When the securities token tsunami strikes, who can seize the opportunity to become the ultimate winner?

One of my latest articles on securities tokens, Flippening Is Coming, outlines why 2019 securities tokens will surpass practical tokens. Since then, the future of securities tokens has received a great deal of attention. Here are 8 reasons why I support it.

1. The smartest person in the financial world is leaving Wall Street and dedicated his life to the field of encryption.

News such as "Goldman Sachs bankers bid farewell to Wall Street for encryption of wealth" and "Credit Bankers who are known for advocating encryption" bid farewell to Wall Street are becoming more common in CNBC.

What makes me most confident to bring a storm to securities tokens is the genius who works on encryption and securities tokens. But now many people do this just to make money. But it doesn't matter, the encryption field still needs them. However, some people have seen the dawn of encryption, realizing that the biggest advantage of encryption is that it can make the world a better place for the benefit of billions of people. This is not just a new financial instrument, but a movement driven by a group of talented people who are full of a strong sense of mission and aim to change the world.

- After releasing the white paper for two consecutive years, Jingdong tried to regain a game through the blockchain.

- Adam Back: Bitcoin mining centralization hinders the development of side chains, but the final side chain will likely show those competitive coins

- Introduction | Verifiable Distribution Network: Blockchain Expansion Ultimate Solution

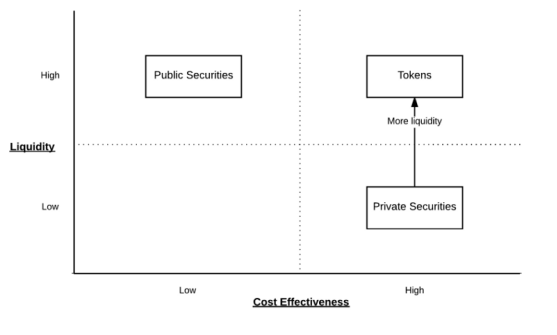

2. Liquidity requirements

The simplest argument for securities tokens comes from the Harbor white paper:

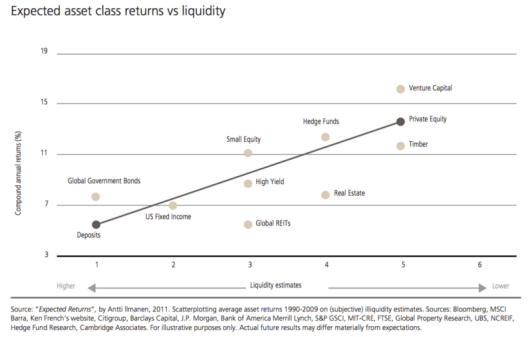

It is commonplace for people to pay for liquidity. All other things being equal, the higher the liquidity you provide to investors, the lower the return they require:

Since multi-million-dollar private assets can be tokenized, the value of unlocking through token technology over the next decade will be trillions of dollars.

3. Securities token retail

The mechanisms for creating, trading, keeping, and maintaining security compliance for securities tokens are much more complicated than at first glance. This is why there are still a few technology companies that are struggling to date. But everything has been changing. Retail is rising at an alarming rate and is becoming more powerful.

Companies like Tokensoft, OpenFinance Network, Teknos, Polymath, Verify Investor, Start Engine, tZERO, Templum, Kingdon, Blackmoon, Securitize, Slice, Swarm, and Harbor are just ones that build standardized, interoperable, and scalable securities token solutions. A small number of companies.

4. The golden age of securities innovation is coming

The interest was in Mesopotamia in 3000 BC, and the initial interest rate was set at 20%.

About 800 BC, China invented banknotes.

Around 600 BC, Asia Minor minted the first coin containing gold.

Mutual funds were invented by the Dutch in 1774 in response to the rescue of the British East India Company.

Mortgage-backed securities (MBS) were invented in the United States in the 1950s.

The leveraged buyout was invented in 1919 by Ford's LBO.

In 1977, Bear Stearns first issued junk bonds, and then Drexel issued another seven junk bonds. De Chong Securities subsequently invented the Debt Collateral Bond (CDO) in 1987.

But in history we have not seen any examples of the digitization of securities and the use of smart contracts. Our imagination limits securities innovation:

A good example of financial technology innovation is Bancor, which eliminates market friction and provides unprecedented liquidity.

The early STO (tech company) just digitized existing securities. Just like the early TV, we just broadcast on TV instead of using the innovation brought by new media. The first batch of TV broadcasters could not think of this:

At the time we couldn't imagine what a security was. But now we are about to enter the golden age of securities innovation, ready to open the storm of thought, waiting for the digital wallet to bomb!

5. Securities token regulations have been implemented for 85 years

Institutional investors have fiduciary duties, including cautious obligations, to ensure that investments are legal. This is why there are very few institutions that invest in utility tokens because US investors are regulated by securities regulations, and utility tokens are largely not securities.

But the five important securities laws of 1933-1940 have been amended several times by Congress, including the 2012 Employment Act. We may not like these laws, but securities token investors know what these laws are and are free to invest because they know that their actions are in compliance with the law.

6. I want my own MTV – part of the ownership will have a huge impact

The shares are part of the company's ownership. NetJets brought us some of the ownership of the aircraft in 1964. Although some of the ownership is not new, the tokenized private ownership solves the problem of de-trust verification and ownership liquidity of ownership, creating an era of unprecedented growth in ownership. There are already many projects underway in the fields of art and real estate. We will wait and see.

The Green Bay Packers (American football team) first sold shares for $5 in 1923 and sold shares for $250 in 2012. These stocks do not represent equity, cannot be traded, nor can they bring season ticket privileges. But shareholders can get the right to vote, the invitation to the annual meeting, and the opportunity to buy exclusive merchandise. This is a practical stock! But in the future, sports sales will include ownership as fans want (more than 350,000 fans own Packers shares) and are willing to pay (Green Bay raised $64 million in 2012). I can't wait to buy stocks from the Red Sox (American Major League Baseball team) and sit in Fenway Park to watch them!

Instead of owning part of the ownership of the aircraft, why not have partial ownership of the aircraft seat? In the future, we can also see partial ownership of songs, movies, TV shows, restaurants, bicycles, cars, motorcycles, mining equipment and cable channels. In the future, if you want to own a MTV, you can do it.

7. Enhancing transparency is equal to enhancing value

With blockchains and smart contracts, transaction information can be made public in real time, eliminating endless one-time disclosures. As more and more services become distributed books, reports will evolve from static disclosure to real-time, networked. By definition, companies with higher transparency will have higher valuations under otherwise identical conditions.

In addition, technologies such as zero-knowledge proofing will implement complex privacy functions, eliminating one of the main drivers of the private blockchain.

8. Securities token meeting – all about the community

The main difference between encryption technology and all previous technologies is the importance of the community to the success of the project. That's why CryptoMondays, CryptoCommons, and CryptoOracle all focus on the community.

Tel Aviv is also pushing for a grand securities token meeting, and many cities have followed suit. As with the field of encryption, the development and participation of the securities token community will make it the ultimate winner.

Finally, read Stephen McKeon, Howard Marks, and Anthony Pompliano for more information on securities tokens. The more time you spend, the higher your return on investment. So be sure to "close the cabin door", the securities token tsunami is coming soon!

Source of this article: First class warehouse

For reprint, please indicate the source!

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Tencent's force blockchain game: "Catch the demon" public test on the day of the heat of the king is glory

- Babbitt column | The impact of non-standardization of products and services on blockchain applications

- April 14th market analysis: long and short sides are arrogant, the market is in a dilemma

- The most powerful number in the encrypted world: 2256

- Simply read Byzantine fault tolerance

- What are we talking about when we talk about interoperability?

- Bitcoin Lightning Network: RSMC