What should we do when the stable currency is no longer stable?

In April 2019, the digital asset market has recovered, and Bitcoin has re-emphasized the $5,000 integer mark and drove the mainstream digital assets to rise. This round of gains has also caused many investors who are waiting to see or have left the market to refocus their attention on digital assets, and funds continue to flow into the currency market. According to the coinmarketcap data, the market value of digital assets rose from $125.47 billion at the beginning of the year to $186.06 billion, and the daily trading volume also rose from $13.79 billion to a maximum of $88.4 billion.

The rapid influx of external funds has caused a certain degree of fluctuation in the stable currency. On some trading platforms, the price of a USDT OTC is close to or even more than 7 yuan, with a premium of 4%. Then, why is the stable currency no longer stable? When the stable currency loses its original attributes, how should investors respond?

Frequently questioned, USDT no longer anchors the dollar

In November 2014, Tether issued a USDT and declared that the USDT would be pegged to the US dollar, anchoring 1 USDT to $1. Tether promises that users can trade USDT back to the US dollar on their platform 1:1. The concept of "stable currency" was born.

Shortly after the issuance of the USDT, Bitfinex, a well-known digital asset exchange that has inextricably linked with Tether, took the lead, and famous exchanges such as the P network were introduced. When the legal currency transaction is not allowed, it is difficult for investors to accurately measure the price of a certain currency through the currency standard. The emergence of the stable currency perfectly solves this problem, and the USDT is almost occupied by the entire market soon.

Before the emergence of credit currency, the central bank issued a currency must store a certain amount of gold or silver as a basis for issuing currency. The USDT is similar, except that its collateral changes from precious metals to dollars. As an issuer, Tether's credibility is far less than that of a government. Therefore, financial transparency and authoritative third-party audits are necessary. However, since April 2017, due to financial fraud, the market value of USDT has soared from less than 500 million US dollars to 2.7 billion US dollars, and it has successfully ranked among the top 10 in the market value of digital assets. Behind the soaring market value, the USDT credibility that completely limits the development of the coin is rapidly declining and accompanied by constant doubts from investors. In October 2018, there was a rumor that “Tether could not cope with the run”. The USDT off-market price plunged nearly 10% in one day, and many investors suffered heavy losses when they only held USDT.

Perhaps tired of coping with outsiders' demands for bank deposit certificates, Tether officially announced in March this year that USDT changed from a full margin system to a partial margin system. What does that mean? It is the original release of a USDT, the company needs to deposit 1 US dollar in the bank account, and now how much to save, 1 cent is not impossible. This means that the USDT price in the hands of investors will be determined by the market. If there is excessive excess, there is a risk of depreciation; if there is a short supply in the market, there will be a certain margin.

Stabilizing the future of coins: compliance

The USDT issue is constantly exposed, allowing many well-funded project parties to see opportunities. In 2018 alone, stable currencies such as TUSD, USDC, GUSD and PAX appeared. Among them, USDC, GUSD, PAX, etc. are all compliant stable coins, that is, stable coins are issued by companies that obtain digital asset licenses. For example, LLC, the distribution company of USDC, got the first New York State Financial Services Authority (NYDFS) to issue a digital currency license (BitLicense) as early as 2015, and in 2016 the UK Financial Conduct Authority (UK Financial ConductAuthority). The first electronic currency issuance license (E-Money IssuerLicense) issued.

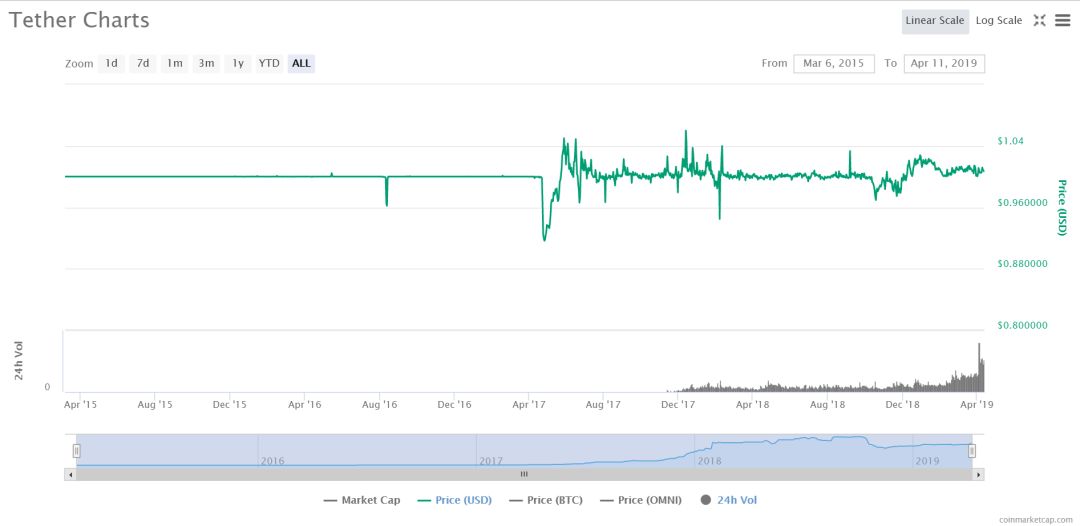

From the data provided by CoinMarketCap, USDT began to fluctuate after April 2017 and could not maintain stable at 1 US dollar/piece. Since the reserve is no longer anchored 1:1 with the US dollar, the over-the-counter market price volatility marks the fact that the USDT has actually lost its stable currency.

Source: CoinMarketCap

Source: CoinMarketCap

Although other stable currencies will fluctuate within a certain margin on the off-exchange price, the issuer deposits a full margin in the bank account. The fluctuation is only the embodiment of market liquidity and does not affect the properties of its stable currency.

to sum up

Stabilizing coins is an important channel for French currency to enter the digital asset market and plays a pivotal role in the entire digital asset ecosystem. At present, USDT still occupies a market quota of more than 70% of stable currency, but its influence and credibility decline is undeniable. In addition, the lack of stable attributes also worried investors, the rise of compliance stable currency may have an impact on the USDT hegemony.

About HashKey Pro

HashKey Pro is part of the digital asset group HashKey Group and is a full-featured digital asset trading platform. Guided by fairness and justice, the company strictly abides by compliance operations, strictly controls technology research and development, and attaches importance to risk prevention and control, pays attention to user transaction experience, and is committed to providing safe, reliable and convenient for professional individuals and institutional investors worldwide. Efficient asset services.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- In addition to layoffs, Jingdong is still secretly doing this.

- Sand, Death and Cryptographic Currency: Decentralized Social Practice in Northern Syria

- Facebook will open a cryptocurrency plan worth 1 billion knives, Tim Draper said it intends to invest

- The trillion business of the PoS mine pool

- "Gray" carnival digital currency management: profiteering, trading, lack of supervision…

- Daily Twitter Pickup: Coinbase releases Visa debit card; Youtube currency circle red talks about mining "ban"

- Babbitt Exclusive | US Congress Hearing Record: Does Goldman Sachs really want to do cryptocurrency transactions? Why is JP Morgan Chase?