What is the actual trading volume of Bitcoin?

Source: Medium

Author: Charles Edwards,

Translation: First Class (First.VIP)_Jill

Editor's Note: The original title is "The Impact of Bitcoin Derivative Market Growth on the Future of Bitcoin"

- Babbitt column | Xiao Wei: The formal blockchain project, where is the legal boundary?

- EdenChain and NodeNum jointly released 12 dApp games, one-step login to experience

- Federal Reserve's latest Financial Stability Report: Stabilizing coins may become a new trading medium

In 2019, the main use of Bitcoin was still investment and speculation. On the surface, from the transaction volume of the bitcoin spot market, the situation is not optimistic.

In-depth research, we can find from the prosperous derivatives market that Bitcoin is more liquid than ever.

This paper examines the recent developments in bitcoin trading behavior and its many benefits to ecosystems.

What is the actual trading volume of Bitcoin?

Determining the true trading volume of Bitcoin is a hot topic.

In early 2019, Bitwise found that 95% of the bitcoin transactions reported on CoinMarketCap.com were fake. Bitwise concluded that trading volume can be accurately reported by relying on only 10 exchanges. Subsequently, Alameda Research found that although many exchanges did generate false transaction data, the actual transaction volume was much higher than Bitwise's findings.

This article does not provide an absolute number for the actual trading volume of Bitcoin today, but rather focuses on the relationship between trading volume and time. By analyzing changes in trading volume, we can gain insight into the development of the Bitcoin ecosystem.

To develop a trusted bitcoin historical volume file, we used Bitwise's conservative choices and Alameda-trusted exchanges that can access data in TradingView.

Spot market trading volume is basically flat

As shown in the chart below, the spot market trading volume (the value of unlevered physical bitcoin traded in legal tender) does not exceed the 2017/2018 bubble peak.

The average weekly trading volume of the Bitcoin spot market did not exceed the 2017 peak

The average weekly trading volume of the Bitcoin spot market did not exceed the 2017 peak

However, since the beginning of 2018, a new dynamic has evolved – the massive use of Bitcoin derivatives.

Derivatives change everything

Now only considering the trading volume of the spot market is no longer accurate.

The size of the derivatives market has surpassed the spot market, and traders use futures contracts for long and short leverage.

The growth rate of derivatives is surprising, and the total trading volume of Bitcoin's spot and derivatives is currently at the same level as the 2017/18 peak.

By August 2019, the average daily trading volume of Bitcoin was more than 40% higher than the 2017/18 peak.

Bitcoin derivative market trading volume has swallowed up the spot market

Bitcoin derivative market trading volume has swallowed up the spot market

Why is the volume of derivatives trading growing?

There are no signs of slowing down the use of derivatives, and we have no reason to suspect that it will slow down. Some people say that recent futures trading is hot, just like the 2017 ICO boom, but the observation of the legal currency market has found another.

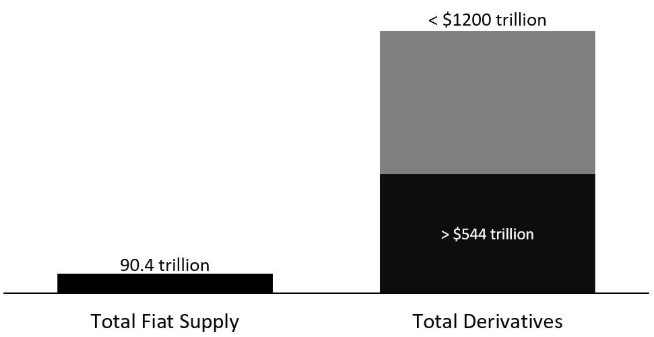

Globally, the nominal value of a legal currency derivative contract is approximately $1 trillion. This is 6250 times larger than the market value of Bitcoin (the French currency derivative is 6 to 13 times larger than the total supply of French currency), and Bitcoin has a lot of room for growth.

Traditional money market valuation

Traditional money market valuation

Trading volume as an important indicator

It is not uncommon for strong trading volumes to drive strong price increases. As the recent tweet says, bitcoin has reached an all-time high and price consolidation has taken place as bitcoin has risen. The recent surge in trading volume may have a potential impact on bitcoin price movements.

The benefits of increased liquidity

The increase in trading volume is a step toward greater adoption of Bitcoin, which provides a larger entry point for Bitcoin. Greater liquidity makes it easier for large financial institutions to enter the bitcoin market because:

· Market prices can be better trusted. • When large funds enter or exit the market, they will not cause major price falls in the market. Options and other derivatives provide multiple investment strategies.

Derivatives also allow miners to lock in their selling prices before they are dug up, thus hepacing recent cash flows. Instead of expecting Bitcoin prices to remain the same or rising, miners can now short (sell) bitcoins or buy put options. This process can help miners gain a clearer source of income, enabling them to better manage their business to ensure profitability. This certainty also makes the cost of switching to other cryptocurrencies more expensive. Miners' hedging is particularly useful when halving, and when the block rewards are halved, the decline in profitability may lead to miners selling and causing bitcoin prices to plummet in the short term. Therefore, in the long run, we may see that the growth of computing power is more stable.

Conclusion :

1. Bitcoin is more mobile than ever

2. This liquidity provides a greater entry into the Bitcoin market for institutions.

3. Derivatives bring more deterministic income to Bitcoin miners and promote long-term development of Bitcoin networks

4. The growth of trading volume is higher than the growth of the bull market

Finally, the more Bitcoin trading instruments approved by regulators, the more Bitcoin instruments a fund holds, and the more banks trade, the harder it is for the government to ban it.

This is a win-win situation for the long-term adoption of Bitcoin.

Please reprint the copyright information.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Ethereum is expected to upgrade to Istanbul on December 7th

- The cryptocurrency wallet GateHub data was leaked and 1.4 million account information was stolen

- Li Lihui, former president of Bank of China: The blockchain needs to be scaled up, and it is urgent to break through five technical bottlenecks.

- Featured | Read the Ethereum community new favorite MarketingDAO

- Yao Yudong, former director of the Central Bank's Financial Research Institute: Called the Dawan District to try the digital currency first

- Grayscale Bitcoin Trust Fund submits registration application to SEC, investors may benefit

- A deep understanding of the role of luck in cryptocurrency investment: whether the quilt is to cut the meat or the dead bar