The trillion business of the PoS mine pool

This is a business with a total market capitalization of nearly one trillion yuan. Wanxiang, Firecoin, Coinbase, etc. have long been known.

The current 80 PoS or PoS-like projects have a total market capitalization of $145.3 billion. With the changes in the future market, the economic value of these 80 PoS or PoS-like projects will be difficult to estimate each year due to the Staking rewards issued to nodes or users.

Some node service providers said that if they operate 10 Staking nodes, their profitability exceeds that of a listed company.

Profitability in Staking Economy mode

- "Gray" carnival digital currency management: profiteering, trading, lack of supervision…

- Daily Twitter Pickup: Coinbase releases Visa debit card; Youtube currency circle red talks about mining "ban"

- Babbitt Exclusive | US Congress Hearing Record: Does Goldman Sachs really want to do cryptocurrency transactions? Why is JP Morgan Chase?

On April 2, 2019, at 10:30 pm, in the conference hall of Youke Workshop in Dongcheng District, Beijing, Kamie, the founder of Wetez, ended a 15-minute speech on the theme of "Staking Economy Risk".

Wetez is a Chinese node operation service provider based on the cross-chain star project Cosmos and Tezos. Through the node wallet or node mine pool, it provides users with the services of participating in the chain mortgage token to verify the block and get the bonus reward. As a node, Wetez will The user is charged a corresponding percentage of the service fee.

This service differentiates the bitcoin mining pool business based on the PoW consensus mechanism. It is mainly based on the blockchain project of PoS, DPoS or PoW+PoS dual consensus mechanism, providing users with Staking (node verification of blockchain, called Staking). service.

The user (token holder) obtains the transaction fee, block reward, and dividends through pledge, voting, authorization, and lock-in. The node that provides such service is called (Staking-as-a-Service). , StaaS). The way users get revenue through the node is called Staking Economy.

At the same time, the node that owns a large number of tokens can also participate in Staking itself, and the dividend income obtained will be a considerable amount.

In the case of Cosmos, the original issue of the original token ATOM is about 240 million, and is issued annually by one-third of the initial circulation, that is, 80 million ATOMs.

At present, although ATOM has not been able to openly trade on the exchange, according to Shenzhen Chain Finance, ATOM's OTC average price has been fired to 1 US dollar. Based on the OTC price, the value of the additional issuance will reach USD 0.8 billion. .

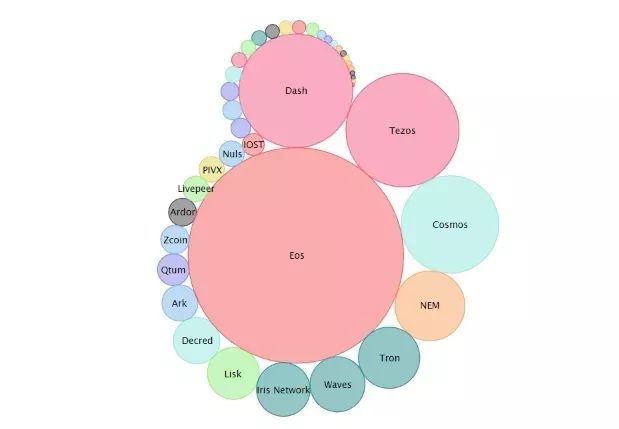

The following picture shows the current blockchain project based on the PoS, DPoS or PoW+PoS dual consensus mechanism listed in the article "Staking Economy #14: Staking Goes Mainstream". In addition, the final route of Ethereum and Cardano is also PoS. mechanism.

Image courtesy of "Staking Economy #14: Staking Goes Mainstream"

The author of the article, Felix Lutsch, pointed out that our friends at Staking Rewards are constantly adding new data and now visualize all Staking projects:

The total value of PoS (such as Tezos and Cosmos), DPoS (such as EOS and Tron), and Masternodes (such as Dash).

According to their data, at the time of writing, the total value of these mortgage tokens was nearly $5 billion.

According to the statistics of the number chain, the total market value of 80 PoS or PoS-like projects has reached US$145.3 billion, and the revenue range of Staking is [0.02%, 156.23%], of which Livepeer has the highest equity return rate of 156.23%.

EOS issuance totaling 1 billion, with an annual increase of 5%, and super nodes will receive 1%.

Even with a current estimate of about $5.80, the total revenue of Staking Economy for 21 super nodes is up to $58 million.

With the changes in the future market, the economic value of these 80 PoS or PoS-like projects will be difficult to estimate each year due to the Staking rewards issued to nodes or users.

Some insiders believe that PoW's early mining model has created a billion-dollar mining machine giants such as Bitian, Jianan, and Yibang International, and large mining pools such as btc.com, antpool, and f2pool.

The awakening of the PoS project, the capitalists who have long coveted the mining industry, are likely to wait for the blue ocean of Staking Economy.

Profit or more than a listed company

In July 2018, Kamie set out to build the PoS node wallet Wetez and Cosmos, Tezos and other nodes.

“We are a team that has recently noticed Staking business opportunities in China,” Kamie said.

At the time, Wetez evaluated many PoS projects. The project's popularity, on-line time, token threshold, and project annual revenue were the four main assessment dimensions.

“The project heat determines the user's participation in the node. The online time determines the timing of the node participation. The token threshold is the hard indicator for building certain nodes, and the annual revenue determines the profit of the node itself and the user.” With more than half a year of node operation experience. Kamie summarizes the basic logic of the four evaluation dimensions.

Kamie told Deep Chain Finance: "We generally choose to build a node based on the amount of money that is not a very high entry threshold. We want to do it like LOOM, but our team does not have 1.25 million LOOMs."

For Staking, the biggest cost of a node is actually the amount of tokens held, not the operating costs. At the beginning of the construction of the Tezos node, Wetez began to seek support from Tezos.

But node operations are not always smooth. Although the Wetez team prepared for Cosmos's main online line in advance, what they didn't expect was that Cosmos, which was originally expected to be launched at the end of 2018, was not launched until March 2019. Cosmos's progress made Wetez's cash flow tight. .

Mr. Zhang, the head of Tezos' operations, participated in the operation and construction of the PoS node. On the other hand, he wrote an article on the PoS economy in the public, and made a thoughtful output to users in the industry concerned about blockchain technology.

The Cobo wallet was launched in May 2018, when it was connected to a currency of LBTC. Currently, Cobo Wallet has access to five PoS currencies including DCR, VET, Dash and so on.

A Cobo staff member told Deep Chain Finance that the PoS gain is a PoS currency that generates revenue for node mining, such as XZC and IOST. We provide a function similar to one-click voting. Users can enjoy the benefits by going to the gain account. For the proceeds of active voting, users do not need to build their own nodes for the currency in which they need to take the node.

In addition to Tezos and Cobo, HuobiPool and the universal HashQuark are also deployed in the PoS node service. Firecoin currently supports CMT, IOST, ONT and other currencies, and has issued HPT mine tokens.

As the Shenzhen SuperNode of IOST and CMT, its founder, Zhao Chuanlin, told Shenshen Finance that we are still waiting for Polkaadot's nodes. Technology-driven projects like LOOM can be made into 10 nodes with more profitability than one listed. The company is over.

But Kamie said: "Despite the recent Staking Economy being fired, there is no more capital coming in and there are waiting to see."

Polarized state

Staking Economy does not have a clear Chinese translation, nor is it included in Wikipedia. The reason for the sudden fire in the near future is that PoS such as Cosmos, Polkadot and Cardano started the main network at the time of 2019. Some people in the industry have reached a consensus on value.

Kamie believes that another reason is that Coinbase recently led a Staking node service provider called Staking.us, which was reported by the domestic media and sparked a Staking Economy-oriented topic.

Compared with the domestic Staking Economy, the foreign Staking Economy is small.

There are 100 certification service providers for Cosmos. According to the Hubble browser, Cosmos's previous 100 node limit quotas are not only full, but its token pledge rate has reached 50%.

On the one hand, well-known node service providers like Staking.us, StakeCapital, and Chorus One have already joined the proxy service early.

On the other hand, capital such as Coinbase and WinklevossCapital lays out the Staking industry in the form of investing in Staking.us.

Chorus One, which provides Staking services, is currently involved in the construction of two nodes in Cosmos and LOOM. Chorus One researcher Felix Lutsch told Deep Chain Finance that Polkaadot's pledge verification service will be provided to users in the future.

Kamie believes that foreign Staking nodes prefer to focus on a certain value project, they like to do governance, development and decision-making.

They will have technical thinking output, not just like some domestic nodes, they simply come to Staking income, and even domestic new nodes will use low fees as a means of competition instead of community.

According to Kamie, the foreign Staking nodes are more focused and segmented. Staking.us mainly serves the organization, Chorus One targets individual households, and like TezosCapital and Sky, they focus on the Tezos and Cosmos chains themselves.

Risk remains

Although in Kamie's view, Staking Economy can be expected in the future, the Staking node itself is also at great risk.

Kamie believes that the biggest risk of Staking Economy comes from the PoS equity mechanism itself. Kamie comes down to three points: the token lock cycle, the system Slasher, and the reward loss.

The basic logic and the consensus mechanism of PoS have a certain causal relationship.

As an alternative to Work-of-Stake (PoW), whether it is a Proof-of-Stake (PoS) proposed by Sunny King in 2012, or a Proof of Proof of Proof of Proof Stake, DPoS), ignored the important issue of "nothing at stake" at the beginning of the design.

No interest: In the case of a fork, the equity holder has an incentive to place a bet on both chains formed by the fork, and is more likely to have a double payment problem.

In order to solve the problem that the production block of the node will only generate rewards without imposing a penalty for it, Vitalik et al. proposed a punitive proof algorithm called Slasher, which makes the cost of the node more expensive than the cost of the pledge. Please pay attention to three words here: bet, punishment and pledge.

In the PoS mechanism project, whether it is a normal token holder or an institutional investor, if you want to get the Staking reward, you can choose a Salone wallet, node and other third-party professional node verification service providers to pledge by building a node. Tokens are paid for dividends, and the service provider will charge a certain service fee proportionally (except for self-built nodes).

For a node that is evil, if it threatens the security of the system, the system will perform a Slasher, and the penalty will be waived for the token that is greater than the cost of the mortgage; the node will verify but there is no block, resulting in the loss of the reward.

At present, the industry recognizes that the token lock-up time is about 20 days. During the lock-in period, the node cannot perform token asset conversion or sale behavior. When the currency price fluctuates drastically, this is for the huge token holder. In other words, the loss caused by the inability to cash out in time will be immeasurable.

Reference article:

"Staking Economy is here! 》

Proof of Stake FAQ

"Staking Economy#14 Staking Goes Mainstream"

Dry Goods | Equity Proof Ecosystem 102: The End of the Era of the Conservatory

[Deep chain original]

Wen Hao Wu Salt

This article is the original deep chain Deepchain ( ID: deepchainvip) . Unauthorized reproduction is prohibited.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Getting started with blockchain | Read the hash function in a text

- Stabilizing currency management: The next block in the blockchain?

- Explain the 12 blockchain demonstration projects selected by the Korean government

- US SEC Chairman: Using existing laws to deal with cryptocurrency entity non-compliance

- Money and payments in the digital age: IMF presidential bureau, Circle "heads-up" JPMorgan Chase and regulators

- Can the bitcoin belief that has collapsed be rebuilt now?

- QKL123 Research Report | Ruibo, the leading currency for cross-border payment, can the market stand in the top three?