Bitcoin network March analysis report: hash power gains grow slowly, difficulty or slightly reduced again

This report will analyze and judge the Bitcoin network data from five major parts: Bitcoin BTC price fluctuations, Bitcoin mining, on-chain addresses and transactions, Bitcoin network status, and social media popularity.

This report will analyze and judge the Bitcoin network data from five major parts: Bitcoin BTC price fluctuations, Bitcoin mining, on-chain addresses and transactions, Bitcoin network status, and social media popularity.

The data and charts in this report were obtained and processed by the Mars Institute of Finance and Economics and the Mars Cloud Mine (mclouds.io) data center.

Summary

1. For the first time, Bitcoin has had such a close relationship with the global financial market. Since then, the two will inevitably deepen this relationship. Bitcoin will have more and more opportunities for investors to recognize, but it must be The financial world recognizes that it still takes a long time to convert from speculative assets to investment assets;

2. The spread of the global epidemic has not yet reached an inflection point, and despite unprecedented water releases from various countries, expectations of economic downturn have not been reversed;

- Blockchain Application in Hangzhou Practice: "Blockchain +" Breakthrough to Solve Supply Chain Financial Problems

- Coinbase overweights DeFi, 1.1 million USDC injected into two major DeFi protocols, Uniswap and PoolTogether

- Enterprise Ethereum Software Client Enters Japanese Market, Hitachi Group Establishes Cooperation with ConsenSys

3. The mining revenue is rising slowly. Under the expectation of low revenue, there are still many models that cannot be started. The difficulty of the whole network is expected to continue to be slightly reduced in the next adjustment;

4. The current bitcoin price is highly correlated with the global financial market, and the network activity is affected by the secondary market more than its own factors.

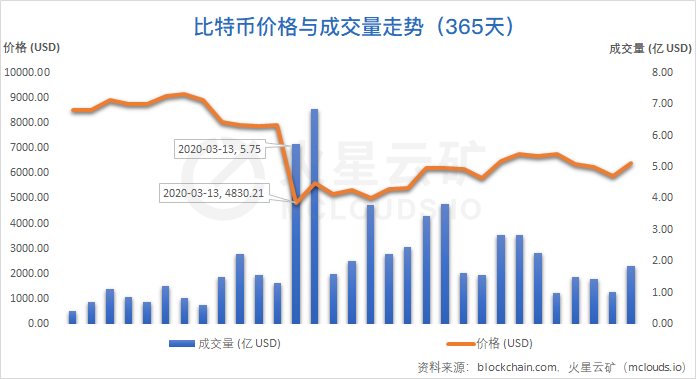

I. Bitcoin price and trading volume

On March 12, Bitcoin plunged sharply, falling from 8,000 USDT to 5,000 USDT, a drop of 40%; on March 13, after a brief rebound, Bitcoin dropped again to a minimum of 3800 USDT, a significant premium for USDT.

The main reason for the bitcoin plunge on March 12 was the systemic financial storm brought about by the global spread of the epidemic. The global financial market tumbled. The multinational stock markets triggered a meltdown. Dow Jones and Nasdaq dropped their full-year gains in 2019. Globally, Gold, the largest safe-haven asset, is also not immune. Although Bitcoin is called a safe-haven asset, it is at best only a safe-haven asset with a market value of less than 200 billion U.S. dollars. When the correlation between digital currencies and global financial markets is strengthened, Bitcoin is affected by it or worsens and collapses. Stomp in China will be particularly severe. It is not difficult to imagine that if BitMEX stays online, BTC does fall below $ 1,000.

This plunge is actually the first time that Bitcoin has such a close connection with the global financial market. Since then, the two will inevitably deepen this connection. Bitcoin will have more and more opportunities for investors to recognize, but The market value of less than 200 billion US dollars is only a fraction of the value of traditional capital. Its volume is small and easily manipulated, and its risks are high but the returns are not commensurate. Bitcoin wants to be recognized by the traditional financial world and convert from speculative assets to investment. Assets, still need a long time.

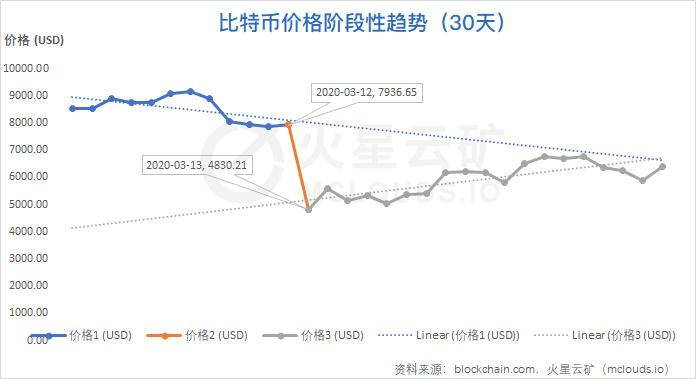

In the past 30 days, after Bitcoin's plunge, it reversed its upward trend from the downward trend, but it is still in the repair period after the plunge. It cannot be judged that it has entered a stable rebound trend. The short-term correlation between Bitcoin and global financial markets is high. The currency trend still needs to pay attention to the global market trend, and the current spread of the global epidemic has not yet reached the inflection point. Although countries have released unprecedented water, the expectations of economic downturn have not been reversed. The Dow and the Nasdaq rebounded a week later and showed a weak trend again.

Bitcoin mining

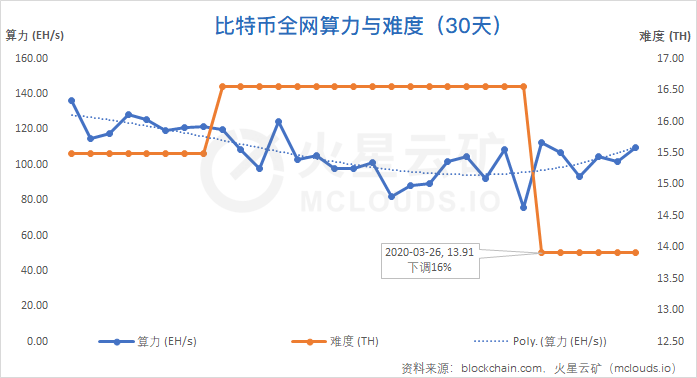

1. Bitcoin network computing power and difficulty adjustment

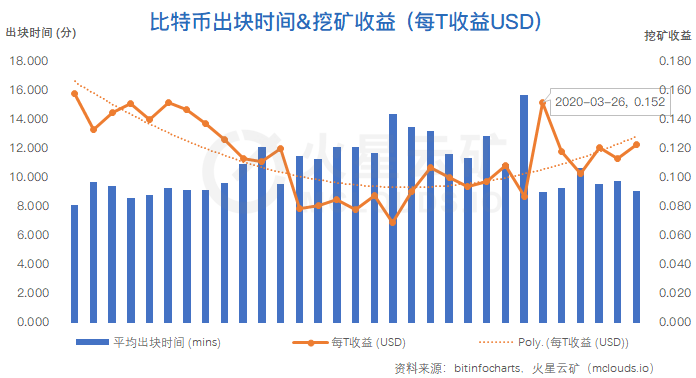

The difficulty of Bitcoin's entire network was briefly raised to a record high of 16.55T on March 9. The computing power of the entire network subsequently declined, and the block time increased with the decline of computing power. The unit mining revenue (BTC) declined; March 12 The plummeting of the currency caused the unit mining revenue (fiat currency) to drop sharply, and some miners shut down when they were unable to make ends meet. The network's total block output continued to decrease, from an average of 0.0000167 BTC per T to about 0.0000155 BTC.

On March 16th, the difficulty of the Bitcoin network was adjusted down by 15.95% to 13.91T, a historical record, and the theoretical mining income rose by more than 20% that day to 0.00001872 BTC per T output. The currency price stabilized slightly, the mining revenue (BTC) increased, and the legal currency revenue increased sharply. The number of shut-down mining machines decreased sharply, and the computing power was slowly increasing.

The next difficulty adjustment is expected to be carried out in the morning of April 8. According to BTC.com's calculations based on the data of the last week, the difficulty will be adjusted to 12.47T, which is lowered by 10.34% again. However, the adjustment is expected to be around 5%.

2.Bitcoin block production time and mining revenue

At the beginning of March, the price of bitcoin retreated to US $ 8,000, and the market plummeted on March 12th and 13th. After the difficulty of adjusting the Bitcoin network based on the PoW consensus mechanism to a historical high of 16.55T, the computing power did not increase, but fell quickly The time has increased significantly to a maximum of 16 minutes, which has led to a reduction in mining revenue. Old mining machines continue to cause a reduction in computing power.

After the record-breaking difficulty on March 26th, the mining revenue began to pick up, but due to the impact of the currency price, the mining revenue rose slowly. Under the low-income expectation, the miners that had previously been shut down due to the increased difficulty and the decline in revenue still remained. Many models cannot be turned on, and the computing power of the entire network will still be adjusted at about 100 EH / s. The difficulty of the entire network is expected to continue to be slightly reduced in the next adjustment.

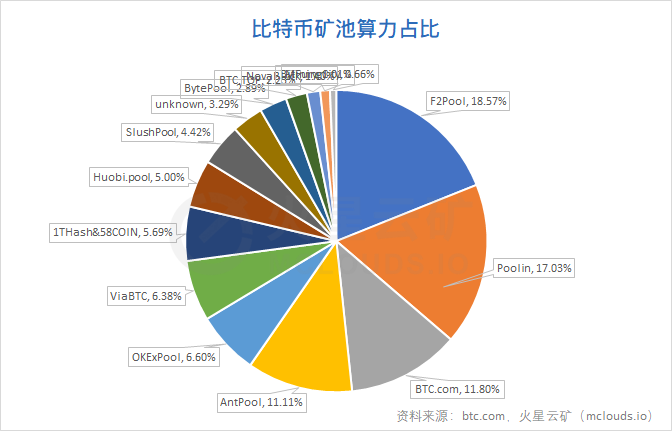

3. BTC computing power distribution

According to BTC.com data, the top three mining pools for monthly block production are F2Pool, Poolin, and BTC.com. The mining revenues are:

F2Pool has mined a total of 757 blocks and 9462.5 BTC, accounting for 18.57% of the computing power;

Poolin dug a total of 694 blocks and 8,675 BTC, accounting for 17.03% of the computing power;

BTC.com has mined a total of 481 blocks and 6012.5 BTC, accounting for 11.80% of the computing power.

Addresses and transactions on the Bitcoin chain

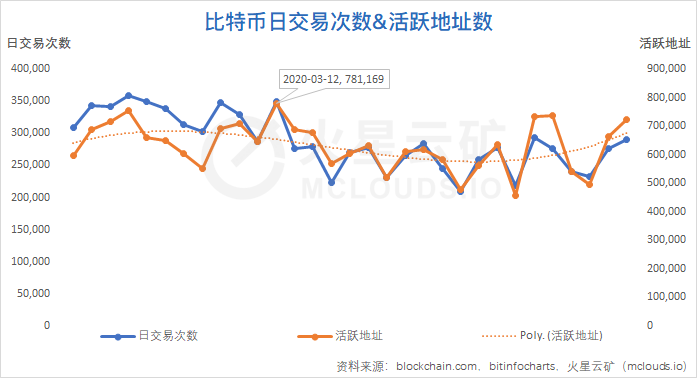

1.Bitcoin daily transactions and active address

Bitcoin's active addresses include the number of on-chain addresses participating in the transaction on the day, reflecting the heat of transactions on the blockchain, and have a positive correlation with the number of daily transactions, with the same trend of change.

As can be seen from the chart, before the Bitcoin crash on March 12, the number of transfers on the Bitcoin network fluctuated between 300,000 and 350,000, and the overall trend was downward. During this time, Bitcoin fell from 9,000 USD to below 8,000 USD, resulting in The overall popularity of the Bitcoin network has decreased. The decrease in network popularity is reflected in the number of network transactions, active addresses, and computing power.

In addition to reflecting the current network conditions, the fluctuations in the bitcoin network's heat also have a certain expected effect on the currency price fluctuations in the secondary market, but they will fail in the case of sudden and large fluctuations. The current network heat has shown a certain warming trend, mainly after the recent difficulty adjustment The impact of rising mining revenue, Bitcoin miners gradually recovered, and the currency price is expected to stabilize. However, the current bitcoin price is highly correlated with global financial markets, and the network activity is affected by the secondary market more than its own factors.

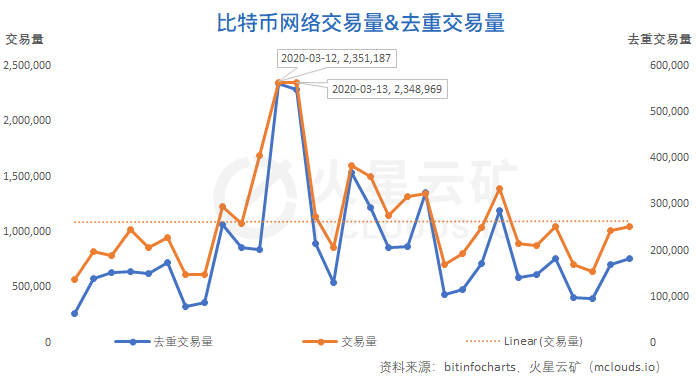

2.Bitcoin transaction volume & deduplication transaction volume

Deduplication transaction volume refers to the transaction that is returned to the sender after removing the Bitcoin transfer from the total transaction volume, that is, the transaction volume of one-way transactions at each address.

Bitcoin dropped sharply on March 12th and 13th, and the transaction volume of bitcoin transfers in the network was basically the same as the volume after deduplication. The transfer transactions were basically one-way transfers. Combined with large transfer records, large transfer destinations There are a large number of exchange addresses in the market, and it is more likely that they will be transferred to the exchange for selling. On March 13, bitcoin rebounded and stopped falling after the second decline. Bitcoin network transfers remained at a similar level as on the 12th, but the volume of deduplication was somewhat. Fall and gradually return to daily levels.

The transaction volume on March 12 and 13 reflected a 40% plunge in bitcoin and caused a lot of panic. Bitcoin holders were heavily sold, and online transfers showed a one-way panic sale. After 13 days, repurchase transactions gradually Recovery, BTC holders gradually out of panic emotions, reflecting the stable sentiment of currency holders in the current market from the Bitcoin network transfer.

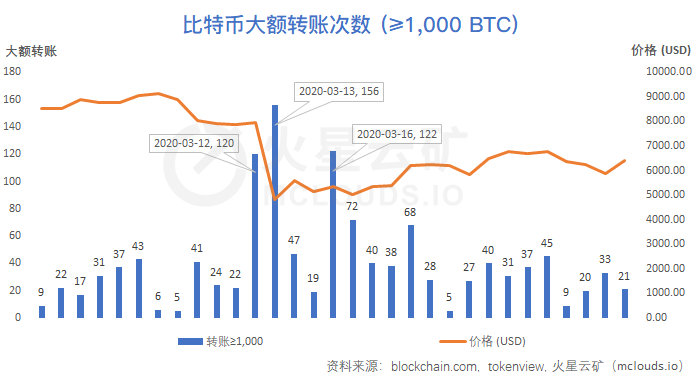

3. Bitcoin large transfer (≥1,000BTC)

On March 12th and 13th, Bitcoin plunged to a minimum of 3800 USDT, during which a total of 276 large transfers of more than 1,000 BTC occurred, the highest record since August 2019; in the past year, large-scale single-day transfers (≥ (1000 BTC) is the highest on March 3, 2019, 350; June 29, 2019, 309; July 12, 2019, 300; April 25, 2019, 269.

This month was the biggest drop in Bitcoin, but the number of large transfers fell less than the previous few. The reasons may be that the day fell faster, the network was congested, and some holders were slower than the transfer transaction or the transfer was blocked. Below the psychological minimum selling price, hold the currency to wait and see; it is expected that Bitcoin will rebound and pick up again, holding the currency to rise and so on.

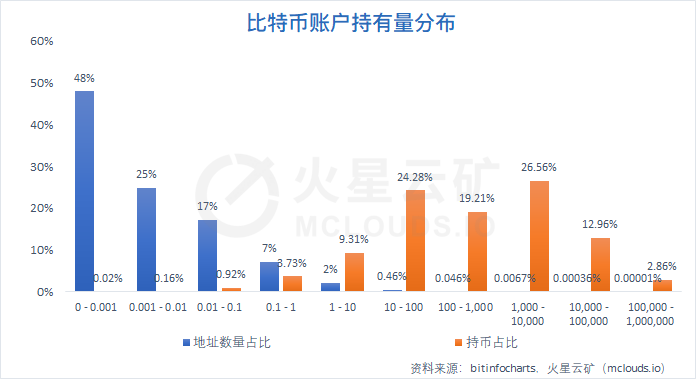

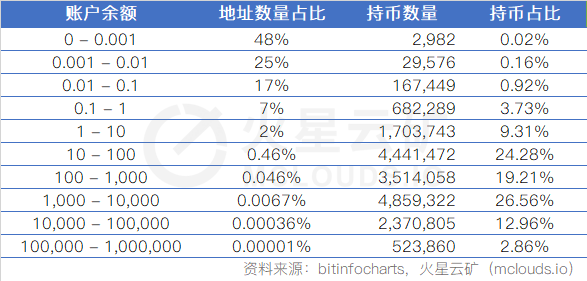

4. BTC holding distribution

The addresses currently holding less than 0.001 BTC account for 47.97% of the total number of addresses, but hold a total of 0.02% of the total BTC; while the addresses holding 1-10 BTC have 2.15%, these accounts hold a total of 9.31% BTC; 107 addresses holding 10,000 to 100,000 BTC, accounting for 0.00%, but holding 12.96% of BTC; and only 3 addresses holding more than 100,000 BTC, but holding 523860 BTC.

The "gap between rich and poor" of the balance on the BTC chain is extremely obvious, of which 0.51% of the head addresses hold 85.87% of the total BTC.

Fourth, the Bitcoin network status

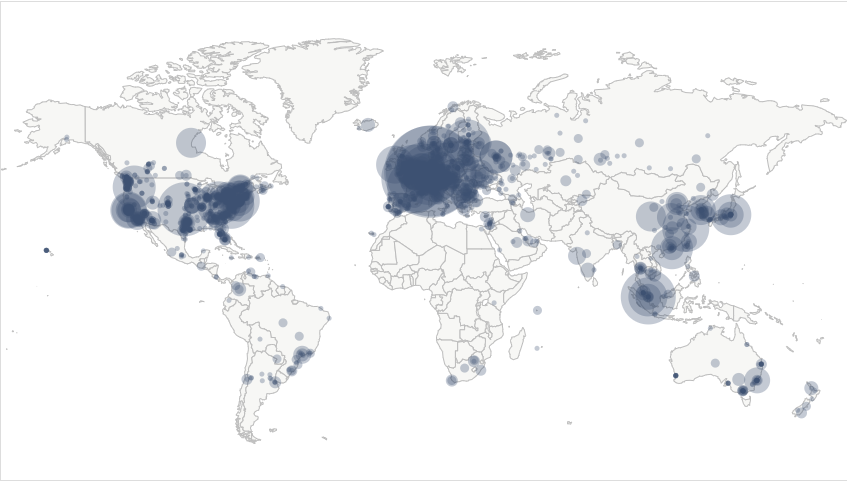

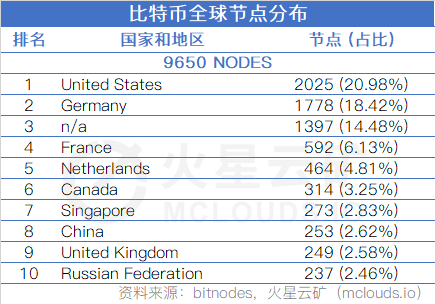

1. Number and distribution of nodes

V. Bitcoin social media fever

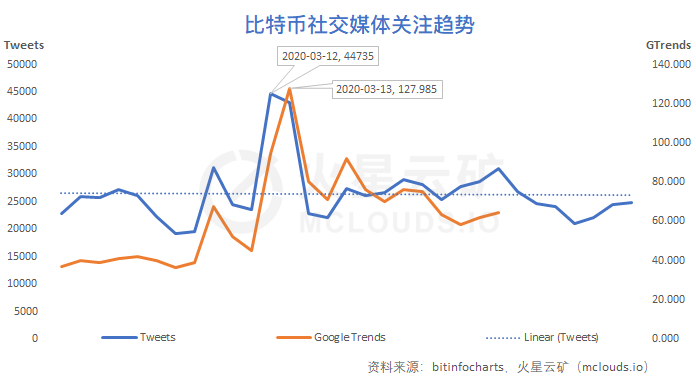

The bitcoin network's attention gradually recovered to its original level after the skyrocketing on March 12th and 13th, with less fluctuations, and the overall popularity was relatively stable. The number of daily Tweets basically remained between 20,000 and 30,000, and reached a peak of 45,000 and 43,000 on March 12 and 13. The Google Trends index peaked at 127.985 on March 13. Twitter, as a social media, is still significantly more effective at responding to hot events than search engines.

This article is the original manuscript of Mars Cloud Mine (mclouds.io). The copyright belongs to Mars Cloud Mine. It must not be reprinted without authorization. The reprint must indicate the source of the article after the title. If it is reproduced in violation, Mars Cloud Mine has the right to pursue legal responsibility.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Perspective | George Mason University Professor: If CBDC is deployed in the United States, it will have a serious impact on privacy

- How does the financial model explain the price movement of Bitcoin after halving?

- Review of "Black Thursday": this venture fund received 68% of tokens at MakerDAO's debt auction

- Crazy currency contract: leverage up to 125 times, and overnight positions of 2 billion US dollars

- Vitalik argues with Bitcoin developers: Bitcoin is first P2P cash, second is digital gold

- Bitcoin Exotic 8Q: Why was block 620826 born 1 second earlier than block 620825?

- Satoshi Nakamoto may be the creator of Monero. Do you accept the findings?