Exploring Whether LUSD Will Become the Best Choice in the Stablecoin Competition Landscape?

Will LUSD be the top choice in stablecoin competition?Original Title: “Stablecoin competition pattern: Will LUSD become the best choice beyond USDC and USDT?”

Written by: Rxndy444

Translated by: Deep Tide TechFlow

*Deep Tide Note: This report was produced in collaboration with Rxndy444 and Liquity Protocol and does not constitute investment advice.

- Understanding ZeroLiquid: A Non-Liquidating Zero-Interest Lending Agreement Secured by LST

- Development of Polkadot parallel threads has already begun. Learn how it works.

- Will the combination of the ZK and OP methods become the future of Ethereum Rollup?

The narrative of cryptocurrencies has had its ups and downs, but stablecoins will always exist as a core component of on-chain financial infrastructure. Currently, there are over 150 stablecoins on the market, and it seems like a new one is launched every week. How should users sift through all of the different choices?

When evaluating the pros and cons of different stablecoins, it is helpful to categorize them based on their design elements. So what are some basic ways in which stablecoins can vary? The main differences between different stablecoins include:

- Collateral Assets — Are these tokens fully backed by assets? Partially backed? Or not backed by anything?

- Centralization — Does the collateral involve government-backed assets such as the USD, GBP, or treasury bonds? Or decentralized assets such as Ethereum?

With these attributes in mind, we can begin to construct a framework for comparing different stablecoins.

Exploring Decentralized Stablecoins

Looking at the top ten stablecoins by trading volume, we can see that centralized stablecoins are essentially on-chain USD, but are the most widely used. These stablecoins cannot provide censorship resistance or immunity from the effects of traditional financial crises. For example, when Silicon Valley Bank went bankrupt in March, USDC holders had to worry about their reserve assets in that bank. Many people were eager to exchange their USDC for a more reliable option, and this is not the first time that we have seen the premium for decentralization at work.

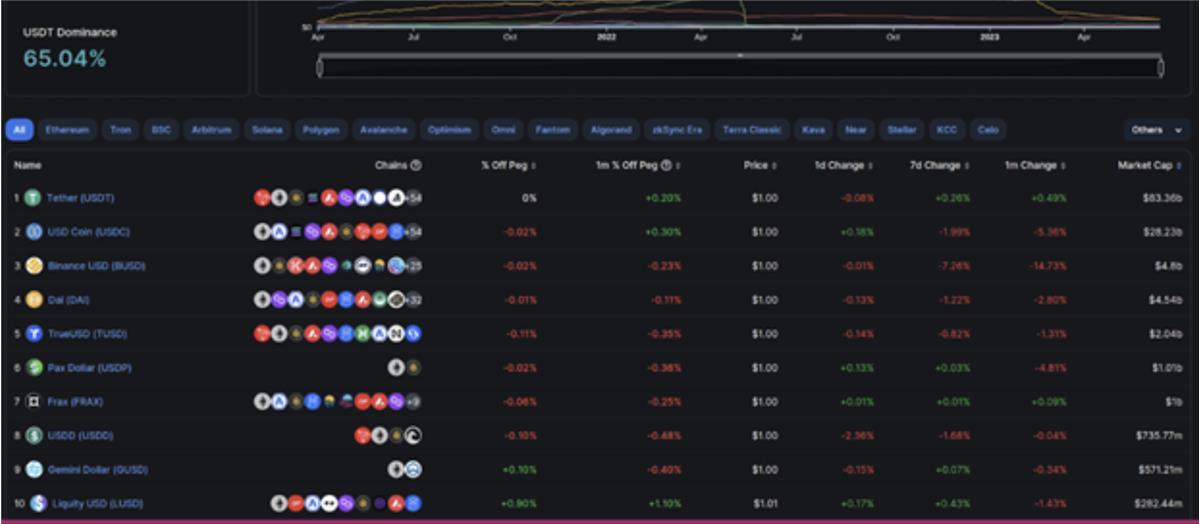

The ultimate goal of stablecoins is to find a solution to the trilemma of decentralization, capital efficiency, and anchoring, and USDC and USDT clearly do not do a good enough job. To advance the stablecoin industry, we must move beyond these two choices—so what does the current competitive landscape look like?

Of the top 10, only three can be considered somewhat decentralized: DAI, FRAX, and LUSD.

Frax: Algorithmic Stablecoin Route

Frax is a partially collateralized stablecoin that uses an AMO (Algorithmic Market Operations) system to adjust its collateral ratio and make its price tend towards pegging. At its most basic level, when the price is below $1, the AMO increases the collateral ratio, and when the price is above $1, it decreases the collateral ratio. For FRAX holders, this means exchanging stablecoins based on the current level of collateralization. If the collateral ratio is 90%, then 1 FRAX exchanged will be paid out from the protocol’s reserves as 0.90 USDC + the value of 0.10 USD of FXS (Frax Shares) minted by AMO. Due to the dynamic nature of the collateral ratio, it is difficult to calculate the actual amount of collateral backing FRAX at any given time.

Recently passed proposals indicate that the community supports a shift towards a fully collateralized model. The main reason for this is due to increased regulatory scrutiny of algorithmic stablecoins after Terra’s UST issue.

Overall, algorithmic stablecoins remain a highly experimental area in the market, and while Frax has successfully grown using its AMO model, it appears to be changing.

DAI: Partially Decentralized

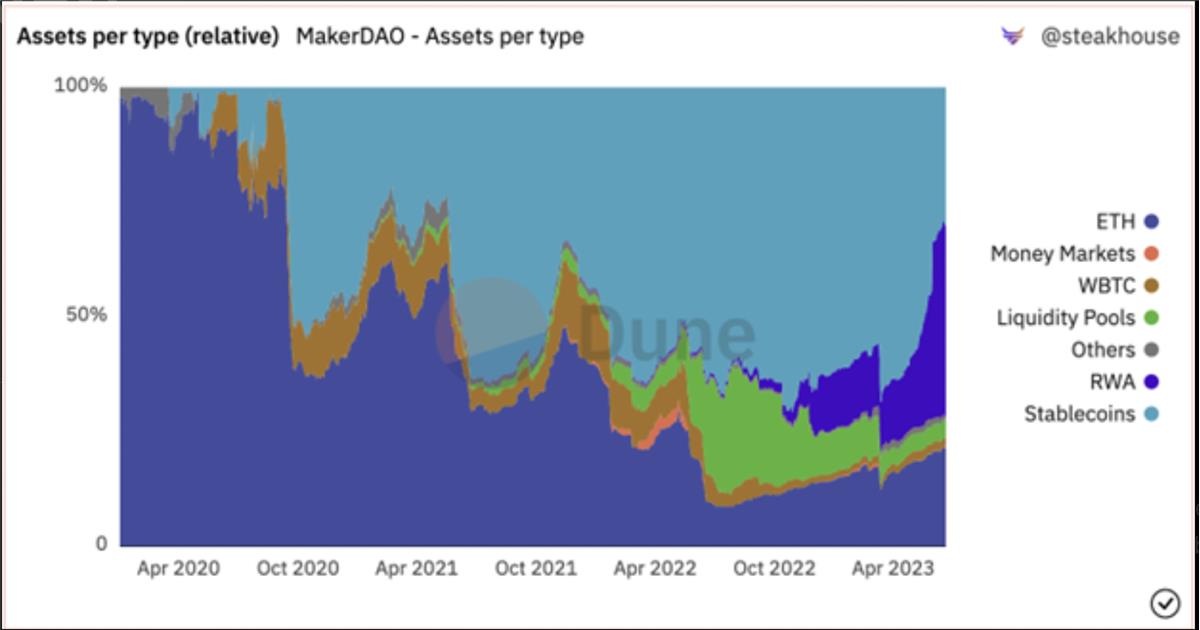

DAI has proven to be one of the most successful stablecoins aside from on-chain dollars such as USDC and USDT, through its CDP (Collateralized Debt Position) model. The main limitation here that most people may not initially be aware of is that DAI borrowing often uses the same centralized stablecoins as collateral, exposing it to the same centralized risks. Since expanding to a multi-collateral model, these centralized stablecoins have become a significant part of what DAI supports, sometimes even exceeding 50%.

DAI Collateral Types Broken Down by Dominance

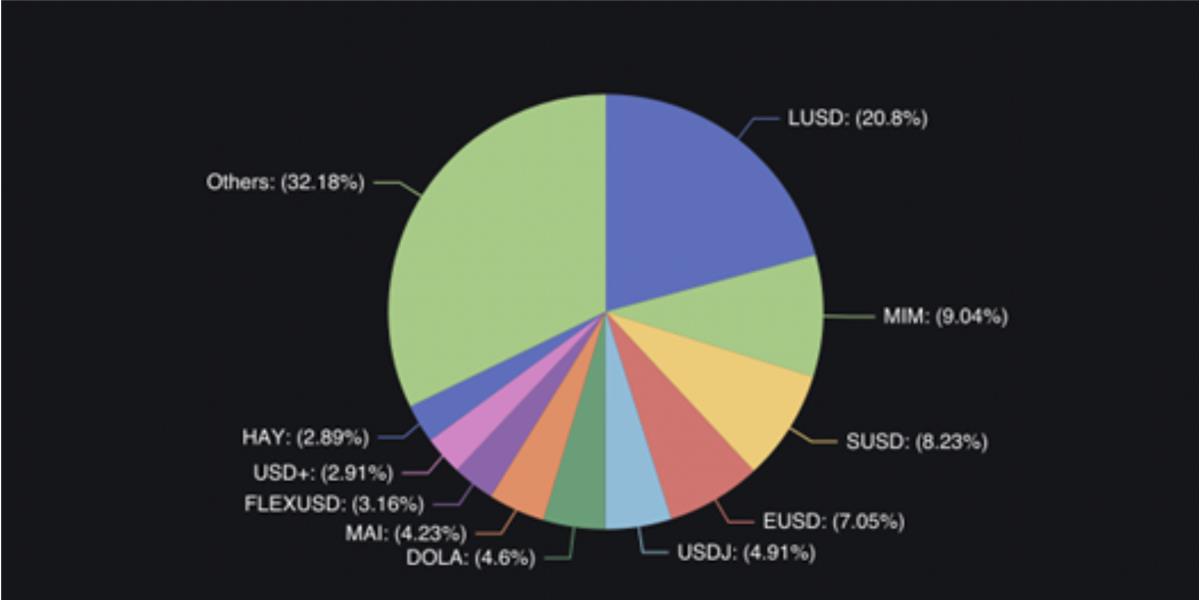

Given that we’ve established the reserve uncertainties of Frax and DAI, let’s take a look at the rest of the decentralized stablecoin market and which stablecoins are both decentralized and only collateralized by crypto assets?

Market share of stablecoins backed by cryptocurrencies

LUSD

In the field of stablecoins backed only by cryptocurrencies, LUSD is by far the most important to date. It has achieved this status by establishing a solid foundation: an immutable smart contract, an economically reasonable anchoring mechanism, and capital-efficient characteristics that allow for growth without jeopardizing the collateral ratio.

Although Liquity’s smart contract will always remain on Ethereum, LUSD is now also bridged to L2, with a total liquidity on Optimism and Arbitrum exceeding $11 million.

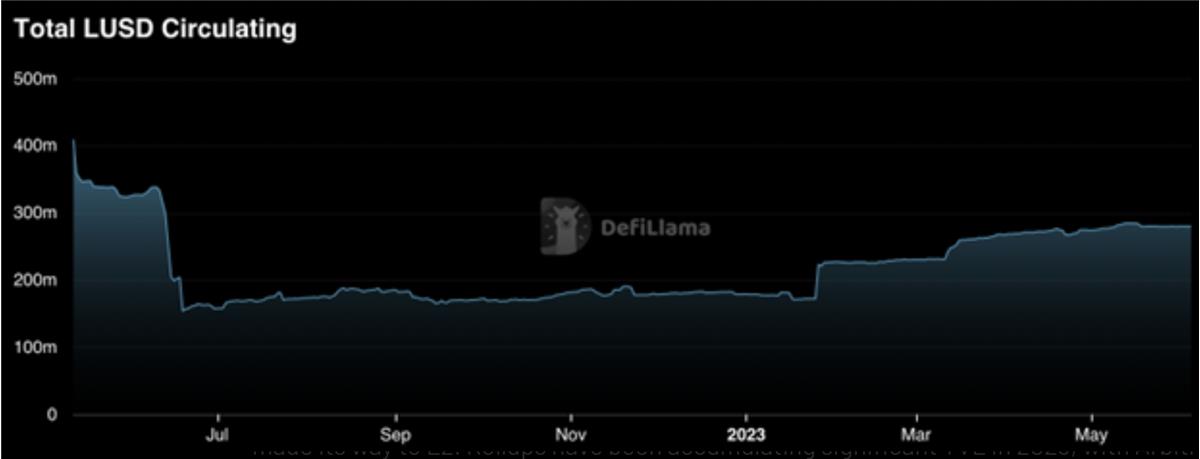

Total circulating supply of LUSD

Since the beginning of this year, the circulating supply of LUSD has increased by over 100 million, with over 10 million entering the L2 network.

In 2023, as Rollup technology accumulates a significant total locked value (TVL), Arbitrum’s TVL increases from $980 million to over $2.3 billion, and Optimism’s TVL increases from $500 million to $900 million. This not only shows that mainnet users value decentralized stablecoin choices, but also provides ample opportunities for LUSD to gain more market share on L2 networks.

In addition to the circulating supply, the number of Troves has also skyrocketed this year, approaching historic highs. With over 1,200 active Troves, this is a situation that has not occurred since the bull market of 2021. Considering that the Ethereum price is still far below its level at that time, this suggests that these users value stablecoins more than Ethereum leveraged trading.

Stablecoin Market Trends

Forks

People often say that imitation is the sincerest form of flattery, and some new stablecoins are copying the Liquity model. Most use the same CDP style, but with pledged ETH as collateral. This makes sense given the attention that Ethereum and its LSDs (ETH pledged) will receive in the first half of 2023, and with the now available withdrawal feature, pledged ETH is more liquid and attractive.

It’s hard to say whether pledging ETH is better than using ETH as collateral, but there are certainly trade-offs to consider. The main advantage of using an interest-bearing stablecoin like stETH is its interest-bearing properties.

The main drawbacks may be the combination of liquidation risk and LSD detachment risk. As a result, a higher minimum collateral ratio is typically used relative to LUSD.

In addition to these risks, the contracts for these stablecoins can be upgraded and controlled by multi-signature, unlike the smart contracts behind Liquity, which are immutable. This means that parameters such as the collateralization rate may change. The stablecoin supported by pledged ETH is indeed interesting, with high ratings in decentralization and yield generation, but its capital efficiency is lower than that of pure ETH to cope with increased risk.

USD Risk and Decentralization Premium

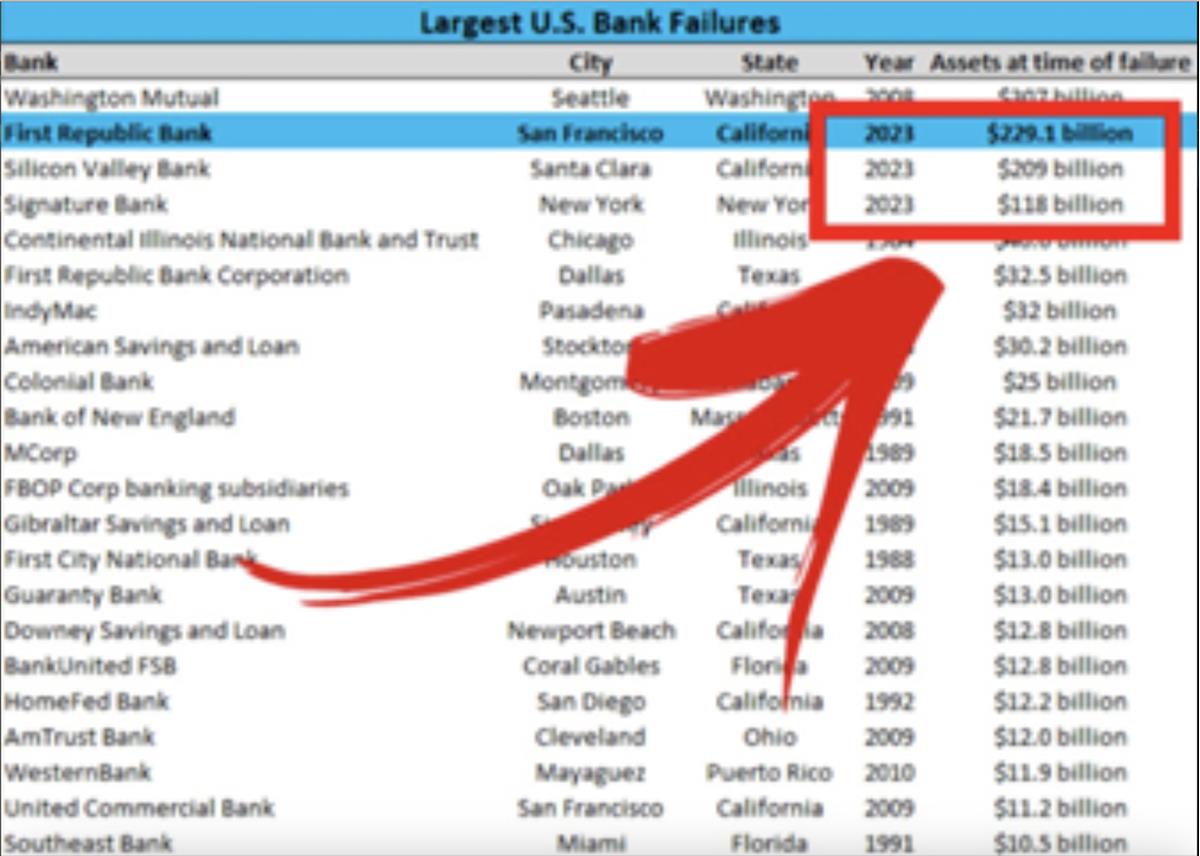

We mentioned at the beginning of this article a point worth revisiting – traditional banking crises. Silvergate, SVB, and First Republic are the three largest bank bankruptcies in US history, all occurring in the past few months.

The real question behind these events is where do you feel the safest storing your funds during a crisis?

Not all dollars are created equal, as recent bank failures have reminded us, deposits can be wiped out in an instant. Of course, the FDIC (Federal Deposit Insurance Corporation) provides up to $250,000 in insurance, and the government has indicated a willingness to bail out failing banks, but because the dollar operates on a fractional reserve system, people will still seek safe havens in uncertain times.

This means bank runs, and we’ve seen the impact of this on stablecoins that rely on legal reserves like USDC and SVB.

In uncertain times, decentralized stablecoins have relevant use cases for those who care about asset protection, providing true non-custodial ownership. So, from a resilience perspective, which stablecoin would you choose as your pick for a time frame of over 5 years? If it’s based on an immutable smart contract and can always be redeemed for a fixed amount of decentralized assets, then you’ve made the right choice.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Has the PoW Narrative Renaissance become a dream as BCH tripled in two weeks?

- I have drawn over 100,000 robot images, and my Twitter avatar is full of these pictures. This AI painting competition is becoming very popular.

- The New Frontier of DeFi: the Rise of Repeated Collateralization, Liquidity Mining, and LSD Tokens

- The bankruptcy judge in the southern district of New York has approved Celsius’ exchange of altcoins for BTC and ETH starting from July 1st.

- Exclusive Interview with HashKey PRO: Has Reached Cooperation with Zhongan Bank, Currently Supporting SWIFT Bank Transfers in 16 Countries and Regions

- ZeroLiquid: Zero-Collateral, Zero-Interest Loan Agreement with LST as Collateral

- Unveiling the New Future of ZK-Rollup: Taiko – Pioneering the Challenge of zkEVM