How to handle the confiscated virtual currency worth 400 billion yuan involved in the case?

What to do with the seized 400 billion yuan worth of virtual currency?Virtual currency is no longer far away from our daily lives, and more and more people are learning about and using it through various channels. Due to the characteristics of virtual currency such as virtuality, decentralization, and anonymity, it has become a “secret weapon” for many crimes such as money laundering and illegal fundraising.

Recently, there was a high-profile “cross-border online gambling case” in Jingmen City, Hubei Province, in which the individuals involved used virtual currency for settlement. The special task force coordinated with the virtual currency issuing institution and froze the relevant virtual currency accounts involved, preventing the flow of virtual currency worth $160 million (over 1 billion yuan) into the hands of the suspects. In October 2022, the People’s Court of Shayang County made a judgment to confiscate part of the frozen virtual currency in accordance with the law. This case became the first case of “virtual currency confiscation by court judgment” in the country.

So, people can’t help but wonder, how is the “confiscation of virtual currency” actually carried out? How does the executing authority liquidate these virtual currencies? Do these liquidation methods violate legal provisions? This article will explain the judicial execution of virtual currency.

- Is the hype around AI Agents that Silicon Valley giants are talking about real or just a bubble?

- Be vigilant of the hidden rug pull caused by contract storage leading to a run-off.

- Variant Partner Why is UniswapX said to be a boost for Uniswap?

Risk Warning: This article only represents the personal opinions of Lawyer Honglin and is for communication and discussion purposes only. It does not constitute legal advice on specific matters and business projects. For specific matters, please add the author’s WeChat at the end of the article for consultation.

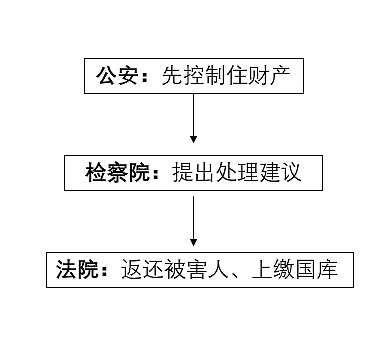

01. Traditional approaches to handling assets involved in a case

The general process of criminal litigation consists of three stages: police investigation, prosecution by the procuratorate, and trial by the court. The handling of assets involved in a case generally involves mandatory measures such as sealing, seizure, freezing, recovery, and confiscation, which are approved by the investigative agency (police) in the first place. After the police investigation is completed, the case will be transferred to the procuratorate, where the prosecutor will initiate public prosecution and propose recommendations for handling the assets involved in the case. Subsequently, the case will be transferred to the court, which should make a judgment according to the law and handle the assets involved. If the assets involved are found to be illegal gains or should be recovered according to the law, the court should order the return to the victim or confiscate and hand over to the national treasury. The above process is shown in the following diagram:

02. Challenges in executing virtual currency

Due to the unique nature of virtual currency, it is difficult for law enforcement personnel to handle assets involved in a case according to the above conventional process. The main challenges in executing virtual currency are as follows:

1. Difficulty in implementing seizure measures

Unlike general assets, in order for investigative agencies to seize virtual currencies, the first step is to have the suspect surrender the keys (private key, mnemonic phrase, etc.). If the suspect agrees to transfer the virtual currencies in their electronic wallet to the public security authorities, the authorities can then hold the keys and the electronic wallet. However, if the suspect does not cooperate, the authorities cannot seize these virtual assets.

2. Difficulty in safeguarding virtual currencies

Most of China’s public security agencies or judicial agencies do not have proficient knowledge of blockchain technology, nor do they have dedicated accounts or professional custody institutions for storing virtual currencies. Therefore, custodians are prone to losing or confiscating virtual currencies. In addition, these confiscated virtual currencies may also be subject to attacks by criminals or hackers, making them irrecoverable and causing significant losses.

3. The handling process may be illegal

Currently, all types of transaction services related to virtual currencies are completely prohibited in China, and such activities are not allowed in the domestic market. Consequently, the question arises as to how judicial agencies should handle the virtual currencies seized in cases. If the judicial agencies liquidate these virtual currencies, they will also face legal risks. Although judicial enforcement agencies have the right to auction or sell the assets involved in a case, liquidating virtual currencies by judicial authorities is essentially a transaction involving virtual currencies, which contradicts the current policies in China aimed at preventing and combating virtual currency speculation.

03. Current status of domestic virtual currency enforcement

Due to the lack of clear regulations regarding the execution of confiscated virtual currencies in China, different judicial agencies have adopted various approaches in practice. The key differences in their handling approaches mainly lie in the following aspects:

1. Whether to “liquidate”

The first point of disagreement among different agencies in handling virtual currencies is whether to “liquidate” them. Some agencies in certain regions choose to liquidate the virtual currencies and contribute the proceeds to the national treasury, while others only confiscate the virtual currencies without liquidating them.

However, most of the virtual currencies obtained through illegal fundraising, pyramid schemes, and other criminal activities are initially acquired from ordinary people, and then these funds are exchanged for virtual currencies and consolidated. Therefore, directly confiscating the seized virtual currencies without converting them into circulating legal tender would result in significant losses for the victims and would also amount to a significant waste of social resources.

In addition, if the virtual currencies are directly contributed to the national treasury and subsequently allocated to public fiscal expenditures, to some extent, this would imply that virtual currencies have the same status as legal tender, which contradicts China’s regulatory attitude towards virtual currencies.

“Monetization” seems to be something that judicial authorities have to do after confiscating virtual currencies involved in a case.

2. Who “monetizes”

There are currently two main ways to handle confiscated virtual currencies: one is for the public security organs to handle them first, and the other is for the court to confiscate them and then hand them over to the local finance department.

In China’s judicial practice, the usual practice is for the public security organs to dispose of virtual currencies during the investigation stage. Because the general financial departments cannot handle these virtual currencies and the judicial authorities need to monetize them, most of the judicial authorities will find the public security department to monetize them. After going around in circles, it is still the public security organs that “monetize”.

3. How to “monetize”

During the process of handling cases, there are three main methods commonly used to monetize virtual currencies:

-

Direct sale by relevant departments

-

Entrusting a third party to sell

-

Requiring the suspect to entrust a third party to sell

The current mainstream practice is to persuade the criminal suspect to plead guilty and cooperate with the public security organs to entrust a third party to sell the virtual currencies involved in the case, and use the proceeds for refund or transfer to the national treasury.

4. Legal risks in the “monetization” process

Originally, using a third party to monetize was the main way for judicial authorities to solve the problem of executing virtual currencies. However, with the release of the “Notice on Further Preventing and Dealing with the Risks of Virtual Currency Trading Speculation” by ten ministries and commissions in 2021 (hereinafter referred to as the “Notice”), this path seems to have been “blocked”:

“Financial institutions and non-bank payment institutions are not allowed to provide services for virtual currency-related business activities. Financial institutions and non-bank payment institutions are not allowed to provide services such as account opening, fund transfer, clearing and settlement, and are not allowed to include virtual currency in the scope of collateral. They are not allowed to engage in insurance business related to virtual currency or include virtual currency in the scope of insurance liability. If illegal or irregular clues are found, they should be reported to the relevant departments in a timely manner.”

“Internet companies are not allowed to provide services such as online operating places, commercial displays, marketing promotions, and paid traffic diversion for virtual currency-related business activities. If illegal or irregular clues are found, they should be reported to the relevant departments in a timely manner and provide technical support and assistance for related investigations and investigations. The cyberspace and telecommunications authorities will close websites, mobile applications, mini-programs, and other Internet applications that engage in virtual currency-related business activities in accordance with the problem clues transferred by the financial management department.”

According to the “Notice”, it can be seen that the “third parties” generally chosen by the executing authorities are suspected of engaging in illegal financial activities, which makes the path of our judicial authorities’ execution “even more difficult”. Even if monetization can be done through a third party, the third-party institution will charge a certain percentage of fees, and the amounts involved in virtual currency-related cases are mostly huge, making the fees a significant amount and the judicial costs extremely high. In addition, the flow of funds after third-party monetization is unclear, and it is unknown whether the monetization behavior will contribute to the illegal financial activities such as “speculation” of virtual currencies.

Therefore, it is not a good idea to realize the confiscated virtual currency through third parties.

05. Summary

In fact, the fundamental problem of the “difficulty” in judicial enforcement of virtual currency lies in the lack of legislation in our country. The act of “realizing” virtual currency itself is contradictory and conflicting with existing legal provisions in our country, and the unclear procedural provisions make it easy for various agencies to pass the buck and shirk responsibility when dealing with virtual currency cases. Virtual currency has become the “spear” of crime, and it is urgent to forge the “shield” of justice. The road ahead is long and far, with the birth and circulation of more and more digital assets in the era of Web3.0, and it is a heavy task to improve the relevant institutional provisions for the execution of virtual currency issues.

References:

Hongxing Han, Ran Wang: “Construction of Disposal Procedures for Criminal Virtual Currency Cases”, “Criminal Research” 2023 Issue 3.

Guanman Zhao: “On the Criminal Confiscation of Bitcoin”, “Journal of China People’s Public Security University (Social Sciences Edition)” 2022 Issue 4.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Another case of flash loan attack Analysis of the LianGuailmswap security incident

- Why is Musk’s Twitter reform said to have a profound impact on cryptocurrencies?

- Google Play Store announces new rules allowing games and apps to offer NFTs.

- The Struggle between Ripple and SEC What Will Happen Next? Experts Evaluate Four Possible Outcomes.

- Blockchain Criminal Case 3.0 How to Reduce Illegal Gains? How to Deduct Reasonable Expenses?

- Zonff LianGuairtners The Logic behind Investing in EigenLayer

- Clash of Perspectives Taking on-chain games as an example, is Optimistic Rollups more suitable for high throughput and low composability applications?