Variant Partner Why is UniswapX said to be a boost for Uniswap?

UniswapX, a variant partner, is considered a boost for Uniswap.Author: Jack Gorman & Derek Walkush, Variant; Translation: LianGuaixiaozou

Last week at the EthCC conference in Paris, Uniswap announced the launch of UniswapX, a new protocol for cross-AMM transactions. Our view is that UniswapX will be a boost to the Uniswap protocol. Why? This is based on our in-depth research on the Uniswap protocol at Variant.

One key fact to understand is that about 25% of the trading volume generates the majority of the fees (in the past 180 days). Please keep this data in mind.

UniswapX is a new aggregator protocol built by Uniswap Labs. In short, the protocol introduces a new participant called “fillers” (essentially searchers), who use on-chain and off-chain liquidity sources to fill swapper orders.

- Another case of flash loan attack Analysis of the LianGuailmswap security incident

- Why is Musk’s Twitter reform said to have a profound impact on cryptocurrencies?

- Google Play Store announces new rules allowing games and apps to offer NFTs.

This seems like a threat to the underlying AMM protocol, as “fat head” assets like ETH and BTC typically have higher trading volume and more efficient price discovery on off-chain CEXs (centralized exchanges). If fillers flow to off-chain liquidity, the fat head volume in the protocol may decrease.

However, despite the possibility of fat head liquidity flowing elsewhere, we believe this will not pose a serious threat to Uniswap AMM. Uniswap can still price most of the long-tail tokens (DeFi tokens, meme tokens, etc.) better than other protocols, making Uniswap the primary market for many of these tokens.

So does UniswapX pose a survival threat to the Uniswap protocol? Probably not. This is because AMM was never intended to compete with central limit order books (CLOBs), which are ultimately a more efficient market structure when there are a large number of liquidity providers and demanders.

AMM is particularly suitable for price discovery and liquidity of long-tail tokens, which are more niche tokens that do not have sufficient liquidity for efficient trading on CLOBs. AMM can create passive liquidity, allowing niche buyers/sellers to still be able to trade.

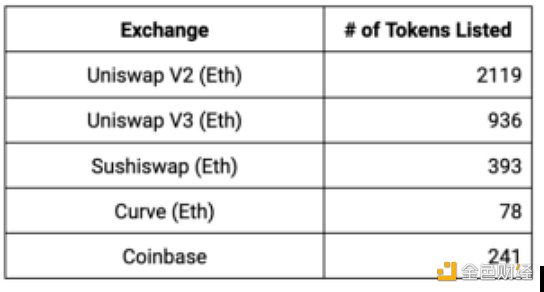

Uniswap controls the majority of long-tail liquidity. According to CoinGecko’s data, Uniswap has the most token listings among major Ethereum trading applications.

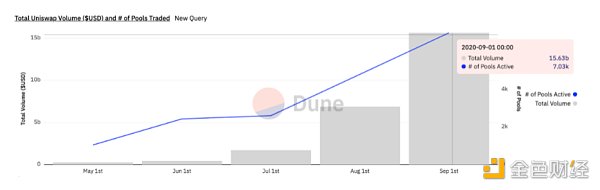

This is largely due to the huge long tail of cryptocurrencies, which roughly doubles in each major cycle.

The “DeFi Summer” of 2020 brought us an interesting case study, where many CEXs were unable to list long-tail tokens due to quantity, liquidity constraints, or other reasons. In July to September of that year, Uniswap’s monthly trading volume increased by about 10 times.

Due to its deep liquidity from billions of TVL, Uniswap offers better pricing for these tokens compared to other on-chain liquidity sources. The following graph shows which part of Uniswap the aggregator trades flowed to, based on the type of token pair.

Please note that 74% of the trading volume for ETH/”OTHER” token pairs (DeFi tokens, meme coins, etc.) is directed towards Uniswap compared to other exchanges. This indicates that Uniswap is more competitive in long-tail pricing compared to other decentralized exchanges (DEX).

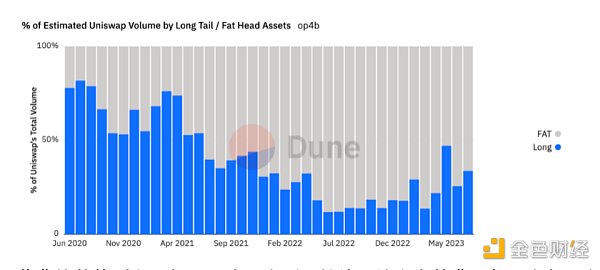

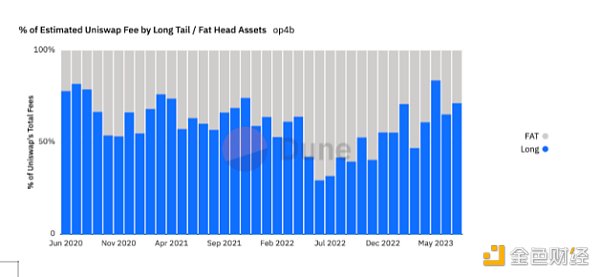

The following chart shows the monthly trading volume of Uniswap since June 2020, categorized into long-tail and fat head. Any major L1, L2, and stablecoin pairs fall under the fat head category. Over time, it is evident that an increasing amount of Uniswap trading volume comes from fat head trading pairs.

The fee trend, however, is quite different. Except for a few months, the majority of fees are generated by long-tail trading pairs. This is because Uniswap V3 introduced lower tiers, thereby compressing fees to obtain more competitive fat head liquidity.

One explanation for this is that long-tail liquidity is more valuable than fat head liquidity, as it has been proven to be less sensitive to fees. Long-tail liquidity is scarcer and accessibility and convenience often outweigh price efficiency.

UniswapX ensures superior fat head pricing even in areas that AMMs cannot reach. As long as the Uniswap protocol remains the best liquidity venue for the long tail, we expect frontend interfaces to continue directing these trades to the protocol.

A healthy and sustainable application ecosystem exists on top of the most successful protocols. As cryptocurrency technology matures, protocols need to ensure they provide unique value that multiplies for the end-user applications integrated with them.

Uniswap has been doing this for long-tail trading pairs, and our view is that there will be a large number of long-tail trading pairs generating substantial revenue. UniswapX will attract more users to discover the long tail through more efficient pricing.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- The Struggle between Ripple and SEC What Will Happen Next? Experts Evaluate Four Possible Outcomes.

- Blockchain Criminal Case 3.0 How to Reduce Illegal Gains? How to Deduct Reasonable Expenses?

- Zonff LianGuairtners The Logic behind Investing in EigenLayer

- Clash of Perspectives Taking on-chain games as an example, is Optimistic Rollups more suitable for high throughput and low composability applications?

- Exploring the Decentralized Business Potential of XMTP from the Perspective of Coinbase Wallet’s New Features

- World Coin Hard to Talk About Fairness?

- Must-read in the evening | Understanding the ‘World Coin’ by OpenAI Founder in One Article