Monthly Financing Report | Global Blockchain Private Equity Financing in March was 3.767 billion, 90% of the funds flowed to the US market

In March, the global blockchain investment and financing market started to heat up.

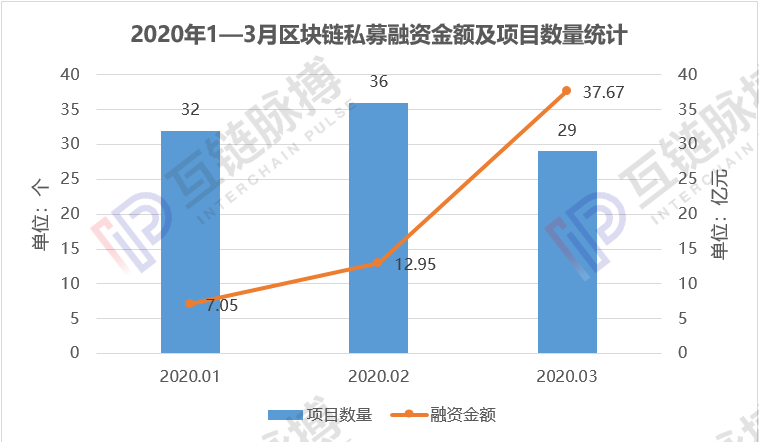

According to the statistics from the Interchain Pulse Institute (IPRI), in March 2020, a total of 29 financings were obtained in the global blockchain field, with a financing amount of approximately 3.767 billion yuan, an increase of 190.9% from the previous quarter.

- Crypto market battered in March, Tether becomes biggest winner

- Danger and Change: Can China Seize the Breakthrough Opportunity of the Digital Economy?

- Viewpoint | Scenario matching and technology maturity, why hasn't the blockchain made a large-scale application yet?

(Drawing: Interlink Pulse Academy)

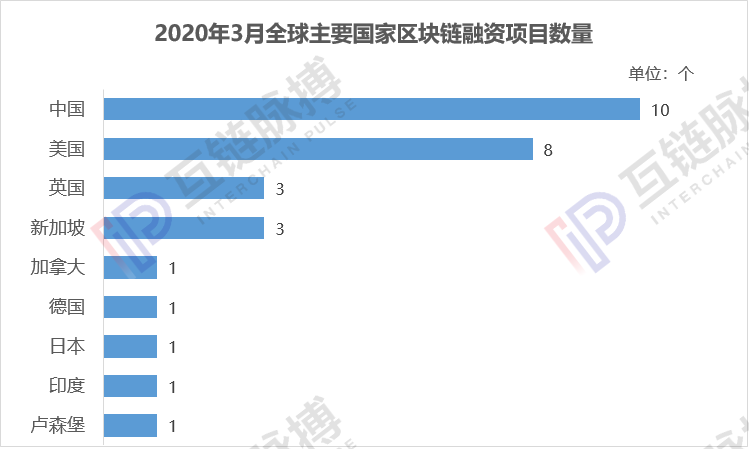

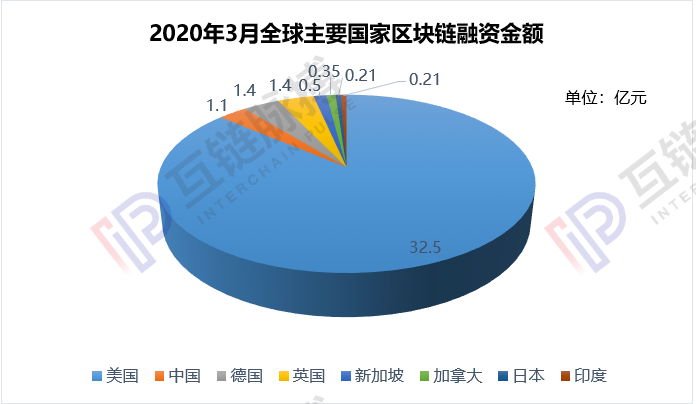

Among them, the US market, one of the main forces, is heating up the fastest. Of the 29 financing projects, although there are only 8 financing projects in the United States, the financing amount is as high as 3.25 billion yuan, and nearly 90% of the funds are invested in the US market.

In addition, the UK and Germany's financing enthusiasm also started to heat up in March, and both of them raised 140 million yuan.

The Chinese market has cooled down. In March, there were 10 financing projects in the Chinese market with a financing amount of about 110 million yuan, a decrease of 17.9% from the previous quarter.

(Drawing: Interlink Pulse Academy)

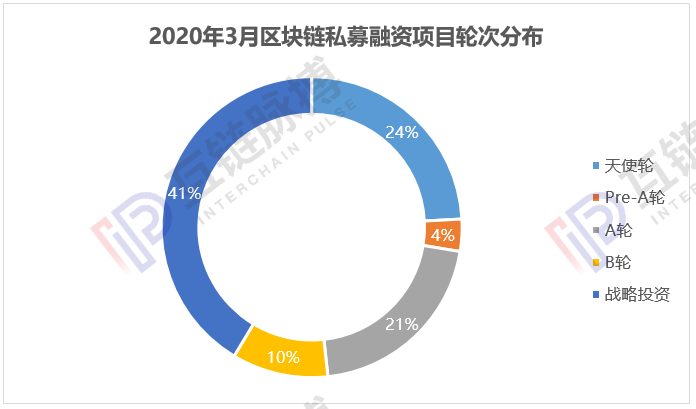

From the perspective of rounds of financing projects, the number of strategic investments is the largest, accounting for 41%, followed by angel rounds and round A projects, which account for 24% and 21%, respectively, and another 10% of project financing goes into round B. .

(Drawing: Interlink Pulse Academy)

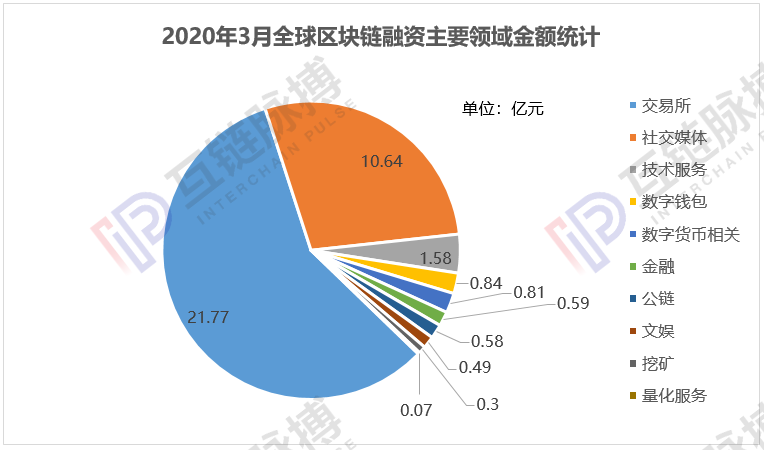

From the perspective of industry distribution, the most promising capital project in March is still the cryptocurrency exchange.

According to the statistics of the Interchain Pulse Institute (IPRI), in March 2020, a total of 6 cryptocurrency exchanges around the world received financing with a financing amount of up to 2.177 billion yuan, accounting for nearly 60%.

Among the exchange projects, the largest financing amount is the Bakkt exchange in the United States. In March, it received a number of investment institutions such as the NYSE parent company Intercontinental Exchange (ICE), Microsoft's M12 investment department, PayU, Boston Consulting Group $ 300 million (about 2.128 billion yuan) in Series B financing.

Singapore's Phemex Exchange and India's CoinDCX Exchange also raised US $ 3.5 million and US $ 3 million respectively. In addition, Futureswap, a decentralized futures exchange in the United States, also raised $ 400,000 (about 2.8 million yuan) in financing.

(Drawing: Interlink Pulse Academy)

Technology service providers are the second largest area of financing after the exchange.

According to the statistics of the Interchain Pulse Institute (IPRI), in March 2019, a total of 6 projects in the field of blockchain technology service providers were funded, but only 2 projects disclosed the financing amount publicly, totaling about 158 million yuan.

The largest financing amount is the German project Penta, which received 18.5 million euros in Series B financing. Penta mainly uses multi-chain fusion technology and diversified consensus components to solve the problems of democratization of public chain consensus mechanisms and the difficulty of landing Dapps. In addition, US-based crypto software developer Zabo also received an angel round of $ 2.5 million.

In addition to exchanges and technology service providers, digital currency related projects also have relatively promising capital areas.

According to the statistics from the Interlink Pulse Institute (IPRI), a total of 4 digital currency related projects received financing in March, and the financing amount was all in the level of 10 million yuan.

The larger financing amount is the IBMR.io project in Singapore, which received an angel round of financing of 3.48 million US dollars (about 24.69 million yuan). The project recently launched the Algorand standard asset token ARCC.

In addition, Japanese cryptocurrency developer LastRoots and Hong Kong-based digital asset custody company First Digital Trust also secured financing of USD 21.32 million and USD 3 million (about RMB 21.02 million, respectively). Ystar, another Chinese project dedicated to the privacy and key management of digital currency transactions, also received 14 million yuan in financing.

(Drawing: Interlink Pulse Academy)

In addition, in March, there were also large single financing projects in the fields of social media, digital wallets, public chains and mining.

For example, the US-based blockchain social media Voice project has secured a large amount of US $ 150 million (about RMB 1.064 billion) in financing. Argent, the UK's decentralized digital wallet project, secured 10.4 million euros (about 84.06 million yuan) in Series A financing.

In terms of public chain and mining, the British storage public chain Arweave project received a strategic investment of US $ 8.3 million (approximately RMB 57.54 million); China's comprehensive mining service provider Panda Power received RMB 30 million in financing.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Mutual Gold Association: Risk Tips on Participating in Speculative Hype of Overseas Virtual Currency Trading Platforms

- 2020 Central Enterprise Blockchain Development Report Released: Nearly 40% of central enterprises are involved in the chain, and supply chain finance has the most landing applications

- Babbitt launches | "Qin Qin Technology" completes Pre A round of financing of tens of millions of yuan, and is expected to be listed in 2020

- Ethereum name service exposes privacy flaws, Vitalik Buterin proposes solution

- Research Report | Blockchain launches innovation in the underlying infrastructure of financial infrastructure and advances to the 3.0 stage of the enabling industry

- 10% of net worth bets on BTC, ETH makes a net profit of 1.5 billion, Wall Street giant Mike's road to crypto kingdom?

- Blockchain security | 19 security incidents in March, DeFi security issues highlighted