Blockchain Weekly | 25% down in a single day, is the bull market ending?

Guide

On the 27th, from 4 am to 4 am on the 28th, the BTC price fell by nearly 25%. Why did the flash collapse? Is the bull market ending?

Summary

Topic: Why did BTC crash? We believe that this round of decline is mainly affected by the following factors: (1) the overdue profit-taking of the over-the-counter sell-off; (2) the technical level price has a callback demand; and (3) the short-term profit is exhausted. Multiple negatives prompted BTC to fall sharply, but the bull market was basically unchanged. We believe that although the BTC has suffered a large decline due to multiple factors, on the one hand, the adjustment in the bull market is inevitable, on the other hand, the short-term negative factors have relatively limited impact, and the basic logic of the current bull market has not changed, and the risk is fully released. Conducive to the further development of long-term market. For investors, the early adjustment of the bull market is a good opportunity for jiacang.

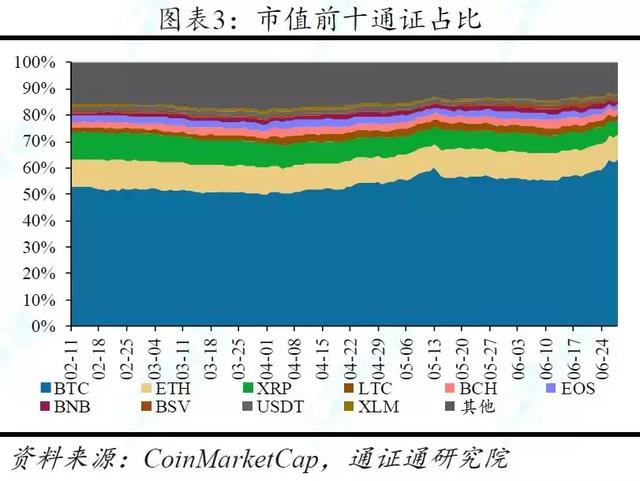

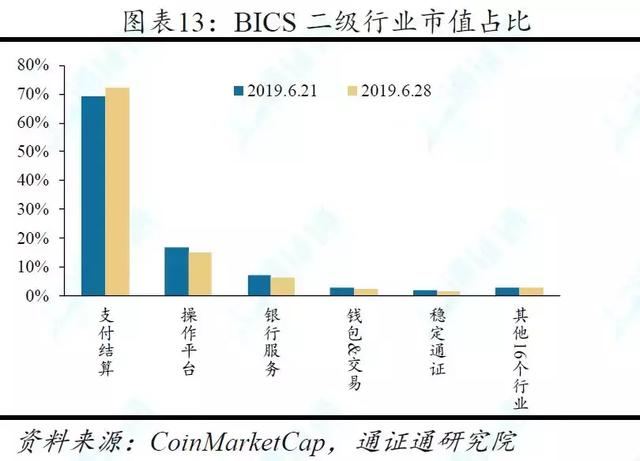

Quotes: BTC led the gains and fell back. The total market value of digital certificates this week was 348.69 billion US dollars, an increase of 12.9%; the average daily trading volume was 96.37 billion US dollars, up 59.1%; the average daily turnover rate was 28.5%, up 7.5%. The current price of BTC is 12,407 US dollars, an increase of 22.3%; the average daily turnover of BTC this week is 30.8 billion US dollars, and the average daily turnover rate is 14.8%. The current price of ETH is 311.2 US dollars, an increase of 5.5%; the average daily trading volume of ETH is 11.23 billion US dollars, and the average daily turnover rate is 33.6%. This week, the exchange's BTC balance was 877,700, a decrease of 0.61 million; the exchange's ETH balance was 8.11 million, an increase of 20,000. In the BICS secondary industry, the market value of the payment and settlement industry increased significantly, and the market value of other types of currencies and the number of certificates fell.

Output and heat: BTC's computing power and mining difficulty have increased significantly, and public attention has grown significantly. The difficulty of mining this week is 7.935T, which is 0.525T higher than last week. The average daily power is 59.81EH/s, up 5.82EH/s from last week. The mining difficulty of ETH this week is 2128, up 106 from last week. The average daily power is 167.5TH/S, which is 6.5TH/S higher than last week.

- Why is the blockchain far beyond people's imagination?

- Winter is over, is spring still far behind? 10 pictures review how the cryptocurrency in the first half of 2019 came out of the trough

- The gathering of the public coffee, the Ethereum Technology and Application Conference was held in Jingsheng University

Industry: Blockchain has gained more attention and recognition, and competition in the payment and settlement industry has intensified. Ukrainian bank Dukascopy plans to launch stable card Dukascash; PwC began to provide eight kinds of cryptographic certification services; US House Financial Services Committee will hold a hearing on Libra on July 17; Beijing Mutual Gold Association released "About Be wary of risk warnings for investing in the virtual pass market.

Risk warning: regulatory policy risk, market volatility risk

text

1

Topic: A 25% drop in a single day, is the bull market ending?

1.1 Why does BTC crash?

At 4 o'clock in the morning of June 27th, Beijing time, the BTC price reached 13969USDT, which set a new high for the year, but then it fell sharply. At 4 o'clock on the 28th, the BTC price dropped to 10,521USDT to stop the decline, and the 24-hour drop was near. 25%.

So why is BTC crashing? We believe that this round of decline is mainly affected by the following factors:

(1) The set-up disc sells the overlay and the profit-taking disc is repelled. In the downturn in 2018, many investors were stuck at a high level. As the price of BTC continued to rise sharply in the near future, the investors who had stuck in the previous period had a large sell-off, and the investors who entered the market earlier took profits, resulting in the price of BTC. Drastic fluctuations.

(2) There is a callback demand for the technical level. From a technical perspective, BTC prices have continued to rise in recent weeks, and they have repeatedly broken through multiple resistance levels in the short-term. The weekly line breaks the Bollinger's online track, KDJ is at a high cross, and deviates from the price trend, and the price callback demand is strong.

(3) Short-term positives are exhausted. The early stage of the Middle East and international trade tensions prompted global risk aversion. Last week, Facebook launched Libra to greatly increase the attention of all sectors on the encryption pass. The short-term positive factors prompted the BTC price to accelerate. With the short-term positive factors, The market is back and forth.

1.2 The market has turned sharply, where will the future market go?

Multiple negatives prompted BTC to fall sharply, but the bull market was basically unchanged. We believe that although the BTC has suffered a large decline due to multiple factors, on the one hand, the adjustment in the bull market is inevitable, on the other hand, the short-term negative factors have relatively limited impact, and the basic logic of the current bull market has not changed, and the risk is fully released. Conducive to the further development of long-term market.

A similar situation occurred in early June 2019. At that time, in less than half an hour, BTC rose from 8730USDT to 9064USDT, setting a new high for the year, but after only 6 hours, the BTC price dropped to 8010USDT.

The bull market has plummeted. According to our previous statistics, the “popping and plunging” in the general market can be described as commonplace. Compared with the traditional financial market, there is no price limit in the secondary market of digital pass, and the price fluctuation of the pass is relatively high. As a result, the “popping ups and downs” for the traditional market can be described as commonplace in the market. If the 10% rise and fall limit of the stock market is used as a measure of the "shocking and plunging", in the past 6 years, the BTC has risen and fallen more than 10% in a single day, and there have been 150 times. On average, there will be a "surge" every half month. The plunge", which rose more than 10% in a total of 81 times, the daily decline of more than 10% a total of 69 times.

The short-term plunge in the bull market often does not affect the market to continue to develop. In the bull market, when the price is close to the interval of the accumulation of a large number of sets in the previous period or due to the impact of major bad news, there is often a concentrated sell-off, which leads to the emergence of a "plunge" market. However, in the bull market, the "plunge" often It will soon be digested by a large number of buying discs that will appear later. The short-term decline does not affect the continued development of the bull market. This time, the performance of BTC also verified the above viewpoint. BTC fell to 10,500 USDT to gain support and quickly rebounded to around 12,000 USDT.

It is still in the early days of the bull market, and the callback is a good opportunity for jiacang. According to our judgment on the BTC Bulls and Bears cycle, it is still in the early stage of the bull market. This round of BTC can get about 10 times to increase to about 50,000 US dollars. In case of callback investors, they can appropriately increase their positions according to their own circumstances.

2

Quotes: BTC led the rise, rushed back

2.1 Overall market: Rise back

The total market value of digital passes this week was 348.69 billion US dollars, an increase of 39.9 billion US dollars compared with last week, an increase of about 12.9%. This week, the BTC rose faster, and then there was a large adjustment.

The average daily trading volume of the digital pass market was US$96.37 billion, up 59.1% from last week, and the average daily turnover rate was 28.5%, up 7.5% from last week.

This week, the exchange's BTC balance was 877,700, a decrease of 0.61 million from last week. The exchange's ETH balance was 8.11 million, an increase of 20,000 from last week.

The USDT market value was $3.6 billion, an increase of $0.3 billion from last week. The enthusiasm for funds entering the market has dropped, and the USDT premium is not obvious.

2.2 Core Pass: BTC leads the rise

The current price of BTC is 12,407 US dollars, with a weekly increase of 22.3% and a monthly increase of 43.3%. The average daily turnover of BTC this week was 30.8 billion US dollars, and the average daily turnover rate was 14.8%. The BTC accelerated in the first half of the week and the second half showed a correction.

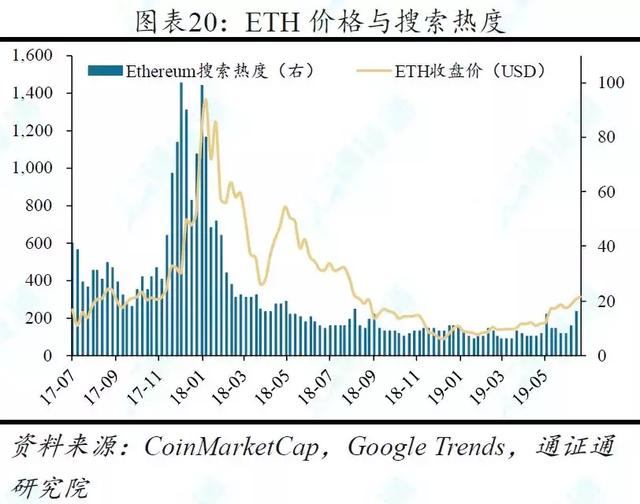

The current price of ETH is 311.2 US dollars, with a weekly increase of 5.5% and a monthly increase of 15.5%. The average daily trading volume of ETH this week was 11.23 billion US dollars, and the average daily turnover rate was 33.6%. ETH weakly linked the BTC market.

EOS is currently trading at $6.26, down 11.7% for the week and down 21.6% for the month. The average daily trading volume of EOS this week was 3.39 billion US dollars, and the average daily turnover rate was 54.7%. EOS had a higher increase in the previous period and was weaker this week.

The current price of BCH is US$436.8, with a weekly decline of 0.6% and a monthly decline of 3.8%. The average daily volume of BCH this week was 2.76 billion US dollars, and the average daily turnover rate was 33.4%. BCH had a higher increase in the previous period and was weaker this week.

The volatility of the main circulation certificate increased significantly this week. The monthly volatility of BTC was 27.6%, up 9.8% from last week. The monthly volatility of ETH was 24.9%, up 5.5% from last week. The EOS monthly volatility was 32.2%. Last week, it fell by 0.3%; BCH's monthly volatility was 26.8%, up 6.5% from last week.

2.3 BICS industry: The market value of the payment and settlement industry increased significantly, and the market value of other types of market and the number of certificates fell.

In the top five industries of BICS (Blockchain Industry Classification Standard), the market value of the payment and settlement industry increased from 69.2% to 72.5%. From the perspective of the change rate of market value, the market value of data & storage, leisure services and project service industries accounted for a higher growth rate, which increased by 101.5%, 26.6% and 21.7% respectively compared with last week; other, communication services, medical care The decline in market share was more pronounced, down 63.7%, 39.2% and 26.8% from last week.

The BICS secondary industry with a relatively large increase in the number of passes this year is professional services and pass-through assets, which is an increase of 14.3% compared with last week. The BICS secondary industry with a significant decline in the number of passes this week is non-bank financial Compared with the others, it decreased by 14.3% and 28.6% respectively.

2.4 Market View: The callback does not change the bull market logic

BTC accelerated its rise and reached a new high. In the first half of this week, under the stimulus of multiple positives, the market sentiment was high, the BTC rose faster, the price reached a new high, and the main circulation certificate was linked, and both gained large gains.

Multiple factors prompted the callback to appear. This week, BTC showed a large adjustment after accelerating the rise, and then rebounded rapidly. The main circulation certificate appeared to be linked. The callback was mainly due to the selling of the lock-up, the profit-taking and the short-term positive factors. In addition, the technical level There are also adjustment needs.

The short-term correction does not change the bull market logic, investors should grasp the opportunity to increase positions. Despite the callback, similar situations have occurred in the bull market. At the beginning of the bull market, the callback is a good opportunity to increase.

3

Output and heat: BTC computing power and mining difficulty have increased significantly, and public attention has grown significantly.

BTC, ETH computing power and mining difficulty have all improved. The difficulty of mining this week is 7.935T, which is 0.525T higher than last week. The average daily power is 59.81EH/s, up 5.82EH/s from last week. The mining difficulty of ETH this week is 2128, up 106 from last week. The average daily power is 167.5TH/S, which is 6.5TH/S higher than last week.

This week, Google Trends's Bitcoin entry search heat was 25, and the Ethereum entry search heat was 16, which was a significant improvement compared to last week.

4

Industry News: Blockchain gains more attention and recognition, and competition in the payment and settlement industry is intensifying

4.1 Swiss bank Dukascopy plans to launch a stable pass Dukascash

The Swiss bank Dukascopy plans to launch the stable certificate Dukasash, which will be supported by the three legal tender currencies of the euro, the US dollar and the Swiss franc. The bank has disclosed the address of its certificate reserve.

4.2 PricewaterhouseCoopers begins to provide eight types of cryptographic certification services

The accounting firm PricewaterhouseCoopers has begun to provide encryption and certification audit services, which currently covers eight audits of cryptographic certificates, including BTC and ETH. In the past year, PricewaterhouseCoopers has designed a tool to verify that the private key and public key address of the encrypted asset account match, so that the ownership of the encrypted asset can be confirmed. PricewaterhouseCoopers has used the tool to audit the accounts of Hong Kong-listed blockchain investment company BC Technology Group Ltd.

4.3 The US House Financial Services Committee will hold a hearing on Libra on July 17.

On June 24th, the US House Financial Services Committee announced that it will hold a hearing on Facebook's Virtual Pass Libra on July 17. According to previous reports, the US Senate Bank, Housing and Urban Affairs Committee will hold a hearing on Libra on July 16.

4.4 Beijing Mujin Association issued “The Risk Warning for Continued Vigilance on Investment in Virtual Passport Market”

The Beijing Internet Finance Industry Association issued a document saying that many institutions use the banner of "academic research" to frequently organize different forms of offline "seminars" and "forums" under the name of "1C0" and its variants. Illegal publicity activities. The Algorand project, VDS, etc., will continue to carry out illegal cross-border financial activities in various places including college financing roadshows. The association specifically reminds that relevant enterprises should strictly abide by national laws and regulations and resolutely resist all kinds of illegal and illegal financial activities carried out under the name of “virtual certificate”, “1C0” and its variants.

Source: Tongxuntong Research Institute

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Libra Research Report of CCID Research Institute of the Ministry of Industry and Information Technology: Advocating China's Active Promotion of Digital Legal Currency Construction

- How should the banking industry use blockchain technology?

- Counterfeit currency attacks on the currency circle: how to prevent it effectively?

- Babbitt column | Dovey Wan: Bitcoin is not a safe haven, yet

- Weekends are rising? Since May, 40% of BTC's rising prices have occurred on weekends.

- Where is the development bottleneck of DeFi? What is the opportunity?

- Reddit will accept cryptocurrency rewards, this time without robots