a public wallet.

Due to the inherent memetic properties of Meme, which relies entirely on emotional value support, many members of the crypto community are influenced by Fomo emotions. Based on the expectation of the future box office success of “The Gamble”, they have joined the buying frenzy, hoping that “Crypto Coin” can create another myth in the crypto circle after “Dogeking” and “SQUID”.

Conclusion

“The Gamble” comes from “Biography of Kou Zhun” in “History of the Song Dynasty”. It means to bet all the money and make a final adventure in the face of life and death.

But whether it is in movies or the real world, no matter how many times you lose before, the probability of winning next time will only be 1/2, not to mention that there is a banker behind the scenes. Therefore, there are no winners in the gambling game; leaving the gambling table is winning.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- AlterVerse Research Report Web3 Sandbox Game Based on Binance Chain

- LianGuai Daily | Hackers have returned all stolen funds to Alchemix Curve pool; US SEC provides over $104 million in rewards to 7 whistleblowers

- Decoding Decentralized Order Book The Best Combination of Pricing Quality and Fund Security

- LianGuai Daily | Coinbase, Block, and Apple release quarterly reports; X Company is seeking data partners to establish a trading platform.

- Ether Futures ETF Applications Pile Up, Is the Gear of Crypto ETF’s Fate Starting to Turn?

- Developer’s Guide How to Build Products on the Base Mainnet?

- World Engine A sharding Rollup framework designed for full-chain games