Why decentralization is not as important as you think

If you spend some time on encrypted Twitter, you will be familiar with the narrative of web3. Something like this: At the beginning, the network was "really decentralized." Despite the difficulties, the Internet has won the design victory of the group of companies, and cyberspace has become the domain of enthusiasts and hackers. The Internet is therefore regarded as a neutral platform. Any publisher, regardless of size or strength, is free to open in its network corner.

But in the end, the decentralized Garden of Eden has fallen. That's the story for today.

Nowadays, in the era of web2.0, 93% of searches are performed through Google, 64% of browsers use Crome, and 79% of social advertising revenue is captured by Facebook. A few companies now effectively control cyberspace.

- Bitcoin network March analysis report: hash power gains grow slowly, difficulty or slightly reduced again

- Blockchain Application in Hangzhou Practice: "Blockchain +" Breakthrough to Solve Supply Chain Financial Problems

- Coinbase overweights DeFi, 1.1 million USDC injected into two major DeFi protocols, Uniswap and PoolTogether

Web3 advocates see public blockchains as a catalyst to reverse this trend. They want to let users regain control of the web and replace Google and Facebook with open platforms that may be collectively owned by their users and operate as public utilities.

Some versions of this story were sold to The Economist, The Wall Street Journal, Gartner, and almost all tech media. I believe this story, this decentralized fairy tale, is based on a mistake. This is the error behind most utopian plans.

Let me ask you a question: Why did Satoshi Nakamoto choose to decentralize Bitcoin?

Actually, this is a trick question. Satoshi Nakamoto had no choice. Bitcoin must be decentralized or it won't work. Prior to Bitcoin, all attempts to create Internet-native currencies were either bankrupt or closed down by regulators.

Therefore, Satoshi Nakamoto decentralized Bitcoin. He used proof-of-work mining to achieve consensus without permission. He created a P2P network model, so the network is also decentralized. Eventually, he disappeared completely from the project, and as a result, Bitcoin also had no apparent leadership. He did this to allow Bitcoin to survive and to have the opportunity to realize its vision of a distributed currency without permission.

That's it, we come to where we are today. Bitcoin is now more than 100 billion U.S. dollars, and it has also spawned the renaissance of hundreds of crypto networks, all of which are trying to innovate in the field of digital finance. Now, they have inspired Nakamoto's spirit, and they are arguing and arguing who is the most decentralized.

"Look, how concentrated are your mining pools!"

"You're talking about your block size, your shitcoin."

"Well, we didn't bother pre-digging, so we are truly decentralized."

What happened here? Why did they do this?

This article attempts to make a suggestion: maybe we should stop worrying about decentralization. I know this is very unpopular in the crypto space, but before you vehemently oppose it, listen to me first. If you finish reading, you will understand what I mean.

Maxwell's Bitcoin Guardian

Let us conduct a thought experiment. Assuming a parallel universe, your experience with Bitcoin is all illusion. All your direct bitcoin experiences are the same-it runs the same software, clicks the same button, your UTXO is displayed on the block browser, and all command line interactions are the same. However, there is no decentralized network, no P2P or the like, no actual decentralized consensus. Each Bitcoin transaction simply runs on a huge Postgres database, which is run by a playboy in Canada.

All miners, consensus, and hash rate browsers are just pinging this person's server. Whenever someone digs up a block, they send it to the Canadian's server, and he immediately inserts the block into the database and forwards it to everyone. All external functions of the system look exactly the same. Monetary policy, block time, scarcity, everything is the same. We still have block size debates, we still have Twitter madness, we still have Craig Wright, and we still have an inexplicable link between Bitcoin supporters and carnism.

It's just not "decentralized." That part is the mirage.

What would be different in that world? How is the actual fact about the Bitcoin system different from what we know today? What function does Bitcoin have in our world that Bitcoin does not have in this thought experiment?

Think about it carefully.

The answer is: almost none. It is just as scarce, as hard, and equally "better than gold". The only substantial difference is one of the risks: maybe one day, the Canadian police can kick the guy's door open and make him close Bitcoin. (Blue Fox Note: But this distributed attribute determines whether other attributes are meaningful. Although the surface is similar, the essence is completely different. The problem here is that it is an integral part of the whole. Its separation, which in itself creates conceptual confusion)

This will kill Bitcoin. That is not allowed to happen.

This is why Bitcoin is decentralized. This is to save it from censorship, manipulation and shutdown. But beyond that, Bitcoin's decentralization (decentralization) doesn't really help. Of course, this is important for its image and narrative. If it is not decentralized, we will not consider it legal in this regard. However, all the essential functions of the system are basically the same.

Fortunately, few Canadians control Bitcoin. No one can shut down Bitcoin, which is fine. However, this perspective reveals important content about decentralization.

Satoshi Nakamoto decentralized Bitcoin to solve a specific problem: the previous Internet native currency has been shut down. Decentralized forms of currency are resilient to insolvency, attacks and censorship. However, decentralization itself is not the focus. It's just a tool to achieve a purpose. The key is to create a viable internet currency.

For Satoshi Nakamoto, decentralization is valuable. So far, it has mitigated some fundamental risks: censorship, platform security, corruption, etc. Decentralization gives us some attributes of concern, rather than decentralization itself.

You can't compete on more decentralization

As a cryptographic VC, I often hear some projects claiming that they will be "X, but, decentralized X". Usually, this is a poor sales pitch with poor tone.

The problem is that decentralization is a global emerging property. It is almost impossible for these attributes to compete.

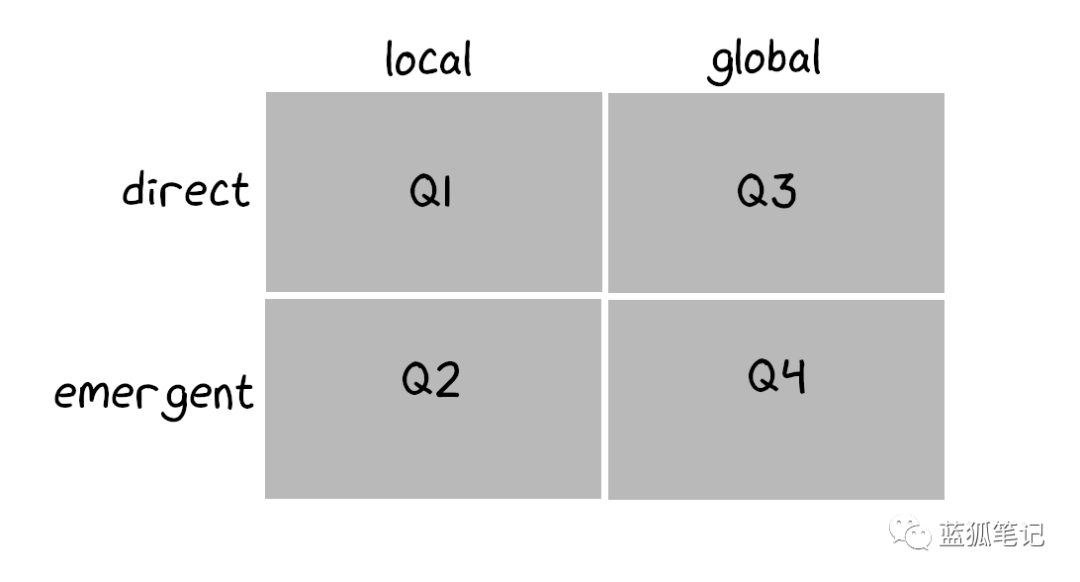

This is a simple framework for thinking about network attributes (originally learned from Nathan Wilcox), with two axes: attributes can be global (global) or local (local), and it can be direct or urgent .

Credit: Tony Sheng

Q1: Local and direct attributes. Think about the local weather. It's a local part of your city, and everyone in your city can feel it, so it's straightforward. People often choose a city based on local and direct attributes, such as weather.

Q2: Locally and naturally. Think about the voter turnout in your city. People in your city know what the number of voters is, and the turnout rate is good, but no one actually feels it directly. Even if people care about citizen participation from an abstract perspective, cities will struggle to compete for better voter turnout.

Q3: Global and direct. Think of global warming. Everyone in the world can directly feel global warming to varying degrees. However, it is difficult for people to coordinate to solve this problem. That is, everyone can feel it, and everyone responds to its consequences.

Q4: Global and natural. This is the most hidden feature. They work for everyone, but no one has experienced them directly. For example, something like "privacy." Not the type "your neighbors can see your privacy through your windows", but more like "billion-dollar companies own a lot of your data, which is weird and uncomfortable, although it seems No obvious bad things have happened. "

This is where the problem lies. Decentralization is the last category: it is global and indirect. No one can feel it. You can feel the delay and feel the transaction costs, but on the surface it's the same whether it's centralized or decentralized. How will users know if your network is decentralized? As a general rule, it is almost impossible for products to compete on global, naturally occurring value attributes, such as decentralization.

Now, you might argue: "It's not about competition between products. It's about building a better Internet."

Ok! Build a better Internet yourself on your own personal Mastodon server. But this is not enough for you, you want the whole world to join in. That's right! If you want, you must compete for the world's attention, and you must compete for merit. In this case, decentralization is not an advantage. It's an obstacle. Leave it alone. You can still win, if decentralization actually allows you to do things that nothing else can handle.

This is why Bitcoin will win, even though it is a decentralized network. It brings something completely new: permissionless transfers without reviewing the currency. Bitcoin has proven its value by surviving and ensuring health. It has more than 10 years of history. It has successfully passed through its seemingly immature adolescence (Mentougou incident, Silk Road, Dark Web market, etc.) . Bitcoin survived because it was decentralized.

But let's be more specific. Many supporters claim that the developers have chosen this new world. Developers are tired of the garden wall of the modern Internet. Developers take us into a new decentralized future.

Ok. So let's take a closer look.

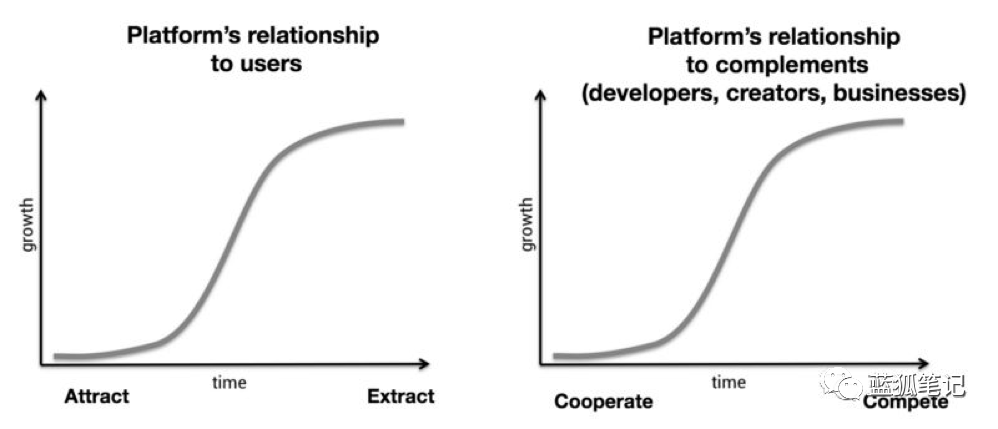

We know that today's developers are very difficult to build on a decentralized blockchain: it is slow, expensive, difficult to use, and there are not many blockchain users. But decentralized supporters will refute: Don't you know the story of the Twitter API? Twitter originally had an open API, but they closed it, and all entrepreneurs building applications based on the API were devastated. Entrepreneurs no longer want to use APIs owned by others. That's why web3 wins.

But that's the problem: developers don't care about "decentralization." When developers evaluate whether to use Linux, npm, React, Twilio, they don't care at all whether they are decentralized. Developers care about risk.

They want to minimize technological risks. They want to minimize the risk of API dependencies. However, they also want to minimize the risk of users of their platform migrating to other platforms (or such risks never occur); they care about the potential risk of technology crashes; they care about the risk of tool degradation or never optimization, and so on.

Risk is a multi-dimensional vector. Decentralization mitigates some risks but does not mitigate others. I assure you that today's developers are more comfortable building products on Twitter's remaining APIs than they are building products on the public chain. Twitter has 38 million accounts that regularly use its API, and the total number of dApp users is still well below 1 million.

To be clear, decentralization reduces some risks! In a decentralized system, the risk of censorship or closure is low. But as developers, are these really the main risks they care about? Or do they care more about uptime, cost or user churn? It depends on what the developer is going to build!

What risks does decentralization add? How does this affect my p99 response time? Or how likely is a spike in fees on the web that will cause my users to migrate elsewhere? As a developer, is this series of trade-offs worth it?

The crypto space cleverly uses its anti-censorship capabilities to build currency and open finance. well! What is more annoying to people than banks? However, the web3 story goes like this: it doesn't matter. Instead, we should try to decentralize Uber and Airbnb. You know, these are the two most popular products in the world, and they are just beginning to disrupt the stagnant and long-established pre-tech industry. And Google, what do you say? Do you mean one of the most trusted brands in American history? Of course, let's try to re-implement the hardest computer science and data problems on Ethereum, which is equivalent to the technology of a graphing calculator.

When it lets you radically change new things instead of radically deteriorating old things, decentralization is valuable. Web3 proponents try to compete with the world's most popular products, while at the same time they plunge themselves into a decentralized architectural dilemma. If you want to win a boxing match, you might as well not choose the strongest person in the room, especially if one of your hands is still tied behind your back.

Innovate against poor products. Such products are everywhere in this world. Only when decentralization becomes a real advantage can you win.

But is this really decentralized?

Asking if certain things are "true decentralized" is very vain. I hope this question dissipates. Let me give two examples of why the use of words beginning with D is so puzzling. (Blue Fox Note: D refers to Decentralized, such as DeFi, etc.)

DeFi is often claimed to be more secure because it is "decentralized." What they mean is that its code is directly executed in the smart contract of the public chain. Any average programmer will refute: Wait, why is it just because it's written in code?

Of course, DeFi itself does not provide security. In fact, a single bug in these programs could wipe out all of their funds. Just look at the 0x hacker, where the attacker could have stolen all the funds in the system! Of course, there are also DAO hacks, Bancor hacks, bZx attacks, examples of which abound in history. DeFi itself has no inherent security factor.

Security starts with audited open source code, which is written by best practices, and preferably, formally verified. However, the most important thing in keeping something safe is long-term, field-tested. Just as centralized systems have encountered.

Another example: the oracle problem. When people talk about the oracle machine, they lose common sense. Therefore, this is a good place for real-world testing.

In short, the oracle question asks: How does the blockchain understand what is happening outside of it? By definition, someone reports this information to the blockchain, but who should we trust to report this data, and how do we know that the data is correct? According to this framework, the "prophecy machine" problem is a problem that children can understand: How do we know that someone is telling us the truth?

Let's take the Maker V1 oracle system as an example. It basically consists of 20 addresses, most of which are anonymous, and they post prices on the chain. The oracle predicts the median of these 20 prices. You might ask "Is this decentralized?"

This is a wrong question. The right question is: How much risk do you believe the message this oracle tells us? How much does it cost to operate a oracle? Whose reputation is involved? What value has been involved so far, and how long has the system been operating correctly? Is it decentralized and not related to what we actually care about, especially if the review is not the main risk of the system?

Take a step back. How is the oracle problem solved in the real world? What do people do when they want to know the outcome of the game? They might check ESPN. They are polycentric! Why do they believe ESPN's score? What complex cryptoeconomic games are ESPN playing so that we can trust them with confidence?

One answer might be: Okay. If the scores published by ESPN are incorrect, then someone can sue them for compensation. ESPN's bank accounts can be controlled by the legal system, so ESPN has an incentive to do things honestly. So we have a good oracle, thanks to the threat of litigation against ESPN.

This analysis is tempting, but not entirely correct.

If ESPN starts publishing the results of the game on Ethereum, how do you think people will treat the oracles on the chain? Let me tell you: people will only use ESPN scores. They will use them instead of Chainlink, Augur, or any other so-called decentralized oracle. Because they believe in the score of ESPN. This is true even if ESPN explicitly denies any legal responsibility for these scores. (Blue Fox Note: If it can't be sent to the blockchain, the probability of a single point of failure and error is very high. I don't agree with the author's judgment. People's more reasonable choice is that they can choose multiple predictors of information sources. , And ESPN is just one of them, including the operation errors of ESPN staff, the possibility of hacking, etc.)

why? Why do people believe in ESPN, even if it is not decentralized? (Speak out loud, it sounds like a stupid question.)

Everyone knows why we believe ESPN's score: because of reputation. The value of ESPN's reputation is so high that we believe ESPN will not try to weaken it. It goes beyond any of these simple things: "They pledged X dollars, but if they broke the oracle, they would earn Y dollars." In this sense, ESPN's reputation underpins every game they post score. They pledged the same X dollars throughout their business lifecycle. You might think that this somehow uses the money they are going to make as a cross margin. You can't do this with people demanding mortgages or bonds or any other cryptoeconomic game. Reputation is the way iterative games achieve long-term value creation. Without reputation, there is not enough capital in the world for all of us to trust each other.

So, what about Maker's oracle system? Why are so many products in DeFi using it? I don't think this is because it is "most decentralized." I think the real answer is simple: reputation. People believe in Maker's reputation.

Of course, they also know that technically, 15 participants can conspire and roll up money to escape. (Indeed, a single developer on ESPN can publish false match scores.) But I think from the bottom of the heart, people will intuitively understand the Maker brand and have reputation protection, which is no different from ESPN. And this reputation, to a certain extent, it is difficult to support its price every time it is published on the chain in a quantitative way. In an abstract sense, the Maker system has greater economic value behind its oracle than the primary system that requires bonds and cuts.

If we accept the concept that DAO can be like a company, why are we reluctant to consider that DAO can have a reputation worth protecting?

MakerDAO is now a monopolist, and we intuitively believe that its reputation will ease its burden. But MakerDAO retains the door to exit through global settlement. If MakerDAO is messed up or manipulated, its users will never return.

Despite many shortcomings, many DeFi projects still choose the Maker oracle. To be clear, I don't think the Maker oracle is close to the design of the best oracle. But it does work. Developers can intuitively understand why Maker oracles are trustworthy.

Many researchers would consider making such an inaccurate safety statement annoying. If it cannot be quantified, if it is not “X times Y = Z”, then this is not the correct cryptoeconomics.

What I want to say is: I don't care if your oracle is decentralized. I only care if your oracle is in the threat model I care about. Although Chainlink and Augur are more decentralized than Maker's oracle, they have not been very successful in the past. I don't think the Maker oracle is perfect. But it is better than most of what we see on the market today. (Blue Fox Note: I do n’t agree with the author ’s judgment very much. The oracle machine has been pursuing decentralization. Its purpose is not to decentralize itself, but to provide a more reliable and safe oracle machine. No word game and Boring and boring logical debate.)

Decentralization is not binary

However, if you ask whether something is "true decentralization", this is another question: Decentralization is not a "yes or no" question. If you need a network that can survive targeted attacks by "three-letter institutions," even Bitcoin is not good enough. But most people don't need these. Only you know how much decentralization you need. No amount of decentralization may be of much use.

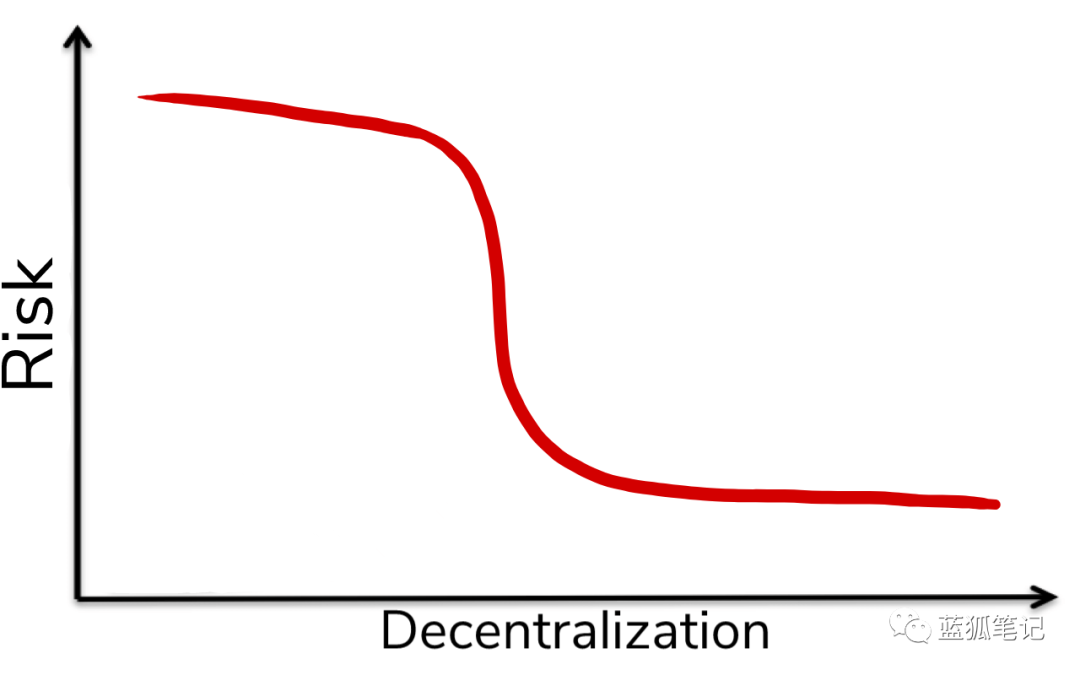

Remember that decentralization does not reduce risk linearly. It's more like an S-shaped curve. The little bit of decentralization in the beginning couldn't actually accomplish anything. Take Napster as an example: Napster is decentralized to some extent, it does not store files on its own server. But Napster acts as a search index, helping people find other people's files. So if someone shuts down a Napster server (which happened in 2001), they basically shut down everything. All the small P2P elements in the Napster design are basically the decoration on the window, because the entire system can be easily sealed off from the top.

Early attempts at decentralization did not accomplish anything until decentralization was sufficient to resist censorship. It's like making a waterproof bucket, a bit of sealant doesn't solve the problem until you actually plug each leaking hole. By that time, you enter the corner of the decentralization curve, and suddenly all your work will have a significant impact on your risk of closing.

Then, you climbed to S, decentralized governance, token ownership, etc., and you reached a stable state. In this state, the system is basically anti-censorship. You can invest more funds to further allocate the hash rate, or add more nodes to the P2P system, or reduce selfish mining or other, but in most cases, any marginal change does not substantially change the properties of the system. These systems cannot be replaced by the script kiddies, and probably all of them can be banned by a motivated nation state. At the end of the day, most debates about decentralization are just criticism.

Where do you think your favorite item is on the S curve? I think most large decentralized networks are closer to the plateau than most people want to admit. Of course, Bitcoin is more decentralized than Ethereum. Unlike Bitcoin, the inventor of Ethereum is still directing the project, and it has frequent upgrade plans. But from a risk perspective, Bitcoin is actually not that far. Both Bitcoin and Ethereum can be destroyed by nation states, but neither can be destroyed by organized participants on the Internet.

What I am saying here is that the decentralized returns are diminishing. This is an obvious marginal analysis, but it is rarely applied to the concept of decentralization itself. So why do we receive endless series of articles that mock how blockchain's P2P networks and governance are not really decentralized.

Protocol risk does not always decrease with decentralization. Decentralization too fast will introduce new risks that did not exist before. I have never seen a centralized server with a 51% risk of attack, the vulnerability of preemptive transactions, or a charge sniper attack. Of course, you should not underestimate the ability to quickly respond to errors by shutting down the system. Centralized systems can respond more effectively to threats and organize around technical leaders.

After thinking about Spectre and Meltdown mistakes, how the computer industry gathered around its leadership. Faced with shaky industry vulnerabilities, special teams on Intel, Microsoft, and Linux, while implementing patches, banned information disclosure throughout the industry. Looking back now, it did a great job! This would be much more difficult in a completely decentralized system. Angela Walch, a law professor at St. Mary's University, mentioned in Deconstruction and Decentralization that "real decentralization" projects cannot have such a secret. In her words, "the secret reveals centralization."

"Bug fixes, secret developer meetings, centralization of the mining pool … all reveal centralization-not decentralized power. However, the blockchain system is described uncritically as decentralized Yes, we skipped all of them. "

Under her premise, she is absolutely right. (Although I reject the binary division of centralization and decentralization), I have come to a different conclusion: this tells us that the best equilibrium of the project is not the current "100% decentralization". Further climbing on the S-shaped curve, the revenue will diminish, and the amount of juice here is not worth extracting.

In summary, there are many networks that cannot go all the way through the decentralized s-curve. I think of IOTA; I'm sure you have your favorite altcoin. If you want to cross the divide but fail, decentralization is really important.

However, for these networks, the biggest risk is not that their governance is too centralized, but that their governance is too inefficient. Of course, I hope that eventually the governance of the blockchain is decentralized. But if you give me the opportunity to choose, I will choose world-class centralized governance instead of bad decentralized governance.

Beyond a purely decentralized culture

Still, the crypto community likes to blame each other and claim that its competitors are not "really decentralized." In a sense, this is the perfect attack, because anything can be more decentralized. This is the original sin of every project. It turns decentralization into a pure virtue, a self-lashing ritual.

But this purely decentralized culture is not only exhausting, but also counterproductive.

I know I stomped the horse honeycomb. So let me be clearer. If it were not decentralized, Bitcoin would never be what it is today. There is no other way to create Internet-native digital gold. However, I don't want to see that the smartest people in our generation are obsessed with this single dimension and ignore the most important problems to be solved.

Before we worry about decentralization, let us first worry about what is worth decentralization. Don't forget, no one really wants these things yet! No one knows what problem it will actually solve! All this is still weird, complicated, and unusable!

At this point, I agree with Jesse Walden: Once the project finds a fit between the product and the market, it should be gradually decentralized. In other words, you must first figure out what is really valuable. However, for most things in this field, finding a product and market fit has a long way to go. Until then, I don't think we need to achieve perfect decentralization. Our focus should be on innovation and building a better digital economy infrastructure.

If you ask me, that is the real goal. Decentralization is sometimes just a means to an end.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Enterprise Ethereum Software Client Enters Japanese Market, Hitachi Group Establishes Cooperation with ConsenSys

- Perspective | George Mason University Professor: If CBDC is deployed in the United States, it will have a serious impact on privacy

- How does the financial model explain the price movement of Bitcoin after halving?

- Review of "Black Thursday": this venture fund received 68% of tokens at MakerDAO's debt auction

- Crazy currency contract: leverage up to 125 times, and overnight positions of 2 billion US dollars

- Vitalik argues with Bitcoin developers: Bitcoin is first P2P cash, second is digital gold

- Bitcoin Exotic 8Q: Why was block 620826 born 1 second earlier than block 620825?