How is the OP ecosystem now? Is it worth investing in?

What is the current state of the OP ecosystem and is it a good investment?Author: Sleep in the Rain

With the widespread adoption of OP Stack, OP has gained more market attention recently. Next, I will analyze the current situation of OP from two perspectives.

– Ecology & Projects

– The future of OP Stack

- The Tech Giants’ Battle of X Digital Identity, Payments, Social Graph, AI, and Universal Basic Income (UBI)

- After a massive layoff of 73%, can Star Atlas, a 3A masterpiece born in a bull market, still be launched as scheduled?

- After LSDFi, will the liquidity provided by derivative LPDFi trigger the next wave of DeFi narrative?

– Ecology & Projects

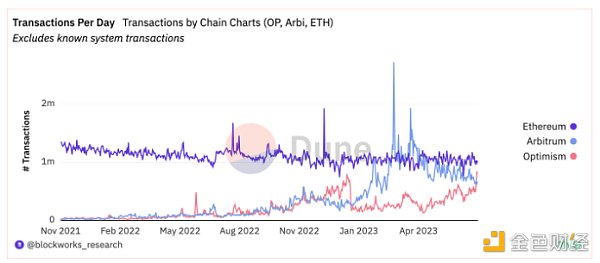

From a data perspective, Arbitrum is still the leader in Layer2, and OP is still at a disadvantage in terms of ecology. However, with the widespread adoption of OP Stack, OP has gained more market attention recently (Basechain, Worldcoin) – even though there are continuous unlocks, the overall market value of OP has been increasing.

It is worth mentioning that OP’s daily transaction volume has now surpassed Arbitrum, indicating a trend of draining Arbitrum.

TVL also has an upward trend.

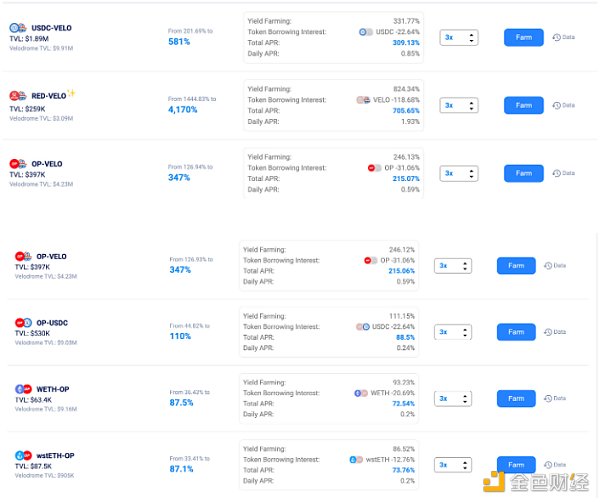

Velo, the flagship protocol of OP, is a DEX that adopts the ve3.3 architecture. It has been lukewarm before due to the lack of native assets on the OP chain, which is far inferior to Arbitrum (GMX, Magic, Dopex, Pendle, etc.). To kickstart the flywheel, ve3.3 needs to attract enough protocol participation, and the more native assets on the chain, the stronger ve3.3 on that chain will be.

More and stronger native assets – high user adoption rate (mining + trading demand) – need deeper liquidity to reduce slippage – ve33 is cost-effective for low liquidity procurement – increase the emission value of ve33 tokens and bribe income – positive flywheel

From the current situation, the development of the OP ecosystem still has a long way to go. But we can also see that many protocols have been built around Velo, such as Extra Finance and Exactly Protocol.

Extra is a lending protocol that comes with UI/UX to support users’ participation in Velo DEX liquidity mining with leverage through the protocol. So far, the protocol still provides high liquidity rewards. The high LP rewards alleviate the token emissions faced by users holding $VELO (another way is to lock VE for bribe income). Its current TVL is 19M, making it the fastest-growing protocol in OP recently.

Exactly is a protocol that provides users with floating/fixed interest rates for assets. The current TVL is 82M. Now, Exactly’s native token $EXA has been deployed in the liquidity pool on Velo and has increased LP rewards through bribes.

Extra and Exactly are two directions that interact with the Velo protocol. The former leverages LP through borrowing, while the latter establishes liquidity pools to provide more bribes for veVELO holders.

Exactly’s behavior represents the demand for liquidity from native protocols on the OP chain and the fulfillment of this demand by ve3.3 DEX Velo. Extra amplifies the wealth effect on the OP chain, attracting more people to join the OP chain.

They represent two different aspects of catalysts, with Velo being the beneficiary and the ecosystem also benefiting. We can also see from the growth of Velo’s Fee and Incentive Rewards that Velo has gained more dividends in the gradual growth of the OP ecosystem. If more market attention and sentiment brought by the OP Stack can continue, Velo will also achieve corresponding growth.

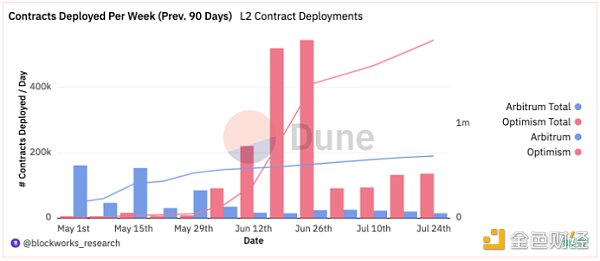

Another proof of the rapid growth of the OP ecosystem is the change in the deployment volume of OP contracts in the past 90 days. So in the past six months, the OP ecosystem should have some protocols with good performance.

Another native protocol with good TVL performance is Sonne Finance. It is a lending protocol with a current TVL of 107M.

As for Synthetix, it is a multi-chain synthetic asset protocol that everyone is already familiar with, so I won’t go into details. However, the difference between it and GMX is that GMX’s GLP provides a powerful income-generating asset Lego for the Arbitrum ecosystem, and various protocols can be built on top of it, creating a positive GLP flywheel. Synthetix’s sUSD does not have such an advantage, and even has to bear joint debt. SNX stakers are providers of protocol liquidity, and their income comes from inflation and fee revenue, so the market value of SNX also determines the upper limit of SNX protocol liquidity—it will be addressed in v3 in Q4.

The advantage of Synthetix, like Velo, is that it provides a powerful product Lego for protocols deployed on OP. Unfortunately, they did not introduce a powerful income-generating asset Lego for OP like GMX/GLP.

For the OP ecosystem, this gap represents a potential growth opportunity.

-The future of OP Stack

We can now see that OP Stack has gained more adoption. Brand endorsements from institutions like Coinbase have given OP Stack a good brand endorsement. Therefore, we don’t have to worry about the future adoption and development of OP Stack. Its main threat comes from zkRollup, but from the current situation, zkRollup is far from mature, and OP Stack has already started to expand into ZKP technology.

Another point worth noting is whether the chains adopting OP Stack can benefit OP. The previous statement from Basechain was that a portion of the revenue would be fed back to the Optimism Collective. This is a good thing for OP, as having a source of income for the treasury means “capability,” and “capability” will be more reflected in the token price. If more chains follow Basechain’s approach, it will provide more “capability” for the Optimism Collective.

Obviously, the OP team has also realized this “capability” of OP Stack and, on July 25th, released the Law of Chain proposal, aiming to launch a shared governance model and sequencer for all chains adopting OP Stack. This is similar to the shared security model previously established by Cosmos. The essence of the Law of Chain is to standardize the “revenue feedback” model. The implementation of this proposal will also bring more revenue to the Optimism Collective.

Above is my understanding of OP, and in the future, I personally will actively participate in the ecosystem of OP.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Bybit Payroll Manager Steals Large Amounts of USDT, Singapore Court Elaborates on Cryptocurrency Property Attributes

- Binance Chain L2 pioneering application MEKE to start public testing on July 31st

- Involved in a transaction of 400 billion yuan, how do law enforcement agencies dispose of confiscated cryptocurrencies?

- How will the five market makers improve the liquidity of WLD compared to Zero as a market maker for PEPE?

- Analyzing UNI Long-tail Liquidity Scenarios How Does it Work?

- African Gold Rush I Help Chinese People with Worldcoin KYC, Earning Up to 20,000 RMB per Day

- Is the concern about Worldcoin groundless?